Transition Planning - (Sellers/Second Edition)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

VALUATION - RISK & REWARDS<br />

IT’S ALL ABOUT VALUE<br />

Pavilion has a team of highly qualified professionals who utilize various<br />

methods for conducting valuations.<br />

We recognize that a sound valuation will be based on all the relevant<br />

facts including the elements of common sense, informed judgment<br />

which must enter into the process of weighing those facts and<br />

determining their combined or cumulative significance.<br />

“<br />

The value of a thing is the amount of<br />

laboring or work that its possession<br />

will save the possessor.<br />

- Henry George<br />

“<br />

In addition, Pavilion has further resources that help smaller and midcap<br />

clients optimize their current “fair marketplace” value.<br />

INTERNAL VALUE DRIVERS<br />

Our team works closely with sellers to assess the business internal<br />

“value drivers” that ultimately determine the Enterprise Value in the<br />

marketplace. In addition, we utilize real time access to the following<br />

resources:<br />

4 Precedent database of completed transactions across North<br />

America that provide evidence to support the valuation.<br />

4 Real time access to the financial performance in each SIC or<br />

Industry sector to enable an independent “yard stick” for key<br />

performance indicators (KPI’s).<br />

4 RMA Ratio’s – The Risk Management Association provides a wide<br />

range of metrics that we use to assess the business and provide a<br />

“score card”.<br />

The true indicator of a company’s success is measurable by a wide<br />

range of factors. One of the main components is the financial metrics<br />

of the business including the Profit and Loss statements and Balance<br />

Sheet performance. While this is a key financial metric, there are<br />

numerous other factors that enhance enterprise value.<br />

“<br />

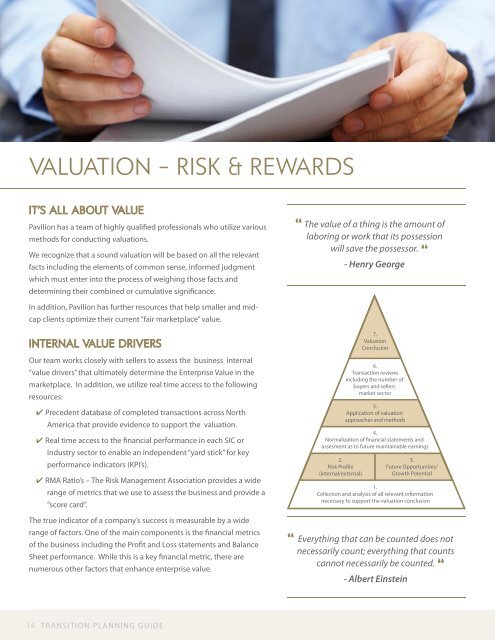

4.<br />

Normalization of financial statements and<br />

assesment as to future maintainable earnings<br />

2.<br />

Risk Profile<br />

(internal/external)<br />

7.<br />

Valuation<br />

Conclusion<br />

6.<br />

Transaction reviews<br />

including the number of<br />

buyers and sellers<br />

market sector<br />

5.<br />

Application of valuation<br />

approaches and methods<br />

3.<br />

Future Opportunities/<br />

Growth Potential<br />

1.<br />

Collection and analysis of all relevant information<br />

necessary to support the valuation conclusion<br />

Everything that can be counted does not<br />

necessarily count; everything that counts<br />

cannot necessarily be counted.<br />

- Albert Einstein<br />

“<br />

14<br />

TRANSITION PLANNING GUIDE