ExtraMileIssue6

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2017 ISSUE 2<br />

NOTES FROM NATIONAL INTERSTATE INSURANCE<br />

Excess<br />

Insurance<br />

Is it right for you?<br />

The Fork in<br />

the Road<br />

A look at tough<br />

claims decisions<br />

FOR OUR PARTNERS IN RISK<br />

Distracted<br />

Driving<br />

The 9 Most Common Causes<br />

and What You Can Do to<br />

Avoid Them<br />

Alaina Macia<br />

Powered by<br />

Her People

LETTER from the President and CEO 3<br />

EXTRA MILER: Nicole Pizzuli 4<br />

Contents2017 ISSUE 2<br />

THE FORK IN THE ROAD: Analyzing Tough Claims Decisions 6<br />

INSURANCE IN PLAIN ENGLISH:<br />

Umbrella vs. Excess Insurance – Which is Better? 8<br />

PRODUCT SPOTLIGHT: Excess Insurance 10<br />

POWERED BY HER PEOPLE<br />

12<br />

A Conversation with Alaina Macia<br />

COME ON IN. WE’RE OPEN! 17<br />

MILITARY DRIVERS WELCOME 18<br />

THE 9 MOST Dangerous Driving Distractions 20<br />

BUILDING PROGRESS 23<br />

SERVICE CENTER REMINDER 24<br />

Subscriptions:<br />

Extra Mile magazine is a free, quarterly publication offered by National Interstate Insurance Company in<br />

support of its customers. To subscribe, call 800-929-1500 or email amanda.genther@natl.com.<br />

Publisher:<br />

Established in 1989, National Interstate Insurance is one of the leading specialty property and casualty<br />

insurance companies in the country. Offering more than 30 different insurance products, including traditional<br />

insurance, innovative alternative risk transfer (ART) programs for commercial companies and insurance for<br />

specialty vehicle owners. Its customized solutions are made possible by its talented and dedicated team<br />

members. National Interstate employs over 700 employees in offices in Northeast Ohio, HI, and MO.<br />

