SI Annual Report 2016

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Saunders International Limited<br />

Notes to the Financial Statements<br />

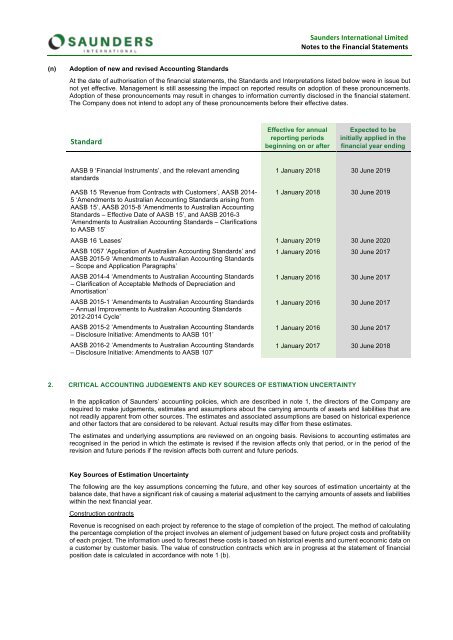

(n)<br />

Adoption of new and revised Accounting Standards<br />

At the date of authorisation of the financial statements, the Standards and Interpretations listed below were in issue but<br />

not yet effective. Management is still assessing the impact on reported results on adoption of these pronouncements.<br />

Adoption of these pronouncements may result in changes to information currently disclosed in the financial statement.<br />

The Company does not intend to adopt any of these pronouncements before their effective dates.<br />

Standard<br />

Effective for annual<br />

reporting periods<br />

beginning on or after<br />

Expected to be<br />

initially applied in the<br />

financial year ending<br />

AASB 9 ‘Financial Instruments’, and the relevant amending<br />

standards<br />

1 January 2018 30 June 2019<br />

AASB 15 ‘Revenue from Contracts with Customers’, AASB 2014-<br />

5 ‘Amendments to Australian Accounting Standards arising from<br />

AASB 15’, AASB 2015-8 ‘Amendments to Australian Accounting<br />

Standards – Effective Date of AASB 15’, and AASB <strong>2016</strong>-3<br />

‘Amendments to Australian Accounting Standards – Clarifications<br />

to AASB 15’<br />

1 January 2018 30 June 2019<br />

AASB 16 ‘Leases’ 1 January 2019 30 June 2020<br />

AASB 1057 ‘Application of Australian Accounting Standards’ and<br />

AASB 2015-9 ‘Amendments to Australian Accounting Standards<br />

– Scope and Application Paragraphs’<br />

AASB 2014-4 ‘Amendments to Australian Accounting Standards<br />

– Clarification of Acceptable Methods of Depreciation and<br />

Amortisation’<br />

AASB 2015-1 ‘Amendments to Australian Accounting Standards<br />

– <strong>Annual</strong> Improvements to Australian Accounting Standards<br />

2012-2014 Cycle’<br />

AASB 2015-2 ‘Amendments to Australian Accounting Standards<br />

– Disclosure Initiative: Amendments to AASB 101’<br />

AASB <strong>2016</strong>-2 ‘Amendments to Australian Accounting Standards<br />

– Disclosure Initiative: Amendments to AASB 107’<br />

1 January <strong>2016</strong> 30 June 2017<br />

1 January <strong>2016</strong> 30 June 2017<br />

1 January <strong>2016</strong> 30 June 2017<br />

1 January <strong>2016</strong> 30 June 2017<br />

1 January 2017 30 June 2018<br />

2. CRITICAL ACCOUNTING JUDGEMENTS AND KEY SOURCES OF ESTIMATION UNCERTAINTY<br />

In the application of Saunders’ accounting policies, which are described in note 1, the directors of the Company are<br />

required to make judgements, estimates and assumptions about the carrying amounts of assets and liabilities that are<br />

not readily apparent from other sources. The estimates and associated assumptions are based on historical experience<br />

and other factors that are considered to be relevant. Actual results may differ from these estimates.<br />

The estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are<br />

recognised in the period in which the estimate is revised if the revision affects only that period, or in the period of the<br />

revision and future periods if the revision affects both current and future periods.<br />

Key Sources of Estimation Uncertainty<br />

The following are the key assumptions concerning the future, and other key sources of estimation uncertainty at the<br />

balance date, that have a significant risk of causing a material adjustment to the carrying amounts of assets and liabilities<br />

within the next financial year.<br />

Construction contracts<br />

Revenue is recognised on each project by reference to the stage of completion of the project. The method of calculating<br />

the percentage completion of the project involves an element of judgement based on future project costs and profitability<br />

of each project. The information used to forecast these costs is based on historical events and current economic data on<br />

a customer by customer basis. The value of construction contracts which are in progress at the statement of financial<br />

position date is calculated in accordance with note 1 (b).