MEXICO

1r3fkNK

1r3fkNK

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

EMPEA • MAY 2016 | 5<br />

For decades, Mexico remained under the radar as private equity<br />

investors with an interest in Latin America poured their money<br />

into Brazil. Headline risk around corruption and the war on<br />

drugs, a relatively small pool of fund managers, and the high<br />

concentration of large, family-owned businesses potentially<br />

restricting deal flow were among the many factors that had<br />

deterred greater investment. However, the tide appears to be<br />

turning—particularly with the entrance of the local pension funds<br />

(or Afores), which in 2009 were given the freedom to invest 10%<br />

of their assets into private equity under new regulations. Since<br />

this time, fund sizes for the more established general partners<br />

in the region have grown, while the total number of private<br />

equity and venture capital funds operating in the market has<br />

multiplied. In the eight years leading to 2016, Mexico-dedicated<br />

funds had raised nearly US$8.7 billion, with an additional portion<br />

of the US$12.7 billion raised by regional funds earmarked for<br />

the market (see Exhibit 1).<br />

Perhaps the most important driver, however, in pushing the<br />

asset class forward has been the Mexican government. It has<br />

demonstrated a deep appreciation for how private equity can<br />

help develop the economy, lead to job creation and instill best<br />

practices throughout local businesses, which puts the country<br />

well ahead of the curve in relation to a number of its emerging<br />

market peers. While the road is not always a straight one, the<br />

government, along with the local industry, has been focused on<br />

making continuous improvements to the legal and regulatory<br />

framework in favor of private equity, one small step at a time.<br />

A ROCKY ROAD<br />

The earliest private equity fund managers, the majority of which<br />

were large buyout firms based in the United States, began to flock<br />

to Latin America during the 1990s. On the back of their success<br />

with the asset class at home, many of these firms’ institutional investors<br />

were flush with cash and saw the fact that many emerging<br />

markets were increasingly opening up their economies as a means<br />

to generate high returns and diversify their portfolios. By the end of<br />

1999, over 100 private equity funds were deploying capital in Latin<br />

America. 1 Mexico—as well as a number of other countries across the<br />

region—saw substantial volumes of capital flow into the market.<br />

Unfortunately, a bust quickly followed the boom, and by the early<br />

2000s, many of these pioneers had not survived. In 2002, the former<br />

Texas-based buyout firm Hicks, Muse, Tate & First, Inc. and GE Private<br />

Equity, an investment arm of General Electric Co., both shut down<br />

their Mexico City offices, representing just two examples of firms on<br />

the retreat. The reasons were multifold: a growing realization that the<br />

model that had worked so well in a developed market context was<br />

not a plug-and-play that could be applied to Latin America, coupled<br />

with broader regional macroeconomic woes—including the aftermath<br />

of the 1994 Tequila Crisis—resulted in overall poor performance.<br />

“These early investors were not very happy because their results<br />

never materialized,” recalls Joaquín Ávila, Co-founder of EMX Capital.<br />

“What followed was a drying out of equity, and it took quite some<br />

time before people and money started to return to this industry.<br />

With the next wave, we started humble and small, but the opening<br />

of the local pension funds has really moved the needle.”<br />

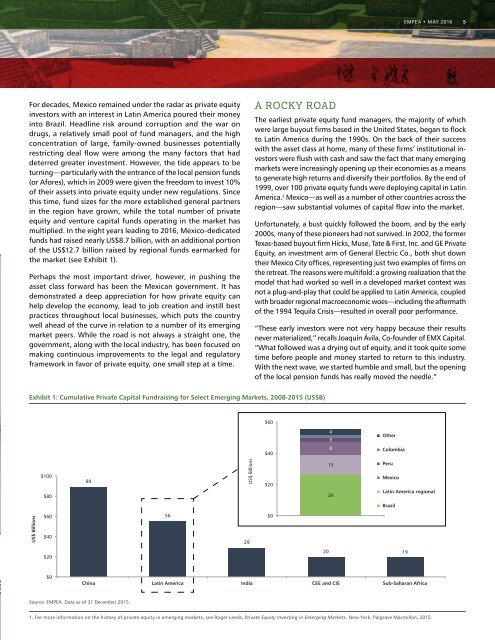

Exhibit 1: Cumulative Private Capital Fundraising for Select Emerging Markets, 2008-2015 (US$B)<br />

$60<br />

$40<br />

4<br />

3<br />

9<br />

Other<br />

Colombia<br />

$100<br />

$80<br />

89<br />

US$ Billions<br />

$20<br />

13<br />

Peru<br />

Mexico<br />

Latin America regional<br />

26<br />

Brazil<br />

US$ Billions<br />

$60<br />

$40<br />

56<br />

29<br />

$0<br />

$20<br />

20 19<br />

$0<br />

China Latin America India CEE and CIS Sub-Saharan Africa<br />

Source: EMPEA. Data as of 31 December 2015.<br />

1. For more information on the history of private equity in emerging markets, see Roger Leeds, Private Equity Investing in Emerging Markets. New York: Palgrave Macmillan, 2015.