You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

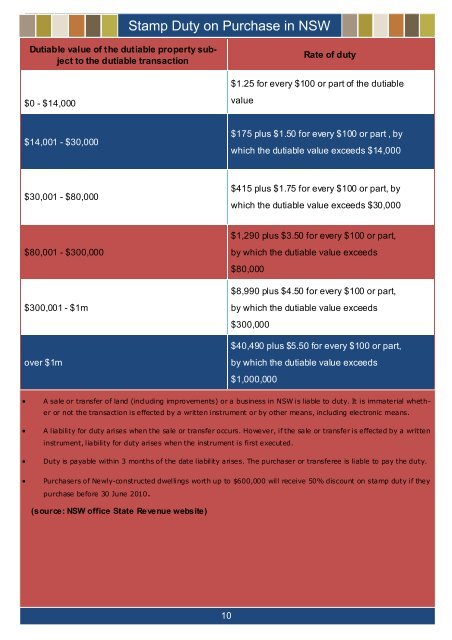

Stamp Duty on Purchase in NSW<br />

Dutiable value of the dutiable property subject<br />

to the dutiable transaction<br />

Rate of duty<br />

$1.25 for every $100 or part of the dutiable<br />

$0 - $14,000<br />

value<br />

$14,001 - $30,000<br />

$175 plus $1.50 for every $100 or part , by<br />

which the dutiable value exceeds $14,000<br />

$30,001 - $80,000<br />

$415 plus $1.75 for every $100 or part, by<br />

which the dutiable value exceeds $30,000<br />

$1,290 plus $3.50 for every $100 or part,<br />

$80,001 - $300,000<br />

by which the dutiable value exceeds<br />

$80,000<br />

$8,990 plus $4.50 for every $100 or part,<br />

$300,001 - $1m<br />

by which the dutiable value exceeds<br />

$300,000<br />

$40,490 plus $5.50 for every $100 or part,<br />

over $1m<br />

by which the dutiable value exceeds<br />

$1,000,000<br />

· A sale or transfer of land (including improvements) or a business in NSW is liable to duty. It is immaterial whether<br />

or not the transaction is effected by a written instrument or by other means, including electronic means.<br />

· A liability for duty arises when the sale or transfer occurs. However, if the sale or transfer is effected by a written<br />

instrument, liability for duty arises when the instrument is first executed.<br />

· Duty is payable within 3 months of the date liability arises. The purchaser or transferee is liable to pay the duty.<br />

· Purchasers of Newly-constructed dwellings worth up to $600,000 will receive 50% discount on stamp duty if they<br />

purchase before 30 June 2010.<br />

(source: NSW office State Revenue website)<br />

10<br />

10