annual report 31 Mar 2007 - SEB Asset Management

annual report 31 Mar 2007 - SEB Asset Management

annual report 31 Mar 2007 - SEB Asset Management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

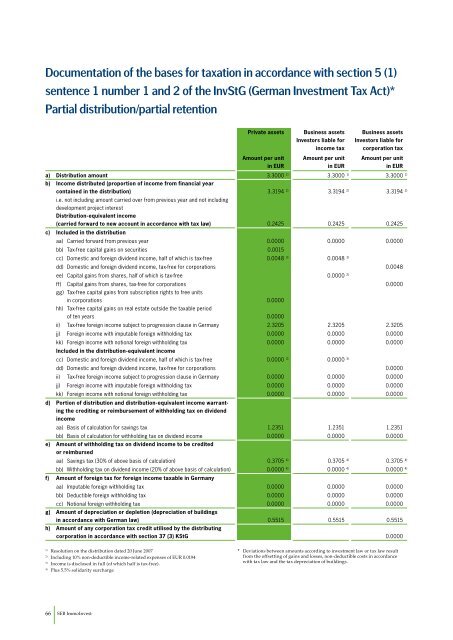

Documentation of the bases for taxation in accordance with section 5 (1)<br />

sentence 1 number 1 and 2 of the InvStG (German Investment Tax Act)*<br />

Partial distribution/partial retention<br />

66 <strong>SEB</strong> ImmoInvest<br />

Private assets Business assets<br />

Amount per unit<br />

in EUR<br />

Investors liable for<br />

income tax<br />

Amount per unit<br />

in EUR<br />

Business assets<br />

Investors liable for<br />

corporation tax<br />

Amount per unit<br />

a) Distribution amount 3.3000 1) 3.3000 1) 3.3000 1)<br />

b) Income distributed (proportion of income from financial year<br />

contained in the distribution) 3.<strong>31</strong>94 2) 3.<strong>31</strong>94 2) 3.<strong>31</strong>94 2)<br />

i.e. not including amount carried over from previous year and not including<br />

development project interest<br />

Distribution-equivalent income<br />

(carried forward to new account in accordance with tax law) 0.2425 0.2425 0.2425<br />

c) Included in the distribution<br />

aa) Carried forward from previous year 0.0000 0.0000 0.0000<br />

bb) Tax-free capital gains on securities 0.0015<br />

cc) Domestic and foreign dividend income, half of which is tax-free 0.0048 3) 0.0048 3)<br />

dd) Domestic and foreign dividend income, tax-free for corporations 0.0048<br />

ee) Capital gains from shares, half of which is tax-free 0.0000 2)<br />

ff) Capital gains from shares, tax-free for corporations 0.0000<br />

gg) Tax-free capital gains from subscription rights to free units<br />

in corporations<br />

hh) Tax-free capital gains on real estate outside the taxable period<br />

0.0000<br />

of ten years 0.0000<br />

ii) Tax-free foreign income subject to progression clause in Germany 2.3205 2.3205 2.3205<br />

jj) Foreign income with imputable foreign withholding tax 0.0000 0.0000 0.0000<br />

kk) Foreign income with notional foreign withholding tax<br />

Included in the distribution-equivalent income<br />

0.0000 0.0000 0.0000<br />

cc) Domestic and foreign dividend income, half of which is tax-free 0.0000 3) 0.0000 3)<br />

dd) Domestic and foreign dividend income, tax-free for corporations 0.0000<br />

ii) Tax-free foreign income subject to progression clause in Germany 0.0000 0.0000 0.0000<br />

jj) Foreign income with imputable foreign withholding tax 0.0000 0.0000 0.0000<br />

kk) Foreign income with notional foreign withholding tax 0.0000 0.0000 0.0000<br />

d) Portion of distribution and distribution-equivalent income warranting<br />

the crediting or reimbursement of withholding tax on dividend<br />

income<br />

aa) Basis of calculation for savings tax 1.2351 1.2351 1.2351<br />

bb) Basis of calculation for withholding tax on dividend income 0.0000 0.0000 0.0000<br />

e) Amount of withholding tax on dividend income to be credited<br />

or reimbursed<br />

aa) Savings tax (30% of above basis of calculation) 0.3705 4) 0.3705 4) 0.3705 4)<br />

bb) Withholding tax on dividend income (20% of above basis of calculation) 0.0000 4) 0.0000 4) 0.0000 4)<br />

f) Amount of foreign tax for foreign income taxable in Germany<br />

aa) Imputable foreign withholding tax 0.0000 0.0000 0.0000<br />

bb) Deductible foreign withholding tax 0.0000 0.0000 0.0000<br />

cc) Notional foreign withholding tax 0.0000 0.0000 0.0000<br />

g) Amount of depreciation or depletion (depreciation of buildings<br />

in accordance with German law) 0.5515 0.5515 0.5515<br />

h) Amount of any corporation tax credit utilised by the distributing<br />

corporation in accordance with section 37 (3) KStG 0.0000<br />

1) Resolution on the distribution dated 20 June <strong>2007</strong><br />

2) Including 10% non-deductible income-related expenses of EUR 0.0194<br />

3) Income is disclosed in full (of which half is tax-free).<br />

4) Plus 5.5% solidarity surcharge<br />

in EUR<br />

* Deviations between amounts according to investment law or tax law result<br />

from the offsetting of gains and losses, non-deductible costs in accordance<br />

with tax law and the tax depreciation of buildings.