LOCKHEED MARTIN CORPORATION

2015-Annual-Report

2015-Annual-Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

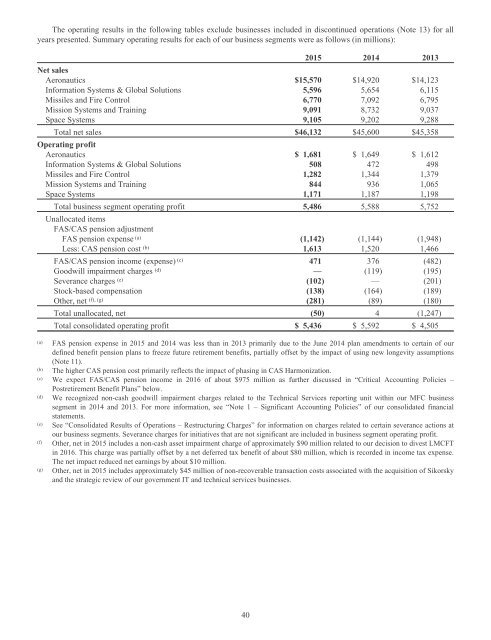

The operating results in the following tables exclude businesses included in discontinued operations (Note 13) for all<br />

years presented. Summary operating results for each of our business segments were as follows (in millions):<br />

2015 2014 2013<br />

Net sales<br />

Aeronautics $15,570 $14,920 $14,123<br />

Information Systems & Global Solutions 5,596 5,654 6,115<br />

Missiles and Fire Control 6,770 7,092 6,795<br />

Mission Systems and Training 9,091 8,732 9,037<br />

Space Systems 9,105 9,202 9,288<br />

Total net sales $46,132 $45,600 $45,358<br />

Operating profit<br />

Aeronautics $ 1,681 $ 1,649 $ 1,612<br />

Information Systems & Global Solutions 508 472 498<br />

Missiles and Fire Control 1,282 1,344 1,379<br />

Mission Systems and Training 844 936 1,065<br />

Space Systems 1,171 1,187 1,198<br />

Total business segment operating profit 5,486 5,588 5,752<br />

Unallocated items<br />

FAS/CAS pension adjustment<br />

FAS pension expense (a) (1,142) (1,144) (1,948)<br />

Less: CAS pension cost (b) 1,613 1,520 1,466<br />

FAS/CAS pension income (expense) (c) 471 376 (482)<br />

Goodwill impairment charges (d) — (119) (195)<br />

Severance charges (e) (102) — (201)<br />

Stock-based compensation (138) (164) (189)<br />

Other, net (f), (g) (281) (89) (180)<br />

Total unallocated, net (50) 4 (1,247)<br />

Total consolidated operating profit $ 5,436 $ 5,592 $ 4,505<br />

(a) FAS pension expense in 2015 and 2014 was less than in 2013 primarily due to the June 2014 plan amendments to certain of our<br />

defined benefit pension plans to freeze future retirement benefits, partially offset by the impact of using new longevity assumptions<br />

(Note 11).<br />

(b) The higher CAS pension cost primarily reflects the impact of phasing in CAS Harmonization.<br />

(c) We expect FAS/CAS pension income in 2016 of about $975 million as further discussed in “Critical Accounting Policies –<br />

Postretirement Benefit Plans” below.<br />

(d) We recognized non-cash goodwill impairment charges related to the Technical Services reporting unit within our MFC business<br />

segment in 2014 and 2013. For more information, see “Note 1 – Significant Accounting Policies” of our consolidated financial<br />

statements.<br />

(e) See “Consolidated Results of Operations – Restructuring Charges” for information on charges related to certain severance actions at<br />

our business segments. Severance charges for initiatives that are not significant are included in business segment operating profit.<br />

(f) Other, net in 2015 includes a non-cash asset impairment charge of approximately $90 million related to our decision to divest LMCFT<br />

in 2016. This charge was partially offset by a net deferred tax benefit of about $80 million, which is recorded in income tax expense.<br />

The net impact reduced net earnings by about $10 million.<br />

(g) Other, net in 2015 includes approximately $45 million of non-recoverable transaction costs associated with the acquisition of Sikorsky<br />

and the strategic review of our government IT and technical services businesses.<br />

40