A Layperson’s Guide to the Option Pricing Model

Article_Mercer-Capital-Guide-Option-Pricing-Model

Article_Mercer-Capital-Guide-Option-Pricing-Model

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Strengths and Weaknesses Relative <strong>to</strong> PWERM<br />

The primary analytical alternative <strong>to</strong> <strong>the</strong> OPM is <strong>the</strong> probability-weighted expected return method, or<br />

PWERM as it is affectionately known. Whereas <strong>the</strong> OPM is a continuous model, with potential future<br />

outcomes assumed <strong>to</strong> occur pursuant <strong>to</strong> a lognormal distribution, <strong>the</strong> PWERM is a discrete model<br />

which considers a finite number of analyst-selected potential outcomes and associated probabilities. In<br />

contrast <strong>to</strong> <strong>the</strong> OPM, <strong>the</strong> PWERM pulls double duty as both a valuation method and a means of simultaneously<br />

allocating <strong>the</strong> resulting value <strong>to</strong> <strong>the</strong> various equity classes.<br />

Exhibit 15 on page 15 summarizes a comparison of <strong>the</strong> two models along a variety of axes.<br />

Reliability of Backsolve Application of OPM<br />

The OPM is not a valuation method. However, if <strong>the</strong> value of any component of <strong>the</strong> capital structure is<br />

known – through ei<strong>the</strong>r a contemporaneous primary issuance or secondary trade – <strong>the</strong> enterprise value<br />

corresponding <strong>to</strong> that value can be determined. Using <strong>the</strong> OPM <strong>to</strong> work backward from output <strong>to</strong> an<br />

indication of implied <strong>to</strong>tal equity value is known as <strong>the</strong> “backsolve” method.<br />

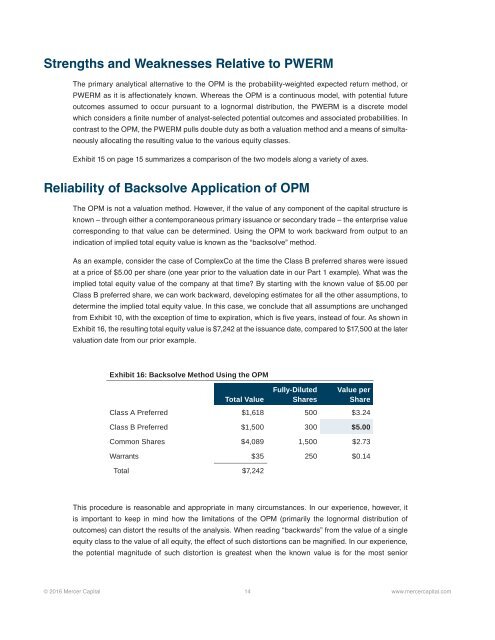

As an example, consider <strong>the</strong> case of ComplexCo at <strong>the</strong> time <strong>the</strong> Class B preferred shares were issued<br />

at a price of $5.00 per share (one year prior <strong>to</strong> <strong>the</strong> valuation date in our Part 1 example). What was <strong>the</strong><br />

implied <strong>to</strong>tal equity value of <strong>the</strong> company at that time? By starting with <strong>the</strong> known value of $5.00 per<br />

Class B preferred share, we can work backward, developing estimates for all <strong>the</strong> o<strong>the</strong>r assumptions, <strong>to</strong><br />

determine <strong>the</strong> implied <strong>to</strong>tal equity value. In this case, we conclude that all assumptions are unchanged<br />

from Exhibit 10, with <strong>the</strong> exception of time <strong>to</strong> expiration, which is five years, instead of four. As shown in<br />

Exhibit 16, <strong>the</strong> resulting <strong>to</strong>tal equity value is $7,242 at <strong>the</strong> issuance date, compared <strong>to</strong> $17,500 at <strong>the</strong> later<br />

valuation date from our prior example.<br />

Exhibit 16: Backsolve Method Using <strong>the</strong> OPM<br />

Total Value<br />

Fully-Diluted<br />

Shares<br />

Value per<br />

Share<br />

Class A Preferred $1,618 500 $3.24<br />

Class B Preferred $1,500 300 $5.00<br />

Common Shares $4,089 1,500 $2.73<br />

Warrants $35 250 $0.14<br />

Total $7,242<br />

This procedure is reasonable and appropriate in many circumstances. In our experience, however, it<br />

is important <strong>to</strong> keep in mind how <strong>the</strong> limitations of <strong>the</strong> OPM (primarily <strong>the</strong> lognormal distribution of<br />

outcomes) can dis<strong>to</strong>rt <strong>the</strong> results of <strong>the</strong> analysis. When reading “backwards” from <strong>the</strong> value of a single<br />

equity class <strong>to</strong> <strong>the</strong> value of all equity, <strong>the</strong> effect of such dis<strong>to</strong>rtions can be magnified. In our experience,<br />

<strong>the</strong> potential magnitude of such dis<strong>to</strong>rtion is greatest when <strong>the</strong> known value is for <strong>the</strong> most senior<br />

© 2016 Mercer Capital 14 www.mercercapital.com