technologies

mic6301ZqIz

mic6301ZqIz

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

SDM EXCLUSIVE REPORT<br />

2016<br />

Expanding<br />

Their Scope of<br />

Services<br />

Security systems integrators are taking on a much greater role in our<br />

connected world through their offerings of cybersecurity and added network<br />

services, as evidenced by the 21st annual Top Systems Integrators Report.<br />

By Laura Stepanek, Editor<br />

Security systems integrators lauded the state of the<br />

market in 2015, yet their revenue was down 1 percent<br />

overall and among those integrators with which<br />

a year-to-year comparison could be made, a significant<br />

number — 34 of 82 companies — reported decreased<br />

North American systems integration revenue. (See table on<br />

page 76 for more information about revenue deviations due to<br />

the omission of certain companies from the report.)<br />

SDM’s Top Systems Integrators Report ranks companies<br />

by their North American systems integration revenue, which<br />

includes solutions such as design, project management, product,<br />

installation, programming, start-up, and training sold<br />

directly to an end-user customer or through a tier of contractors.<br />

Total North American systems integration revenue — which is<br />

not the same as total annual gross revenue — reached $5.63 billion<br />

in 2015 for the 100 companies ranked on this year’s report.<br />

One of the reasons revenue growth did not match the commentary<br />

given by systems integrators could be that projects<br />

secured in the latter part of 2015 will not be on the books until<br />

2016 — contributing to flat financial performance, but elated<br />

forecasts by the integrators.<br />

“In my opinion the security market made a comeback last<br />

year and it is looking even better in 2016,” says No. 30, Sound<br />

Incorporated, which reported $20.2 million in 2015 systems<br />

integration revenue, up 2.6 percent over 2014.<br />

While there were some who experienced a flat or downcast<br />

market, a larger number of systems integrators say the market<br />

expanded in 2015. They cited several factors as having influenced<br />

that growth, including a higher level of new construction<br />

and the need to upgrade timeworn systems — especially given<br />

the greater benefit that digital-based <strong>technologies</strong> offer.<br />

“2015 saw a strong market for security system sales. In large<br />

part the market was driven by increased customer focus on<br />

upgrading legacy systems to newer digital <strong>technologies</strong>. Clients<br />

continue to gain a higher level of understanding that digital <strong>technologies</strong><br />

can drive efficiencies within their security operations<br />

and provide more value to their corporate stakeholders,” reports<br />

Tutela Inc., ranked No. 35. The company saw strong growth in<br />

the logistics and transportation vertical market last year.<br />

Security as a service, managed offerings, and cloud-based<br />

solutions are gaining traction in the marketplace, the integrators<br />

observed.<br />

Continues on page 63<br />

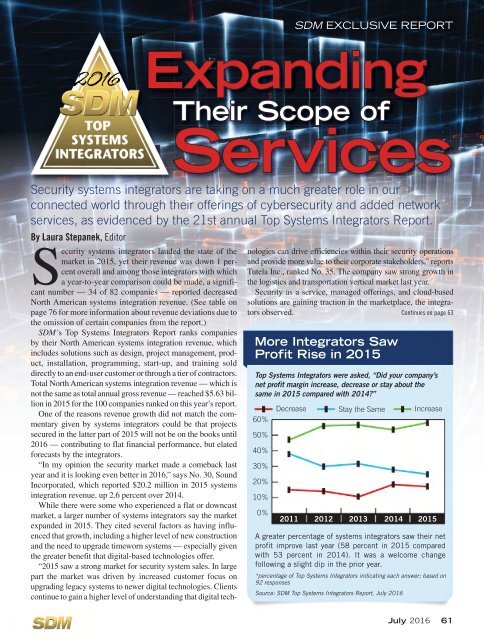

More Integrators Saw<br />

Profit Rise in 2015<br />

Top Systems Integrators were asked, “Did your company’s<br />

net profit margin increase, decrease or stay about the<br />

same in 2015 compared with 2014?”<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

Decrease Stay the Same Increase<br />

2011 2012 2013<br />

2014 2015<br />

A greater percentage of systems integrators saw their net<br />

profit improve last year (58 percent in 2015 compared<br />

with 53 percent in 2014). It was a welcome change<br />

following a slight dip in the prior year.<br />

*percentage of Top Systems Integrators indicating each answer; based on<br />

92 responses<br />

Source: SDM Top Systems Integrators Report, July 2016<br />

July 2016 61

2016<br />

21 st ANNUAL REPORT<br />

North American Number of New Value of<br />

2016 2015 Company & Headquarters Systems Integration Non-Residential Non-Residential Top 3 Markets Full-time Business<br />

Rank Rank Location Revenue 2015 Projects, 2015 Projects, 2015 Contributing to Revenue Employees Locations<br />

1 1 Tyco Integrated Security<br />

Boca Raton, Fla.<br />

2 4 Convergint Technologies<br />

Schaumburg, Ill.<br />

3 5 Johnson Controls Inc.<br />

Milwaukee, Wis.<br />

4 6 Kratos Public Safety & Security<br />

Solutions Inc.<br />

San Diego, Calif.<br />

5 Red Hawk Fire & Security<br />

Boca Raton, Fla.<br />

6 Kastle Systems International<br />

Falls Church, Va.<br />

7 8 G4S Secure Integration LLC<br />

Omaha, Neb.<br />

8 10 Vector Security Inc.<br />

Warrendale, Pa.<br />

9 11 Securadyne Systems LLC<br />

Dallas, Texas<br />

10 12 VTI Security<br />

Burnsville, Minn.<br />

11 13 AFA Protective Systems Inc.<br />

Syosset, N.Y.<br />

12 15 RFI Communications & Security Systems<br />

San Jose, Calif.<br />

13 17 Securityhunter Inc.<br />

Baltimore, Md.<br />

14 19 Entech Sales & Service Inc.<br />

Dallas, Texas<br />

15 14 Tech Systems Inc.<br />

Duluth, Ga.<br />

16 18 Universal Protection Security Systems<br />

Santa Ana, Calif.<br />

17 20 Unlimited Technology Inc.<br />

Chester Springs, Pa.<br />

18 25 Intertech Ci<br />

Pittsburgh, Pa.<br />

19 28 SIGNET Electronic Systems Inc.<br />

Norwell, Mass.<br />

20 43 Mountain Alarm<br />

Ogden, Utah<br />

21 24 Interface Security Systems Holdings Inc.<br />

Earth City, Mo.<br />

22 23 Genesis Security Systems LLC<br />

Germantown, Md.<br />

23 40 GSI<br />

Troy, Mich.<br />

$3,054,000,000e<br />

na na na 10,000e<br />

200<br />

e<br />

$471,000,000 11,260 $350,000,000 na 2,161 67<br />

$314,000,000 3,330 $225,000,000 govt, corp, edu 637 118<br />

$144,700,000e na na na 500e 31e<br />

$100,000,000 3,900 $119,000,000 corp, health, hotel 1,400 37<br />

$80,500,000 na na corp 421 10<br />

$77,875,785 852 $48,856,979 na 494 17<br />

$74,910,250 5,692 $75,000,000 retail, transport, health 1,375 35<br />

$70,000,000 na $70,000,000 utilities, edu 288 19<br />

$59,442,000 na na utilities, financial, health 205 8<br />

$45,350,000 6,109 $42,175,000 retail, airport, corp 400 15<br />

$44,975,048 1,498 $42,382,000 na 231 5<br />

$42,800,466 39 $42,800,466 govt 39 1<br />

$39,780,000 131 $39,780,000 na 268 8<br />

$36,680,941 1,300 $36,405,462 health, financial 256 2<br />

$34,116,944 1,336 na na 278 13<br />

$32,409,000 785 na na 77 5<br />

$31,177,503 12 $23,574,000 na 183 8<br />

$30,700,000 880 $30,700,000 govt, edu, health 63 3<br />

$26,854,919 3,500 $17,956,101 na 214 10<br />

$24,511,035 15,000 $33,400,000 na 683 15<br />

$23,500,000 35 $18,000,000 corp, utilities, financial 61 1<br />

$23,400,000 na $23,400,000 industrial, financial,<br />

utilities<br />

87 2<br />

■ No. 2 – Acquired and integrated GS Security and Dakota Security. SDM’s 2007 and 2012 Systems Integrator of the Year. ■ No. 3 – Double-digit growth in sales volume and ended year with largest<br />

projects backlog to date. SDM’s 2009 Systems Integrator of the Year. ■ No. 6 – Launched KastlePresence; IoT platform available in the App Store. SDM’s 2015 Systems Integrator of the Year. ■ No.<br />

