A Layperson’s Guide to the Option Pricing Model

Article_Mercer-Capital-Guide-Option-Pricing-Model

Article_Mercer-Capital-Guide-Option-Pricing-Model

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

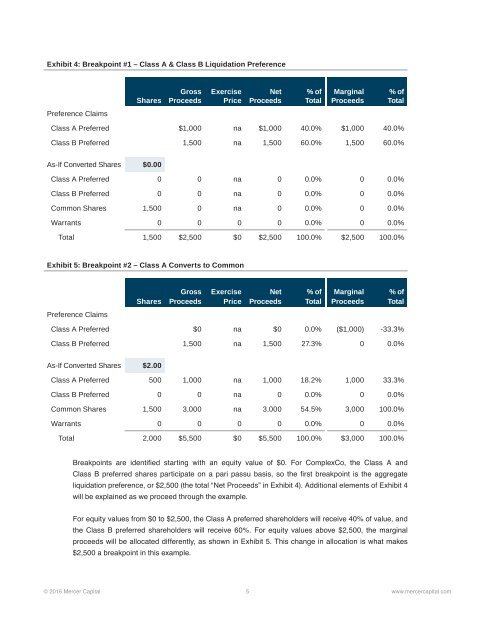

Exhibit 4: Breakpoint #1 – Class A & Class B Liquidation Preference<br />

Shares<br />

Gross<br />

Proceeds<br />

Exercise<br />

Price<br />

Net<br />

Proceeds<br />

% of<br />

Total<br />

Marginal<br />

Proceeds<br />

% of<br />

Total<br />

Preference Claims<br />

Class A Preferred $1,000 na $1,000 40.0% $1,000 40.0%<br />

Class B Preferred 1,500 na 1,500 60.0% 1,500 60.0%<br />

As-If Converted Shares $0.00<br />

Class A Preferred 0 0 na 0 0.0% 0 0.0%<br />

Class B Preferred 0 0 na 0 0.0% 0 0.0%<br />

Common Shares 1,500 0 na 0 0.0% 0 0.0%<br />

Warrants 0 0 0 0 0.0% 0 0.0%<br />

Total 1,500 $2,500 $0 $2,500 100.0% $2,500 100.0%<br />

Exhibit 5: Breakpoint #2 – Class A Converts <strong>to</strong> Common<br />

Shares<br />

Gross<br />

Proceeds<br />

Exercise<br />

Price<br />

Net<br />

Proceeds<br />

% of<br />

Total<br />

Marginal<br />

Proceeds<br />

% of<br />

Total<br />

Preference Claims<br />

Class A Preferred $0 na $0 0.0% ($1,000) -33.3%<br />

Class B Preferred 1,500 na 1,500 27.3% 0 0.0%<br />

As-If Converted Shares $2.00<br />

Class A Preferred 500 1,000 na 1,000 18.2% 1,000 33.3%<br />

Class B Preferred 0 0 na 0 0.0% 0 0.0%<br />

Common Shares 1,500 3,000 na 3,000 54.5% 3,000 100.0%<br />

Warrants 0 0 0 0 0.0% 0 0.0%<br />

Total 2,000 $5,500 $0 $5,500 100.0% $3,000 100.0%<br />

Breakpoints are identified starting with an equity value of $0. For ComplexCo, <strong>the</strong> Class A and<br />

Class B preferred shares participate on a pari passu basis, so <strong>the</strong> first breakpoint is <strong>the</strong> aggregate<br />

liquidation preference, or $2,500 (<strong>the</strong> <strong>to</strong>tal “Net Proceeds” in Exhibit 4). Additional elements of Exhibit 4<br />

will be explained as we proceed through <strong>the</strong> example.<br />

For equity values from $0 <strong>to</strong> $2,500, <strong>the</strong> Class A preferred shareholders will receive 40% of value, and<br />

<strong>the</strong> Class B preferred shareholders will receive 60%. For equity values above $2,500, <strong>the</strong> marginal<br />

proceeds will be allocated differently, as shown in Exhibit 5. This change in allocation is what makes<br />

$2,500 a breakpoint in this example.<br />

© 2016 Mercer Capital 5 www.mercercapital.com