Q2 Financial Report - 2014

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Our business in Ukraine, as is the case with most of our new business in emerging markets, is<br />

primarily comprised of turn-key projects that bundle our commercial grain handling equipment<br />

with large diameter storage bins and are sold to large corporate farms, commercial grain handlers<br />

and port facilities. Our customers in Ukraine are predominantly well capitalized entities that either<br />

qualify for EDC insurance, direct financing or are able to pay cash in advance of shipment, and<br />

they generally transact a significant portion of their business in U.S. dollars and accordingly are<br />

largely insulated from volatility in local currencies. We remain in regular contact with our<br />

customers in the region and to date there has not been an indication that their capital expenditure<br />

plans have been substantially impacted by the recent events and accordingly we continue to ship<br />

product to Ukraine.<br />

In the six months ended June 30, <strong>2014</strong> sales to RUK were $12 million and as at June 30, <strong>2014</strong><br />

committed orders for future shipments to RUK approximate $53 million, the significant majority<br />

of which are in Ukraine. Sales in the first six months of <strong>2014</strong> were largely consistent with<br />

expectations and reflect AGI’s production scheduling as well as customer timelines. Of the $53<br />

million in committed orders, management estimates $15 million to $20 million will ship in fiscal<br />

2015. The majority of the 2015 shipments relate to a large port facility and reflect both the<br />

complexity of the project as the site continues to undergo design changes as well as delays related<br />

to financing structure that resulted in part from the unrest in Ukraine. Of the $53 million in<br />

committed orders, $20 million will be shipped based on existing export credit agency facilities or<br />

cash deposits while shipment of the remaining $33 million is subject to receipt of additional export<br />

credit agency support or cash deposits.<br />

The situation in Ukraine and the region is very fluid. Although at this time our customers have not<br />

changed their view with respect to our capital projects this may change if the situation worsens.<br />

Our business may also be adversely affected in the event of negative developments with respect to<br />

currency controls, trade sanctions, a deterioration in or expansion of the current political, social or<br />

military situation or if the current situation is protracted. Export Development Canada is currently<br />

reviewing new credit applications on a case-by-case basis and future business in the region may be<br />

constrained in the absence of export credit agency support. (See also, "Risk and Uncertainties -<br />

International Sales and Operations").<br />

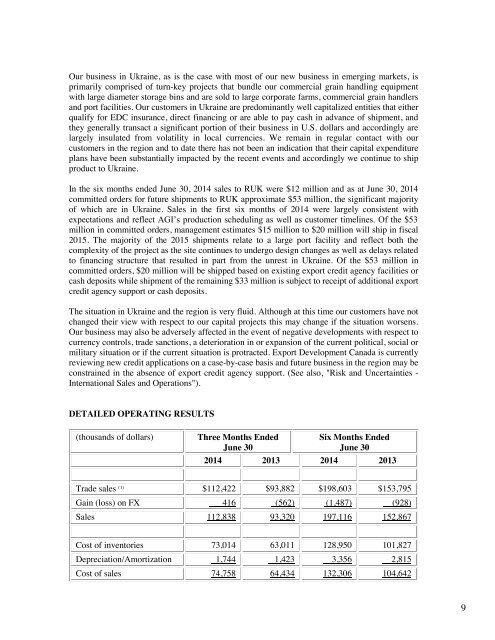

DETAILED OPERATING RESULTS<br />

(thousands of dollars)<br />

Three Months Ended<br />

June 30<br />

Six Months Ended<br />

June 30<br />

<strong>2014</strong> 2013 <strong>2014</strong> 2013<br />

Trade sales (1) $112,422 $93,882 $198,603 $153,795<br />

Gain (loss) on FX 416 (562) (1,487) (928)<br />

Sales 112,838 93,320 197,116 152,867<br />

Cost of inventories 73,014 63,011 128,950 101,827<br />

Depreciation/Amortization 1,744 1,423 3,356 2,815<br />

Cost of sales 74,758 64,434 132,306 104,642<br />

12<br />

9