© 2017 National Interstate Insurance Company<br />

On the Cover: Alaina Macia from Ride Right, LLC<br />

natl.com/facebook<br />

natl.com/linkedin<br />

natl.com/twitter<br />

natl.com/youtube<br />

Editorial Contributors:<br />

Amanda Genther<br />

Terri Johnson<br />

Randy Metzger<br />

Chris Mikolay<br />

Nicole Pizzuli<br />

John Rich<br />

Chris Vasquez<br />

Mike Wilson<br />

2

Letter from the President and CEO<br />

TONY MERCURIO<br />

Just Drive.<br />

Soon enough, Cleveland’s last snowplow will be parked until next<br />

winter and our world will be green and vibrant again – and it won’t<br />

come too soon. As spring arrives I hope your year is off to a great<br />

start, and that you enjoy this latest issue of the Extra Mile. In this<br />

edition you’ll read about Alaina Macia, the President and CEO of Ride<br />

Right, LLC. Alaina has enjoyed tremendous success in founding and<br />

growing Ride Right into a premier and vital multi-state transportation<br />

network in Missouri. Under Alaina’s leadership, Ride Right boasts a<br />

vibrant culture focused on hiring the right people and an uncommon<br />

customer retention rate (two things that go hand in hand and<br />

something we focus on at National Interstate). I’m proud of the<br />

partnership we have with Alaina and Ride Right and look forward to<br />

watching her business continue to thrive.<br />

You’ll also read about the scourge of Distracted Driving in Amanda<br />

Genther’s article on page 20. How many times have you glanced<br />

over at another motorist and witnessed that familiar downward gaze,<br />

his eyes set not on the road, but on the phone in his lap? Or, being<br />

honest with ourselves, how many of us have been unable to resist<br />

the allure of the incoming text or email, and driven while holding<br />

the steering wheel in one hand and our phone in the other? We tell<br />

ourselves it will be quick or that the text is urgent and cannot wait.<br />

I am not proud of it, but I have done it, and the statistics would say<br />

most of you have, too.<br />

However, as Amanda’s article points out, driving while texting has<br />

been shown to be more dangerous than driving while drunk! As the<br />

President and CEO of a leading transportation insurer, I wish I could<br />

wave a magic wand and turn off every cell phone in every vehicle. It<br />

would unquestionably save lives. While I can’t do that, I CAN control<br />

one thing: me. So that’s why I have made a commitment to drive<br />

distraction-free in 2017 and beyond. The text or email can wait. I<br />

hope you join me in resisting the urge and in waiting until you are<br />

home, or at the very least, until you can find a safe place to park.<br />

Finally, I hope you read Randy Metzger’s article on how we evaluate<br />

difficult claims decisions. Make no mistake: Claims is a very difficult<br />

and often thankless job. And it is one that is prone to easy Mondaymorning<br />

quarterbacking. Randy’s article details how we often come<br />

to a fork in the road, and how to determine which path to take.<br />

Those decisions are never made lightly and are made more difficult<br />

when information is sometimes scarce and when we deal with so<br />

many unknown outcomes. There are many risk and reward decisions<br />

to evaluate, and Randy does a nice job explaining some of the pros<br />

and cons of the more common tough decisions we frequently make.<br />

In closing, on behalf of the hundreds of dedicated employees at<br />

National Interstate who work hard every day to build an insurance<br />

experience around you, I thank you for your business and for placing<br />

your trust in National Interstate.<br />

Tony Mercurio,<br />

President & CEO<br />

P.S – Here’s a simple but effective trick for avoiding the temptation<br />

of the phone. Before you take your car out of park, put your phone<br />

on silent and throw it in the glove compartment. Then, continue,<br />

distraction free, to your destination (where the roads just got safer).<br />

3

When Nicole Pizzuli left one of the world’s premier hospitals, and<br />

the largest private employer in Northeast Ohio to work for National<br />

Interstate, she had one goal in mind – career growth. Little did she<br />

know that decision would quickly put her in a position to lead the<br />

rebuilding of a critical department that touches just about every single<br />

customer.<br />

“When I came to National Interstate for my interview – immediately<br />

when I walked through the door, I saw so many smiling faces and<br />

thought to myself, ‘were these people staged?’ Through more research,<br />

I found myself watching videos on the company, and quickly realized<br />

the sense of pride that people felt working for this company. I knew<br />

it was something I wanted to be a part of. About six weeks after<br />

my initial meeting with our CEO, I was in the breakroom when he<br />

said hello using my name. How cool is that? I knew I chose a special<br />

company to work for.”<br />

Arriving at National Interstate in 2014, Nicole used the skills she<br />

gained working at the Cleveland Clinic to build a world-class Claims<br />

Contact Center. She has assembled a service-oriented team and is<br />

reinventing processes and procedures to gain efficiencies. Her team<br />

is currently working with IT Development to create a state of the art<br />

claims intake system.<br />

Under Nicole’s direction, two claims intake groups and multiple<br />

operations units have merged into one, synergistic team. While the<br />

transformation required a major collaborative effort, it was worth it –<br />

the insured now experiences a seamless and consistent loss reporting<br />

experience.<br />

“This company embraces change,” said Nicole. “If someone presents<br />

an idea, it’s heard, considered and can usually be easily implemented.<br />

It’s remarkable!” But the change has to also benefit the customer. “My<br />

4

Nicole Pizzuli<br />

Claims Operations Manager<br />

vision for the team is for us to be there for our customers, both internal<br />

and external. I want to truly fulfill the promise of world-class service.<br />

Our customers are the reason we exist, and I want my team to be there<br />

whenever needed. I’m committed to fulfilling that promise.”<br />

Transforming a business process is keeping Nicole plenty busy. But her<br />

real joy comes at home. “My family is my motivation – everything I do<br />

is for them” says Nicole. Like many families, Nicole and her husband<br />

are supporting each other’s careers. “My husband was an active<br />

duty Marine with two combat deployments. His current career in law<br />

enforcement is actually more predictable and was easy to adjust to<br />

after that.<br />

Going the extra mile – for customers, for employees and for her family<br />

– that’s Nicole Pizzuli!<br />

MORE ABOUT NICOLE<br />

1. My favorite thing to do outside of the office is<br />

spend time with family.<br />

2. My team members don’t know that I love to read!<br />

3. My first job was a server at a corned beef restaurant when<br />

I was in high school.<br />

4. My favorite TV show is Friends.<br />

5. My favorite vacation destination is the beach!<br />

6. The best part of my job is the people.<br />

7. My day can’t start until I have coffee!<br />

8. My favorite wine comes from a bottle - I’m not picky!<br />

9. The best description of my desk is let’s just say,<br />

I like to color code.<br />

10. If I could recommend one book for everyone to read,<br />

it would be the entire Harry Potter series. I can’t be<br />

limited to just one book.<br />

11. My favorite team is anything Cleveland!<br />

Our Browns will get there one day!<br />

5

THE<br />

FORKIN THE<br />

IN THE ROAD:<br />

ANALYZING TOUGH CLAIMS DECISIONS<br />

We make decisions every day in our personal and professional lives.<br />

Some are large and some are small, some are easy and some are<br />

always much more difficult. The Claims professional is no different<br />

and may make more decisions on a regular basis than most. The<br />

beauty and the curse of claims is that in many circumstances, there<br />

is no obvious right decision. Instead there are options that depend<br />

on a myriad of circumstances and unique facts. In instances when<br />

liability appears very clear – for example, the driver was distracted<br />

and ran through a stop sign, t-boning an oncoming car with the<br />

right of way, or the driver failed to check his tarps and tie-downs<br />

and a piece of lumber falls from the trailer, striking a motorist – the<br />

decisions are often times much easier. When liability is not so clear<br />

however, the decisions are often more difficult and the outcomes<br />

widely varied. It is these types of scenarios, along with a sampling of<br />

decisions and their potential outcomes that will be explored further.<br />

One of the earliest decisions to make when an incident occurs is<br />

what to preserve on the insured’s vehicle and whether or not to<br />

download data from the Electronic Control Module (ECM). The ECM<br />

is a component attached to the engine of a commercial vehicle that<br />

records information such as speed, hard stops, etc.<br />

The potential injury severity is also a factor and in general, the<br />

more severe the injury, the greater the impact of this decision.<br />

Downloading the ECM data and preserving the vehicle can provide<br />

definitive information such as speed, hard brake and other impact<br />

information. Certainly a positive when deciding to download<br />

and preserve is that the information gained will often provide<br />

documented facts, as opposed to relying on subjective descriptions<br />

offered by the claimant, plaintiff, insured driver or witness. It can be<br />

argued that the more information obtained – particularly scientific<br />

and undisputable information – the better. This will not only allow<br />

us to know the potential defenses, but also the potential concerns<br />

which can shape the strategy for moving the case forward, and<br />

ultimately toward resolution.<br />

If the ECM shows the insured’s unit traveling at an excessive speed<br />

prior to a rear-end collision, the case may be one to employ an<br />

early settlement strategy. Additionally, if the insured’s unit had a<br />

marker lamp out during a nighttime lane change accident, this too<br />

may be a case where early resolution should be considered. On the<br />

contrary, if the ECM data supports the insured driver’s account of<br />

speed and vehicle maneuvering, the foundation of the defense may<br />

be established. Similarly, if the unit is in excellent condition with<br />

proper maintenance and no mechanical issues, its preservation<br />

can be used to promote and emphasize to the claimant, plaintiff,<br />

mediator, judge and ultimately a jury, the safety consciousness and<br />

responsibility of the insured driver.<br />

Is there a downside? A common counterpoint to this argument is<br />

that in some circumstances, the data obtained from an ECM or the<br />

condition of the vehicle itself may have little or nothing to do with<br />

the accident, and only provide fuel for the claimant’s attorney to<br />

change the focus from the facts to the vehicle, driver or company. If<br />

several witnesses emphatically state that the claimant ran a red light<br />

directly into the path of the insured vehicle, does an ECM download<br />

showing the insured’s unit exceeding the speed limit by five miles<br />

per hour prior to the loss help or hinder the defense? Does an outof-adjustment<br />

