Alternate revenue models for Payments Banks in India

29oMCDq

29oMCDq

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The target groups <strong>for</strong> <strong>Payments</strong> <strong>Banks</strong> are ma<strong>in</strong>ly <strong>India</strong>’s migrant<br />

laborers, low-<strong>in</strong>come households and small bus<strong>in</strong>esses to whom<br />

sav<strong>in</strong>gs accounts and remittance services can be offered at<br />

lower transaction costs. It is envisaged that <strong>Payments</strong> <strong>Banks</strong> will<br />

accelerate the penetration of f<strong>in</strong>ancial services among the low<strong>in</strong>come<br />

customer segments by leverag<strong>in</strong>g technology and build<strong>in</strong>g a<br />

large geographical footpr<strong>in</strong>t.<br />

1.1 An <strong>in</strong>flection po<strong>in</strong>t <strong>for</strong> f<strong>in</strong>ancial<br />

services <strong>in</strong> <strong>India</strong><br />

At present, the environment <strong>in</strong> <strong>India</strong> is very conducive to further<br />

f<strong>in</strong>ancial <strong>in</strong>clusion <strong>in</strong> the country. The Government, regulators,<br />

banks and support<strong>in</strong>g <strong>in</strong>stitutions have come to a consensus on<br />

<strong>in</strong>novation that could significantly accelerate the drive toward<br />

achiev<strong>in</strong>g complete f<strong>in</strong>ancial <strong>in</strong>clusion <strong>in</strong> the country.<br />

Aga<strong>in</strong>st this backdrop, the RBI has provided <strong>in</strong>-pr<strong>in</strong>ciple approval<br />

to multiple players to set up <strong>Payments</strong> <strong>Banks</strong> <strong>in</strong> <strong>India</strong>. These banks<br />

have been conceptualized to address the basic bank<strong>in</strong>g (bank<br />

accounts), remittance and payments requirements <strong>in</strong> the country<br />

and are expected to use technological <strong>in</strong>novations to reduce<br />

operational costs. At present, <strong>Payments</strong> <strong>Banks</strong> are at different<br />

stages of build-out. Strategy <strong>for</strong>mulation and <strong>in</strong>novation brought<br />

<strong>in</strong>to the f<strong>in</strong>ancial services <strong>in</strong>dustry and the growth of the newly<br />

licensed <strong>Payments</strong> <strong>Banks</strong> will be important parameters to track.<br />

These two concepts, if realized could potentially <strong>in</strong>troduce large<br />

sections of underbanked and under focused population to <strong>for</strong>mal<br />

bank<strong>in</strong>g and payments services.<br />

The success of the <strong>Payments</strong> <strong>Banks</strong> h<strong>in</strong>ges on redef<strong>in</strong><strong>in</strong>g the way<br />

traditional banks approach the key components of the bank<strong>in</strong>g<br />

lifecycle, <strong>in</strong>clud<strong>in</strong>g customer acquisition, on-board<strong>in</strong>g, keep<strong>in</strong>g<br />

customers actively transact<strong>in</strong>g, assess<strong>in</strong>g their f<strong>in</strong>ancial needs and<br />

provid<strong>in</strong>g the appropriate solutions and thereby assist<strong>in</strong>g them to<br />

become a part of the ma<strong>in</strong>stream economy.<br />

Acquir<strong>in</strong>g a critical mass of customers will be a key factor <strong>for</strong> the<br />

success of <strong>Payments</strong> <strong>Banks</strong>. These banks could save time and ef<strong>for</strong>t<br />

by leverag<strong>in</strong>g established government <strong>in</strong>itiatives, programs, and<br />

plat<strong>for</strong>ms to achieve the required economies of scale.<br />

1.2 Enabler <strong>for</strong> broaden<strong>in</strong>g reach of<br />

f<strong>in</strong>ancial services <strong>in</strong> <strong>India</strong><br />

<strong>Payments</strong> and remittances have traditionally been a part of the<br />

service offer<strong>in</strong>g of banks and post offices. Over the last five to<br />

seven years, non-bank players such as telecom companies (through<br />

mobile money services), bus<strong>in</strong>ess correspondents (BCs,) — entities<br />

that assist banks <strong>in</strong> provid<strong>in</strong>g basic bank<strong>in</strong>g services <strong>in</strong> rural<br />

areas — and prepaid payment <strong>in</strong>strument issuers (PPIs) have made<br />

significant contributions toward mak<strong>in</strong>g domestic remittances<br />

widespread <strong>in</strong> <strong>India</strong>. In a country where significant migration of<br />

work<strong>for</strong>ce occurs from rural areas to <strong>in</strong>dustrial centers and large<br />

cities, domestic remittance corridors have emerged between these<br />

employment hubs to the h<strong>in</strong>terland. While the emergence of nonbank<br />

players has helped <strong>in</strong> mak<strong>in</strong>g domestic remittance accessible<br />

<strong>for</strong> many with<strong>in</strong> the country’s migrant work<strong>for</strong>ce, the impact on the<br />

extended f<strong>in</strong>ancial system has been limited.<br />

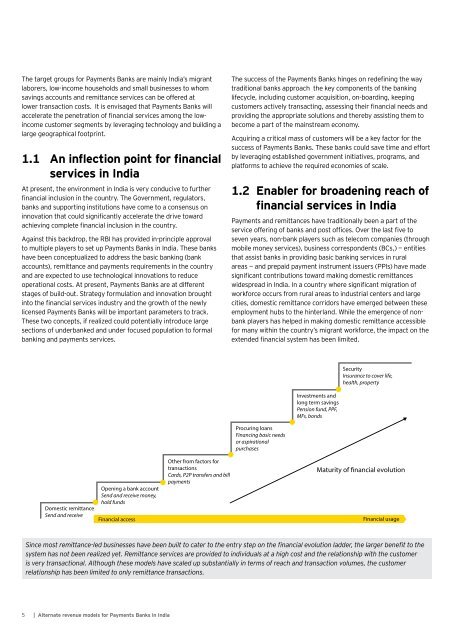

Security<br />

Insurance to cover life,<br />

health, property<br />

Investments and<br />

long term sav<strong>in</strong>gs<br />

Pension fund, PPF,<br />

MFs, bonds<br />

Procur<strong>in</strong>g loans<br />

F<strong>in</strong>anc<strong>in</strong>g basic needs<br />

or aspirational<br />

purchases<br />

Domestic remittance<br />

Send and receive<br />

Open<strong>in</strong>g a bank account<br />

Send and receive money,<br />

hold funds<br />

F<strong>in</strong>ancial access<br />

Other from factors <strong>for</strong><br />

transactions<br />

Cards, P2P transfers and bill<br />

payments<br />

Maturity of f<strong>in</strong>ancial evolution<br />

F<strong>in</strong>ancial usage<br />

S<strong>in</strong>ce most remittance-led bus<strong>in</strong>esses have been built to cater to the entry step on the f<strong>in</strong>ancial evolution ladder, the larger benefit to the<br />

system has not been realized yet. Remittance services are provided to <strong>in</strong>dividuals at a high cost and the relationship with the customer<br />

is very transactional. Although these <strong>models</strong> have scaled up substantially <strong>in</strong> terms of reach and transaction volumes, the customer<br />

relationship has been limited to only remittance transactions.<br />

5 | <strong>Alternate</strong> <strong>revenue</strong> <strong>models</strong> <strong>for</strong> <strong>Payments</strong> <strong>Banks</strong> <strong>in</strong> <strong>India</strong>