7 – SDM’s 2013 Systems Integrator of the Year (and 2008 as Adesta). ■ No. 8 – SDM’s 2015 Dealer of the Year. ■ No. 13 – Captured Social Security Administration Blanket Purchase Agreement<br />

for $210 M for the next 5 years. ■ No. 15 – SDM’s 2004 Systems Integrator of the Year. ■ No. 17 – Developed and launched a big data offering. SDM’s 2014 Systems Integrator of the Year. ■ No.<br />

19 – Closed a $1,890,000 prison security project. ■ No. 21 – Won contract for multiple security/video solutions with 4,100-site retailer.<br />

e = SDM estimate. na = not available. Abbreviations to markets: airport = airports; corp = corporate office space; correctional = correctional; edu = education/campus; entertainment =<br />

entertainment/sports venues; financial = financial/banking; gaming = casinos/gaming; govt = government; health = healthcare; hotels = hotels/hospitality; industrial = industrial; law = law<br />

enforcement; retail = retail/restaurants; transport = transportation/distribution; utilities = utilities/critical infrastructure.<br />

62 July 2016

21 st ANNUAL REPORT<br />

Continued from page 61<br />

“In general, we participated in a strong market in 2015; good<br />

economic trends in many of the markets we serve helped to drive<br />

strong sales performance,” notes ADS Security, ranked No. 48,<br />

reporting 14.1 percent higher integration revenue. “While we<br />

saw growth across the board, we especially saw strong growth in<br />

our commercial segment and, in particular, with our cloud-based<br />

services such as SecureDoor (managed access control) and our<br />

family of RemoteView video (cloud based video storage).”<br />

Integrated Security Technologies says, “We are still looking<br />

to see the cloud services end of the business take off. It has<br />

been discussed more frequently but we anticipate some activity<br />

taking hold in 2016.”<br />

Other integrators also commented on factors that contributed<br />

to a strong marketplace:<br />

Telenet VoIP Inc. (No. 92): “Overall the market seemed to<br />

be healthier, margins seemed to stay flat but more opportunities<br />

were available for bidding. After structured cabling, and<br />

network upgrades, CCTV and access control seem to continue<br />

to be the focal point of educational entities.<br />

Advanced Electronic Solutions (No. 51): “2015 was a<br />

strong year for AES. We had many upgrades to IP systems<br />

as well as a number of new major projects. Profits increased<br />

as opposed to 2014.”<br />

Sentry Security (No. 94): “Market was strong in 2015. Integrated<br />

systems dominated.”<br />

Security Integrations (No. 40): “The market was strong,<br />

fueled by upgrades from analog CCTV to IP-based solutions.”<br />

Tele-Tector of Maryland Inc. (No. 68): “The market was<br />

strong in the area of upgrading analog systems to IP base.”<br />

Perhaps most telling about the direction that things are heading<br />

in comes from an observation by MidCo Inc., ranked No.<br />

28: “There is a need for more network-savvy systems integrators<br />

like MidCo.”<br />

Not only are offerings of cloud-based and managed security<br />

solutions growing, but the market is desiring — and demand-<br />

Continues on page 68<br />

Guide to Reading the Top Systems Integrators Report<br />

Top Systems Integrators:<br />

2015 Performance Statistics<br />

Total North American<br />

systems integration<br />

revenue:<br />

Total North American revenue from systems integration for<br />

the 100 largest integrators reached $5.63 billion in 2015<br />

from solutions such as design, project management,<br />

product, installation, programming, start-up, and training<br />

sold directly to an end-user customer or through a tier of<br />

contractors. It does not include recurring revenue from<br />

service and monitoring, as integrators were asked to report<br />

that amount separately in order to be ranked on the SDM<br />

100, a report based on RMR in the security industry. A<br />

comparison between the top 100 companies ranked this<br />

year and the top 100 ranked in 2015 shows a 17.34<br />

percent decrease in systems integration revenue. This<br />

can be attributed to the fact that several of the largest<br />

systems integrators either did not reply to SDM’s requests<br />

for information, could not comply due to restrictions of<br />

being publicly held, or were omitted due to acquisition<br />

(includes Diebold Security – will report next year as<br />

Securitas Electronic Security Inc.; Stanley Convergent<br />

Security Solutions; Protection 1; Schneider Electric; SDI;<br />

DTT; and Dakota Security Systems, among the top 25).<br />

Source: SDM Top Systems Integrators Report, July 2016<br />

2014 2015<br />

$6.83 billion $5.63 billion<br />

New systems started: 123,849 112,352<br />

Total full-time<br />

employed:<br />

Business locations<br />

operated:<br />

39,971 27,785<br />

1,164 894<br />

The 2016 Top Systems Integrators Report ranks North<br />

American companies by their security systems integration<br />

revenue. This ranking is based on data provided to<br />

or, in a few cases, estimated by SDM. Ranked companies<br />

were asked to submit either an audited or reviewed<br />

financial statement, or a copy of their income tax return<br />

showing total gross receipts for the stated period. The<br />

vast majority of the firms ranked are privately held.<br />

The main table, which begins on page 62, ranks<br />

100 companies by their North American revenue in<br />

2015 from their security system integration projects.<br />

Integration includes solutions such as design, project<br />

management, product, installation, programming, startup,<br />

training, and time-and-materials-based service sold<br />

directly to an end-user customer or through a tier of contractors.<br />

This includes revenue related to security, such<br />

as: access control, ID/badging, video surveillance/analytics,<br />

intrusion alarms, perimeter security, electronic gate<br />

entry, intercom/communications, fire protection, etc. It<br />

does not include recurring revenue, as that is counted<br />

towards ranking on the SDM 100 (www.SDMmag.com/<br />

SDM100Report).<br />

Note: an e following the figure indicates it is an SDM<br />

estimate.<br />

To find a company by name, use the alphabetical index<br />

on page 78.<br />

July 2016 63

2016<br />

21 st ANNUAL REPORT<br />

North American Number of New Value of<br />

2016 2015 Company & Headquarters Systems Integration Non-Residential Non-Residential Top 3 Markets Full-time Business<br />

Rank Rank Location Revenue 2015 Projects, 2015 Projects, 2015 Contributing to Revenue Employees Locations<br />

