PCM Vol.2 - Issue 10

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Thought Leaders Corner<br />

start to become a more important<br />

modality because this can provide<br />

continuous authentication while a<br />

person is naturally using their device.<br />

By analysing how a person implicitly<br />

uses their device, it is now possible to<br />

recognise users. The technology can<br />

also be combined with other biometric<br />

modalities and authentication factors<br />

to create an authentication risk scoring<br />

that has the ability to reduce fraud. Its<br />

ability to integrate into fraud and risk<br />

management solutions makes it an ideal<br />

technology for cross industry use cases.<br />

A few months ago, I met the CEO of<br />

a Canadian startup, Zighra, and was<br />

excited to learn about how he and<br />

his team are building some of this<br />

capability. They call their solution<br />

“KineticID” - it combines the power of<br />

artificial intelligence and behavioural<br />

analytics to detect account takeover<br />

fraud and automated attacks in mobile<br />

transactions. I found it very simple in<br />

its execution, as it plugs into mobile<br />

applications and implicitly recognises<br />

the device based on its unique sensorial<br />

fingerprints, the user based on their<br />

habits and interaction patterns, and ties<br />

it to the user action such as account<br />

registration, login, and payments. By<br />

actively evaluating the user’s unique<br />

kinetic signature - including the way<br />

the user holds their device, the angle<br />

in which they hold it, the touch screen<br />

pressure, and acceleration while<br />

performing an action - it provides<br />

continuous authentication and threat<br />

detection.<br />

With technology moving at such a pace,<br />

timing is perfect to kill the product<br />

centric thinking and move to design<br />

thinking to focus on delivering that<br />

compelling end-to- end experience. Not<br />

only is there a great opportunity to focus<br />

on doing that within every industry,<br />

given the capability of smart devices, it<br />

will soon be expected when customers<br />

are going through experiences that cut<br />

across multiple industries.<br />

So how will identity, insurance and<br />

driver’s licenses manifest themselves<br />

when the self driving cars become<br />

mainstream; when home appliances<br />

are smart enough to place orders and<br />

make payments; when implantable<br />

chips make the driver’s license and the<br />

passport obsolete? Are you ready to<br />

embrace these changes and more?<br />

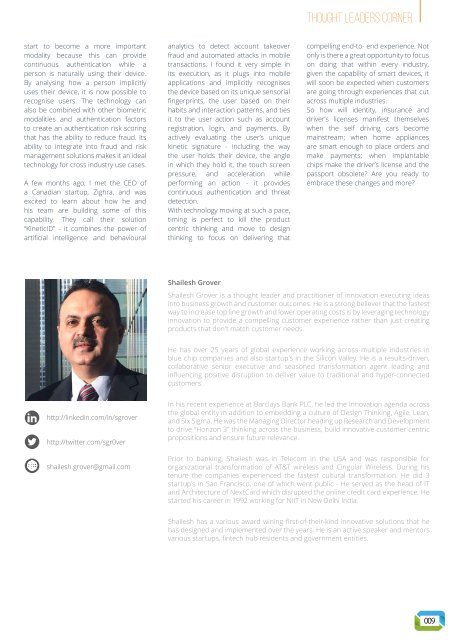

Shailesh Grover<br />

Shailesh Grover is a thought leader and practitioner of innovation executing ideas<br />

into business growth and customer outcomes. He is a strong believer that the fastest<br />

way to increase top line growth and lower operating costs is by leveraging technology<br />

innovation to provide a compelling customer experience rather than just creating<br />

products that don’t match customer needs.<br />

He has over 25 years of global experience working across multiple industries in<br />

blue chip companies and also startup’s in the Silicon Valley. He is a results-driven,<br />

collaborative senior executive and seasoned transformation agent leading and<br />

influencing positive disruption to deliver value to traditional and hyper-connected<br />

customers.<br />

http://linkedin.com/in/sgrover<br />

http://twitter.com/sgr0ver<br />

shailesh.grover@gmail.com<br />

In his recent experience at Barclays Bank PLC, he led the innovation agenda across<br />

the global entity in addition to embedding a culture of Design Thinking, Agile, Lean,<br />

and Six Sigma. He was the Managing Director heading up Research and Development<br />

to drive “Horizon 3” thinking across the business, build innovative customer centric<br />

propositions and ensure future relevance.<br />

Prior to banking, Shailesh was in Telecom in the USA and was responsible for<br />

organizational transformation of AT&T wireless and Cingular Wireless. During his<br />

tenure the companies experienced the fastest cultural transformation. He did 3<br />

startup’s in San Francisco, one of which went public - He served as the head of IT<br />

and Architecture of NextCard which disrupted the online credit card experience. He<br />

started his career in 1992 working for NIIT in New Delhi India.<br />

Shailesh has a various award wining first-of-their-kind innovative solutions that he<br />

has designed and implemented over the years. He is an active speaker and mentors<br />

various startups, fintech hub residents and government entities.<br />

009