Marked exam answers with assessor feedback

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

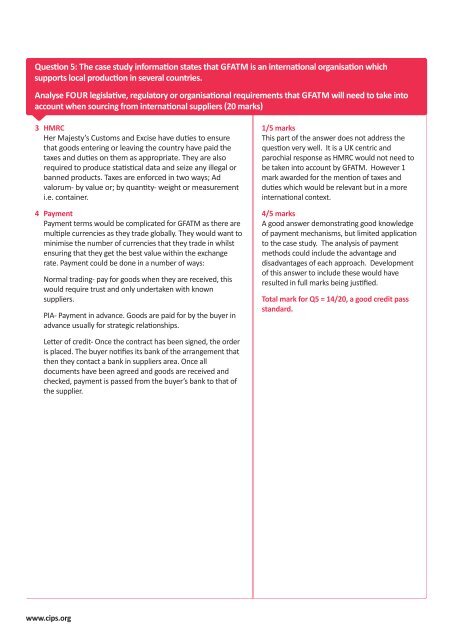

Question 5: The case study information states that GFATM is an international organisation which<br />

supports local production in several countries.<br />

Analyse FOUR legislative, regulatory or organisational requirements that GFATM will need to take into<br />

account when sourcing from international suppliers (20 marks)<br />

3 HMRC<br />

Her Majesty’s Customs and Excise have duties to ensure<br />

that goods entering or leaving the country have paid the<br />

taxes and duties on them as appropriate. They are also<br />

required to produce statistical data and seize any illegal or<br />

banned products. Taxes are enforced in two ways; Ad<br />

valorum- by value or; by quantity- weight or measurement<br />

i.e. container.<br />

4 Payment<br />

Payment terms would be complicated for GFATM as there are<br />

multiple currencies as they trade globally. They would want to<br />

minimise the number of currencies that they trade in whilst<br />

ensuring that they get the best value <strong>with</strong>in the exchange<br />

rate. Payment could be done in a number of ways:<br />

Normal trading- pay for goods when they are received, this<br />

would require trust and only undertaken <strong>with</strong> known<br />

suppliers.<br />

PIA- Payment in advance. Goods are paid for by the buyer in<br />

advance usually for strategic relationships.<br />

1/5 marks<br />

This part of the answer does not address the<br />

question very well. It is a UK centric and<br />

parochial response as HMRC would not need to<br />

be taken into account by GFATM. However 1<br />

mark awarded for the mention of taxes and<br />

duties which would be relevant but in a more<br />

international context.<br />

4/5 marks<br />

A good answer demonstrating good knowledge<br />

of payment mechanisms, but limited application<br />

to the case study. The analysis of payment<br />

methods could include the advantage and<br />

disadvantages of each approach. Development<br />

of this answer to include these would have<br />

resulted in full marks being justified.<br />

Total mark for Q5 = 14/20, a good credit pass<br />

standard.<br />

Letter of credit- Once the contract has been signed, the order<br />

is placed. The buyer notifies its bank of the arrangement that<br />

then they contact a bank in suppliers area. Once all<br />

documents have been agreed and goods are received and<br />

checked, payment is passed from the buyer’s bank to that of<br />

the supplier.<br />

www.cips.org