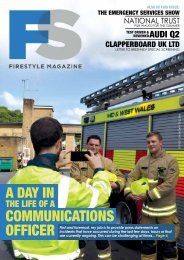

Firestyle Magazine: Issue 6 - Winter 2016

Welcome to the Firestyle Magazine – The Magazine for the 21st Century Fire and Rescue Services Personnel. Please visit our website for more: http://firestylemagazine.co.uk

Welcome to the Firestyle Magazine – The Magazine for the 21st Century Fire and Rescue Services Personnel. Please visit our website for more: http://firestylemagazine.co.uk

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

National Insurance<br />

The National Insurance threshold for employers (secondary) and employees (primary) will be aligned from April<br />

2017, meaning that both employees and employers will start paying National Insurance on weekly earnings above<br />

£157. The currently weekly threshold for <strong>2016</strong>/17 is £156 for employers, and £155 for employees. As announced<br />

in the last Budget, Class 2 National Insurance contributions will be abolished from April 2018. Self-employed<br />

contributory benefit entitlement will be accessed through Class 3 and Class 4 NICs.<br />

Chargeable events gains<br />

As announced in the Budget and following<br />

consultation, the government will legislate to<br />

avoid the disproportionate tax charges that arise<br />

in certain circumstances from life insurance partsurrenders<br />

and part-assignments. The legislation<br />

will allow applications to be made to HMRC to<br />

have the charge recalculated on a just and<br />

reasonable basis to allow fairer outcomes for<br />

policyholders. The change will take effect from 6<br />

April 2017.<br />

The government will also legislate to give HMRC<br />

the power to amend the list of assets that<br />

Personal Portfolio Bond policyholders can invest<br />

in without triggering tax anti-avoidance rules.<br />

The changes will take effect on Royal Assent of<br />

Finance Bill 2017.<br />

Non-domiciled individual.<br />

The government will consider how benefits<br />

in kind are valued for tax purposes, and<br />

the use of Income Tax relief for employees’<br />

business expenses, including those that are not<br />

reimbursed by the employer.<br />

Tax avoidance<br />

The government is continuing its review into the use of<br />

disguised remuneration schemes by employers and<br />

employees and proposes to extend these provisions to<br />

include the use of such schemes by the self-employed. No<br />

further details are available at present.<br />

As signalled in the Budget, the government will also consider<br />

the introduction of penalties for any person who has<br />

enabled another person or business to use a tax-avoidance<br />

arrangement that is later defeated by HMRC. Draft<br />

legislation to this effect will follow shortly. Importantly, these<br />

provisions will not apply to “tried and tested” arrangements<br />

permitted by the legislation such as pensions, ISAs, VCTs,<br />

EISs etc; as, to take effect, the arrangement has to be first<br />

“challenged” by HMRC.<br />

The government will also introduce a new legal requirement<br />

to correct a past failure to pay UK tax on offshore interests<br />

within a defined period of time, with new sanctions for those<br />

who fail to do so.<br />

However, it is important to remember that, just because<br />

something is ‘offshore’ (e.g. an offshore fund or an offshore<br />

bond), this does not necessarily mean that it will be subject<br />

to attack.<br />

Corporation Tax<br />

The government confirmed its commitment to<br />

reduce the level of Corporation Tax to 17% by<br />

2020.<br />

Capital Gains Tax<br />

The tax advantages linked to shares awarded<br />

under Employee Shareholder Status (a special<br />

employee status where certain statutory<br />

employment rights are given up in exchange<br />

for shares) will be abolished for arrangements<br />

entered into on, or after, 1 December <strong>2016</strong>.<br />

Offshore funds<br />

Investors with offshore reporting funds will no<br />

longer be able to deduct performance fees<br />

from the funds’ reportable income for tax<br />

purposes. From April 2017, fees will instead<br />

reduce any tax payable on disposal gains.<br />

Venture Capital Trusts (VCTs) and Enterprise<br />

Investment Schemes (EISs), and Seed Enterprise<br />

Investment Schemes (SEISs)<br />

ISA/Junior ISA limit<br />

From April 2017 the ISA limit will rise to £20,000, as<br />

previously announced. The Junior ISA limit will increase<br />

to £4,128. The government also announced its<br />

intention to launch a new NS&I bond with a £3,000 limit<br />

and indicative 2.2% gross interest rate growth over a<br />

three-year term.<br />

Should you wish to discuss any<br />

of the detail contained in the<br />

note, please do not hesitate to<br />

get in touch.<br />

Contact Paul Brady on<br />

0121 355 2473 or email<br />

paul.brady@sjpp.co.uk<br />

23