24 Access Systems Integration<br />

Eatontown, N.J.<br />

25 26 Security Corporation<br />

Novi, Mich.<br />

26 31 Advanced Cabling Systems<br />

North Little Rock, Ark.<br />

27 32 Low Voltage Contractors Inc.<br />

Minneapolis, Minn.<br />

28 35 MidCo Inc.<br />

Burr Ridge, Ill.<br />

29 33 MSE Corporate Security<br />

Branchburg, N.J.<br />

30 27 Sound Incorporated<br />

Naperville, Ill.<br />

31 30 Integrated Security Technologies<br />

Herndon, Va.<br />

32 34 Allied Fire & Security<br />

Spokane, Wash.<br />

33 55 NextGen Security LLC<br />

King of Prussia, Pa.<br />

34 39 Security Equipment Inc.<br />

Omaha, Neb.<br />

35 49 Tutela Inc.<br />

Brunswick, Ga.<br />

36 52 ACT<br />

Clifton, N.J.<br />

37 36 KST Security<br />

Indianapolis, Ind.<br />

38 45 Firstline Security Systems Inc.<br />

Anaheim, Calif.<br />

39 37 CTSI<br />

Chantilly, Va.<br />

40 56 Security Integrations<br />

Albany, N.Y.<br />

41 38 TRL Systems Inc.<br />

Rancho Cucamonga, Calif.<br />

42 42 American Alarm & Communications<br />

Arlington, Mass.<br />

43 82 Redrock Security & Cabling Inc.<br />

Irvine, Calif.<br />

44 46 The Protection Bureau<br />

Exton, Pa.<br />

45 47 Security and Data Technologies Inc.<br />

Newtown, Pa.<br />

46 58 RAE Security<br />

Houston, Texas<br />

$23,002,793 668 $19,687,594 na 80 1<br />

$22,824,416 na na na 112 2<br />

$22,819,000 50 $22,800,000 corp, edu, financial 168 4<br />

$22,630,743 1,179 $18,292,158 financial, govt, health 113 3<br />

$21,125,410 3,150 $20,000,000 corp, utilities, edu 101 3<br />

$20,400,000 na na retail, health,<br />

entertainment<br />

84 6<br />

$20,200,000 200 $19,912,117 edu, corp, financial 77 1<br />

$20,180,000 805 $20,180,000 govt, health, edu 83 2<br />

$20,000,000 180 $15,800,000 corp, health, edu 81 3<br />

$19,137,505 640 $19,137,505 utilities, industrial, health 58 3<br />

$18,029,072 2,483 $14,744,687 edu, health, corp 167 4<br />

$17,600,000 883 $16,115,671 na 54 15<br />

$16,965,000 84 $12,000,000 health, edu, financial 39 2<br />

$16,343,788 300 $13,415,607 health, industrial, corp 63 4<br />

$15,750,000 235 $11,500,000 utilities, financial, corp 58 3<br />

$15,055,298 147 $11,285,592 govt, health, edu 48 1<br />

$14,986,083 200 $12,000,000 law, utilities, industrial 37 3<br />

$14,967,269 513 $14,967,269 na 177 5<br />

$14,889,368 4,534 $14,934,718 property mgmt, govt,<br />

financial<br />

204 5<br />

$14,874,642 98 $14,874,642 apartments, corp 45 2<br />

$14,850,000 1,300 $7,810,128 retail, corp, edu 180 4<br />

$14,021,173 288 $12,887,952 na 95 1<br />

$13,314,318 300 $13,000,000 na 45 1<br />

■ No. 24 – Completed management buy-out from MSA Security and began operating as an independent company. ■ No. 27 – Secured a large state hospital project, which called for multiple disciplines<br />

and platforms. ■ No. 28 – Global international integrated system in the Middle East. ■ No. 33 – Achieved DHS SAFETY Act Designation for Perimeter Protection Services. ■ No. 34 – Consolidated<br />

from two separate buildings into a new corporate headquarters including moving UL central station. ■ No. 35 – In process of overhauling all administrative software to a new ERM platform. Opened<br />

three new full-service locations: Charlotte, N.C.; Sunrise, Fla.; and Anaheim, Calif., as well as New York City in March 2016. ■ No. 40 – Acquired a small IT services company. ■ No. 44 – Celebrated<br />

40 years in business as a family-owned company.<br />

e = SDM estimate. na = not available. Abbreviations to markets: airport = airports; corp = corporate office space; correctional = correctional; edu = education/campus; entertainment =<br />

entertainment/sports venues; financial = financial/banking; gaming = casinos/gaming; govt = government; health = healthcare; hotels = hotels/hospitality; industrial = industrial; law = law<br />

enforcement; retail = retail/restaurants; transport = transportation/distribution; utilities = utilities/critical infrastructure.<br />

