You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

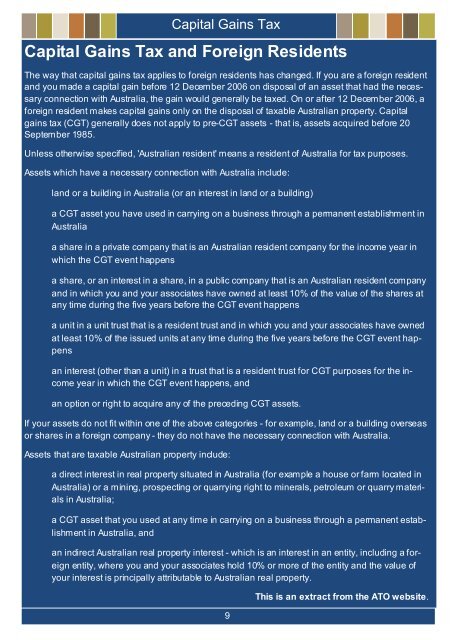

Capital Gains Tax<br />

Capital Gains Tax and Foreign Residents<br />

The way that capital gains tax applies to foreign residents has changed. If you are a foreign resident<br />

and you made a capital gain before 12 December 2006 on disposal of an asset that had the necessary<br />

connection with Australia, the gain would generally be taxed. On or after 12 December 2006, a<br />

foreign resident makes capital gains only on the disposal of taxable Australian property. Capital<br />

gains tax (CGT) generally does not apply to pre-CGT assets - that is, assets acquired before 20<br />

September 1985.<br />

Unless otherwise specified, 'Australian resident' means a resident of Australia for tax purposes.<br />

Assets which have a necessary connection with Australia include:<br />

land or a building in Australia (or an interest in land or a building)<br />

a CGT asset you have used in carrying on a business through a permanent establishment in<br />

Australia<br />

a share in a private company that is an Australian resident company for the income year in<br />

which the CGT event happens<br />

a share, or an interest in a share, in a public company that is an Australian resident company<br />

and in which you and your associates have owned at least 10% of the value of the shares at<br />

any time during the five years before the CGT event happens<br />

a unit in a unit trust that is a resident trust and in which you and your associates have owned<br />

at least 10% of the issued units at any time during the five years before the CGT event happens<br />

an interest (other than a unit) in a trust that is a resident trust for CGT purposes for the income<br />

year in which the CGT event happens, and<br />

an option or right to acquire any of the preceding CGT assets.<br />

If your assets do not fit within one of the above categories - for example, land or a building overseas<br />

or shares in a foreign company - they do not have the necessary connection with Australia.<br />

Assets that are taxable Australian property include:<br />

a direct interest in real property situated in Australia (for example a house or farm located in<br />

Australia) or a mining, prospecting or quarrying right to minerals, petroleum or quarry materials<br />

in Australia;<br />

a CGT asset that you used at any time in carrying on a business through a permanent establishment<br />

in Australia, and<br />

an indirect Australian real property interest - which is an interest in an entity, including a foreign<br />

entity, where you and your associates hold 10% or more of the entity and the value of<br />

your interest is principally attributable to Australian real property.<br />

9<br />

9<br />

This is an extract from the ATO website.