The Voice of Southwest Louisiana News Magazine June 2017

The Voice of Southwest Louisiana News Magazine June 2017

The Voice of Southwest Louisiana News Magazine June 2017

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

SWLAbusiness<br />

A McNeese SEED Center Incubator Client<br />

Member <strong>of</strong> Chamber <strong>Southwest</strong> <strong>Louisiana</strong><br />

Boys to Men:<br />

<strong>The</strong> Financial<br />

Planning Edition<br />

By Trina Duhon, AAMS<br />

Financial Consultant<br />

As boys grow into young men, it is<br />

important they understand what is<br />

needed to become successful. Just<br />

to name the main priorities: you need<br />

God first, success second, followed by the<br />

love <strong>of</strong> a good woman. Spending time in<br />

children’s church and Bible study is where<br />

you begin to learn the lessons <strong>of</strong> Christ<br />

Jesus, how He died for our sins, as well as<br />

many other stories <strong>of</strong> the Bible. Learning<br />

the lessons in school provides you with<br />

knowledge. Working around the house<br />

as a young boy or in a part time job as<br />

a young man builds the work ethic to<br />

earn the wage needed to become a more<br />

successful husband and father as you<br />

grow older. In time, you will learn that<br />

being able to earn the money is much<br />

easier than being able to successfully<br />

manage it.<br />

Managing money takes practice and skill<br />

that is developed with lessons and/or<br />

experience. In success, learning by the<br />

experience that only discipline can bring<br />

(by taking care <strong>of</strong> your needs before<br />

your wants) produces desired results.<br />

Discipline pushes you to work harder<br />

or more hours in order to make more<br />

money to acquire your needs and some<br />

<strong>of</strong> your wants. <strong>The</strong> discipline it takes to<br />

build your emergency fund to cover the<br />

rainy days that will ultimately come and<br />

to save for retirement even if it seems as<br />

though you don’t have enough money<br />

left to do it, builds character.<br />

As a man, the making and managing<br />

<strong>of</strong> money is compounded in the family<br />

environment because the lessons<br />

and experiences come from the head<br />

(or husband.) Because the man is the<br />

leader, he must lead and teach the<br />

family to carry on his success, to protect<br />

and benefit the family financially and<br />

spiritually. <strong>The</strong> emergency fund must be<br />

sufficient to cover the emergencies <strong>of</strong> the<br />

whole family, the retirement savings must<br />

provide retirement for both husband and<br />

wife, and the needs <strong>of</strong> the kids must be<br />

met as well.<br />

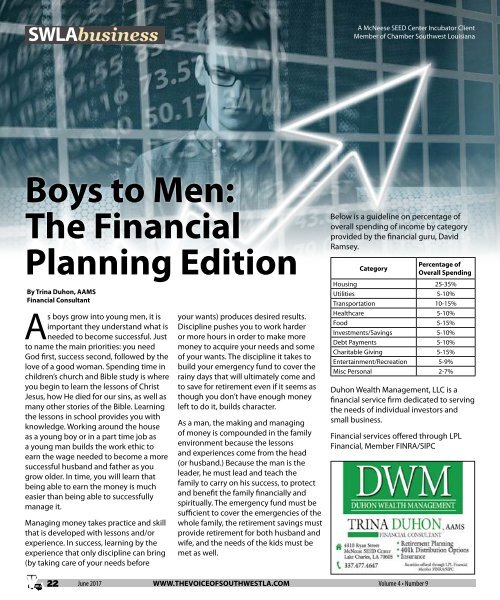

Below is a guideline on percentage <strong>of</strong><br />

overall spending <strong>of</strong> income by category<br />

provided by the financial guru, David<br />

Ramsey.<br />

Category<br />

Percentage <strong>of</strong><br />

Overall Spending<br />

Housing 25-35%<br />

Utilities 5-10%<br />

Transportation 10-15%<br />

Healthcare 5-10%<br />

Food 5-15%<br />

Investments/Savings 5-10%<br />

Debt Payments 5-10%<br />

Charitable Giving 5-15%<br />

Entertainment/Recreation 5-9%<br />

Misc Personal 2-7%<br />

Duhon Wealth Management, LLC is a<br />

financial service firm dedicated to serving<br />

the needs <strong>of</strong> individual investors and<br />

small business.<br />

Financial services <strong>of</strong>fered through LPL<br />

Financial, Member FINRA/SIPC<br />

22<br />

<strong>June</strong> <strong>2017</strong> WWW.THEVOICEOFSOUTHWESTLA.COM Volume 4 • Number 9