64 July 2016

21 st ANNUAL REPORT<br />

Largest Project in 2015: $26 Million<br />

Company<br />

Value of 2016<br />

Largest Project Rank<br />

Johnson Controls Inc. ......$26,000,000 ..........3<br />

Interface Security<br />

Systems Holdings Inc. .....$14,800,000 ........21<br />

Convergint<br />

Technologies....................$10,000,000 ..........2<br />

Minuteman Security<br />

Technologies Inc. ...............$8,087,960 ........53<br />

G4S Secure<br />

Integration LLC..................$7,500,000 ..........7<br />

Security Integrations .........$5,400,000 ........40<br />

Securityhunter Inc. ............$5,211,003 ........13<br />

Red Hawk Fire &<br />

Security .............................$5,000,000 ..........5<br />

VTI Security .......................$5,000,000 ........10<br />

NextGen Security, LLC ........$5,000,000 ........33<br />

ACT....................................$3,956,240 ........36<br />

RAE Security ......................$3,200,000 ........46<br />

Midstate Security<br />

Company ...........................$2,983,555 ........50<br />

Telenet VoIP Inc. ................$2,883,232 ........92<br />

Advanced Electronic<br />

Solutions ...........................$2,575,000 ........51<br />

Unlimited<br />

Technology Inc. ..................$2,200,000 ........17<br />

Integrated Security<br />

Technologies......................$2,168,400 ........31<br />

MidCo Inc. .........................$2,147,000 ........28<br />

RFI Communications<br />

& Security Systems............$2,100,000 ........12<br />

Mountain Alarm.................$2,000,000 ........20<br />

Sound Incorporated ...........$2,000,000 ........30<br />

Firstline Security<br />

Systems Inc. ......................$1,940,000 ........38<br />

SIGNET Electronic<br />

Systems Inc. ......................$1,900,000 ........19<br />

Genesis Security<br />

Systems LLC ......................$1,800,000 ........22<br />

CTSI...................................$1,763,328 ........39<br />

GSI ....................................$1,750,000 ........23<br />

Advanced Cabling<br />

Systems.............................$1,750,000 ........26<br />

AFA Protective<br />

Systems Inc. ......................$1,597,000 ........11<br />

Tele-Tector of<br />

Maryland, Inc. ...................$1,568,250 ........68<br />

Universal Protection<br />

Security Systems ...............$1,529,672 ........16<br />

TRL Systems Inc. ...............$1,400,000 ........41<br />

Value of 2016<br />

Company Largest Project Rank<br />

Strategic Security<br />

Solutions ...........................$1,400,000 ........83<br />

Tech Systems Inc. ..............$1,260,402 ........15<br />

Entech Sales &<br />

Service Inc.........................$1,247,783 ........14<br />

Intertech Ci .......................$1,200,000 ........18<br />

KST Security ......................$1,200,000 ........37<br />

Low Voltage<br />

Contractors Inc..................$1,142,000 ........27<br />

Life Safety Engineered<br />

Systems Inc. ......................$1,100,000 ........54<br />

Tutela Inc. ............................$982,000 ........35<br />

Scarsdale Security<br />

Systems Inc. .........................$975,000 ........60<br />

Access Systems<br />

Integration ...........................$935,094 ........24<br />

Redrock Security &<br />

Cabling Inc...........................$920,000 ........43<br />

CGL Electronic Security Inc. ..$765,000 ........56<br />

Security Equipment Inc. .......$663,528 ........34<br />

Security and Data<br />

Technologies Inc. ..................$635,969 ........45<br />

Allied Fire & Security ............$600,000 ........32<br />

Engineered Security<br />

Systems................................$590,224 ........87<br />

Guardian Protection<br />

Services................................$569,545 ........62<br />

Electronic Security<br />

Concepts LLC .......................$535,000 ........72<br />

The Protection Bureau ..........$503,170 ........44<br />

Will Electronics.....................$500,000 ........71<br />

APL Access & Security Inc. ...$450,000 ........65<br />

Kimberlite Corp. ...................$449,767 ........89<br />

MSE Corporate Security ........$440,000 ........29<br />

D/A Central Inc. ....................$433,000 ........70<br />

Per Mar Security Services .....$432,000 ........69<br />

PASS Security .......................$425,000 ........64<br />

New York Security Solutions ..$412,682 ........88<br />

Vector Security Inc. ...............$375,000 ..........8<br />

Sonitrol of Buffalo,<br />

Rochester, Toronto ................$375,000 ........96<br />

American Alarm &<br />

Communications ..................$356,000 ........42<br />

Vision Security<br />

Technologies.........................$342,193 ........63<br />

Stone Security ......................$341,061 ........59<br />

Sonitrol New England ...........$317,187 ........57<br />

Largest Project Winner:<br />

Johnson Controls<br />

Customer:<br />

New York Power Authority<br />

Johnson Controls will, for up to a two-year<br />

term, engineer, procure and construct systems<br />

associated with physical and cyber<br />

security upgrades in order to maintain<br />

compliance with the North American Electric<br />

Reliability Corporation’s Critical Infrastructure<br />

Protection (NERC CIP), Version 5<br />

Standards. The upgrades consist of physical<br />

and cyber security enhancements,<br />

including cameras, access controls<br />

and methods of preventing and detecting<br />

intrusion in Authority substations.<br />

The contract includes work at five of the<br />

Authority’s generation and transmission<br />

facilities and eight remote substations.<br />

Company<br />

Value of 2016<br />

Largest Project Rank<br />

Southeastern Security<br />

Professionals LLC .................$295,000 ........79<br />

Sentry Security .....................$290,000 ........94<br />

EMC Security ........................$280,000 ........95<br />

Matson Alarm Co. Inc. ..........$275,000 ........85<br />

SCI Inc..................................$250,000 ........90<br />

Peak Alarm Co. Inc. ..............$225,000 ........81<br />

Atronic Alarms Inc. ...............$197,695 ........78<br />

F.E. Moran Inc. Alarm and<br />

Monitoring Services ..............$194,590 ........47<br />

Custom Security Systems .....$173,000 ........99<br />

Bates Security LLC /<br />

Sonitrol of Lexington.............$131,000 ........77<br />

Sonitrol Pacifi c .....................$111,910 ........86<br />

Fleenor Security Systems ......$108,965 ........82<br />

Sonitrol of Sacramento<br />

& Orange County,<br />

Cybex Security ......................$106,598 ........76<br />

Sonitrol Tri-County................$102,000 ........97<br />

These 78 systems integrators reported having the highest-value security projects started in 2015. Note: Four of the top 10<br />

companies did not report their largest project size, as requested by SDM. Projects below $100,000 are not ranked here.<br />

Source: SDM Top Systems Integrators Report, July 2016<br />

July 2016 65

2016<br />

21 st ANNUAL REPORT<br />

North American Number of New Value of<br />

2016 2015 Company & Headquarters Systems Integration Non-Residential Non-Residential Top 3 Markets Full-time Business<br />

Rank Rank Location Revenue 2015 Projects, 2015 Projects, 2015 Contributing to Revenue Employees Locations<br />

47 29 F.E. Moran Inc. Alarm<br />

and Monitoring Services<br />

Champaign, Ill.<br />

48 54 ADS Security L.P.<br />

Nashville, Tenn.<br />

49 44 SSD Alarm Systems / Kern Security &<br />

Fire / Alpha Alarm & McNeill Security<br />

Anaheim, Calif.<br />

50 53 Midstate Security Company<br />

Wyoming, Mich.<br />

51 66 Advanced Electronic Solutions<br />

College Point, N.Y.<br />

52 62 Alarm Detection Systems Inc.<br />

Aurora, Ill.<br />

53 50 Minuteman Security Technologies Inc.<br />

Andover, Mass.<br />

54 Life Safety Engineered Systems Inc.<br />

Buffalo, N.Y.<br />

55 67 Operational Security Systems Inc.<br />

Atlanta, Ga.<br />

56 CGL Electronic Security Inc.<br />

Westwood, Mass.<br />

57 65 Sonitrol New England<br />

Rocky Hill, Conn.<br />

58 59 Dallas Security Systems Inc.<br />

& DSS Fire Inc.<br />

Dallas, Texas<br />

59 80 Stone Security<br />

Salt Lake City, Utah<br />

60 63 Scarsdale Security Systems Inc.<br />

Scarsdale, N.Y.<br />

61 71 AVS Technology<br />

Totowa, N.J.<br />

62 69 Guardian Protection Services<br />

Warrendale, Pa.<br />

63 Vision Security Technologies<br />

Birmingham, Ala.<br />

64 68 PASS Security<br />

Fairview Heights, Ill.<br />

65 75 APL Access & Security Inc.<br />

Gilbert, Ariz.<br />

66 60 Sentry Communications & Security<br />

Hicksville, N.Y.<br />

67 73 Ackerman Security Systems<br />

Atlanta, Ga.<br />

$13,150,482 1,693 $14,571,930 retail, financial, hotel 174 6<br />

$12,800,224 4,375 $6,491,100 retail, corp, industrial 334 19<br />

$12,281,070 na na na na 12<br />

$11,741,165 228 $11,493,165 correctional, health, retail 78 1<br />

$11,535,000 82 na na 75 3<br />

$11,228,103 1,024 $6,624,966 na 306 4<br />

$11,170,235 693 $11,170,235 na 46 3<br />

$10,211,516 119 $5,965,746 na 72 4<br />

$9,664,676 315 na edu, financial, health na 2<br />

$9,302,874 104 $8,536,027 na 43 1<br />

$9,254,435 1,236 $7,534,241 edu, corp, industrial 97 5<br />

$8,140,330 2,500 $8,140,330 na 140 2<br />

$8,126,967 247 $4,860,721 edu, govt, transport 24 2<br />

$7,828,922 1,206 $7,304,651 retail, corp, airport 101 2<br />

$7,750,000 na na na 60 3<br />

$7,574,579 4,223 $7,574,579 retail, health, edu 1,048 14<br />

$7,200,000 100 $6,200,000 edu, govt, health na 2<br />

$7,179,516 500 $7,179,516 na 48 1<br />

$7,056,574 50 $5,000,000 corp, govt, health 40 2<br />

$6,900,000 250 $5,800,000 corp, transport, health na 1<br />

$6,610,393 2,120 $5,024,665 retail, health, govt 319 2<br />

■ No. 48 – Formally introduced ADS +Rewards Customer Loyalty program, which allows existing customers to earn loyalty rebates towards system upgrades based upon their tenure with ADS.■ No.<br />

52 – Purchased Safe Systems Inc., Louisville, Colo. ■ No. 53 – Introduced TransitSentry v1.5, a wireless mass transit video surveillance platform developed by Minuteman. ■ No. 56 – Outgrew<br />

Norwood, Mass., facility and acquired a 13,275 sq. ft. state-of-the-art facility in Westwood, Mass., which includes a customer training center and a technology lab. ■ No. 57 – Full integration of<br />

Mutualink into central station to help leverage verified dispatch to the PSAP. ■ No. 59 – Adding another higher-education organization to client roster: Salt Lake Community College, Utah’s largest<br />

college serving more than 60,000 students on 10 campuses. ■ No. 62 – Opened a second central station in Arizona; the centers in Arizona and Pennsylvania will operate as if they are one, while<br />

enabling independent redundancy. In addition to Customer Care Operations, Data Services, and Technical Support, the site also will incorporate a state-of-the-art training facility.<br />

e = SDM estimate. na = not available. Abbreviations to markets: airport = airports; corp = corporate office space; correctional = correctional; edu = education/campus; entertainment =<br />

entertainment/sports venues; financial = financial/banking; gaming = casinos/gaming; govt = government; health = healthcare; hotels = hotels/hospitality; industrial = industrial; law = law<br />

enforcement; retail = retail/restaurants; transport = transportation/distribution; utilities = utilities/critical infrastructure.<br />

