Newsletter-No8

Newsletter-No8

Newsletter-No8

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

POLICY IN FOCUS<br />

政 策 聚 焦<br />

Financial Institutions<br />

Financial Institutions which have to<br />

take on the obligation of declaration<br />

include banks, financial institutions<br />

that accept public deposits,<br />

security companies, future<br />

companies, insurance companies,<br />

investment institutions and trust<br />

companies, while finance<br />

companies, consumer financing<br />

companies and auto financing<br />

companies do not assume the<br />

obligation of declaration.<br />

Financial Accounts<br />

Financial accounts include deposit<br />

accounts, policy contracts, equities<br />

and creditor’s rights, as well as<br />

security accounts, financial<br />

products and escrow accounts like<br />

funds, trusts, etc.<br />

Contents of Declaration<br />

Financial institutions are required to<br />

submit information of the account<br />

owners annually, such as names,<br />

addresses, taxpayer identification<br />

numbers, account numbers,<br />

account balances, as well as<br />

interests, dividends generated<br />

from financial assets, and<br />

incomes by selling financial<br />

assets, etc.<br />

Account Categorisation<br />

By following the categorisation of<br />

OECD, accounts are grouped into<br />

new accounts, existing accounts,<br />

institution accounts and personal<br />

accounts, and different verification<br />

procedures and standards are<br />

adopted under the Administrative<br />

Measures. Enterprises and persons<br />

who open new accounts in financial<br />

institutions also have to sign an<br />

identity declaration document of<br />

residents for tax purposes.<br />

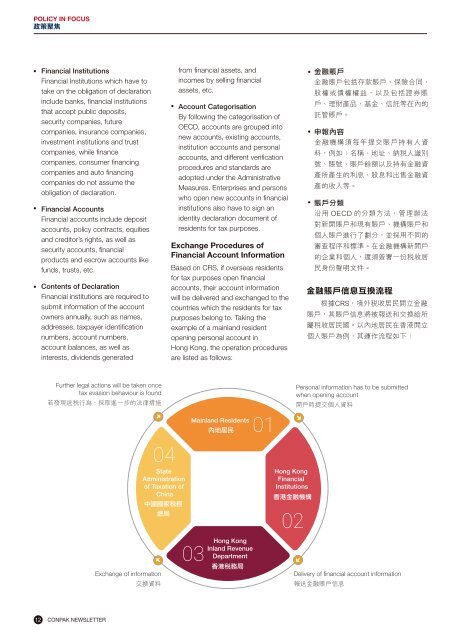

Exchange Procedures of<br />

Financial Account Information<br />

Based on CRS, if overseas residents<br />

for tax purposes open financial<br />

accounts, their account information<br />

will be delivered and exchanged to the<br />

countries which the residents for tax<br />

purposes belong to. Taking the<br />

example of a mainland resident<br />

opening personal account in<br />

Hong Kong, the operation procedures<br />

are listed as follows:<br />

金 融 賬 戶<br />

<br />

<br />

<br />

<br />

申 報 內 容<br />

<br />

<br />

<br />

<br />

<br />

賬 戶 分 類<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

金 融 賬 戶 信 息 互 換 流 程<br />

<br />

<br />

<br />

<br />

Further legal actions will be taken once<br />

tax evasion behaviour is found<br />

<br />

Mainland Residents<br />

內 地 居 民<br />

Personal information has to be submitted<br />

when opening account<br />

<br />

State<br />

Administration<br />

of Taxation of<br />

China<br />

中 國 國 家 稅 務<br />

總 局<br />

Hong Kong<br />

Financial<br />

Institutions<br />

香 港 金 融 機 構<br />

Exchange of information<br />

<br />

Hong Kong<br />

Inland Revenue<br />

Department<br />

香 港 稅 務 局<br />

Delivery of financial account information<br />

<br />

12 CONPAK NEWSLETTER