annual report 31 Mar 2007 - SEB Asset Management

annual report 31 Mar 2007 - SEB Asset Management

annual report 31 Mar 2007 - SEB Asset Management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Liquid assets<br />

Gross liquidity amounted to around EUR 2,696.9 million<br />

as of <strong>31</strong> <strong>Mar</strong>ch <strong>2007</strong>. ccordingly, the liquidity ratio rose<br />

by 20.3 percentage points to 42.4% over the past twelve<br />

months. total liquidity return of 3.4% was realised during<br />

the financial year.<br />

fter deducting all funds reserved for specific purposes<br />

(signed purchase contracts, distributions, etc.) from the<br />

Fund’s gross liquidity of 42.4%, net liquidity amounted to<br />

24.9% or around EUR 1.58 billion (including the 5% mini-<br />

mum liquidity).<br />

The special securities investment fund <strong>SEB</strong> Immo Cash<br />

was launched by <strong>SEB</strong> Invest GmbH with effect from<br />

1 September 2006. t the closing date of <strong>31</strong> <strong>Mar</strong>ch <strong>2007</strong>,<br />

86.5% of the liquidity of <strong>SEB</strong> ImmoInvest was invested in<br />

this special fund. Launching the fund allows us to make<br />

use of the professional portfolio management services<br />

offered by the <strong>SEB</strong> sset <strong>Management</strong> Group.<br />

The liquidity portfolio comprises bank deposits totalling<br />

EUR 365 million and investment units (<strong>SEB</strong> Immo Cash)<br />

in the amount of EUR 2,332 million with an average dura-<br />

tion of 0.3 years.<br />

Capital gains tax and risk provisions<br />

When foreign properties and real estate companies are<br />

sold, gains on disposal may be subject to tax (capital<br />

gains tax). Due to potential changes in the basis for tax<br />

assessment and the market conditions in the respective<br />

countries, the amount and timing of such taxes can only<br />

be estimated at present. Provisions have therefore been<br />

set up on the basis of country-specific tax rates as a pre-<br />

cautionary measure for future capital gains tax charges<br />

on Fund assets. In the process, both the long-term strate-<br />

gy for the respective country portfolio and the individual<br />

property or real estate company are taken into account.<br />

Investments and divestments in the respective country<br />

portfolios are also coordinated with one another so that<br />

disposals can be made in a tax-optimised manner.<br />

12 <strong>SEB</strong> ImmoInvest<br />

For this reason we believe an average capital gains tax<br />

rate equalling 35% of the applicable tax burden is reason-<br />

able.<br />

For more detailed information on the amount of capital<br />

gains tax provisions for country portfolios, please see the<br />

table of key return figures on page 15 and the Disclosures<br />

on the Statement of ssets on page 32.<br />

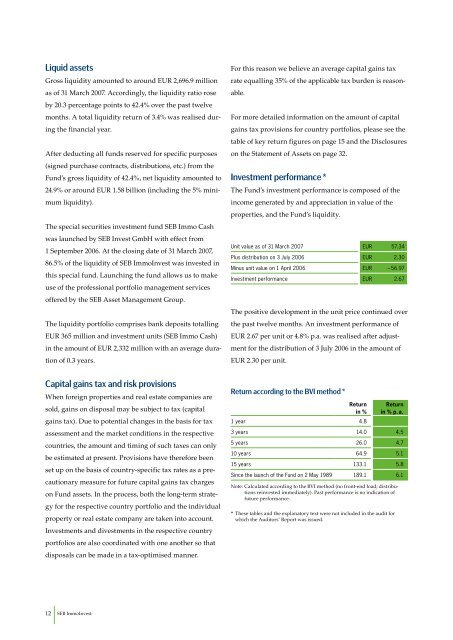

Investment performance *<br />

The Fund’s investment performance is composed of the<br />

income generated by and appreciation in value of the<br />

properties, and the Fund’s liquidity.<br />

Unit value as of <strong>31</strong> <strong>Mar</strong>ch <strong>2007</strong> EUR 57.34<br />

Plus distribution on 3 July 2006 EUR 2.30<br />

Minus unit value on 1 April 2006 EUR – 56.97<br />

Investment performance EUR 2.67<br />

The positive development in the unit price continued over<br />

the past twelve months. n investment performance of<br />

EUR 2.67 per unit or 4.8% p.a. was realised after adjustment<br />

for the distribution of 3 July 2006 in the amount of<br />

EUR 2.30 per unit.<br />

Return according to the BVI method *<br />

Return Return<br />

in % in % p. a.<br />

1 year 4.8<br />

3 years 14.0 4.5<br />

5 years 26.0 4.7<br />

10 years 64.9 5.1<br />

15 years 133.1 5.8<br />

Since the launch of the Fund on 2 May 1989 189.1 6.1<br />

Note: Calculated according to the BVI method (no front-end load; distributions<br />

reinvested immediately). Past performance is no indication of<br />

future performance.<br />

* These tables and the explanatory text were not included in the audit for<br />

which the uditors’ Report was issued.