2013 Autumn

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Refurbishing Properties<br />

Are you the owner of an investment property that has seen<br />

better days? It may be time to think about refurbishing your<br />

property to maximise your potential income.<br />

Refurbishing your investment property has many benefits<br />

beyond the pure cosmetic. A well designed, well maintained<br />

refurbishment can increase the immediate rental value of<br />

the property, impact the quality of tenants you attract, and<br />

influence the value of the property if you decide to sell.<br />

Whilst refurbishing may seem daunting, with large upfront<br />

expenses, it doesn’t have to cost a fortune. Simple changes<br />

such as new light fittings, carpet or a fresh coat of paint, are<br />

affordable and are the best ways to add quick value to your<br />

property. Similarly, giving your kitchen or bathroom a quick<br />

facelift with new doors and handles can drastically change<br />

the look of a room.<br />

In addition to increasing the rental value of your property,<br />

a well presented & well maintained property will not only<br />

increase the your rental value, more importantly it will<br />

impact on the quality of applicants you receive and also can<br />

eliminate lengthy vacancy periods between tenancies.<br />

Regardless of the size of your refurbishment project, any<br />

expenses relating to updating your investment property not<br />

only increase the property’s value, but also increase your<br />

depreciation allowances, meaning that you can claim back<br />

on expenses in the future.<br />

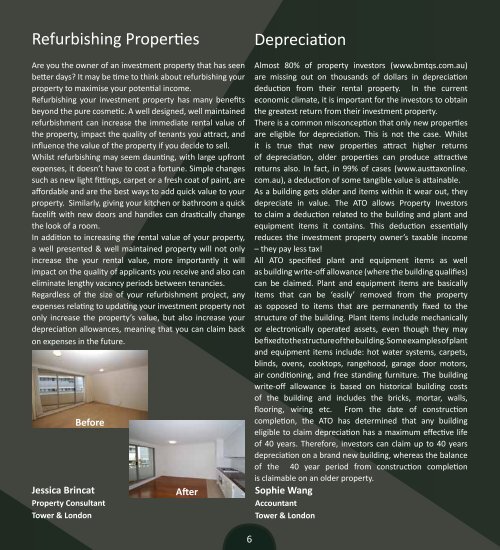

Before<br />

Jessica Brincat<br />

Property Consultant<br />

Tower & London<br />

After<br />

Depreciation<br />

Almost 80% of property investors (www.bmtqs.com.au)<br />

are missing out on thousands of dollars in depreciation<br />

deduction from their rental property. In the current<br />

economic climate, it is important for the investors to obtain<br />

the greatest return from their investment property.<br />

There is a common misconception that only new properties<br />

are eligible for depreciation. This is not the case. Whilst<br />

it is true that new properties attract higher returns<br />

of depreciation, older properties can produce attractive<br />

returns also. In fact, in 99% of cases (www.austtaxonline.<br />

com.au), a deduction of some tangible value is attainable.<br />

As a building gets older and items within it wear out, they<br />

depreciate in value. The ATO allows Property Investors<br />

to claim a deduction related to the building and plant and<br />

equipment items it contains. This deduction essentially<br />

reduces the investment property owner’s taxable income<br />

– they pay less tax!<br />

All ATO specified plant and equipment items as well<br />

as building write-off allowance (where the building qualifies)<br />

can be claimed. Plant and equipment items are basically<br />

items that can be ‘easily’ removed from the property<br />

as opposed to items that are permanently fixed to the<br />

structure of the building. Plant items include mechanically<br />

or electronically operated assets, even though they may<br />

be fixed to the structure of the building. Some examples of plant<br />

and equipment items include: hot water systems, carpets,<br />

blinds, ovens, cooktops, rangehood, garage door motors,<br />

air conditioning, and free standing furniture. The building<br />

write-off allowance is based on historical building costs<br />

of the building and includes the bricks, mortar, walls,<br />

flooring, wiring etc. From the date of construction<br />

completion, the ATO has determined that any building<br />

eligible to claim depreciation has a maximum effective life<br />

of 40 years. Therefore, investors can claim up to 40 years<br />

depreciation on a brand new building, whereas the balance<br />

of the 40 year period from construction completion<br />

is claimable on an older property.<br />

Sophie Wang<br />

Accountant<br />

Tower & London<br />

What can Tower & London do for you?<br />

Executive Leasing<br />

The main thrust of the business is its leasing department. The majority of the residential leases are negotiated<br />

to company executives, general managers and diplomats. The properties leased are middle level to exclusive<br />

apartments, most with prime harbour views. Many major Australian and international companies have entered<br />

into leases with Tower & London.<br />

Property Sales<br />

Apart from considerable private treaty and auction experience Tower & London assist in decorating the property<br />

for sale or auction in order to realise the highest possible sale price. The sale price often exceeds their valuation.<br />

Tower & London have sold every property listed within the exclusive agency period.<br />

Property Management<br />

Our property management team is focused on delivering the highest quality of customer service and in turn<br />

ensuring our clients’ interests are a top priority. At Tower & London we have a full time Trust Account who is<br />

dedicated to ensuring our clients financial matters are given the attention they deserve.<br />

Property Refurbishment<br />

Tower & London manage small refurbishment projects. Often apartments in prime locations require upgrading<br />

in order to maximise returns and increase owner’s equity. Over the years, Tower & London have accumulated an<br />

efficient team of tradespersons to undertake such projects with high quality and care.<br />

Valuations<br />

Property valuations for any purpose are prepared within 48 hours. Expert advice is provided on many technical<br />

issues concerning property values. Comprehensive feasibilty studies and Discounted Cash Flow analysis (DCF)<br />

are conducted on small to medium developments and refurbishment projects.<br />

Commercial Sales and Leasing<br />

Tower & London has a dedicated commercial department specialising in sales, leasing and management of<br />

commercial offices, industrial and retail premises. Our clients love the prompt efficient service they receive as<br />

we treat them like a big fish in a small school. No property is too big or too small, from small office suites to large<br />

industrial facilities. John Wood can tailor a sales or leasing campaign to put the focus on your property.<br />

6 7