Marked exam answers with assessor feedback

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

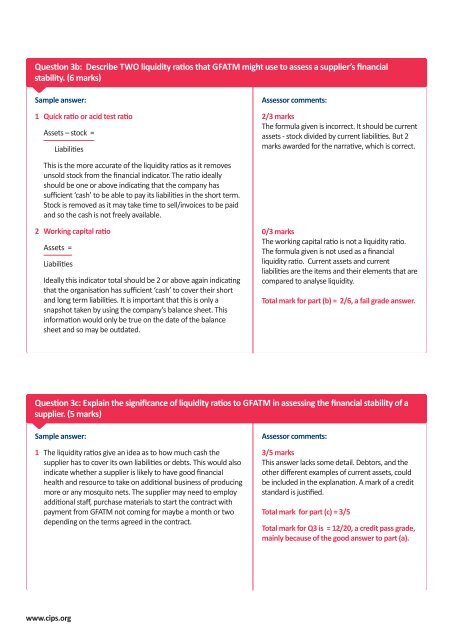

Question 3b: Describe TWO liquidity ratios that GFATM might use to assess a supplier’s financial<br />

stability. (6 marks)<br />

Sample answer:<br />

1 Quick ratio or acid test ratio<br />

Assets – stock =<br />

Liabilities<br />

Assessor comments:<br />

2/3 marks<br />

The formula given is incorrect. It should be current<br />

assets - stock divided by current liabilities. But 2<br />

marks awarded for the narrative, which is correct.<br />

This is the more accurate of the liquidity ratios as it removes<br />

unsold stock from the financial indicator. The ratio ideally<br />

should be one or above indicating that the company has<br />

sufficient ‘cash’ to be able to pay its liabilities in the short term.<br />

Stock is removed as it may take time to sell/invoices to be paid<br />

and so the cash is not freely available.<br />

2 Working capital ratio<br />

Assets =<br />

Liabilities<br />

Ideally this indicator total should be 2 or above again indicating<br />

that the organisation has sufficient ‘cash’ to cover their short<br />

and long term liabilities. It is important that this is only a<br />

snapshot taken by using the company’s balance sheet. This<br />

information would only be true on the date of the balance<br />

sheet and so may be outdated.<br />

0/3 marks<br />

The working capital ratio is not a liquidity ratio.<br />

The formula given is not used as a financial<br />

liquidity ratio. Current assets and current<br />

liabilities are the items and their elements that are<br />

compared to analyse liquidity.<br />

Total mark for part (b) = 2/6, a fail grade answer.<br />

Question 3c: Explain the significance of liquidity ratios to GFATM in assessing the financial stability of a<br />

supplier. (5 marks)<br />

Sample answer:<br />

1 The liquidity ratios give an idea as to how much cash the<br />

supplier has to cover its own liabilities or debts. This would also<br />

indicate whether a supplier is likely to have good financial<br />

health and resource to take on additional business of producing<br />

more or any mosquito nets. The supplier may need to employ<br />

additional staff, purchase materials to start the contract <strong>with</strong><br />

payment from GFATM not coming for maybe a month or two<br />

depending on the terms agreed in the contract.<br />

Assessor comments:<br />

3/5 marks<br />

This answer lacks some detail. Debtors, and the<br />

other different <strong>exam</strong>ples of current assets, could<br />

be included in the explanation. A mark of a credit<br />

standard is justified.<br />

Total mark for part (c) = 3/5<br />

Total mark for Q3 is = 12/20, a credit pass grade,<br />

mainly because of the good answer to part (a).<br />

www.cips.org