brake affect the liability and/or exposure in a lane<br />

change accident? Does an internal video showing the insured driver<br />

making rude gestures and obscene comments impact the defense of<br />

a claim where the adverse vehicle struck the insured’s vehicle in the<br />

rear? These potential outcomes are factors to consider when making<br />

the decision on what should be downloaded or preserved.<br />

6

Contacting the adverse driver is another decision that needs to be<br />

made. If all indications and available information suggest that the<br />

claimant is the culpable party and the insured bears little or no<br />

liability, what are the potential outcomes – positive and negative –<br />

of contacting that party? Not wanting to solicit a claim is often the<br />

rationale behind not contacting the adverse party. However, letting<br />

a sleeping dog lie can in some circumstances result in just that; the<br />

claimant does not pursue. In this case, the ultimate outcome is a<br />

good one - a closed claim with no indemnity paid.<br />

Like two sides of a coin, there are downsides and pitfalls to this<br />

approach. Although all other indications of what occurred may be<br />

considered favorable based on the descriptions offered by the insured<br />

driver and witness(es), the complete version of the loss cannot be<br />

established without knowing the adverse party’s perception of what<br />

occurred. There can be and are occurrences where the adverse party<br />

has a different perception than the insured driver or witness(es). Did<br />

they see road debris, an animal, a merging vehicle or other hazard<br />

that was not visible to the insured driver or witness? Without knowing<br />

their perception, the strategy and defense can only be based on<br />

assumption, as opposed to countering actual allegations. In a pure<br />

comparative fault jurisdiction, a claimant is not barred from recovery<br />

unless found to be 100% at fault. In such a venue they can collect the<br />

percentage of damages from the other party even if that party is only<br />

1% at fault. Although 1% is small, even 1% of a very large number can<br />

itself be a big number. Without contacting the adverse party, the extent<br />

and potential value of their injuries are unknown. Not making contact<br />

also eliminates the possibility of settlement discussions to eliminate<br />

the risk of an adverse outcome, even if that risk is nominal. Essentially<br />

this approach removes the possibility of finality and leaves open the<br />

unknown until the statute of limitations has expired or the status quo<br />

changes and a claim is pursued.<br />

As much as you may hear about the highly unfavorable cases in<br />

the media or around the water cooler, the favorable cases may not<br />

always garner as much attention. Despite having favorable facts,<br />

we have sometimes seen that this does not prevent claimants and<br />

attorneys alike from pursuing claims against the insured and hoping<br />

to collect damages. Here too, a decision must be made regarding if<br />

and how to communicate the position on liability and/or causation.<br />

When all known and available information suggests that the<br />

insured driver bear no fault, should a claim denial be sent? In these<br />

instances, sending a formal claim denial indicates a clear message<br />

to the claimant and sets a tone that if a lawsuit is filed, it will be<br />

vigorously defended. On the other hand, if a denial letter is not<br />

sent, you may not find out the extent of an injury and potential<br />

full value of the case. Another potential risk is the attorney filing<br />

a lawsuit may not be receptive to any discussions on resolution.<br />

This potentially increases the cost of the case in litigation fees<br />

and expenses.<br />

These are but a few of the numerous decisions involved in<br />

investigating, evaluating and managing claims. One certainty in<br />

claims is this – that every case is different. Every claim is unique<br />

and the decisions made must be specific to the attributes, facts and<br />

details of the claim at hand.<br />

RANDY METZGER<br />

Director – Truck and Environmental Claims<br />

7

Plain<br />

English<br />

INSURANCE IN<br />

In Plain English is an ongoing feature designed to take the mystery out of all the agreements,<br />

exclusions, conditions and definitions found in your insurance policy. We’ll choose topics based<br />

on the questions we hear most often, as well as suggestions we receive directly from you.<br />

