Alternate revenue models for Payments Banks in India

29oMCDq

29oMCDq

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

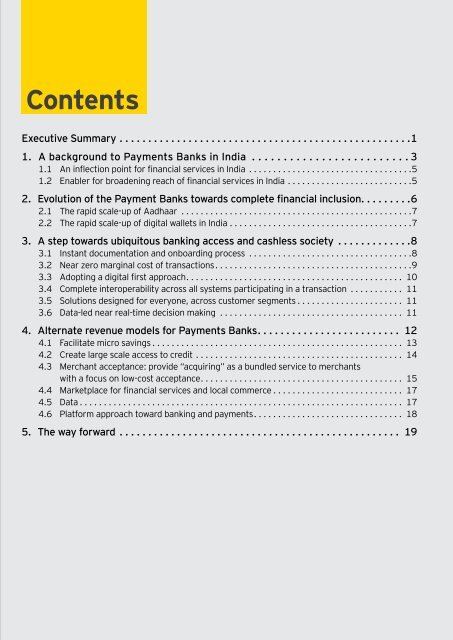

Contents<br />

Executive Summary................................................... 1<br />

1. A background to <strong>Payments</strong> <strong>Banks</strong> <strong>in</strong> <strong>India</strong> ......................... 3<br />

1.1 An <strong>in</strong>flection po<strong>in</strong>t <strong>for</strong> f<strong>in</strong>ancial services <strong>in</strong> <strong>India</strong> ..................................5<br />

1.2 Enabler <strong>for</strong> broaden<strong>in</strong>g reach of f<strong>in</strong>ancial services <strong>in</strong> <strong>India</strong> ..........................5<br />

2. Evolution of the Payment <strong>Banks</strong> towards complete f<strong>in</strong>ancial <strong>in</strong>clusion. . . . . . . . .6<br />

2.1 The rapid scale-up of Aadhaar ................................................7<br />

2.2 The rapid scale-up of digital wallets <strong>in</strong> <strong>India</strong> ......................................7<br />

3. A step towards ubiquitous bank<strong>in</strong>g access and cashless society ............. 8<br />

3.1 Instant documentation and onboard<strong>in</strong>g process ..................................8<br />

3.2 Near zero marg<strong>in</strong>al cost of transactions .........................................9<br />

3.3 Adopt<strong>in</strong>g a digital first approach ............................................. 10<br />

3.4 Complete <strong>in</strong>teroperability across all systems participat<strong>in</strong>g <strong>in</strong> a transaction ........... 11<br />

3.5 Solutions designed <strong>for</strong> everyone, across customer segments ...................... 11<br />

3.6 Data-led near real-time decision mak<strong>in</strong>g ...................................... 11<br />

4. <strong>Alternate</strong> <strong>revenue</strong> <strong>models</strong> <strong>for</strong> <strong>Payments</strong> <strong>Banks</strong>.......................... 12<br />

4.1 Facilitate micro sav<strong>in</strong>gs .................................................... 13<br />

4.2 Create large scale access to credit ........................................... 14<br />

4.3 Merchant acceptance: provide “acquir<strong>in</strong>g” as a bundled service to merchants<br />

with a focus on low-cost acceptance .......................................... 15<br />

4.4 Marketplace <strong>for</strong> f<strong>in</strong>ancial services and local commerce ........................... 17<br />

4.5 Data ................................................................... 17<br />

4.6 Plat<strong>for</strong>m approach toward bank<strong>in</strong>g and payments ............................... 18<br />

5. The way <strong>for</strong>ward.................................................. 19