Graduate

IPU-Review-APRIL-2017

IPU-Review-APRIL-2017

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

BUSINESS Susan Wylie, Audit Partner, PKF O’Connor, Leddy & Holmes<br />

Companies<br />

(Accounting) Bill 2016<br />

– Proposed changes in<br />

Reporting & Filing of<br />

Companies Accounts<br />

The Companies (Accounting) Bill 2016 was published<br />

on 5 August 2016. Once enacted, the Bill will amend<br />

and supplement the Companies Act 2014 in a number<br />

of aspects. Currently, it is just a Bill and changes may<br />

be made before it becomes law.<br />

The Bill transposes<br />

the Accounting<br />

Directive 2013,<br />

which will<br />

simplify and<br />

reduce some administrative<br />

burdens with regard to the<br />

preparation of financial<br />

statements for enterprises, in<br />

particular SMEs. In addition,<br />

the Bill makes a number of<br />

miscellaneous amendments<br />

to the Companies Act 2014 not<br />

related to the transposition<br />

of the Directive.<br />

Main features of the Bill<br />

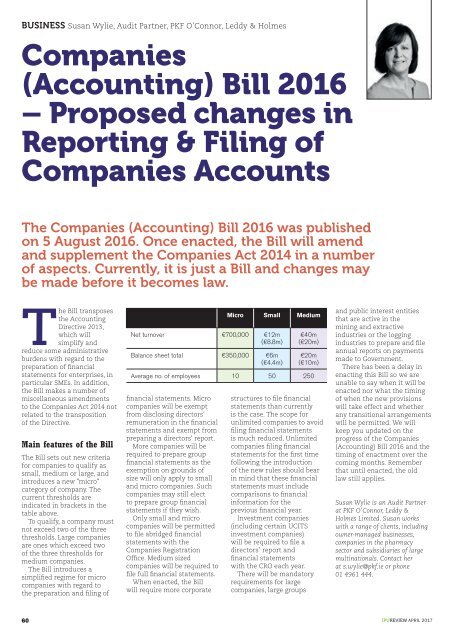

The Bill sets out new criteria<br />

for companies to qualify as<br />

small, medium or large, and<br />

introduces a new "micro"<br />

category of company. The<br />

current thresholds are<br />

indicated in brackets in the<br />

table above.<br />

To qualify, a company must<br />

not exceed two of the three<br />

thresholds. Large companies<br />

are ones which exceed two<br />

of the three thresholds for<br />

medium companies.<br />

The Bill introduces a<br />

simplified regime for micro<br />

companies with regard to<br />

the preparation and filing of<br />

financial statements. Micro<br />

companies will be exempt<br />

from disclosing directors'<br />

remuneration in the financial<br />

statements and exempt from<br />

preparing a directors' report.<br />

More companies will be<br />

required to prepare group<br />

financial statements as the<br />

exemption on grounds of<br />

size will only apply to small<br />

and micro companies. Such<br />

companies may still elect<br />

to prepare group financial<br />

statements if they wish.<br />

Only small and micro<br />

companies will be permitted<br />

to file abridged financial<br />

statements with the<br />

Companies Registration<br />

Office. Medium sized<br />

companies will be required to<br />

file full financial statements.<br />

When enacted, the Bill<br />

will require more corporate<br />

Micro Small Medium<br />

Net turnover €700,000 €12m<br />

(€8.8m)<br />

Balance sheet total €350,000 €6m<br />

(€4.4m)<br />

€40m<br />

(€20m)<br />

€20m<br />

(€10m)<br />

Average no. of employees 10 50 250<br />

structures to file financial<br />

statements than currently<br />

is the case. The scope for<br />

unlimited companies to avoid<br />

filing financial statements<br />

is much reduced. Unlimited<br />

companies filing financial<br />

statements for the first time<br />

following the introduction<br />

of the new rules should bear<br />

in mind that these financial<br />

statements must include<br />

comparisons to financial<br />

information for the<br />

previous financial year.<br />

Investment companies<br />

(including certain UCITS<br />

investment companies)<br />

will be required to file a<br />

directors’ report and<br />

financial statements<br />

with the CRO each year.<br />

There will be mandatory<br />

requirements for large<br />

companies, large groups<br />

and public interest entities<br />

that are active in the<br />

mining and extractive<br />

industries or the logging<br />

industries to prepare and file<br />

annual reports on payments<br />

made to Government.<br />

There has been a delay in<br />

enacting this Bill so we are<br />

unable to say when it will be<br />

enacted nor what the timing<br />

of when the new provisions<br />

will take effect and whether<br />

any transitional arrangements<br />

will be permitted. We will<br />

keep you updated on the<br />

progress of the Companies<br />

(Accounting) Bill 2016 and the<br />

timing of enactment over the<br />

coming months. Remember<br />

that until enacted, the old<br />

law still applies.<br />

Susan Wylie is an Audit Partner<br />

at PKF O’Connor, Leddy &<br />

Holmes Limited. Susan works<br />

with a range of clients, including<br />

owner-managed businesses,<br />

companies in the pharmacy<br />

sector and subsidiaries of large<br />

multinationals. Contact her<br />

at s.wylie@pkf.ie or phone<br />

01 4961 444.<br />

60<br />

IPUREVIEW APRIL 2017