UMBRELLA VS. EXCESS LIABILITY: WHICH IS BETTER?<br />

In this installment of Insurance in Plain English, we are going to<br />

shed some light on two questions:<br />

➼ ➼ “What are the differences between excess liability and umbrella<br />

liability policy?”; and<br />

➼ ➼ “Which is the better choice for my organization?”<br />

First, some housekeeping: Any explanation of umbrella and excess<br />

liability insurance policies must begin with a disclaimer. The forms<br />

used by insurance companies can differ significantly in what is and<br />

is not covered, so this article will deal with the proverbial average<br />

policy, making note when National Interstate’s approach may differ.<br />

Also, when the term ‘primary policy’ is used, it refers to the insurance<br />

policy that would be the first to respond, most commonly providing<br />

$1 million of coverage, and sometimes above a deductible or selfinsured<br />

retention (SIR).<br />

Now that we put that behind us, let’s dig in.<br />

Q. Aren’t “Umbrella” and “Excess” really two terms that describe<br />

basically the same policy?<br />

A. Any policy that provides additional limits above the General<br />

Liability “per occurrence,” Auto Liability “per accident” and/<br />

or Employers Liability “each accident” limits, is, technically, an<br />

excess liability policy. There are a number of approaches that can<br />

accomplish this, two of the most frequent being Umbrella and<br />

Follow-Form Excess Liability Policies. For this discussion we’ll call<br />

them umbrellas and excess policies, respectively.<br />

Regardless of the actual policy chosen, the objective is the same:<br />

increasing the amount of risk the insured transfers to an insurance<br />

company. If the insured has Automobile and General Liability<br />

policies, each providing limits of $1 million ‘per accident’ and ‘per<br />

occurrence’, respectively, and they purchase $4 million in excess<br />

or umbrella limits, the available protection for an accident or an<br />

occurrence would now be $5 million.<br />

Q. So, if they are not the same. What is the most obvious difference<br />

between the two?<br />

A. Umbrellas are complete policies with their own insuring<br />

agreements, exclusions, description of who is an insured, policy<br />

conditions and definitions, any of which may differ from those in<br />

the primary policy or policies over which it sits. A typical excess<br />

policy is only a few pages long and states, in essence, that whatever<br />

is covered in the primary is covered in the excess. Additional<br />

endorsements may be attached to further restrict coverage or, rarely,<br />

broaden it.<br />

8

Excess policies of many insurance companies add limits to only one<br />

policy, requiring separate policies to cover the Auto liability, General<br />

Liability and the Employers’ Liability. National Interstate’s followform<br />

excess policy borrows the umbrella approach and can provide<br />

additional limits above multiple primary forms.<br />

Q. If National Interstate’s follow-form excess and umbrella policies can<br />

add higher limits to more than one primary policy, aren’t they the same?<br />

A. There can be some significant differences. An umbrella,<br />

being a complete insurance policy may provide coverage that the<br />

primary policy does not, thereby broadening coverage. An excess<br />

policy, while it may have a few of its own conditions, generally<br />

follows the coverages, exclusions and other conditions included<br />

in the primary policy with no expansion of coverage, hence the<br />

name: Follow-Form Excess.<br />

Q. So, an umbrella can broaden the coverage provided in the primary<br />

policy. Are there any other differences?<br />

A. Yes, there are two more advantages of an umbrella policy that<br />

need to be mentioned; they involve what’s called its “drop-down”<br />

provision. This provision applies in two instances:<br />

In the event that the primary policy excludes something not<br />

also excluded in the umbrella, the umbrella would drop down<br />

and provide coverage once the insured has paid the Self-Insured<br />

Retention (SIR), stated on the declarations page. A typical SIR is<br />

either $10,000 or $25,000.<br />

Unlike the Auto Liability, the General Liability and Employer’s Liability<br />

also contain Aggregate Limits for all claims during the policy year.<br />

Each General Liability or Employer’s Liability claim reduces the<br />

aggregate limit remaining to pay for losses on that policy. If losses<br />

against the primary policy have eroded the limits to the point that<br />

they are not sufficient to support a subsequent claim, the dropdown<br />

provision of the umbrella could apply in this instance as well,<br />

subject, again, to exceeding the SIR.<br />

Q. So, if the umbrella might broaden coverage of the primary policies,<br />

and contains the significant advantage of the drop-down feature, why would<br />

someone buy an excess policy?<br />

A. In a word: money. Because an excess policy does not contain<br />

a drop-down provision and rarely provides any more coverage than<br />

is included in the primary, in most cases an excess policy is less<br />

expensive than an umbrella policy with the same limit.<br />

and conditions needed to change, resulting in the possibility that<br />

the excess may provide broader coverage than the primary, alone.<br />

So, National Interstate’s excess policy has the look and feel of an<br />

umbrella in some ways.<br />

Q. Is there anything else that an agent, broker or an insured’s risk<br />

manager should be aware of related to umbrella and excess policies?<br />

A. One last thing worth mentioning is that, whenever possible,<br />

the effective and expiration dates of all primary liability insurance<br />

policies should be the same as the umbrella or excess policy over<br />

which it sits. This is referred to as concurrency.<br />

How an umbrella or, especially, an excess policy responds to a claim<br />

is dependent on the coverage provided in the primary forms. There<br />

is a chance that terms of the primary policy may change from one<br />

year to the next. If the dates of the primary and excess are not<br />

concurrent, these changes would take effect in the middle of the<br />

excess policy’s term. The consequence of such an event would be<br />

that the excess may not provide coverage that it would have, had<br />

the primary policy not changed. While most umbrella and excess<br />

policies contain specific language of how to untangle the web of<br />

issues that could arise, it remains advisable that the effective and<br />

expiration dates of all liability policies be the same, or concurrent.<br />

Q. So, is there a right answer to the question of which is the best policy<br />

for an insured?<br />

A. Everyone’s perception of their business risk and tolerance for<br />

retaining it is different. This will guide the amount of additional<br />

limits purchased. Inevitably, cost will enter the decision as well.<br />

And, because there can be significant coverage differences between<br />

carriers’ umbrella forms and excess forms and that, in some cases,<br />

other primary liability policies may be added, a detailed coverage<br />

analysis is a good practice.<br />

For all but one of our products, National Interstate offers an excess<br />

policy, but with some features of an umbrella, delivering a broad<br />

coverage platform at a reasonable premium. We have a very high<br />

level of confidence in the insurance professionals with whom we<br />

deal; they are the best of the best. So, we encourage them to have a<br />

conversation with their clients to decide what the right choice is for<br />

them. As always, National Interstate is ready to act as a resource to<br />

assist our agents and brokers when needed.<br />

Q. OK, I get it; an excess policy will always be less expensive than an<br />

umbrella, right?<br />

A. As a rule, yes. But, the difference may not be as great as<br />

one might expect. As stated earlier, National Interstate offers an<br />

excess policy that has some of the characteristics of an umbrella.<br />

For instance, our form has been structured to act like an umbrella<br />

and provide excess limits over more than one primary liability policy.<br />

In order to accomplish this, some definitions, exclusions, terms<br />

JOHN RICH<br />

Director of Underwriting - General Liability<br />

9

Excess<br />

Insurance<br />

32A 33A 34A<br />

10

32A 33A 34A<br />

How would your business fare against a sudden catastrophic<br />

claim? Or, a natural weather disaster that wipes out 90% of<br />

your fleet? Having the extra protection to guard against such<br />

large, unexpected risks is simply good business sense. And<br />

for that, National Interstate offers Excess Liability insurance.<br />

WHAT IS EXCESS INSURANCE?<br />

Excess Liability insurance is a policy issued to provide coverage<br />

when an underlying liability policy has reached its limit. Federal<br />

law requires motor carriers to maintain minimum levels of financial<br />

responsibility that range from $750,000 for general freight carriers,<br />

up to $5,000,000 for carriers of hazardous materials. These limits<br />

have been in place since 1985 and will rarely contain the cost of a<br />

catastrophic accident that occurs today. For a detailed explanation<br />

on the difference between Excess Liability and Umbrella insurance<br />

policies, check out John Rich’s article on the previous page.<br />

WHY DO I NEED EXCESS INSURANCE?<br />

According to a 2013 study conducted by the Federal Motor Carrier<br />

Safety Administration (FMCSA), although a majority of crashes fall<br />

below current limits, a small but significant share of crashes exceed<br />

the current limits. 1 These findings provide justification in favor of<br />

increasing the minimum levels of financial responsibility. However,<br />

even if the minimum levels are increased, there will always be some<br />

crashes that will fall above that level. There is no realistic dollar<br />

amount that will necessarily ensure every possible crash victim is<br />

fully compensated. Regardless of if or when the minimum levels of<br />

financial responsibility are increased, there will still be a need for<br />

companies to protect their assets with excess liability insurance.<br />

Motor carriers have done an excellent job over the last 30 years to<br />

continually drive down the frequency of accidents through the use<br />

of improved safety techniques and new technology. Unfortunately,<br />

as frequency was driven down, the cost of catastrophic claims<br />

continued to escalate. One of the main factors for the increase<br />

in catastrophic claims has been the increase in medical costs.<br />

According to the Bureau of Labor and Statistics, medical care costs<br />

have increased over 400% over the last 30 years. 2<br />

Although the frequency of fatal accidents involving large trucks<br />

has declined 20% over the past decade, the number has actually<br />

increased in the last year - this according to an article from National<br />

Law Review. Furthermore, there has been an increase over the past<br />

few years in the number of large verdicts where juries have awarded<br />

tens of millions of dollars or more to families of truck accident<br />

victims. 3<br />

WHAT ARE THE BENEFITS OF A NATIONAL INTERSTATE EXCESS POLICY?<br />

The rapidly increasing severity of claims has had an impact on the<br />

insurance industry as well. Several larger insurance companies have<br />

pulled out of the excess and primary markets leaving customers in<br />

a rush to find last minute replacements for their expiring coverages.<br />

National Interstate has remained a stable player in the trucking<br />

industry for over 25 years and continues to provide insurance<br />

solutions for best-in-class operators for their primary coverages<br />

including Auto Liability, General Liability, Workers’ Compensation,<br />

Physical Damage and Cargo, as well as Excess Liability. Advantages<br />

of a National Interstate Excess Liability insurance policy include:<br />

➼➼<br />

Follow-Form Excess Policy<br />

➼➼<br />

Claims continuity with underlying policy<br />

➼➼<br />

Experienced in-house claims handlers<br />

➼➼<br />

Niche industry expertise<br />

➼➼<br />

Interest-free payment plans<br />

➼➼<br />

Issued on A.M. Best “A” Rated National Interstate paper<br />

➼➼<br />

Unsupported Excess over select carriers<br />

For more information on Excess Liability insurance, please contact<br />

Michael Wilson at 800-929-1500 x1186 or michael.wilson@natl.com.<br />

Sources:<br />

1 https://www.fmcsa.dot.gov/sites/fmcsa.dot.gov/files/docs/Financial-Responsibility-Study.pdf<br />

2 https://www.bls.gov/cpi/data.htm<br />

3 http://www.natlawreview.com/article/large-verdicts-truck-accident-cases-rise<br />

