Halal Goes Global

Halal_Goes_Global-web(1)

Halal_Goes_Global-web(1)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

8<br />

Chapter 2 – THE HALAL SECTOR<br />

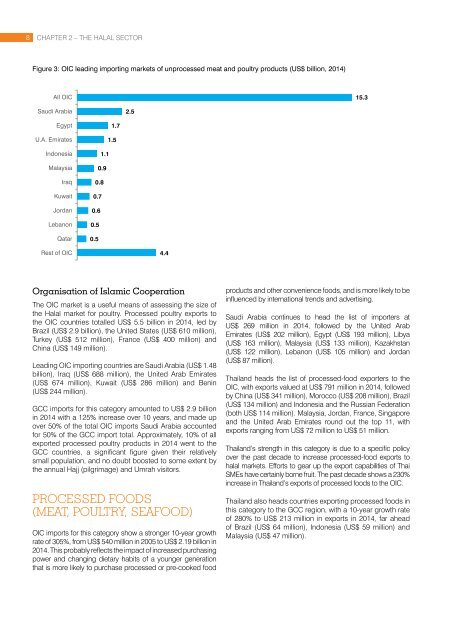

Figure 3: OIC leading importing markets of unprocessed meat and poultry products (US$ billion, 2014)<br />

All OIC<br />

15.3<br />

Saudi Arabia<br />

2.5<br />

Egypt<br />

U.A. Emirates<br />

Indonesia<br />

Malaysia<br />

Iraq<br />

Kuwait<br />

Jordan<br />

Lebanon<br />

Qatar<br />

1.7<br />

1.5<br />

1.1<br />

0.9<br />

0.8<br />

0.7<br />

0.6<br />

0.5<br />

0.5<br />

Rest of OIC<br />

4.4<br />

Organisation of Islamic Cooperation<br />

The OIC market is a useful means of assessing the size of<br />

the <strong>Halal</strong> market for poultry. Processed poultry exports to<br />

the OIC countries totalled US$ 5.5 billion in 2014, led by<br />

Brazil (US$ 2.9 billion), the United States (US$ 610 million),<br />

Turkey (US$ 512 million), France (US$ 400 million) and<br />

China (US$ 149 million).<br />

Leading OIC importing countries are Saudi Arabia (US$ 1.48<br />

billion), Iraq (US$ 688 million), the United Arab Emirates<br />

(US$ 674 million), Kuwait (US$ 286 million) and Benin<br />

(US$ 244 million).<br />

GCC imports for this category amounted to US$ 2.9 billion<br />

in 2014 with a 125% increase over 10 years, and made up<br />

over 50% of the total OIC imports Saudi Arabia accounted<br />

for 50% of the GCC import total. Approximately, 10% of all<br />

exported processed poultry products in 2014 went to the<br />

GCC countries, a significant figure given their relatively<br />

small population, and no doubt boosted to some extent by<br />

the annual Hajj (pilgrimage) and Umrah visitors.<br />

Processed foods<br />

(meat, poultry, seafood)<br />

OIC imports for this category show a stronger 10-year growth<br />

rate of 305%, from US$ 540 million in 2005 to US$ 2.19 billion in<br />

2014. This probably reflects the impact of increased purchasing<br />

power and changing dietary habits of a younger generation<br />

that is more likely to purchase processed or pre-cooked food<br />

products and other convenience foods, and is more likely to be<br />

influenced by international trends and advertising.<br />

Saudi Arabia continues to head the list of importers at<br />

US$ 269 million in 2014, followed by the United Arab<br />

Emirates (US$ 202 million), Egypt (US$ 193 million), Libya<br />

(US$ 163 million), Malaysia (US$ 133 million), Kazakhstan<br />

(US$ 122 million), Lebanon (US$ 105 million) and Jordan<br />

(US$ 87 million).<br />

Thailand heads the list of processed-food exporters to the<br />

OIC, with exports valued at US$ 791 million in 2014, followed<br />

by China (US$ 341 million), Morocco (US$ 208 million), Brazil<br />

(US$ 134 million) and Indonesia and the Russian Federation<br />

(both US$ 114 million). Malaysia, Jordan, France, Singapore<br />

and the United Arab Emirates round out the top 11, with<br />

exports ranging from US$ 72 million to US$ 51 million.<br />

Thailand’s strength in this category is due to a specific policy<br />

over the past decade to increase processed-food exports to<br />

halal markets. Efforts to gear up the export capabilities of Thai<br />

SMEs have certainly borne fruit. The past decade shows a 230%<br />

increase in Thailand’s exports of processed foods to the OIC.<br />

Thailand also heads countries exporting processed foods in<br />

this category to the GCC region, with a 10-year growth rate<br />

of 280% to US$ 213 million in exports in 2014, far ahead<br />

of Brazil (US$ 64 million), Indonesia (US$ 59 million) and<br />

Malaysia (US$ 47 million).