annual report 31 Mar 2007 - SEB Asset Management

annual report 31 Mar 2007 - SEB Asset Management

annual report 31 Mar 2007 - SEB Asset Management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

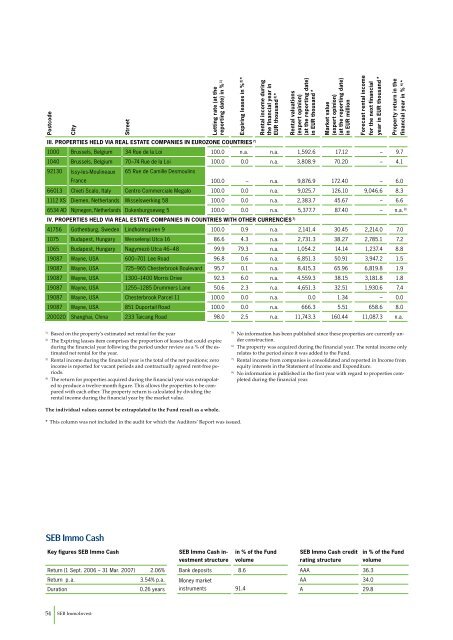

Overview: <strong>Mar</strong>ket Values and Rents<br />

Postcode<br />

City<br />

<strong>SEB</strong> Immo Cash<br />

Key figures <strong>SEB</strong> Immo Cash <strong>SEB</strong> Immo Cash in-<br />

54 <strong>SEB</strong> ImmoInvest<br />

Street<br />

vestment structure<br />

in % of the Fund<br />

volume<br />

<strong>SEB</strong> Immo Cash credit<br />

rating structure<br />

Return (1 Sept. 2006 – <strong>31</strong> <strong>Mar</strong>. <strong>2007</strong>) 2.06% Bank deposits 8.6 AAA 36.3<br />

Return p. a. 3.54% p.a. Money market<br />

Duration 0.26 years instruments<br />

91.4<br />

A 29.8<br />

Letting rate (at the<br />

<strong>report</strong>ing date) in % 1)<br />

Expiring leases in % 2) *<br />

Rental income during<br />

the financial year in<br />

EUR thousand 3) *<br />

Rental valuations<br />

(expert opinion)<br />

(at the <strong>report</strong>ing date)<br />

in EUR thousand *<br />

<strong>Mar</strong>ket value<br />

(expert opinion)<br />

(at the <strong>report</strong>ing date)<br />

in EUR million<br />

Forecast rental income<br />

for the next financial<br />

year in EUR thousand *<br />

III. PROPERTIES HELD VIA REAL ESTATE COMPANIES IN EUROZONE COUNTRIES 7)<br />

1000 Brussels, Belgium 34 Rue de la Loi 100.0 n.a. n.a. 1,592.6 17.12 – 9.7<br />

1040 Brussels, Belgium 70–74 Rue de la Loi 100.0 0.0 n.a. 3,808.9 70.20 – 4.1<br />

92130 Issy-les-Moulineaux 65 Rue de Camille Desmoulins<br />

France<br />

100.0 – n.a. 9,876.9 172.40<br />

– 6.0<br />

66013 Chieti Scalo, Italy Centro Commerciale Megalo 100.0 0.0 n.a. 9,025.7 126.10 9,046.6 8.3<br />

1112 XS Diemen, Netherlands Wisselswerking 58 100.0 0.0 n.a. 2,383.7 45.67 – 6.6<br />

6534 AD Nijmegen, Netherlands Dukenburgseweg 5 100.0 0.0 n.a. 5,377.7 87.40 – n.a. 8)<br />

IV. PROPERTIES HELD VIA REAL ESTATE COMPANIES IN COUNTRIES WITH OTHER CURRENCIES 7)<br />

41756 Gothenburg, Sweden Lindholmspiren 9 100.0 0.9 n.a. 2,141.4 30.45 2,214.0 7.0<br />

1075 Budapest, Hungary Wesselenyi Utca 16 86.6 4.3 n.a. 2,7<strong>31</strong>.3 38.27 2,785.1 7.2<br />

1065 Budapest, Hungary Nagymezö Utca 46–48 99.9 79.3 n.a. 1,054.2 14.14 1,237.4 8.8<br />

19087 Wayne, USA 600–701 Lee Road 96.8 0.6 n.a. 6,851.3 50.91 3,947.2 1.5<br />

19087 Wayne, USA 725–965 Chesterbrook Boulevard 95.7 0.1 n.a. 8,415.3 65.96 6,819.8 1.9<br />

19087 Wayne, USA 1300–1400 Morris Drive 92.3 6.0 n.a. 4,559.3 38.15 3,181.8 1.8<br />

19087 Wayne, USA 1255–1285 Drummers Lane 50.6 2.3 n.a. 4,651.3 32.51 1,930.6 7.4<br />

19087 Wayne, USA Chesterbrook Parcel 11 100.0 0.0 n.a. 0.0 1.34 – 0.0<br />

19087 Wayne, USA 851 Duportail Road 100.0 0.0 n.a. 666.3 5.51 658.6 8.0<br />

200020 Shanghai, China 233 Taicang Road 98.0 2.5 n.a. 11,743.3 160.44 11,087.3 n.a.<br />

1) Based on the property‘s estimated net rental for the year<br />

2) The Expiring leases item comprises the proportion of leases that could expire<br />

during the financial year following the period under review as a % of the estimated<br />

net rental for the year.<br />

3) Rental income during the financial year is the total of the net positions; zero<br />

income is <strong>report</strong>ed for vacant periods and contractually agreed rent-free periods.<br />

4) The return for properties acquired during the financial year was extrapolated<br />

to produce a twelve-month figure. This allows the properties to be compared<br />

with each other. The property return is calculated by dividing the<br />

rental income during the financial year by the market value.<br />

The individual values cannot be extrapolated to the Fund result as a whole.<br />

* This column was not included in the audit for which the Auditors’ Report was issued.<br />

in % of the Fund<br />

volume<br />

AA 34.0<br />

Property return in the<br />

financial year in % 4) *<br />

5) No information has been published since these properties are currently under<br />

construction.<br />

6) The property was acquired during the financial year. The rental income only<br />

relates to the period since it was added to the Fund.<br />

7) Rental income from companies is consolidated and <strong>report</strong>ed in Income from<br />

equity interests in the Statement of Income and Expenditure.<br />

8) No information is published in the first year with regard to properties completed<br />

during the financial year.