ACCT 324 Week 4 Midterm Exam Answers

ACCT 324 Week 4 Midterm Exam Answers

ACCT 324 Week 4 Midterm Exam Answers

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

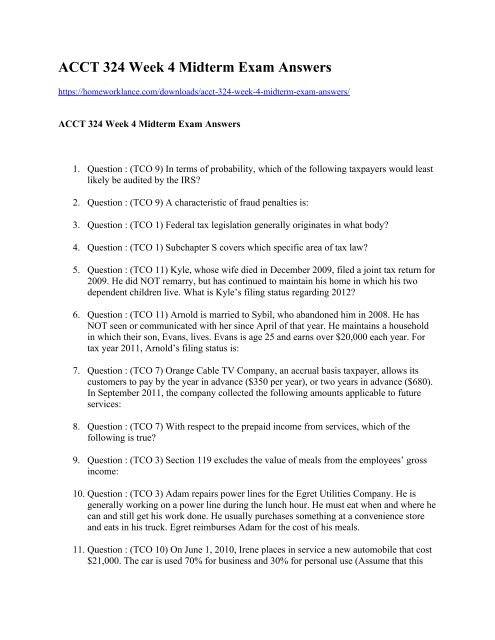

<strong>ACCT</strong> <strong>324</strong> <strong>Week</strong> 4 <strong>Midterm</strong> <strong>Exam</strong> <strong>Answers</strong><br />

https://homeworklance.com/downloads/acct-<strong>324</strong>-week-4-midterm-exam-answers/<br />

<strong>ACCT</strong> <strong>324</strong> <strong>Week</strong> 4 <strong>Midterm</strong> <strong>Exam</strong> <strong>Answers</strong><br />

1. Question : (TCO 9) In terms of probability, which of the following taxpayers would least<br />

likely be audited by the IRS?<br />

2. Question : (TCO 9) A characteristic of fraud penalties is:<br />

3. Question : (TCO 1) Federal tax legislation generally originates in what body?<br />

4. Question : (TCO 1) Subchapter S covers which specific area of tax law?<br />

5. Question : (TCO 11) Kyle, whose wife died in December 2009, filed a joint tax return for<br />

2009. He did NOT remarry, but has continued to maintain his home in which his two<br />

dependent children live. What is Kyle’s filing status regarding 2012?<br />

6. Question : (TCO 11) Arnold is married to Sybil, who abandoned him in 2008. He has<br />

NOT seen or communicated with her since April of that year. He maintains a household<br />

in which their son, Evans, lives. Evans is age 25 and earns over $20,000 each year. For<br />

tax year 2011, Arnold’s filing status is:<br />

7. Question : (TCO 7) Orange Cable TV Company, an accrual basis taxpayer, allows its<br />

customers to pay by the year in advance ($350 per year), or two years in advance ($680).<br />

In September 2011, the company collected the following amounts applicable to future<br />

services:<br />

8. Question : (TCO 7) With respect to the prepaid income from services, which of the<br />

following is true?<br />

9. Question : (TCO 3) Section 119 excludes the value of meals from the employees’ gross<br />

income:<br />

10. Question : (TCO 3) Adam repairs power lines for the Egret Utilities Company. He is<br />

generally working on a power line during the lunch hour. He must eat when and where he<br />

can and still get his work done. He usually purchases something at a convenience store<br />

and eats in his truck. Egret reimburses Adam for the cost of his meals.<br />

11. Question : (TCO 10) On June 1, 2010, Irene places in service a new automobile that cost<br />

$21,000. The car is used 70% for business and 30% for personal use (Assume that this

percentage is maintained for the life of the car.). She does NOT elect to take additional<br />

first-year depreciation. Determine the cost recovery deduction for 2011.<br />

12. Question : (TCO 10) Which of the following is correct?<br />

13. Question : (TCO 10) On May 2, 2011, Karen places in service a new sports utility vehicle<br />

that costs $70,000 and has a gross vehicle weight of 6,300 lbs. The vehicle is used 40%<br />

for business and 60% for personal use. Determine the cost recovery deduction for 2011.<br />

14. Question : (TCO 10) Danielle owns a vacation cottage. During the current year, she<br />

rented it for $1,500 for 48 days, and lived in it for 12 days. How would any expenses be<br />

accounted for?<br />

15. Question : (TCO 3) During the year, Rick had the following insured personal casualty<br />

losses (arising from one casualty). Rick also had $18,000 AGI for the year.<br />

16. Question : (TCO 3) John had adjusted gross income of $60,000. During the year, his<br />

personal use summer home was damaged by a fire. Pertinent data with respect to the<br />

home follows:<br />

17. Question : (TCO 3) Jim purchases a ticket for $80 for a special concert by the symphony<br />

(a qualified charity). If the price of a ticket is normally $25, what is the amount allowed<br />

as a charitable deduction?<br />

18. Question : (TCO 3) Karen, a calendar year taxpayer, made the following donations to<br />

qualified charitable organizations in the current year:<br />

19. Question : (TCO 3) This year, Ralph made the following contributions to the University<br />

of the Northwest (a qualified charitable organization):<br />

20. Question : (TCO 3) Several years ago, Joy acquired a passive activity. Until 2008, the<br />

activity was profitable. Joy’s at-risk amount at the beginning of 2008 was $250,000. The<br />

activity produced losses of $100,000 in 2008, $80,000 in 2009, and $90,000 in 2010.<br />

During the same period, no passive income was recognized. How much is suspended<br />

under the at-risk rules and the passive loss rules at the beginning of 2011?<br />

21. Question : (TCO 3) Wes’ at-risk amount in a passive activity is $25,000 at the beginning<br />

of the current year. His current loss from the activity is $35,000, and he has no passive<br />

activity income. At the end of the current year, which of the following statements is<br />

incorrect?<br />

22. Question : (TCO 2) The installment method applies to which of the following sales with<br />

payments being made in the year following the year of sale?<br />

23. Question : (TCO 2) In 2010, Helen sold property and reported her gain by the installment<br />

method. Her basis in the property was $150,000 ($250,000 cost less $100,000 of

depreciation). Helen sold the property for $375,000, with $75,000 due on the date of the<br />

sale and $300,000 (plus interest at the federal rate) due in 2011. Helen’s recognized<br />

installment sale gain in 2011 is:<br />

24. Question : (TCO 2) Todd, a CPA, sold land for $200,000 plus a note for $400,000. The<br />

interest rate on the note was equal to the federal rate. The fair market value of the note<br />

was $360,000. Todd’s basis in the land was $75,000.<br />

25. Question : (TCO 2) Both economic and social considerations can be used to justify:<br />

26. Question : (TCO 3) Joe’s automobile, which was used only for business purposes, was<br />

damaged in an accident. At the date of the accident, the fair market value of the<br />

automobile was $13,000 and its adjusted basis was $7,000. After the accident, the<br />

automobile was appraised at $4,000. Calculate Joe’s loss. Is it a for or from AGI<br />

deduction?<br />

27. Question : (TCO 1) In 2010, David had the following transactions: