Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

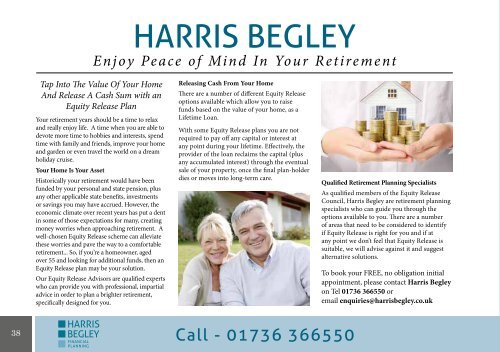

HARRIS BEGLEY<br />

Enjoy Peace of Mind In Your Retirement<br />

Tap Into <strong>The</strong> Value Of Your Home<br />

And Release A Cash Sum with an<br />

Equity Release Plan<br />

Your retirement years should be a time to relax<br />

and really enjoy life. A time when you are able to<br />

devote more time to hobbies and interests, spend<br />

time with family and friends, improve your home<br />

and garden or even travel the world on a dream<br />

holiday cruise.<br />

Your Home Is Your Asset<br />

Historically your retirement would have been<br />

funded by your personal and state pension, plus<br />

any other applicable state benefits, investments<br />

or savings you may have accrued. However, the<br />

economic climate over recent years has put a dent<br />

in some of those expectations for many, creating<br />

money worries when approaching retirement. A<br />

well-chosen Equity Release scheme can alleviate<br />

these worries and pave the way to a comfortable<br />

retirement... So, if you’re a homeowner, aged<br />

over 55 and looking for additional funds, then an<br />

Equity Release plan may be your solution.<br />

Our Equity Release Advisors are qualified experts<br />

who can provide you with professional, impartial<br />

advice in order to plan a brighter retirement,<br />

specifically designed for you.<br />

Releasing Cash From Your Home<br />

<strong>The</strong>re are a number of different Equity Release<br />

options available which allow you to raise<br />

funds based on the value of your home, as a<br />

Lifetime Loan.<br />

With some Equity Release plans you are not<br />

required to pay off any capital or interest at<br />

any point during your lifetime. Effectively, the<br />

provider of the loan reclaims the capital (plus<br />

any accumulated interest) through the eventual<br />

sale of your property, once the final plan-holder<br />

dies or moves into long-term care.<br />

Qualified Retirement Planning Specialists<br />

As qualified members of the Equity Release<br />

Council, Harris Begley are retirement planning<br />

specialists who can guide you through the<br />

options available to you. <strong>The</strong>re are a number<br />

of areas that need to be considered to identify<br />

if Equity Release is right for you and if at<br />

any point we don’t feel that Equity Release is<br />

suitable, we will advise against it and suggest<br />

alternative solutions.<br />

To book your FREE, no obligation initial<br />

appointment, please contact Harris Begley<br />

on Tel 01736 366550 or<br />

email enquiries@harrisbegley.co.uk<br />

Key Factors of Equity Release<br />

• You must be aged 55 or over, have a property worth at least<br />

£75,000 and be able to release a minimum of £15,000.<br />

• You must use the cash sum released to pay off any existing<br />

outstanding mortgage.<br />

• You retain legal ownership of your home.<br />

• You can safeguard a percentage of your home’s value with an<br />

inheritance guarantee.<br />

• You’re protected with a no negative equity guarantee, so you, or<br />

your estate, will never pay back more than you receive from the<br />

eventual sale of your home.<br />

• <strong>The</strong>re are no monthly repayments. Instead, interest is added<br />

to the loan each year. <strong>The</strong> loan and interest are repaid in full,<br />

usually from the sale of your home, when you die or go into<br />

long-term care.<br />

• Releasing equity can affect your tax position and eligibility for<br />

welfare benefits.<br />

• Equity Release isn’t suitable if you have savings you could use<br />

instead, or would prefer to sell all, or part of your home, or<br />

downsize.<br />

• It will reduce the amount of inheritance you can leave.<br />

Equity Release is a lifetime mortgage or home reversion scheme.<br />

To understand the features and risks, ask for a personalised illustration.<br />

Finance<br />

Call - 01736 366550<br />

email - enquiries@harrisbegley.co.uk<br />

38 39