THOUGHT

2jd3pK8

2jd3pK8

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

16 BIG INTERVIEW<br />

BIG INTERVIEW<br />

17<br />

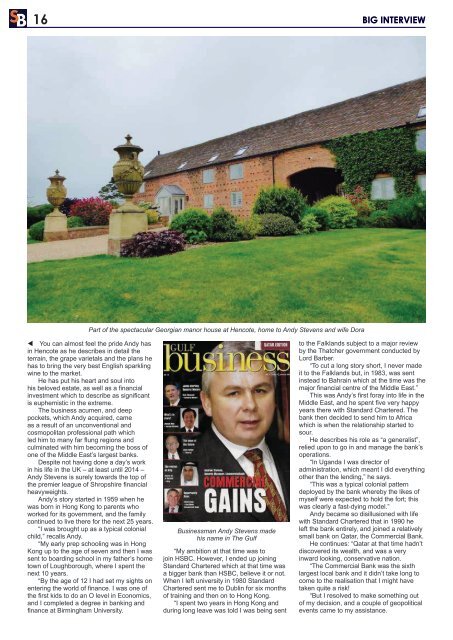

Part of the spectacular Georgian manor house at Hencote, home to Andy Stevens and wife Dora<br />

Wellness treatments take place indoors...<br />

t You can almost feel the pride Andy has<br />

in Hencote as he describes in detail the<br />

terrain, the grape varietals and the plans he<br />

has to bring the very best English sparkling<br />

wine to the market.<br />

He has put his heart and soul into<br />

his beloved estate, as well as a financial<br />

investment which to describe as significant<br />

is euphemistic in the extreme.<br />

The business acumen, and deep<br />

pockets, which Andy acquired, came<br />

as a result of an unconventional and<br />

cosmopolitan professional path which<br />

led him to many far flung regions and<br />

culminated with him becoming the boss of<br />

one of the Middle East’s largest banks.<br />

Despite not having done a day’s work<br />

in his life in the UK – at least until 2014 –<br />

Andy Stevens is surely towards the top of<br />

the premier league of Shropshire financial<br />

heavyweights.<br />

Andy’s story started in 1959 when he<br />

was born in Hong Kong to parents who<br />

worked for its government, and the family<br />

continued to live there for the next 25 years.<br />

“I was brought up as a typical colonial<br />

child,” recalls Andy.<br />

“My early prep schooling was in Hong<br />

Kong up to the age of seven and then I was<br />

sent to boarding school in my father’s home<br />

town of Loughborough, where I spent the<br />

next 10 years.<br />

“By the age of 12 I had set my sights on<br />

entering the world of finance. I was one of<br />

the first kids to do an O level in Economics,<br />

and I completed a degree in banking and<br />

finance at Birmingham University.<br />

Businessman Andy Stevens made<br />

his name in The Gulf<br />

“My ambition at that time was to<br />

join HSBC. However, I ended up joining<br />

Standard Chartered which at that time was<br />

a bigger bank than HSBC, believe it or not.<br />

When I left university in 1980 Standard<br />

Chartered sent me to Dublin for six months<br />

of training and then on to Hong Kong.<br />

“I spent two years in Hong Kong and<br />

during long leave was told I was being sent<br />

to the Falklands subject to a major review<br />

by the Thatcher government conducted by<br />

Lord Barber.<br />

“To cut a long story short, I never made<br />

it to the Falklands but, in 1983, was sent<br />

instead to Bahrain which at the time was the<br />

major financial centre of the Middle East.”<br />

This was Andy’s first foray into life in the<br />

Middle East, and he spent five very happy<br />

years there with Standard Chartered. The<br />

bank then decided to send him to Africa<br />

which is when the relationship started to<br />

sour.<br />

He describes his role as “a generalist”,<br />

relied upon to go in and manage the bank’s<br />

operations.<br />

“In Uganda I was director of<br />

administration, which meant I did everything<br />

other than the lending,” he says.<br />

“This was a typical colonial pattern<br />

deployed by the bank whereby the likes of<br />

myself were expected to hold the fort; this<br />

was clearly a fast-dying model.”<br />

Andy became so disillusioned with life<br />

with Standard Chartered that in 1990 he<br />

left the bank entirely, and joined a relatively<br />

small bank on Qatar, the Commercial Bank.<br />

He continues: “Qatar at that time hadn’t<br />

discovered its wealth, and was a very<br />

inward looking, conservative nation.<br />

