issue39_URIT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

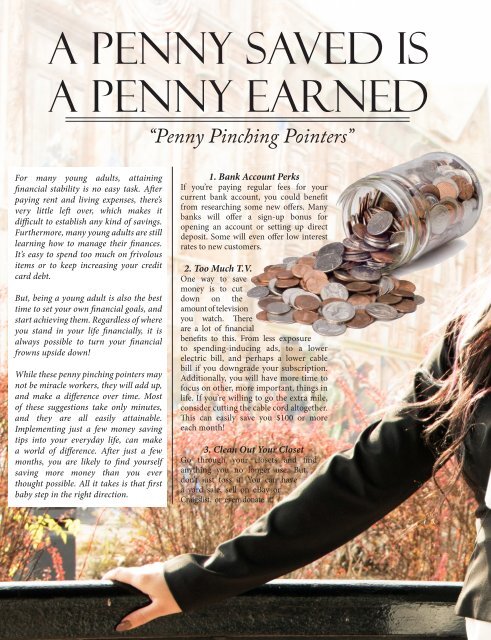

A Penny Saved is<br />

a Penny Earned<br />

“Penny Pinching Pointers”<br />

For many young adults, attaining<br />

financial stability is no easy task. After<br />

paying rent and living expenses, there’s<br />

very little left over, which makes it<br />

difficult to establish any kind of savings.<br />

Furthermore, many young adults are still<br />

learning how to manage their finances.<br />

It’s easy to spend too much on frivolous<br />

items or to keep increasing your credit<br />

card debt.<br />

But, being a young adult is also the best<br />

time to set your own financial goals, and<br />

start achieving them. Regardless of where<br />

you stand in your life financially, it is<br />

always possible to turn your financial<br />

frowns upside down!<br />

While these penny pinching pointers may<br />

not be miracle workers, they will add up,<br />

and make a difference over time. Most<br />

of these suggestions take only minutes,<br />

and they are all easily attainable.<br />

Implementing just a few money saving<br />

tips into your everyday life, can make<br />

a world of difference. After just a few<br />

months, you are likely to find yourself<br />

saving more money than you ever<br />

thought possible. All it takes is that first<br />

baby step in the right direction.<br />

1. Bank Account Perks<br />

If you’re paying regular fees for your<br />

current bank account, you could benefit<br />

from researching some new offers. Many<br />

banks will offer a sign-up bonus for<br />

opening an account or setting up direct<br />

deposit. Some will even offer low interest<br />

rates to new customers.<br />

2. Too Much T.V.<br />

One way to save<br />

money is to cut<br />

down on the<br />

amount of television<br />

you watch. There<br />

are a lot of financial<br />

benefits to this. From less exposure<br />

to spending-inducing ads, to a lower<br />

electric bill, and perhaps a lower cable<br />

bill if you downgrade your subscription.<br />

Additionally, you will have more time to<br />

focus on other, more important, things in<br />

life. If you’re willing to go the extra mile,<br />

consider cutting the cable cord altogether.<br />

This can easily save you $100 or more<br />

each month!<br />

3. Clean Out Your Closet<br />

Go through your closets and find<br />

anything you no longer use. But,<br />

don’t just toss it! You can have<br />

a yard sale, sell on eBay or<br />

Craigslist, or even donate it<br />

32