MICHAEL WILSON<br />

Director, Truck Underwriting & Analytics<br />

11

12<br />

Alaina Macia<br />

President<br />

and CEO<br />

Ride Right, LLC

Powered by<br />

Her People<br />

As a women-owned, multi-state operation, Ride Right, LLC<br />

provides more than 1.2 million trips to the general public,<br />

transit-dependent, elderly, disabled and transportation<br />

disadvantaged populations each year. The company offers bestin-class<br />

paratransit, fixed route, special needs transportation and<br />

mobility management services focused on quality, while delivering<br />

cost savings and increased efficiencies to the communities it serves.<br />

This issue, we caught up with President and CEO, Alaina Macia,<br />

to talk about her company’s commitment to quality, safety and<br />

passenger satisfaction.<br />

Can you talk about your career<br />

path and how you came to be the<br />

President and CEO of Ride Right, LLC?<br />

It really started in 2003 when my parents asked me to come into the<br />

family business - which is also on the transportation side - but on<br />

the healthcare part of the transportation arena and work with major<br />

healthcare/managed care operators. With the family business, we<br />

contracted out transportation services and I just really felt the need<br />

for higher quality transportation operators than what we were finding<br />

out in the market. Additionally, in some locations where maybe there<br />

was a monopoly in a certain geographic area that didn’t have a lot<br />

of competition, some could be created. Competition is healthy for<br />

all industries and for the payers and the clients in order to obtain<br />

the best service at the best price, and that’s really what got me<br />

interested in starting a transportation company. It’s a different skill<br />

set than what we had internally at the family business because<br />

Ride Right is an actual operator of transportation versus a manager<br />

of transportation. I knew the best way to start a quality company<br />

was to hire individuals that had experience delivering transportation<br />

and high quality services. I recruited some of the best people in<br />

the industry who I knew were looking to work for a company that<br />

had a quality operation and a customer service-oriented mindset.<br />

That’s really how we got Ride Right started in 2007 with about 10<br />

employees. Today, we’re close to 600 employees across 11 states!<br />

What were the main reasons<br />

that you decided to enter the<br />

transportation industry as an owner?<br />

There was definitely a need for it. Not only was there a need for a<br />

quality transportation provider, there was a necessity for a company<br />

that was focused on the client, both the payer and the rider. I think<br />

Ride Right is a little unique, though. One of my clients said it the best<br />

– he said “You’re not chasing revenue, you’re building a company.”<br />

And, that’s true. We don’t bid on everything that comes our way<br />

and we don’t go after every contract. We pick the clients that we<br />

13

14<br />

Treating people with<br />

respect has been our secret<br />

sauce. It’s pretty simple,<br />

but not everyone does it.<br />

want to work for and that are good to partner with. We’re picky<br />

about our growth, but we’re like that so we can be successful. We<br />

have had 100% client retention throughout our contract rebids from<br />

2007 through today. That’s when you know you’ve done something<br />

successful – when your clients choose you again and again.<br />

What was the biggest obstacle<br />

shifting from healthcare to<br />

transportation?<br />

First and foremost credibility was a factor and establishing in the<br />

mind of the client that you can be a viable contender in a new<br />

market despite not having operated on those contracts in the past.<br />

And, that was really the key to hiring experienced professionals,<br />

so that when prospective customers asked, “Do you have five<br />

years’ experience managing paratransit operations?” we were able<br />

to leverage the experience and backgrounds of those individuals.<br />

They not only had the experience factor, but they had the financial<br />

backing, as well. We did leverage my parent’s company, MTM’s<br />

(Medical Transportation Management) corporate headquarters and I<br />

think that was a key success factor in that we were able to leverage<br />

Legal, HR and Accounting and Finance at a reasonable rate. It was<br />

a win-win for both organizations. MTM could offset overhead costs<br />

and Ride Right did not have to build an entirely new team.<br />

What has been your greatest<br />

challenge as a female CEO in the<br />

transportation industry?<br />

I’ll flip this question on its head and say that I think being a female<br />

in a very male-dominated industry has served me well. I think<br />

there are obviously more discussions that need to take place about<br />

diversity and the leadership of women in the workplace and on<br />

boards, but frankly, a lot of my clients are women. There are a lot<br />

more women in paratransit than you would think. Maybe not in the<br />

highest levels but at the county government level, these operations<br />

are being managed by women. In fact, I was at an interview this<br />

week where probably half of the panel of ten people was women,<br />

so that’s exciting.<br />

Also, I think it’s an advantage. As a woman, you feel like you have to<br />

try and establish your credibility, but I do that through great service<br />

and then my gender becomes a non-discussion. People always say<br />

to me, “Have you had discrimination in the workplace?” Maybe I<br />

have, but I choose not to pay attention to it; I just work harder.<br />

Ride Right is a multi-state<br />

operator, spread across the country –<br />

how has your company managed such<br />

wide-spread growth so well?<br />

I think it starts with hiring good people, both in our regional locations<br />

and at the corporate level, to support those regions. I always tell the<br />

general managers in the field that they’re mini CEOs. We give them a<br />

budget and help them with key processes and support services, but<br />

ultimately it’s their job to extend our employee engagement model<br />

that we are very big on at Ride Right. We make sure that they have<br />

appropriate wages and benefits to staff the drivers and it’s our job<br />

to make sure all of their day-to-day activities are as seamless and<br />

streamlined as possible. Additionally, we bring the field together<br />

with corporate. We get together as a whole company once a year<br />

to strategize and talk about how to improve the company and our<br />

people. We also have regional people who visit the field to ensure<br />

that our Mission and Vision are being lived. Ultimately, the clients<br />

will tell me. They know who I am. I’ve been in the room with them,<br />

typically if we’re bidding on a contract. I rarely get phone calls, but<br />

when I do, I make sure that we correct any issue that we have in<br />

their eyes and that’s the key. Having that open door communication<br />

policy with your GMs and your clients is critical. People are the only<br />

way that I know to be successful. Treating people with respect has<br />

been our secret sauce. It’s pretty simple, but not everyone does it.<br />

What are the top three factors<br />

that have contributed to the growth<br />

that Ride Right has achieved over<br />

the years?<br />

Number one – it starts with the people. We have to invest in good<br />

people. I think a lot of small businesses and entrepreneurs always<br />

question when you add that additional full-time employee, but for

me, I’m always investing in people. They’re what’s going to carry<br />

