Alternate revenue models for Payments Banks in India

29oMCDq

29oMCDq

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

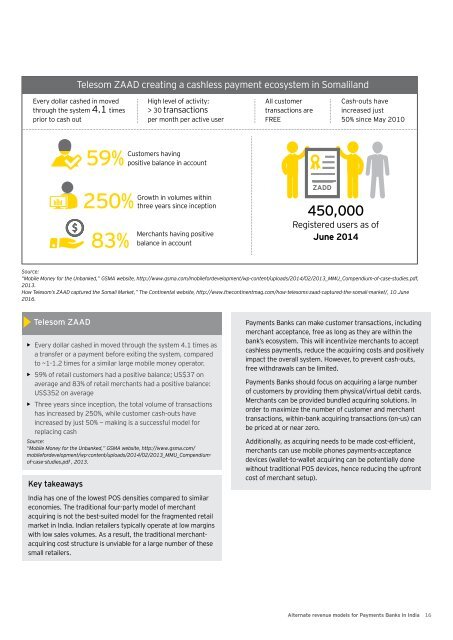

Telesom ZAAD creat<strong>in</strong>g a cashless payment ecosystem <strong>in</strong> Somaliland<br />

Every dollar cashed <strong>in</strong> moved<br />

through the system 4.1 times<br />

prior to cash out<br />

High level of activity:<br />

> 30 transactions<br />

per month per active user<br />

All customer<br />

transactions are<br />

FREE<br />

Cash-outs have<br />

<strong>in</strong>creased just<br />

50% s<strong>in</strong>ce May 2010<br />

59%<br />

Customers hav<strong>in</strong>g<br />

positive balance <strong>in</strong> account<br />

250%<br />

83%<br />

Growth <strong>in</strong> volumes with<strong>in</strong><br />

three years s<strong>in</strong>ce <strong>in</strong>ception<br />

Merchants hav<strong>in</strong>g positive<br />

balance <strong>in</strong> account<br />

ZADD<br />

450,000<br />

Registered users as of<br />

June 2014<br />

Source:<br />

“Mobile Money <strong>for</strong> the Unbanked,” GSMA website, http://www.gsma.com/mobile<strong>for</strong>development/wp-content/uploads/2014/02/2013_MMU_Compendium-of-case-studies.pdf,<br />

2013.<br />

How Telesom’s ZAAD captured the Somali Market,” The Cont<strong>in</strong>ental website, http://www.thecont<strong>in</strong>entmag.com/how-telesoms-zaad-captured-the-somali-market/, 10 June<br />

2016.<br />

Telesom ZAAD<br />

••<br />

Every dollar cashed <strong>in</strong> moved through the system 4.1 times as<br />

a transfer or a payment be<strong>for</strong>e exit<strong>in</strong>g the system, compared<br />

to ~1-1.2 times <strong>for</strong> a similar large mobile money operator.<br />

••<br />

59% of retail customers had a positive balance; US$37 on<br />

average and 83% of retail merchants had a positive balance:<br />

US$352 on average<br />

••<br />

Three years s<strong>in</strong>ce <strong>in</strong>ception, the total volume of transactions<br />

has <strong>in</strong>creased by 250%, while customer cash-outs have<br />

<strong>in</strong>creased by just 50% — mak<strong>in</strong>g is a successful model <strong>for</strong><br />

replac<strong>in</strong>g cash<br />

Source:<br />

“Mobile Money <strong>for</strong> the Unbanked,” GSMA website, http://www.gsma.com/<br />

mobile<strong>for</strong>development/wp-content/uploads/2014/02/2013_MMU_Compendiumof-case-studies.pdf<br />

, 2013.<br />

Key takeaways<br />

<strong>India</strong> has one of the lowest POS densities compared to similar<br />

economies. The traditional four-party model of merchant<br />

acquir<strong>in</strong>g is not the best-suited model <strong>for</strong> the fragmented retail<br />

market <strong>in</strong> <strong>India</strong>. <strong>India</strong>n retailers typically operate at low marg<strong>in</strong>s<br />

with low sales volumes. As a result, the traditional merchantacquir<strong>in</strong>g<br />

cost structure is unviable <strong>for</strong> a large number of these<br />

small retailers.<br />

<strong>Payments</strong> <strong>Banks</strong> can make customer transactions, <strong>in</strong>clud<strong>in</strong>g<br />

merchant acceptance, free as long as they are with<strong>in</strong> the<br />

bank’s ecosystem. This will <strong>in</strong>centivize merchants to accept<br />

cashless payments, reduce the acquir<strong>in</strong>g costs and positively<br />

impact the overall system. However, to prevent cash-outs,<br />

free withdrawals can be limited.<br />

<strong>Payments</strong> <strong>Banks</strong> should focus on acquir<strong>in</strong>g a large number<br />

of customers by provid<strong>in</strong>g them physical/virtual debit cards.<br />

Merchants can be provided bundled acquir<strong>in</strong>g solutions. In<br />

order to maximize the number of customer and merchant<br />

transactions, with<strong>in</strong>-bank acquir<strong>in</strong>g transactions (on-us) can<br />

be priced at or near zero.<br />

Additionally, as acquir<strong>in</strong>g needs to be made cost-efficient,<br />

merchants can use mobile phones payments-acceptance<br />

devices (wallet-to-wallet acquir<strong>in</strong>g can be potentially done<br />

without traditional POS devices, hence reduc<strong>in</strong>g the upfront<br />

cost of merchant setup).<br />

<strong>Alternate</strong> <strong>revenue</strong> <strong>models</strong> <strong>for</strong> <strong>Payments</strong> <strong>Banks</strong> <strong>in</strong> <strong>India</strong><br />

16