DRIVEN

driven-properties-magazine-november-2016

driven-properties-magazine-november-2016

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

PROPERTYMONITOR<br />

RENTAL MARKET<br />

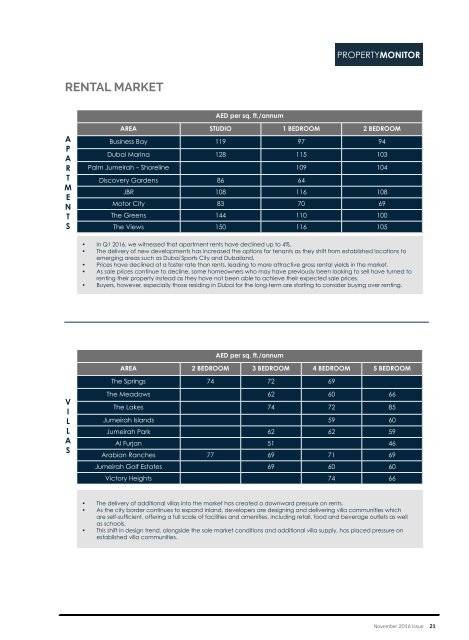

AED per sq. ft./annum<br />

A<br />

P<br />

A<br />

R<br />

T<br />

M<br />

E<br />

N<br />

T<br />

S<br />

AREA STUDIO 1 BEDROOM 2 BEDROOM<br />

Business Bay 119 97 94<br />

Dubai Marina 128 115 103<br />

Palm Jumeirah – Shoreline 109 104<br />

Discovery Gardens 86 64<br />

JBR 108 116 108<br />

Motor City 83 70 69<br />

The Greens 144 110 100<br />

The Views 150 116 105<br />

• In Q1 2016, we witnessed that apartment rents have declined up to 4%.<br />

• The delivery of new developments has increased the options for tenants as they shift from established locations to<br />

emerging areas such as Dubai Sports City and Dubailand.<br />

• Prices have declined at a faster rate than rents, leading to more attractive gross rental yields in the market.<br />

• As sale prices continue to decline, some homeowners who may have previously been looking to sell have turned to<br />

renting their property instead as they have not been able to achieve their expected sale prices.<br />

• Buyers, however, especially those residing in Dubai for the long-term are starting to consider buying over renting.<br />

AED per sq. ft./annum<br />

AREA 2 BEDROOM 3 BEDROOM 4 BEDROOM 5 BEDROOM<br />

The Springs 74 72 69<br />

V<br />

I<br />

L<br />

L<br />

A<br />

S<br />

The Meadows 62 60 66<br />

The Lakes 74 72 85<br />

Jumeirah Islands 59 60<br />

Jumeirah Park 62 62 59<br />

Al Furjan 51 46<br />

Arabian Ranches 77 69 71 69<br />

Jumeirah Golf Estates 69 60 60<br />

Victory Heights 74 66<br />

• The delivery of additional villas into the market has created a downward pressure on rents.<br />

• As the city border continues to expand inland, developers are designing and delivering villa communities which<br />

are self-sufficient, offering a full scale of facilities and amenities, including retail, food and beverage outlets as well<br />

as schools.<br />

• This shift in design trend, alongside the sale market conditions and additional villa supply, has placed pressure on<br />

established villa communities.<br />

November 2016 Issue 21