66 July 2016

2016<br />

21 st ANNUAL REPORT<br />

Integrators’ Sales Revenue<br />

By Product Category<br />

Top Systems Integrators were asked to break out their<br />

2015 revenue by type of product. The majority is earned<br />

from integrated non-residential systems that combine<br />

two or more different technology solutions. No significant<br />

changes were recorded from 2014 to 2015 in the percentage<br />

of revenue from these types of products.<br />

Badging<br />

1%<br />

IT hardware/<br />

software<br />

1%<br />

Intercom/<br />

communications<br />

2%<br />

Integrated<br />

residential<br />

systems<br />

3%<br />

Continued from page 63<br />

ing — solutions that deliver “big data.” There is also a greater<br />

emphasis on cybersecurity, say the integrators of their clients.<br />

“ITO and big data will continue to be a focus of our goforward<br />

strategy. The industry is way behind other industries<br />

in the use of data. Video analytic metadata is going to become<br />

very valuable,” claims D/A Central Inc., ranked No. 70.<br />

Therefore, the need for security systems integrators to become<br />

more network-savvy is greater than ever. When asked what<br />

percentage of projects sold in 2015 incorporated IP-based technology,<br />

45 percent of systems integrators noted that between<br />

three-fourths and 100 percent of their projects incorporated IP.<br />

WHICH MARKETS ARE SPENDING?<br />

A handful of vertical segments stood out as front-runners<br />

in spending on integrated security products and services:<br />

education (especially higher-ed), healthcare, utilities/critical<br />

infrastructure, and transportation/logistics. Integrators also<br />

mentioned:<br />

• Energy<br />

• Retail (especially<br />

multi-location)<br />

• Banking<br />

68 July 2016<br />

Other<br />

1%<br />

Fire protection<br />

9%<br />

Intrusion alarms<br />

10%<br />

Integrated<br />

non-residential<br />

systems<br />

42%*<br />

Video<br />

surveillance<br />

18%<br />

Access control<br />

13%<br />

*percentage of Top Systems Integrators’ 2015 sales revenue; based on 89 responses.<br />

Source: SDM Top Systems Integrators Report, July 2016<br />

• Multi-unit residential<br />

• Hospitality<br />

• Government<br />

• Banking<br />

Integrators’ Sales Revenue<br />

By Service Category<br />

Top Systems Integrators were asked to break out their<br />

2015 revenue by type of service. The majority is earned<br />

from system sales and installation. No significant changes<br />

were recorded from 2014 to 2015 in the percentage<br />

of revenue from these types of services.<br />

Equipment leases<br />

1%<br />

Sales/installation<br />

58%*<br />

Hosted/managed<br />

services<br />

2%<br />

Test and<br />

inspection<br />

3%<br />

Non-contracted<br />

service<br />

7%<br />

Service contracts<br />

11%<br />

*percentage of Top Systems Integrators’ 2015 service revenue; based on 93 responses.<br />

Source: SDM Top Systems Integrators Report, July 2016<br />

Monitoring<br />

18%<br />

No. 2-ranked Convergint Technologies emphasizes the<br />

broad-reaching application of video <strong>technologies</strong>: “The market<br />

for security systems sales and integrated systems continued its<br />

strong growth in 2015. Video sales continue to dominate as customers<br />

begin to look beyond traditional security applications<br />

and start looking at using video for manufacturing, process<br />

improvement, regulatory compliance, etc.<br />

“The best growth came from the utility segment as these<br />

customers continue to be concerned about the security of their<br />

infrastructures. With the downturn in the price of oil, petrochemical<br />

has been hit the hardest in terms of being weak in<br />

2015,” Convergint says.<br />

No. 7-ranked G4S Secure Integration LLC, calls out critical<br />

infrastructure as a leading sector. “Our strongest sector is<br />

definitely critical infrastructure. We see tons of potential in that<br />

market to adhere by NERC/CIP regulations and see ourselves<br />

as one of the best providers,” the company says.<br />

No. 59, Stone Security, says the positive marketplace had a<br />

constructive effect on its operations. “We felt the market was<br />

stronger in 2015 than 2014 especially in education and industrial<br />

markets. We were forced to add a number of people to the<br />

organization to keep up with increased demand in 2015.”<br />

No. 81-ranked Peak Alarm Co. Inc., affirms that spending on<br />

integrated security solutions continues to hold up. “The market<br />

in 2015 continued to be strong in security systems sales driven<br />

Continues on page 76

2016<br />

21 st ANNUAL REPORT<br />

North American Number of New Value of<br />

2016 2015 Company & Headquarters Systems Integration Non-Residential Non-Residential Top 3 Markets Full-time Business<br />

Rank Rank Location Revenue 2015 Projects, 2015 Projects, 2015 Contributing to Revenue Employees Locations<br />

68 Tele-Tector of Maryland Inc.<br />

Columbia, Md.<br />

69 76 Per Mar Security Services<br />

Davenport, Iowa<br />

70 D/A Central Inc.<br />

Oak Park, Mich.<br />

71 77 Will Electronics<br />

St. Louis, Mo.<br />

72 83 Electronic Security Concepts LLC<br />

Scottsdale, Ariz.<br />

73 89 Artel Communications Corp.<br />

Plainview, N.Y.<br />

74 DynaFire Inc.<br />

Casselberry, Fla.<br />

75 Atlantic Coast Alarm Inc.<br />

Mays Landing, N.J.<br />

76 95 Sonitrol of Sacramento & Orange<br />

County, Cybex Security<br />

Roseville, Calif.<br />

77 84 Bates Security LLC / Sonitrol of Lexington<br />

Lexington, Ky.<br />

78 87 Atronic Alarms Inc.<br />

Lenexa, Kan.<br />

79 Southeastern Security Professionals LLC<br />

Norcross, Ga.<br />

80 88 Select Security<br />

Lancaster, Pa.<br />

81 86 Peak Alarm Co. Inc.<br />

Salt Lake City, Utah<br />

82 90 Fleenor Security Systems<br />

Johnson City, Tenn.<br />

83 Strategic Security Solutions<br />

Raleigh, N.C.<br />

84 Acadiana Security Plus<br />

Broussard, La.<br />

85 92 Matson Alarm Co. Inc.<br />

Fresno, Calif.<br />

86 96 Sonitrol Pacific<br />

Portland, Ore.<br />

87 81 Engineered Security Systems<br />

Towaco, N.J.<br />

88 New York Security Solutions<br />

Brooklyn, N.Y.<br />

89 85 Kimberlite Corp.<br />

Fresno, Calif.<br />

90 93 SCI Inc.<br />

Albuquerque, N.M.<br />

$6,518,284 303 $6,286,200 health, govt, corp 88 1<br />

$6,516,917 5,023 $19,946,615 na 354 14<br />

$6,382,534 245 $6,632,000 industrial, financial,<br />

health<br />

42 2<br />

$6,043,266 na $4,731,430 na 26 1<br />

$6,008,263 510 $4,500,000 govt, health, edu 32 1<br />

$6,000,000 15 $6,000,000 na 10 1<br />

$5,885,805 240 $5,878,000 na 146 4<br />

$5,821,709 na na govt, health, edu 33 3<br />

$5,323,594 392 $5,296,129 corp, govt, industrial 49 2<br />

$5,310,823 561 $3,244,624 edu, corp, industrial 54 1<br />

$5,267,958 708 $2,893,178 corp, hotel, retail 53 1<br />

$5,261,967 374 $4,533,151 na 31 1<br />

$5,117,000 na $5,117,000 retail, financial, hotel 161 10<br />

$4,731,871 1,366 $3,100,000 corp, industrial, retail 88 4<br />

$4,563,074 575 $2,772,076 industrial, health, corp 54 1<br />

$4,342,717 1,086 na health, corp, edu 12 1<br />

$3,651,391 193 $1,222,667 govt, industrial, corp 80 1<br />

$3,155,762 1,114 $2,109,730 na 68 4<br />

$3,061,422 415 $3,006,422 edu, corp, govt 82 5<br />

$2,940,471 210 $2,620,471 na 48 4<br />

$2,875,608 600 $2,875,608 na 13 1<br />

$2,868,000 36 $2,843,000 edu, law, govt 108 8<br />

$2,814,303 252 $1,932,461 govt, utilities 13 1<br />

■ No. 73 – Opened 10 new school projects and secured two major NYCT contracts. ■ No. 77 – Acquired Kentucky Alarm Services. ■ No. 79 – Joined PSA co-op as an owner company. ■ No. 81 –<br />