my business forward and I’d rather pay them first and myself last.<br />

Secondly, we are aggressive yet selective, in that we bid on what we<br />

know we can manage and we don’t go outside of our wheelhouse<br />

very often. That way, we don’t spread ourselves too thin and we’re<br />

able to really target the right clients for Ride Right.<br />

Third, similar to people, we invest in technology because it’s<br />

the key that helps us manage the growth. We’ve invested in<br />

routing, scheduling and dispatching technology to optimize route<br />

performance; fleet software to manage vehicle age, wear and<br />

properly retire vehicles; plus cloud-based telephony software so<br />

our operations are always backed up in the case of weather or<br />

electrical issues.<br />

Ultimately, the number one thing that we’re selling and that has<br />

helped us grow is our culture. Our culture is something that clients<br />

are looking for and they understand that if you don’t pay drivers<br />

fair wages, service will suffer. So, we lead with that and with our<br />

employee-centric model. We don’t win business while sacrificing our<br />

drivers. When you do that, you create quality and safety issues.<br />

What are the biggest obstacles in<br />

the ADA paratransit industry?<br />

When the economy is doing really well, driver shortages exist. There<br />

are more jobs available to drivers, so being cognizant of recruiting<br />

and training the best driver force is number one for us. To combat<br />

driver attrition, we offer driver incentive programs and driver safety<br />

bonuses. We also have a Driver Rewards Program that provides<br />

additional bonuses for good customer service, good attendance, etc.<br />

The biggest way to combat the driver shortage is to engage your<br />

driver, talk to your driver and ride along with them in their vehicle.<br />

It’s not always about money; it’s about recognition and employee<br />

engagement. Our GMs are even rated on driver recognition and<br />

engagement – it really is the number one piece to solving that<br />

problem.<br />

Safety – making sure that we not only operate our vehicles safely,<br />

but we care for and secure our passengers correctly and that we<br />

provide them with great customer service.<br />

Fuel has been stably low, so it hasn’t been on our radar as much, but<br />

traditionally, we have to watch for that as well.<br />

What are some of the different<br />

ways in which Ride Right separates<br />

itself from other ADA paratransit<br />

operators? For example, your company<br />

is a certified Woman-Owned Business<br />

Enterprise (WBE). How do you<br />

leverage this certification and other<br />

certifications to grow the operation?<br />

Different states have different requirements and different<br />

participation levels and sometimes there are certain revenue<br />

thresholds, therefore we don’t qualify in every state, but where<br />

we do, we absolutely utilize that to our advantage and bid on<br />

those contracts.<br />

The way that we really separate ourselves from the competition is<br />

15

to say that we don’t offer a traditional cookie-cutter transportation<br />

model. We work with the client, listen to them and create a<br />

customer-centric solution for them. And ultimately, it comes down to<br />

investing in the right places within the company. A lot of companies<br />

will put their bottom line ahead of maintenance, new hires or driver<br />

incentives and we simply just won’t do that.<br />

What makes you a<br />

best-in-class operator?<br />

We really enable our general managers at the field level to make the<br />

best decisions to manage the business. It goes back to putting off<br />

investments to make a bottom line. We tell them they have a budget<br />

they can use for what’s best for their operation and their clients.<br />

Empowering people to make the right decision is another way to<br />

improve employee engagement and morale, especially when we’re<br />

reliant on a regional-based model. That’s really key.<br />

What has been the reason for<br />

Ride Right’s desire to continue their<br />

appetite for taking on risk?<br />

I think we’re really comfortable with our safety record and we’re<br />

also of the mindset that we want to properly build our reserves so<br />

that we can take on additional risk. It also depends on the markets<br />

that you’re in. From either urban density to the nature of litigation in<br />

that area, you have to really understand what your risks are in that<br />

market before you engage.<br />

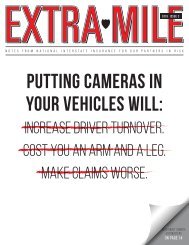

Safety is a daily conversation beginning when the driver gets in the<br />

vehicle throughout the entire day. Whether it’s communications on<br />

holidays, weather or traffic updates, back to school changes - these<br />

are things that will change transportation and we talk about it all<br />

the time. Also, we obviously use cameras in our vehicles so that<br />

triggering safety events are captured and we can have discussions<br />

with those drivers. If there are repeated issues, then we take the<br />

next step and remove that driver because we’re not willing to risk<br />

the safety of our passengers or our safety record on one driver. Yes,<br />

it’s transportation, and accidents will happen, but we don’t want to<br />

have one of those accidents on our records.<br />

Is community involvement<br />

important to Ride Right and<br />

if so, how and why?<br />

It really is – we are a public agency in that regard. We are an<br />

extension of our client’s staff, which is typically the county<br />

government, and we want people to trust us. We handle the elderly<br />

who sometimes cannot advocate on their own behalf and we want<br />

to be a trusted partner and caregiver in those cases. We transport<br />

your grandmother, great grandfather or other loved one. It’s very<br />

important for us to be seen as a good community partner.<br />

Locally and regionally, we definitely get involved in the community.<br />

Right now, we have locations participating in Toys for Tots and Stuff<br />

the Bus. We also volunteer for Habitat for Humanity and host blood<br />

The biggest way to combat the<br />

driver shortage is to engage<br />

your driver, talk to your<br />

driver and ride along with<br />

them in their vehicle.<br />

drives. It’s our employees’ passion and it makes them very proud to<br />

work for a company that continuously gives back to the community.<br />

What has been your proudest<br />

moment with Ride Right?<br />

My proudest moments are when we retain a bid or a contract<br />

because it says we’re doing all the right things. It shows that the<br />

client is happy with our service.<br />

In 2016, we had four contracts go out to rebid and we were able<br />

to retain all of them. That was a great year for us. We don’t have<br />

the mindset that as you get bigger as a company, you’re bound to<br />

lose something; we just don’t believe in that. When you can sleep<br />

at night knowing you’re not going to lose a contract, you know your<br />

team is providing a good service.<br />

What does Ride Right look<br />

like in 10 years?<br />

We’re pretty goal-oriented people around here! Our revenue currently<br />

sits at $40-50M. In 10 years, I’d like to see $200M in revenue and<br />

over 2,000 employees. And of course, hopefully we’re still at that<br />

100% client retention with our safety record intact!<br />

16

Come On In. We’re Open!<br />

TERRI JOHNSON<br />

Vice President of Customer Service<br />

When your organization made the decision to join National Interstate,<br />

we promised you world-class service.<br />

Our team is committed to that promise and we’re continuously looking<br />

for ways to enhance your experience with us. One of the recent<br />