“The Commercial Bank was the sixth<br />

largest local bank and it didn’t take long to<br />

come to the realisation that I might have<br />

taken quite a risk!<br />

“But I resolved to make something out<br />

of my decision, and a couple of geopolitical<br />

events came to my assistance.<br />

“Soon after I joined the bank, the first<br />

Gulf War in 1990/91 resulted in every<br />

economy in the region trying to stimulate<br />

change. Then, in 1995, there was a<br />

bloodless coup in Qatar. As is often the way<br />

in that part of the world the heir apparent<br />

overthrew his father and he proceeded to<br />

usher in massive, unprecedented change.<br />

“Qatar had been sitting on known<br />

gas reserves for 40 years, and the new<br />

emir brought about monetising those<br />

underground assets.<br />

“He instigated the massive<br />

industrialisation in Qatar which became the<br />

second largest exporting gas producing<br />

nation in the world.<br />

“What had been a very small economy<br />

worth about 6 billion dollars became, within<br />

the space of about 15 years, one of the<br />

most modern, dynamic economies in the<br />

world. The value of the economy escalated<br />

to 200 billion dollars.<br />

“And in this extraordinary period of<br />

change I was lucky enough to be there and<br />

the bank rode that wave.”<br />

Andy’s role with the bank evolved as<br />

time went on. In the early years he was<br />

assistant general manager looking after the<br />

retail bank but in 1998 he took the bank<br />

overseas into Egypt where it bought the<br />

franchise for Diner’s Club.<br />

That gave the bank a glimpse of the<br />

future and what could be achieved – and it<br />

also illustrated Andy’s capabilities.<br />

He was promoted to general manager in<br />

2001 with the clear brief to “wake the bank<br />

up”.<br />

...and outside too. Hencote is gaining a fantastic reputation as a five-star wellness retreat<br />

It is probably easiest to look at<br />

statistics when judging Andy’s time as<br />

general manager and then group CEO.<br />

When he took it on, the bank was the sixth<br />

largest in Qatar with a balance of about<br />

1 billion dollars on a capital base of 600<br />

million dollars – “we were very small and<br />

insignificant,” says Andy.<br />

By the time he stepped down at the<br />

end of 2013 the balance was up to 35<br />

billion dollars. Commercial Bank sat second<br />

behind the Qatari National Bank, was highly<br />

rated by all the credit ratings agencies,<br />

and had taken majority stakes in banks in<br />

Oman, UAE and Turkey.<br />

“We achieved stellar results,” says Andy.<br />

“We delivered a return on equity of 25 per<br />

cent which were unheard of, and dividend<br />

yields which were unsurpassed in the<br />

market.”<br />

In 2013, largely as a result of a change<br />

in power in Qatar and being asked to take<br />

on an advisory role which he felt unsuited<br />

to, Andy stepped down and thoughts turned<br />

back to the UK and, specifically, Shropshire.<br />

Andy recounts his story in his Hencote<br />

office, as immaculate and ordered as the<br />

vineyard outside.<br />

He looks content, as well he might.<br />

Married for 27 years to Dora and with four<br />

children who are now living independently,<br />

family life is good.<br />

It also transpires that not only was<br />

he very, very successful, but Andy also<br />

learnt the importance of health and<br />

wellbeing through the stresses and strains<br />

of his career. This is why Hencote is fast<br />

becoming a destination as a five star<br />

wellness retreat – its owner understands the<br />

value of health.<br />

u