Alternate revenue models for Payments Banks in India

29oMCDq

29oMCDq

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Significant progress has been made <strong>in</strong> expand<strong>in</strong>g access to <strong>for</strong>mal<br />

bank<strong>in</strong>g <strong>in</strong> <strong>India</strong> through a host of re<strong>for</strong>ms by the Government of<br />

<strong>India</strong>. Through the Pradhan Mantri Jan Dhan Yojana (PMJDY),<br />

there has been a significant <strong>in</strong>crease <strong>in</strong> access to bank<strong>in</strong>g across<br />

households. Subsequent schemes <strong>for</strong> <strong>in</strong>surance and pensions have<br />

attempted to extend access to a wider gamut of f<strong>in</strong>ancial products<br />

– the Pradhan Mantri Suraksha Bima Yojana (accidental death and<br />

disability <strong>in</strong>surance), the Pradhan Mantri Jeevan Jyoti Bima Yojana<br />

(life Insurance) and the Atal Pension Yojna (pension).<br />

organized f<strong>in</strong>ancial services. <strong>Payments</strong> <strong>Banks</strong> are permitted to<br />

offer basic bank accounts (current and sav<strong>in</strong>gs with a balance limit<br />

of INR 100,000) but are not permitted to extend credit or accept<br />

term deposits. They can accept demand deposits, pay bills, facilitate<br />

remittances and government welfare payments to their customers,<br />

and provide other basic bank<strong>in</strong>g services to <strong>in</strong>dividuals and small<br />

bus<strong>in</strong>esses .<br />

While these schemes have focused on f<strong>in</strong>ancial access, <strong>in</strong>creas<strong>in</strong>g<br />

f<strong>in</strong>ancial usage still rema<strong>in</strong>s a challenge <strong>for</strong> both <strong>in</strong>dividuals and<br />

micro and small bus<strong>in</strong>esses. Most small bus<strong>in</strong>ess owners cont<strong>in</strong>ue<br />

to rely on unorganized sources <strong>for</strong> f<strong>in</strong>anc<strong>in</strong>g their daily work<strong>in</strong>g<br />

capital at extremely high rates of <strong>in</strong>terest. Lack of access to<br />

<strong>for</strong>mal f<strong>in</strong>ancial services not only acts as a growth <strong>in</strong>hibitor, but<br />

also creates a poverty spiral <strong>for</strong> the impacted segments of the<br />

population.<br />

Conceptualization of <strong>Payments</strong> <strong>Banks</strong> is a bold policy re<strong>for</strong>m<br />

well suited to both broaden<strong>in</strong>g access to and creat<strong>in</strong>g usage of<br />

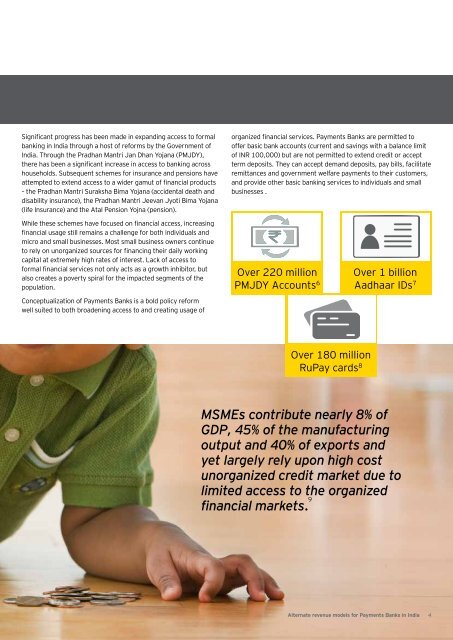

Over 220 million<br />

PMJDY Accounts 6<br />

Over 1 billion<br />

Aadhaar IDs 7<br />

Over 180 million<br />

RuPay cards 8<br />

MSMEs contribute nearly 8% of<br />

GDP, 45% of the manufactur<strong>in</strong>g<br />

output and 40% of exports and<br />

yet largely rely upon high cost<br />

unorganized credit market due to<br />

limited access to the organized<br />

f<strong>in</strong>ancial markets. 9<br />

<strong>Alternate</strong> <strong>revenue</strong> <strong>models</strong> <strong>for</strong> <strong>Payments</strong> <strong>Banks</strong> <strong>in</strong> <strong>India</strong> 4