Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

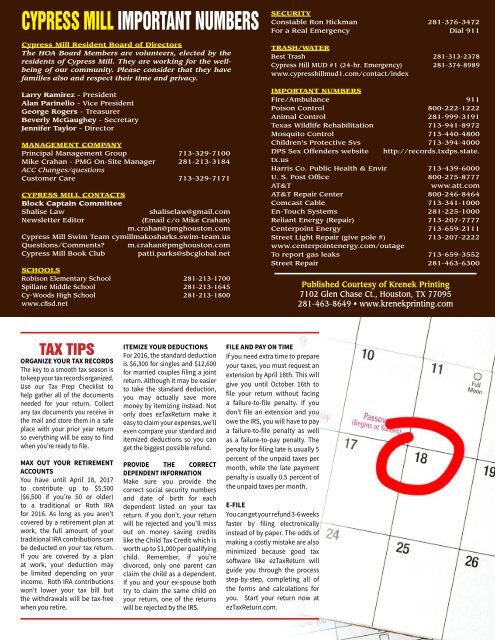

CYPRESS MILL IMPORTANT NUMBERS<br />

<strong>Cypress</strong> <strong>Mill</strong> Resident Board of Directors<br />

The HOA Board Members are volunteers, elected by the<br />

residents of <strong>Cypress</strong> <strong>Mill</strong>. They are working for the wellbeing<br />

of our community. Please consider that they have<br />

families also and respect their time and privacy.<br />

Larry Ramirez - President<br />

Alan Parinello - Vice President<br />

George Rogers - Treasurer<br />

Beverly McGaughey - Secretary<br />

Jennifer Taylor - Director<br />

MANAGEMENT COMPANY<br />

Principal Management Group 713-329-7100<br />

Mike Crahan - PMG On-Site Manager 281-213-3184<br />

ACC Changes/questions<br />

Customer Care 713-329-7171<br />

CYPRESS MILL CONTACTS<br />

Block Captain Committee<br />

Shalise Law<br />

shaliselaw@gmail.com<br />

Newsletter Editor<br />

(Email c/o Mike Crahan)<br />

m.crahan@pmghouston.com<br />

<strong>Cypress</strong> <strong>Mill</strong> Swim Team cymillmakosharks.swim-team.us<br />

Questions/Comments? m.crahan@pmghouston.com<br />

<strong>Cypress</strong> <strong>Mill</strong> Book Club patti.parks@sbcglobal.net<br />

SCHOOLS<br />

Robison Elementary School 281-213-1700<br />

Spillane Middle School 281-213-1645<br />

Cy-Woods High School 281-213-1800<br />

www.cfisd.net<br />

SECURITY<br />

Constable Ron Hickman 281-376-3472<br />

For a Real Emergency Dial 911<br />

TRASH/WATER<br />

Best Trash 281-313-2378<br />

<strong>Cypress</strong> Hill MUD #1 (24-hr. Emergency) 281-374-8989<br />

www.cypresshillmud1.com/contact/index<br />

IMPORTANT NUMBERS<br />

Fire/Ambulance 911<br />

Poison Control 800-222-1222<br />

Animal Control 281-999-3191<br />

Texas Wildlife Rehabilitation 713-941-8972<br />

Mosquito Control 713-440-4800<br />

Children’s Protective Svs 713-394-4000<br />

DPS Sex Offenders website http://records.txdps.state.<br />

tx.us<br />

Harris Co. Public Health & Envir 713-439-6000<br />

U. S. Post Office 800-275-8777<br />

AT&T<br />

www.att.com<br />

AT&T Repair Center 800-246-8464<br />

Comcast Cable 713-341-1000<br />

En-Touch Systems 281-225-1000<br />

Reliant Energy (Repair) 713-207-7777<br />

Centerpoint Energy 713-659-2111<br />

Street Light Repair (give pole #) 713-207-2222<br />

www.centerpointenergy.com/outage<br />

To report gas leaks 713-659-3552<br />

Street Repair 281-463-6300<br />

Published Courtesy of Krenek Printing<br />

7102 Glen Chase Ct., Houston, TX 77095<br />

281-463-8649 • www.krenekprinting.com<br />

TAX TIPS<br />

ORGANIZE YOUR TAX RECORDS<br />

The key to a smooth tax season is<br />

to keep your tax records organized.<br />

Use our Tax Prep Checklist to<br />

help gather all of the documents<br />

needed for your return. Collect<br />

any tax documents you receive in<br />

the mail and store them in a safe<br />

place with your prior year return<br />

so everything will be easy to find<br />

when you’re ready to file.<br />

MAX OUT YOUR RETIREMENT<br />

ACCOUNTS<br />

You have until <strong>April</strong> 18, <strong>2017</strong><br />

to contribute up to $5,500<br />

($6,500 if you’re 50 or older)<br />

to a traditional or Roth IRA<br />

for 2016. As long as you aren’t<br />

covered by a retirement plan at<br />

work, the full amount of your<br />

traditional IRA contributions can<br />

be deducted on your tax return.<br />

If you are covered by a plan<br />

at work, your deduction may<br />

be limited depending on your<br />

income. Roth IRA contributions<br />

won’t lower your tax bill but<br />

the withdrawals will be tax-free<br />

when you retire.<br />

ITEMIZE YOUR DEDUCTIONS<br />

For 2016, the standard deduction<br />

is $6,300 for singles and $12,600<br />

for married couples filing a joint<br />

return. Although it may be easier<br />

to take the standard deduction,<br />

you may actually save more<br />

money by itemizing instead. Not<br />

only does ezTaxReturn make it<br />

easy to claim your expenses, we’ll<br />

even compare your standard and<br />

itemized deductions so you can<br />

get the biggest possible refund.<br />

PROVIDE THE CORRECT<br />

DEPENDENT INFORMATION<br />

Make sure you provide the<br />

correct social security numbers<br />

and date of birth for each<br />

dependent listed on your tax<br />

return. If you don’t, your return<br />

will be rejected and you’ll miss<br />

out on money saving credits<br />

like the Child Tax Credit which is<br />

worth up to $1,000 per qualifying<br />

child. Remember, if you’re<br />

divorced, only one parent can<br />

claim the child as a dependent.<br />

If you and your ex-spouse both<br />

try to claim the same child on<br />

your return, one of the returns<br />

will be rejected by the IRS.<br />

FILE AND PAY ON TIME<br />

If you need extra time to prepare<br />

your taxes, you must request an<br />

extension by <strong>April</strong> 18th. This will<br />

give you until October 16th to<br />

file your return without facing<br />

a failure-to-file penalty. If you<br />

don’t file an extension and you<br />

owe the IRS, you will have to pay<br />

a failure-to-file penalty as well<br />

as a failure-to-pay penalty. The<br />

penalty for filing late is usually 5<br />

percent of the unpaid taxes per<br />

month, while the late payment<br />

penalty is usually 0.5 percent of<br />

the unpaid taxes per month.<br />

E-FILE<br />

You can get your refund 3-6 weeks<br />

faster by filing electronically<br />

instead of by paper. The odds of<br />

making a costly mistake are also<br />

minimized because good tax<br />

software like ezTaxReturn will<br />

guide you through the process<br />

step-by-step, completing all of<br />

the forms and calculations for<br />

you. Start your return now at<br />

ezTaxReturn.com.