Q2 Financial Report - 2014

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Ag Growth International Inc.<br />

NOTES TO UNAUDITED INTERIM CONDENSED<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

[in thousands of Canadian dollars, except where otherwise noted and per share data]<br />

June 30, <strong>2014</strong><br />

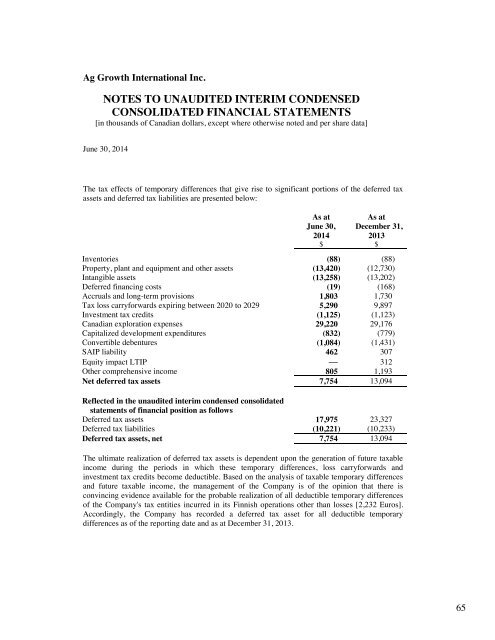

The tax effects of temporary differences that give rise to significant portions of the deferred tax<br />

assets and deferred tax liabilities are presented below:<br />

As at<br />

June 30,<br />

<strong>2014</strong><br />

$ $<br />

As at<br />

December 31,<br />

2013<br />

Inventories (88) (88)<br />

Property, plant and equipment and other assets (13,420) (12,730)<br />

Intangible assets (13,258) (13,202)<br />

Deferred financing costs (19) (168)<br />

Accruals and long-term provisions 1,803 1,730<br />

Tax loss carryforwards expiring between 2020 to 2029 5,290 9,897<br />

Investment tax credits (1,125) (1,123)<br />

Canadian exploration expenses 29,220 29,176<br />

Capitalized development expenditures (832) (779)<br />

Convertible debentures (1,084) (1,431)<br />

SAIP liability 462 307<br />

Equity impact LTIP — 312<br />

Other comprehensive income 805 1,193<br />

Net deferred tax assets 7,754 13,094<br />

Reflected in the unaudited interim condensed consolidated<br />

statements of financial position as follows<br />

Deferred tax assets 17,975 23,327<br />

Deferred tax liabilities (10,221) (10,233)<br />

Deferred tax assets, net 7,754 13,094<br />

The ultimate realization of deferred tax assets is dependent upon the generation of future taxable<br />

income during the periods in which these temporary differences, loss carryforwards and<br />

investment tax credits become deductible. Based on the analysis of taxable temporary differences<br />

and future taxable income, the management of the Company is of the opinion that there is<br />

convincing evidence available for the probable realization of all deductible temporary differences<br />

of the Company's tax entities incurred in its Finnish operations other than losses [2,232 Euros].<br />

Accordingly, the Company has recorded a deferred tax asset for all deductible temporary<br />

differences as of the reporting date and as at December 31, 2013.<br />

68<br />

65