Launched PeakEdge, an access control package centered on an affordable entry point with aggressive RMR generation. This is in addition to PeakLink and PeakView, security and video surveillance<br />

packages. ■ No. 82 – In 2015 began the process of converting estimating and CRM system to WeSuite. Also in the final stages of getting central station UL listed. ■ No. 86 – Recognized as Sonitrol<br />

Dealer of the Year at the 2015 Sonitrol National Dealers Association. ■ No. 88 – Became an exclusive safety and security provider for six NYC public hospitals. ■ No. 89 – Completed technology and<br />

communication infrastructure upgrade.<br />

e = SDM estimate. na = not available. Abbreviations to markets: airport = airports; corp = corporate office space; correctional = correctional; edu = education/campus; entertainment =<br />

entertainment/sports venues; financial = financial/banking; gaming = casinos/gaming; govt = government; health = healthcare; hotels = hotels/hospitality; industrial = industrial; law = law<br />

enforcement; retail = retail/restaurants; transport = transportation/distribution; utilities = utilities/critical infrastructure.<br />

70 July 2016

2016<br />

21 st ANNUAL REPORT<br />

North American Number of New Value of<br />

2016 2015 Company & Headquarters Systems Integration Non-Residential Non-Residential Top 3 Markets Full-time Business<br />

Rank Rank Location Revenue 2015 Projects, 2015 Projects, 2015 Contributing to Revenue Employees Locations<br />

91 94 Redwire / Sonitrol of Tallahassee,<br />

Bay, NW FL, EC FL<br />

Tallahassee, Fla.<br />

92 Telenet VoIP Inc.<br />

El Segundo, Calif.<br />

93 Washington Alarm Inc.<br />

Seattle, Wash.<br />

94 Sentry Security<br />

Wheeling, Ill.<br />

95 97 EMC Security<br />

Suwanee, Ga.<br />

96 98 Sonitrol of Buffalo, Rochester, Toronto<br />

Buffalo, N.Y.<br />

97 99 Sonitrol Tri-County<br />

Grand Blanc, Mich.<br />

98 100 World Wide Security & GC Alarm Inc.<br />

Garden City, N.Y.<br />

99 91 Custom Security Systems<br />

Lacey, Wash.<br />

100 Sonitrol Security Systems of the Triangle<br />

Raleigh, N.C.<br />

$2,810,323 na na na 73 6<br />

$2,741,179 68 $8,355,120 edu, corp, industrial 52 1<br />

$2,715,772 337 $1,403,031 edu, corp, industrial 53 2<br />

$2,645,261 156 $2,395,000 hotel, financial, industrial 25 1<br />

$2,600,000 840 $2,886,999 edu, corp, utilities 127 1<br />

$2,475,500 297 $4,151,771 industrial, corp, transport 78 3<br />

$2,255,429 883 $2,181,000 corp, industrial, transport 60 3<br />

$2,101,113 na na hotel, edu, corp 53 2<br />

$2,060,910 412 $2,060,910 edu, corp, utilities 99 3<br />

$1,749,882 180 $1,750,000 corp, health, industrial 25 1<br />

■ No. 92 – Design and installation of the IP audio/video intercom system for Marlton School for the Deaf. ■ No. 95 – Major Georgia theme park facility landed for systems and monitoring.<br />

e = SDM estimate. na = not available. Abbreviations to markets: airport = airports; corp = corporate office space; correctional = correctional; edu = education/campus; entertainment =<br />

entertainment/sports venues; financial = financial/banking; gaming = casinos/gaming; govt = government; health = healthcare; hotels = hotels/hospitality; industrial = industrial; law = law<br />

enforcement; retail = retail/restaurants; transport = transportation/distribution; utilities = utilities/critical infrastructure.<br />