enhancements we made is our improved Claims Contact Center.<br />

On January 3, 2017, we extended our hours to better serve all of our<br />

customers. We are now available by phone Monday through Friday<br />

from 8:00 a.m. to 9:00 p.m. EST. Our Claims Contact Center can<br />

assist you in multiple ways, from reporting new claims to inquiries on<br />

existing claims, as well as answering general questions.<br />

When the office is closed, our afterhours reporting service continues<br />

to be in place. We hope this extension of services gives you additional<br />

flexibility to meet your business needs. As always, your feedback and<br />

suggestions are greatly appreciated.<br />

To contact the Claims Contact Center, please call 800-929-0870.<br />

17

MILITARY<br />

DRIVERS<br />

The driver shortage in the United States is a reality and one<br />

that is not going away anytime soon. It is those companies<br />

that deal with it effectively that will have a competitive<br />

advantage. Recently signed government programs may offer<br />

transportation organizations relief and an untapped candidate pool<br />

– military veterans.<br />

Yes, there have been programs in existence since 2011 1 to<br />

transition military drivers into civilian commercial license holders,<br />

but the signing of the Fixing America’s Surface Transportation Act,<br />

or FAST Act, implemented federal regulations to help streamline<br />

this process and make commercial transportation a more viable<br />

civilian career for separating Service Members. The FAST Act<br />

authorizes $305 billion over fiscal years 2016 through 2020 for<br />

highway, public transportation, highway and motor vehicle safety,<br />

motor carrier safety, hazardous materials safety, rail, research,<br />

technology and statistics programs. The FAST Act increases the<br />

skills waiver program time frame, allows for DOT med certificates<br />

to be acquired by the Department of Veterans Affairs physicians<br />

and permits military drivers to apply and be tested in the state<br />

where they are stationed. 2<br />

Another significant aspect of the FAST Act is a pilot program that<br />

allows for select military personnel between 18 and 21 years<br />

of age to operate CMV’s in interstate commerce. Because many<br />

active duty Service Members are already 21 or older when they<br />

leave active duty, the program was designed primarily for current<br />

Reserve and National Guard personnel. 12 Over the course of three<br />

years, select drivers will have their safety performance evaluated<br />

against a control group of other CDL drivers aged 21 to 26. The<br />

intention of the program is to help determine if age is a critical<br />

safety factor.<br />

Veterans represent a significant portion of America’s workforce,<br />

and as the military continues to undergo drawdowns and<br />

sequestration cuts, the population of veterans will continue to<br />

increase. However, military strength reductions mean that greater<br />

numbers of young Service Members are joining the workforce as<br />

they seek a civilian career. 3<br />

According to the Bureau of Labor Statistics, there are 22 million<br />

veterans in the United States. Of those, nearly 11 million are<br />

currently in the U.S. labor force and approximately 4.5 million are<br />

under 45 years of age. 5 Additionally, 148,000 of those veterans<br />

who are between 18 to 45 years old are presently unemployed<br />

and many more are underemployed. 6 On average, there are an<br />

additional 200,000 Service Members leaving the military each<br />

year. 7 However, the military workforce doesn’t end with separated<br />

veterans, because there are an additional 1 million National Guard<br />

and Military Reserve personnel currently serving who have and/or<br />

need civilian employment.<br />

18

Welcome<br />

The transition from military life to civilian life can be cumbersome<br />

to navigate, with one of the most significant obstacles being<br />

employment. For many, military service provides a source of<br />

identity and purpose – a significant contribution to their life’s<br />

work. Upon entering the civilian world, some Service Members<br />

struggle to find that same significance in their jobs as they seek<br />

a new career. 8 The transportation industry – the backbone of<br />

America’s economy – can offer veterans an opportunity to support<br />

their country internally, after having served to defend it.<br />

There are numerous veterans and Reserve Component Service<br />

Members who either don’t have a civilian equivalent to their<br />

occupational specialty or don’t wish to pursue a civilian career<br />

in their occupational specialty. The FMCSA recognized this and<br />

awarded nearly $1 million to commercial driving schools to be<br />

used for the training of veterans as commercial truck and bus<br />

drivers. 9 These schools received grant money as a part of the<br />

Commercial Motor Vehicle Operator Safety Training Grant Program,<br />

which began in 2005. 10<br />

Veteran and Reserve Component Service Members have an easily<br />

transferable skillset and represent a relatively untapped potential<br />

to revitalize the commercial driving workforce with reliable, safe<br />

and quality employees. Companies need to learn how to hire good<br />

military drivers.<br />

For more information about the DOT’s military employment<br />

initiatives, please visit https://www.fmcsa.dot.gov/registration/<br />

commercial-drivers-license/military. Additionally, to connect<br />

with veterans seeking employment visit https://www.va.gov/<br />

vetsinworkplace/.<br />

You can also check with your state department of Veterans<br />

Services for state specific veterans hiring initiatives, or other<br />

industry organizations such as Troops To Truckers http://<br />

troopstotruckers.com/business/, Hire Heroes USA https://www.<br />

hireheroesusa.org/, Hire Our Heroes https://hireourheroes.org/<br />

corporations/ and many more.<br />

Sources:<br />

1. https://www.fmcsa.dot.gov/registration/commercial-drivers-license/military-skills-test-waiver-program<br />

2. https://www.fmcsa.dot.gov/fastact/veteran-drivers<br />

3. https://www.federalregister.gov/documents/2016/08/22/2016-19948/commercial-drivers-licenses-proposed-pilot-program-to-allowpersons-between-the-ages-of-18-and-21<br />

4. http://index.heritage.org/military/2017/assessments/us-military-power/<br />

5. https://www.bls.gov/news.release/pdf/vet.pdf<br />

6. https://www.bls.gov/news.release/pdf/vet.pdf<br />

7. https://www.dllr.state.md.us/mil2fedjobs/learn_mil.htm<br />

8. http://www.military.com/veteran-jobs/career-advice/military-transition/finding-passion-and-purpose-after-the-military.html<br />

9. https://www.fmcsa.dot.gov/newsroom/fmcsa-awards-nearly-1-million-grants-help-train-veterans-jobs-commercial-truck-and-bus<br />

10. https://www.fmcsa.dot.gov/cmv-operator-safety-training-grant/commercial-motor-vehicle-operator-safety-training-grant-applicationaward-process<br />

CHRIS VASQUEZ<br />

Risk Management Associate<br />

(and 1LT BTRY B, 1-174th ADA BDE OHARNG)<br />

19

DISTRACTED DRIVING:<br />

THE<br />

MOST<br />

9<br />

DANGEROUS<br />

DISTRACTIONS<br />

KNOW YOUR RISKS<br />

1.2 MILLION 4 TIMES<br />

According to the World Health Organization more than 1.2 million<br />

people die in road crashes worldwide each year – the equivalent<br />

of one traffic-related fatality every 30 seconds – and another 20 to<br />

50 million people are injured.<br />

Distracted drivers are about 4 times as likely to be involved in<br />

crashes as those who are focused on driving.<br />

20

Beyond texting while you’re behind the wheel, distracted driving means driving while doing another activity that takes your attention<br />

