ACCT 324 Week 4 Midterm Exam Answers

ACCT 324 Week 4 Midterm Exam Answers

ACCT 324 Week 4 Midterm Exam Answers

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

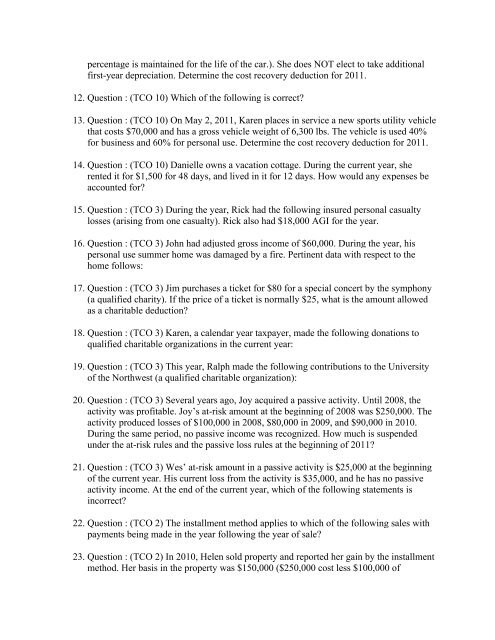

percentage is maintained for the life of the car.). She does NOT elect to take additional<br />

first-year depreciation. Determine the cost recovery deduction for 2011.<br />

12. Question : (TCO 10) Which of the following is correct?<br />

13. Question : (TCO 10) On May 2, 2011, Karen places in service a new sports utility vehicle<br />

that costs $70,000 and has a gross vehicle weight of 6,300 lbs. The vehicle is used 40%<br />

for business and 60% for personal use. Determine the cost recovery deduction for 2011.<br />

14. Question : (TCO 10) Danielle owns a vacation cottage. During the current year, she<br />

rented it for $1,500 for 48 days, and lived in it for 12 days. How would any expenses be<br />

accounted for?<br />

15. Question : (TCO 3) During the year, Rick had the following insured personal casualty<br />

losses (arising from one casualty). Rick also had $18,000 AGI for the year.<br />

16. Question : (TCO 3) John had adjusted gross income of $60,000. During the year, his<br />

personal use summer home was damaged by a fire. Pertinent data with respect to the<br />

home follows:<br />

17. Question : (TCO 3) Jim purchases a ticket for $80 for a special concert by the symphony<br />

(a qualified charity). If the price of a ticket is normally $25, what is the amount allowed<br />

as a charitable deduction?<br />

18. Question : (TCO 3) Karen, a calendar year taxpayer, made the following donations to<br />

qualified charitable organizations in the current year:<br />

19. Question : (TCO 3) This year, Ralph made the following contributions to the University<br />

of the Northwest (a qualified charitable organization):<br />

20. Question : (TCO 3) Several years ago, Joy acquired a passive activity. Until 2008, the<br />

activity was profitable. Joy’s at-risk amount at the beginning of 2008 was $250,000. The<br />

activity produced losses of $100,000 in 2008, $80,000 in 2009, and $90,000 in 2010.<br />

During the same period, no passive income was recognized. How much is suspended<br />

under the at-risk rules and the passive loss rules at the beginning of 2011?<br />

21. Question : (TCO 3) Wes’ at-risk amount in a passive activity is $25,000 at the beginning<br />

of the current year. His current loss from the activity is $35,000, and he has no passive<br />

activity income. At the end of the current year, which of the following statements is<br />

incorrect?<br />

22. Question : (TCO 2) The installment method applies to which of the following sales with<br />

payments being made in the year following the year of sale?<br />

23. Question : (TCO 2) In 2010, Helen sold property and reported her gain by the installment<br />

method. Her basis in the property was $150,000 ($250,000 cost less $100,000 of