Top 10 Integrators<br />

By Total Revenue<br />

Among companies ranked on the Top Systems Integrators<br />

Report, these businesses reported (or were estimated by<br />

SDM) the highest total revenue in 2015: Johnson Controls,<br />

Tyco Integrated Security, and Convergint Technologies<br />

are the top three.<br />

Company<br />

Total Revenue<br />

Johnson Controls Inc. $4,443,000,000<br />

Tyco Integrated Security $3,879,000,000<br />

Convergint Technologies LLC $471,000,000<br />

Vector Security Inc. $300,800,000<br />

Red Hawk Fire & Security $220,000,000<br />

Guardian Protection Services $187,406,066<br />

Interface Security Systems Holdings Inc. $149,400,000<br />

Kratos Public Safety & Security Solutions Inc. $144,700,000<br />

G4S Secure Integration LLC $136,521,182<br />

Entech Sales & Service Inc. $102,000,000<br />

Source: SDM Top Systems Integrators Report, July 2016<br />

Integrators Predict<br />

Performance in 2016<br />

Top Systems Integrators were asked, “How do you expect<br />

revenues in 2016 to compare with revenues in 2015?”<br />

Decrease<br />

1%<br />

Stay the same<br />

13%<br />

Increase<br />

86%*<br />

Nearly nine in 10 Top Systems Integrators (86 percent)<br />

expect their 2016 revenues to exceed 2015’s. These<br />

results exceed the expectations systems integrators had<br />

in 2015.<br />

*percentage of Top Systems Integrators indicating each answer; based<br />

on 91 responses<br />

Source: SDM Top Systems Integrators Report, July 2016<br />

72 July 2016

2016<br />

21 st ANNUAL REPORT<br />

Top 3 Market Sectors:<br />

Office Space, Education, Healthcare — Again<br />

Top Systems Integrators were asked to rank the sectors that<br />

provided the most significant portion of their 2015 revenue.<br />

2014<br />

1. Corporate<br />

2. Education/campus<br />

3. Healthcare<br />

4. Government<br />

5. Industrial<br />

6. Retail/restaurant<br />

7. Financial/banking<br />

8. Utilities/critical<br />

infrastructure<br />

2015<br />

1. Corporate<br />

2. Education/campus<br />

3. Healthcare<br />

4. Government<br />

5. Industrial<br />

6. Retail/restaurant<br />

7. Financial/banking<br />

8. Utilities/critical<br />

infrastructure<br />

9. Transportation/distribution 9. Transportation/distribution<br />

10. Hotel/hospitality 10. Hotel/hospitality<br />

& Airports<br />

(tied for this position)<br />

These top 10 market sectors provided the most significant<br />

portion of revenues to systems integrators in 2015<br />

— and the top 10 list is almost exactly the same yearover-year.<br />

For the past several years, corporate/property<br />

management, education, and healthcare have steadfastly<br />

been among the top market sectors for integrators.<br />

Source: SDM Top Systems Integrators Report, July 2016<br />

Integrators Give<br />

Thumbs up to Funding<br />

Top Systems Integrators were asked, “Do you think funding<br />

for security projects was generally better, worse, or about<br />

the same in 2015 as it was in 2014?”<br />

Don’t Know<br />

1%<br />

Worse<br />

5%<br />

About<br />

the same<br />

40%<br />

Better<br />

54%*<br />

Top Systems Integrators have a positive outlook on the state<br />

of funding for their clients’ security projects, citing conditions<br />

such as an increase in crime and concern for employee<br />

safety. One respondent said the economy is on the upswing,<br />

and fear of current events, such as active shooters, is helping<br />

to keep security projects active. Among the 5 percent<br />

who see funding as worse than the previous year, they cite<br />

frozen state funds, among other reasons.<br />

*percentage of Top Systems Integrators indicating each answer; based on 89<br />

responses<br />

Source: SDM Top Systems Integrators Report, July 2016<br />

Average Percentage of Jobs on an Integrator’s Staff<br />

This chart, which you can<br />

use to compare job titles<br />

in your own company with<br />

industry averages, shows<br />

the average percentage<br />

distribution of job titles<br />

among Top Systems<br />

Integrator companies.<br />

More than two-thirds of<br />

jobs (36 percent) are<br />

comprised of installation<br />

and technical service<br />

positions.<br />

*average percentage distribution<br />

of staff titles among systems<br />

integrators; based on 91 responses<br />

Source: SDM Top Systems<br />

Integrators Report, July 2016<br />

General management<br />

4%<br />

Executive<br />

management<br />

2%<br />

Administrative<br />

9%<br />

Customer service<br />

6%<br />

Finance<br />

4%<br />

Central station<br />

7%<br />

Sales/marketing<br />

12%<br />

Other<br />

8%<br />

Installation<br />

21%*<br />

Project management<br />

7%<br />

Technical service<br />

15%<br />

Engineering/<br />

design<br />

3%<br />

IT<br />

2%<br />

74 July 2016

2016<br />

21 st ANNUAL REPORT<br />

Top Systems Integrators: 8-Year Performance<br />

Billions $ (% change)<br />

9<br />

8<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

$7.81*<br />

(17.1)<br />

2007<br />

$7.86<br />

(0.6)<br />

2008<br />

$8.05<br />

top 100 only<br />

(2.4)<br />

2009<br />

$7.14 †<br />

top 100 only<br />

(-11.3)<br />

2010<br />

$6.91<br />

top 100 only<br />

(-3.2)<br />

2011<br />

Year<br />

$6.31**<br />

top 100 only<br />

(-9)<br />

2012<br />

$7.36<br />

top 100 only<br />

17.5<br />

2013<br />

$6.81 ‡<br />

top 100 only<br />

(-7.1)<br />

2014<br />

$5.63***<br />

top 100 only<br />

(-17.3)<br />

2015<br />

North American systems integration revenue (as reported to<br />

or estimated by SDM) reached $5.63 billion in 2015, based<br />

on reporting from 100 Top Systems Integrators. This amount<br />

registers a 17.34 percent decrease, which is attributed to<br />

the omission of several large integrators from the report<br />

(see footnotes below and chart on page 63). For integrators<br />

whose revenue could be compared year-over-year, total<br />

systems integration revenue actually decreased 1 percent.<br />

*2007 figure reflects a correction to reported revenues for Johnson Controls and ADT,<br />

following incorrect reporting in 2006. While it appears that there was a 17 percent<br />

increase in total revenue between 2006 and 2007, it was actually 4 percent growth.<br />

†<br />

In the 2010 report, several notable companies did not participate, including SAIC,<br />

Red Hawk Security, North American Video, and National Security Systems Inc., which<br />

skewed the results. Among systems integrators for which a year-to-year comparison<br />

could be made, there was actually only a 4.4 percent decrease in performance<br />

between 2009 and 2010.<br />

**Two major factors contributed to the decrease in systems integration revenue; ADT<br />

was not ranked, and Siemens Industry Inc. systems integration revenue was adjusted<br />

downward by an SDM estimate.<br />

‡<br />

Siemens Industry Inc., which had been ranked in 2015 using estimated systems<br />

integration revenue, was not ranked in 2016. On the surface, it appears that Top<br />

Systems Integrators revenue declined 7.1 percent in 2015. When Siemens is<br />

removed from this calculation for comparison purposes, however, systems integration<br />

revenue for the top 100 companies grew very slightly, at 0.35 percent year-over-year.<br />

***A 17.34 percent decrease in systems integration revenue is attributable to the<br />

fact that several of the largest systems integrators either did not reply to SDM’s<br />

requests for information, could not comply due to restrictions of being publicly held,<br />

or were omitted due to acquisition (includes Diebold Security – will report next year as<br />

Securitas Electronic Security Inc.; Stanley Convergent Security Solutions; Protection<br />

1; Schneider Electric; SDI; DTT; and Dakota Security Systems, among the top 25).<br />