away from what you should be focused on - driving. 1<br />

In fact, there are three main types of distraction:<br />

1. VISUAL: TAKING YOUR EYES OFF THE ROAD<br />

2. MANUAL: TAKING YOUR HANDS OFF THE WHEEL<br />

3. COGNITIVE: TAKING YOUR MIND OFF OF DRIVING 2<br />

Here, we’ll explore the nine most dangerous types of driving distractions:<br />

9. SMOKING-RELATED ACTIVITIES:<br />

Includes smoking, lighting up and/or putting<br />

ashes in ash tray. In crash reports involving<br />

at least one fatality, 1% of law enforcement<br />

officers cited smoking-related activities. 3<br />

8. COSMETICS:<br />

Have you ever pulled up alongside of<br />

a vehicle and its driver was putting on<br />

mascara with one hand and driving with the<br />

other – but her eyes were looking up in her<br />

mirror? Unfortunately, 5% of drivers admit to<br />

applying makeup, perfume and/or lipstick<br />

while driving. 5 Yikes!<br />

7. SLOWING DOWN TO SEE AN ACCIDENT:<br />

We’re all guilty at some point or another<br />

of rubber necking, even if it happens<br />

subconsciously. Dangerously, 21% of<br />

motorists admitted to have slowed down to<br />

have a look at an accident involving other<br />

motorists. Of course, this means that the<br />

motorist takes his or her eyes off the road<br />

ahead, risking another accident. 5<br />

6. DROWSY DRIVING:<br />

A AAA Foundation study completed in<br />

November 2014 found the impact of having<br />

drowsy drivers on the road is substantial.<br />

Drowsy drivers are involved in an estimated<br />

21% of fatal crashes, up from 16.5% from<br />

the previous study completed in 2010, as<br />

most drivers drift out of their lanes or off<br />

the road entirely. Drowsy drivers themselves<br />

are often crash victims who die in single-car<br />

crashes. 4<br />

80-90 PERCENT 5TH LEADING<br />

Driver behavior is responsible for 80 to 90 percent of these road<br />

crashes, meaning that preventable behaviors contribute more to<br />

fatalities and injuries than road conditions or vehicle defects.<br />

By 2030, road traffic injuries are projected to be the fifth leading<br />

cause of death worldwide, surpassing HIV/AIDS, all forms of<br />

cancer, violence and diabetes. 9<br />

21

5. PHONE CALLS:<br />

Nearly 1 in 4 (23%) drivers admit to making<br />

or receiving phone calls while driving,<br />

despite ad campaigns warning of such<br />

dangers and local and state cell phone bans<br />

while driving. 5<br />

2. MUSIC:<br />

61% of motorists admit to being distracted<br />

while driving by their radio, CD player and<br />

their iPod. Risks are increased by drivers<br />

flicking through their smart phone or iPod to<br />

locate certain songs. 5<br />

4. SENDING TEXT MESSAGES:<br />

Drivers who text can be more than 20 times<br />

likely to crash than non-distracted drivers. 9<br />

A 2011 CDC study compared the percentage<br />

of distracted drivers in the United States<br />

and seven European countries: Belgium,<br />

France, Germany, the Netherlands, Portugal,<br />

Spain, and the United Kingdom. Overall, the<br />

study found that a higher percentage of U.S.<br />

drivers talked on the phone and read or sent<br />

emails or texts while driving than drivers in<br />

several other European countries. The study<br />

also found that about 33% of drivers in the<br />

United States reported that they had read or<br />

sent text messages or emails while driving. 7<br />

1. FOOD AND DRINK:<br />

Wait to eat your drive-thru cheeseburger<br />

until your vehicle is safely parked, or you<br />

arrive home. Why? The National Highway<br />

Traffic Safety Administration estimates that<br />

eating and driving increases the likelihood<br />

of crashes by 80 percent. Additionally, 65<br />

percent of near-miss crashes are caused<br />

by distracted drivers who are eating or<br />

drinking while driving. The NHTSA also<br />

ranked the 10 most dangerous types of food<br />

to eat while in drive. Topping the list were<br />

chocolate, soft drinks, jelly and cream-filled<br />

or powdered doughnuts, fried chicken,<br />

barbecued food, hamburgers, chili, tacos,<br />

soups and coffee. 8<br />

3. SOCIAL NETWORKING:<br />

It seems like everyone has a smart phone<br />

nowadays which means social media is<br />

only a touch away. Using social media while<br />

driving can be three times more dangerous<br />

than drinking and driving. According to<br />

research conducted by the Transport<br />

Research Laboratory and the Institute of<br />

Advanced Motorist, the reaction time of a<br />

driver is slowed by 38% while using their<br />

smartphone, as opposed to the 12% of<br />

someone who has been drinking. 10 Worse,<br />

people are filming and taking pictures of<br />

themselves on Instagram while they’re<br />

driving. And not just a few people: there<br />

are over 3 million posts on Instagram<br />

tagged with “#driving,” nearly 50,000<br />

with “#drivinghome,” over 9,000 tagged<br />

“#drivingtowork” and more than 3,500<br />

tagged “#drivingselfie.” 6<br />

STAY FOCUSED ON THE ROAD<br />

AHEAD AND MAKE A COMMITMENT<br />

TO YOURSELF TO NOT DRIVE<br />

DISTRACTED. REMEMBER,<br />

NATIONAL INTERSTATE IS WITH<br />

YOU EVERY MILE OF YOUR JOURNEY.<br />

Sources:<br />

1. National Center for Statistics and Analysis, Distracted Driving: 2013 Data, in Traffic Safety Research Notes. DOT HS 812 132. April 2015,<br />

National Highway Traffic Safety Administration: Washington, D.C.<br />

2. National Highway Traffic Safety Administration. Policy Statement and Compiled FAQs on Distracted Driving. [cited 2016 Feb 23]<br />

3. http://www.propertycasualty360.com/2013/04/11/10-deadliest-driving-distractions?page_all=1<br />

4. AAA Foundation for Traffic Safety/Brian C. Tefft. Prevalence of Motor Vehicle Crashes Involving Drowsy Drivers, United States, 2009<br />

– 2013 (November 2014)<br />

5. http://www.drive-safely.net/top-ten-driving-distractions/<br />

6. http://www.huffingtonpost.com/2013/10/31/instagram-while-driving_n_4181120.html<br />

7. Rebecca B. Naumann, MSPH, Ann M. Dellinger, PhD, Div of Unintentional Injury Prevention, National Center for Injury Prevention and<br />

Control, CDC. Mobile Device Use While Driving – United States and Seven European Countries, 2011. Centers for Disease Control and<br />

Prevention.<br />

8. http://www.decidetodrive.org/distracted-driving-dangerous/eating-driving/<br />

9. National Highway Traffic Safety Administration. Distracted Driving Global Fact Sheet [5/17 v2]<br />

10. https://www.drivesafer.com/blog/the-dangers-of-using-social-media-while-driving-2/<br />

AMANDA GENTHER<br />

22<br />

Media Relations Specialist

Building for the Future Update<br />

Last issue, we announced plans to expand our Richfield headquarters<br />

by adding a third building. The new building will be the centerpiece of<br />

our campus and have several features including enclosed walkways<br />

between our two existing buildings, a larger cafeteria, additional<br />

wellness facilities and several outdoor decks and patios.<br />

We hope to host you once construction is complete, but in the<br />

meantime, we will use the Extra Mile to keep you updated on how<br />

things are progressing around here!<br />

What started out as a wooded area and parking lot is now an active construction site. The land is cleared, the<br />

lower level is dug out and the walls and foundation are complete. Next comes the cranes and structural steel!<br />

23

3250 Interstate Drive<br />

Richfield, Ohio 44286<br />

Service Center Reminder<br />

Activities<br />

Check balances and submit payments anytime<br />

DON’T JUST TAKE OUR WORD FOR IT –<br />

LISTEN TO WHAT OUR CUSTOMERS THINK!<br />

Need to check a claims status? Click here<br />

Submit accident videos, right online<br />

Link to additional safety tools<br />

Get to know your service team<br />

Read this magazine – digitally<br />

“National Interstate’s a great partner working<br />

together with us every day. As we make changes<br />

to our business model, we rely heavily on their<br />

industry knowledge and experience to keep us<br />

protected. As our state’s top chauffeured ground<br />

transportation company, risk is something we<br />

take seriously, which is why we’re glad we’ve got<br />

National Interstate by our side.”<br />

– COOPER-GLOBAL CHAUFFEURED<br />

Make A Payment<br />

View Claims<br />

Upload AER Videos<br />

Resources<br />

Risk Management Tool<br />

Meet the Team<br />

Extra Mile<br />

“I can’t begin to tell you how satisfied we are with<br />

our team at National Interstate. Claims are handled<br />

smoothly, with most of them closed quicker<br />

than even we would expect. And the day-to-day<br />

interaction with their customer service group is<br />

outstanding. We couldn’t be more pleased.”<br />

– OATS, INC.