CSFI

CSFI+-+Reaching+the+poor+-+release+version

CSFI+-+Reaching+the+poor+-+release+version

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>CSFI</strong><br />

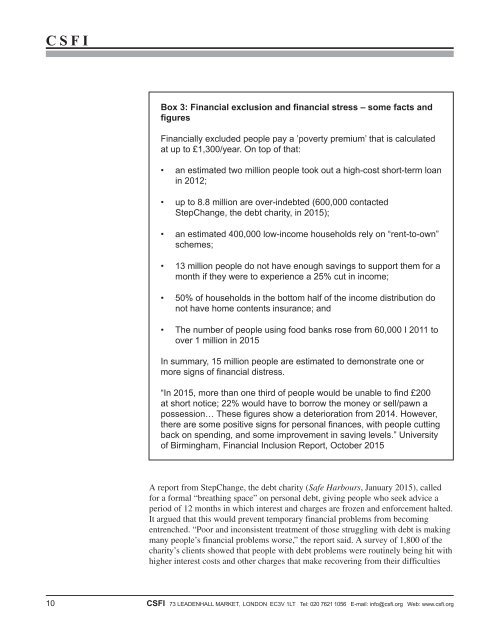

Box 3: Financial exclusion and financial stress – some facts and<br />

figures<br />

Financially excluded people pay a ’poverty premium’ that is calculated<br />

at up to £1,300/year. On top of that:<br />

• an estimated two million people took out a high-cost short-term loan<br />

in 2012;<br />

• up to 8.8 million are over-indebted (600,000 contacted<br />

StepChange, the debt charity, in 2015);<br />

• an estimated 400,000 low-income households rely on “rent-to-own”<br />

schemes;<br />

• 13 million people do not have enough savings to support them for a<br />

month if they were to experience a 25% cut in income;<br />

• 50% of households in the bottom half of the income distribution do<br />

not have home contents insurance; and<br />

• The number of people using food banks rose from 60,000 I 2011 to<br />

over 1 million in 2015<br />

In summary, 15 million people are estimated to demonstrate one or<br />

more signs of financial distress.<br />

“In 2015, more than one third of people would be unable to find £200<br />

at short notice; 22% would have to borrow the money or sell/pawn a<br />

possession… These figures show a deterioration from 2014. However,<br />

there are some positive signs for personal finances, with people cutting<br />

back on spending, and some improvement in saving levels.” University<br />

of Birmingham, Financial Inclusion Report, October 2015<br />

A report from StepChange, the debt charity (Safe Harbours, January 2015), called<br />

for a formal “breathing space” on personal debt, giving people who seek advice a<br />

period of 12 months in which interest and charges are frozen and enforcement halted.<br />

It argued that this would prevent temporary financial problems from becoming<br />

entrenched. “Poor and inconsistent treatment of those struggling with debt is making<br />

many people’s financial problems worse,” the report said. A survey of 1,800 of the<br />

charity’s clients showed that people with debt problems were routinely being hit with<br />

higher interest costs and other charges that make recovering from their difficulties<br />

10 <strong>CSFI</strong> 73 LEADENHALL MARKET, LONDON EC3V 1LT Tel: 020 7621 1056 E-mail: info@csfi.org Web: www.csfi.org