Source: SDM Top Systems Integrators Report, July 2016<br />

Continued from page 68<br />

by corporate spending arising from office and warehouse<br />

expansion. No specific market exhibited low or no growth.”<br />

In addition to specific drivers in individual market segments,<br />

the overall concern about active-shooter situations and terrorist<br />

episodes in general is casting its shadow across North America<br />

and spreading into the systems integration industry.<br />

“Terrorism in the news, especially domestic terrorism,<br />

has led to an increased focus on security. The education segment,<br />

in particular, has dedicated a large amount of budget to<br />

improving security,” writes No. 43-ranked Redrock Security<br />

& Cabling Inc.<br />

“The concern of continued terrorist activity will continue to<br />

drive the need for improved security solutions, which will drive<br />

increased funding,” asserts No. 3-ranked Johnson Controls Inc.<br />

According to No. 13-ranked Securityhunter Inc., terrorism<br />

is a top issue in the security marketplace. “The federal government<br />

is investing heavily in securing its people and facilities. A<br />

great market opportunity exists in helping to secure the border,<br />

and key infrastructure locations like airports.”<br />

MORE ONLINE<br />

To find this article online, as well as previous years’<br />

editions of the Top Systems Integrators Reports, visit<br />

www.SDMmag.com/Top-Systems-Integrators-Report.<br />

Among the top trending issues that Top Systems Integrators<br />

think will have the greatest impact on their business in<br />

2016, active-shooters/acts of terrorism, cybersecurity, and the<br />

growth of Security as a Service through cloud-based services<br />

and managed offerings stand out. The first has the potential<br />

to produce devastating consequences, yet provides opportunities<br />

for integrators to become a key part of securing America<br />

against such atrocious deeds. ■<br />

More from the Report<br />

To gain additional information beyond that published in<br />

this issue and online, the complete SDM Top Systems<br />

Integrators Report and Database is available in Excel<br />

format. Included are contact names, mailing addresses,<br />

telephone numbers, website URLs, targeted vertical<br />

markets, branch office locations, and much more.<br />

SDM’s Top Systems Integrators Report and Database<br />

contains the information needed to target products and<br />

services to the systems integration market.<br />

The cost of the report is $595. It may be ordered by<br />

contacting Heidi Fusaro at 630-518-5470 or by emailing<br />

fusaroh@bnpmedia.com.<br />

76 July 2016

2016<br />

21 st ANNUAL REPORT<br />

Alphabetical Index to Companies<br />

Company 2016 Rank Company 2016 Rank Company 2016 Rank<br />

Acadiana Security Plus . . . . . . . . . . . . . . . . . . 84<br />

Access Systems Integration. . . . . . . . . . . . . . . 24<br />

Ackerman Security Systems. . . . . . . . . . . . . . . 67<br />

ACT . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36<br />

ADS Security L.P. . . . . . . . . . . . . . . . . . . . . . . . 48<br />

Advanced Cabling Systems. . . . . . . . . . . . . . . 26<br />

Advanced Electronic Solutions . . . . . . . . . . . . 51<br />

AFA Protective Systems Inc.. . . . . . . . . . . . . . . 11<br />

Alarm Detection Systems Inc. . . . . . . . . . . . . . 52<br />

Allied Fire & Security. . . . . . . . . . . . . . . . . . . . 32<br />

American Alarm & Communications . . . . . . . . 42<br />

APL Access & Security Inc. . . . . . . . . . . . . . . . 65<br />

Artel Communications Corp. . . . . . . . . . . . . . . 73<br />

Atlantic Coast Alarm Inc. . . . . . . . . . . . . . . . . 75<br />

Atronic Alarms Inc. . . . . . . . . . . . . . . . . . . . . . 78<br />

AVS Technology . . . . . . . . . . . . . . . . . . . . . . . . 61<br />

Bates Security LLC / Sonitrol of Lexington. . . . 77<br />

CGL Electronic Security Inc.. . . . . . . . . . . . . . . 56<br />

Convergint Technologies . . . . . . . . . . . . . . . . . . 2<br />

CTSI. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39<br />

Custom Security Systems . . . . . . . . . . . . . . . . 99<br />

D/A Central Inc.. . . . . . . . . . . . . . . . . . . . . . . . 70<br />

Dallas Security Systems Inc.<br />

& DSS Fire Inc. . . . . . . . . . . . . . . . . . . . . . . 58<br />

DynaFire Inc. . . . . . . . . . . . . . . . . . . . . . . . . . . 74<br />

Electronic Security Concepts LLC . . . . . . . . . . 72<br />

EMC Security. . . . . . . . . . . . . . . . . . . . . . . . . . 95<br />

Engineered Security Systems. . . . . . . . . . . . . . 87<br />

Entech Sales & Service Inc.. . . . . . . . . . . . . . . 14<br />

F.E. Moran Inc. Alarm and<br />

Monitoring Services . . . . . . . . . . . . . . . . . . 47<br />

Firstline Security Systems Inc.. . . . . . . . . . . . . 38<br />

Fleenor Security Systems. . . . . . . . . . . . . . . . . 82<br />

G4S Secure Integration LLC. . . . . . . . . . . . . . . . 7<br />

Genesis Security Systems LLC. . . . . . . . . . . . . 22<br />

GSI . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23<br />

Guardian Protection Services . . . . . . . . . . . . . 62<br />

Integrated Security Technologies. . . . . . . . . . . 31<br />

Interface Security Systems Holdings Inc.. . . . . 21<br />

Intertech Ci . . . . . . . . . . . . . . . . . . . . . . . . . . . 18<br />

Johnson Controls Inc. . . . . . . . . . . . . . . . . . . . . 3<br />

Kastle Systems International. . . . . . . . . . . . . . . 6<br />

Kimberlite Corp. . . . . . . . . . . . . . . . . . . . . . . . 89<br />

Kratos Public Safety & Security<br />

Solutions Inc. . . . . . . . . . . . . . . . . . . . . . . . . 4<br />

KST Security . . . . . . . . . . . . . . . . . . . . . . . . . . 37<br />

Life Safety Engineered Systems Inc. . . . . . . . . 54<br />

Low Voltage Contractors Inc.. . . . . . . . . . . . . . 27<br />

Matson Alarm Co. Inc.. . . . . . . . . . . . . . . . . . . 85<br />

MidCo Inc.. . . . . . . . . . . . . . . . . . . . . . . . . . . . 28<br />

Midstate Security Company. . . . . . . . . . . . . . . 50<br />

Minuteman Security Technologies Inc.. . . . . . . 53<br />

Mountain Alarm. . . . . . . . . . . . . . . . . . . . . . . . 20<br />

MSE Corporate Security. . . . . . . . . . . . . . . . . . 29<br />

New York Security Solutions. . . . . . . . . . . . . . . 88<br />

NextGen Security LLC. . . . . . . . . . . . . . . . . . . . 33<br />

Operational Security Systems Inc.. . . . . . . . . . 55<br />

PASS Security . . . . . . . . . . . . . . . . . . . . . . . . . 64<br />

Peak Alarm Co. Inc.. . . . . . . . . . . . . . . . . . . . . 81<br />

Per Mar Security Services . . . . . . . . . . . . . . . . 69<br />

RAE Security . . . . . . . . . . . . . . . . . . . . . . . . . . 46<br />

Red Hawk Fire & Security . . . . . . . . . . . . . . . . . 5<br />

Redrock Security & Cabling Inc. . . . . . . . . . . . 43<br />

Redwire / Sonitrol of Tallahassee,<br />

Bay, NW FL, EC FL . . . . . . . . . . . . . . . . . . . . 91<br />

RFI Communications & Security Systems . . . . 12<br />

Scarsdale Security Systems Inc. . . . . . . . . . . . 60<br />

SCI Inc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 90<br />

Securadyne Systems LLC. . . . . . . . . . . . . . . . . . 9<br />

Security and Data Technologies Inc. . . . . . . . . 45<br />

Security Corporation . . . . . . . . . . . . . . . . . . . . 25<br />

Security Equipment Inc. . . . . . . . . . . . . . . . . . 34<br />

Security Integrations. . . . . . . . . . . . . . . . . . . . 40<br />

Securityhunter Inc. . . . . . . . . . . . . . . . . . . . . . 13<br />

Select Security. . . . . . . . . . . . . . . . . . . . . . . . . 80<br />

Sentry Communications & Security . . . . . . . . . 66<br />

Sentry Security . . . . . . . . . . . . . . . . . . . . . . . . 94<br />

SIGNET Electronic Systems Inc.. . . . . . . . . . . . 19<br />

Sonitrol New England . . . . . . . . . . . . . . . . . . . 57<br />

Sonitrol of Buffalo, Rochester, Toronto . . . . . . 96<br />

Sonitrol of Sacramento & Orange County,<br />

Cybex Security. . . . . . . . . . . . . . . . . . . . . . . 76<br />

Sonitrol Pacific . . . . . . . . . . . . . . . . . . . . . . . . 86<br />

Sonitrol Security Systems of the Triangle . . . 100<br />

Sonitrol Tri-County. . . . . . . . . . . . . . . . . . . . . . 97<br />

Sound Incorporated. . . . . . . . . . . . . . . . . . . . . 30<br />

Southeastern Security Professionals LLC . . . . 79<br />

SSD Alarm Systems / Kern Security & Fire /<br />

Alpha Alarm & McNeill Security . . . . . . . . . 49<br />

Stone Security . . . . . . . . . . . . . . . . . . . . . . . . . 59<br />

Strategic Security Solutions . . . . . . . . . . . . . . 83<br />

Tech Systems Inc. . . . . . . . . . . . . . . . . . . . . . . 15<br />

Telenet VoIP Inc. . . . . . . . . . . . . . . . . . . . . . . . 92<br />

Tele-Tector of Maryland Inc.. . . . . . . . . . . . . . . 68<br />

The Protection Bureau. . . . . . . . . . . . . . . . . . . 44<br />

TRL Systems Inc.. . . . . . . . . . . . . . . . . . . . . . . 41<br />

Tutela Inc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35<br />

Tyco Integrated Security . . . . . . . . . . . . . . . . . . 1<br />

Universal Protection Security Systems . . . . . . 16<br />

Unlimited Technology Inc. . . . . . . . . . . . . . . . . 17<br />

Vector Security Inc. . . . . . . . . . . . . . . . . . . . . . . 8<br />

Vision Security Technologies . . . . . . . . . . . . . . 63<br />

VTI Security . . . . . . . . . . . . . . . . . . . . . . . . . . . 10<br />

Washington Alarm Inc. . . . . . . . . . . . . . . . . . . 93<br />

Will Electronics . . . . . . . . . . . . . . . . . . . . . . . . 71<br />

World Wide Security & GC Alarm Inc.. . . . . . . . 98<br />

78 July 2016