Halal Goes Global

Halal_Goes_Global-web(1)

Halal_Goes_Global-web(1)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

12<br />

Chapter 2 – THE HALAL SECTOR<br />

Sugar, confectionery and cocoa<br />

<strong>Global</strong> trade in these halal products reached US$ 93 billion<br />

in 2014, an increase of 111% over the decade. Leading<br />

exporters include Brazil (US$ 9.9 billion), Germany (US$<br />

8.1 billion), Netherlands (US$ 6.5 billion), Côte d’Ivoire (US$<br />

5.3 billion), Belgium (US$ 4.8 billion), United States (US$<br />

4.3 billion), France (US$ 4.1 billion), Ghana (US$ 3 billion),<br />

Thailand (US$ 3 billion) and Mexico (US$ 2.3 billion).<br />

Major importing countries for these products in 2014 were<br />

the United States (US$ 9 billion), Germany (US$ 6.7 billion),<br />

Netherlands (US$ 4.9 billion), United Kingdom (US$ 4.7<br />

billion), France (US$ 4.6 billion), Belgium (US$ 3.6 billion),<br />

Italy (US$ 2.6 billion), China (US$ 2.6 billion), Canada (US$<br />

2.6 billion) and Malaysia (US$ 2.4 billion).<br />

Countries with above-average growth rates for these imports<br />

over the past decade are China at 323% and Malaysia<br />

at 215%.<br />

Both Ghana and Thailand showed above-average growth<br />

rates over the decade with increases of 245% and 236%,<br />

respectively.<br />

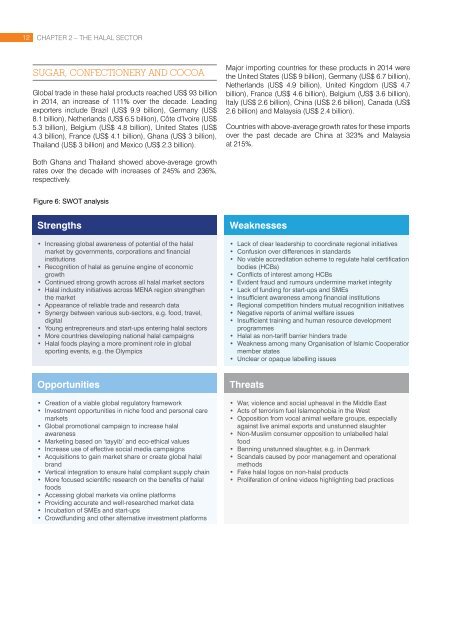

Figure 6: SWOT analysis<br />

Strengths<br />

• Increasing global awareness of potential of the halal<br />

market by governments, corporations and financial<br />

institutions<br />

• Recognition of halal as genuine engine of economic<br />

growth<br />

• Continued strong growth across all halal market sectors<br />

• <strong>Halal</strong> industry initiatives across MENA region strengthen<br />

the market<br />

• Appearance of reliable trade and research data<br />

• Synergy between various sub-sectors, e.g. food, travel,<br />

digital<br />

• Young entrepreneurs and start-ups entering halal sectors<br />

• More countries developing national halal campaigns<br />

• <strong>Halal</strong> foods playing a more prominent role in global<br />

sporting events, e.g. the Olympics<br />

Weaknesses<br />

• Lack of clear leadership to coordinate regional initiatives<br />

• Confusion over differences in standards<br />

• No viable accreditation scheme to regulate halal certification<br />

bodies (HCBs)<br />

• Conflicts of interest among HCBs<br />

• Evident fraud and rumours undermine market integrity<br />

• Lack of funding for start-ups and SMEs<br />

• Insufficient awareness among financial institutions<br />

• Regional competition hinders mutual recognition initiatives<br />

• Negative reports of animal welfare issues<br />

• Insufficient training and human resource development<br />

programmes<br />

• <strong>Halal</strong> as non-tariff barrier hinders trade<br />

• Weakness among many Organisation of Islamic Cooperation<br />

member states<br />

• Unclear or opaque labelling issues<br />

Opportunities<br />

• Creation of a viable global regulatory framework<br />

• Investment opportunities in niche food and personal care<br />

markets<br />

• <strong>Global</strong> promotional campaign to increase halal<br />

awareness<br />

• Marketing based on ‘tayyib’ and eco-ethical values<br />

• Increase use of effective social media campaigns<br />

• Acquisitions to gain market share or create global halal<br />

brand<br />

• Vertical integration to ensure halal compliant supply chain<br />

• More focused scientific research on the benefits of halal<br />

foods<br />

• Accessing global markets via online platforms<br />

• Providing accurate and well-researched market data<br />

• Incubation of SMEs and start-ups<br />

• Crowdfunding and other alternative investment platforms<br />

Threats<br />

• War, violence and social upheaval in the Middle East<br />

• Acts of terrorism fuel Islamophobia in the West<br />

• Opposition from vocal animal welfare groups, especially<br />

against live animal exports and unstunned slaughter<br />

• Non-Muslim consumer opposition to unlabelled halal<br />

food<br />

• Banning unstunned slaughter, e.g. in Denmark<br />

• Scandals caused by poor management and operational<br />

methods<br />

• Fake halal logos on non-halal products<br />

• Proliferation of online videos highlighting bad practices