ACCT 424 Week 8 Final Exam Answers

ACCT 424 Week 8 Final Exam Answers

ACCT 424 Week 8 Final Exam Answers

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>ACCT</strong> <strong>424</strong> <strong>Week</strong> 8 <strong>Final</strong> <strong>Exam</strong> <strong>Answers</strong><br />

https://homeworklance.com/downloads/acct-<strong>424</strong>-week-8-final-exam-answers/<br />

<strong>ACCT</strong> <strong>424</strong> <strong>Week</strong> 8 <strong>Final</strong> <strong>Exam</strong> <strong>Answers</strong><br />

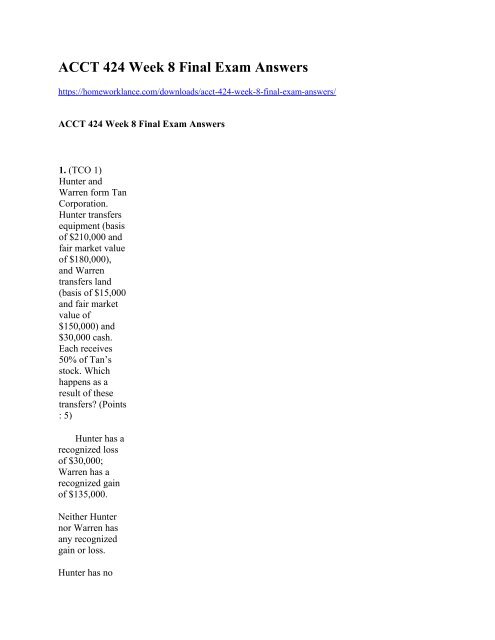

1. (TCO 1)<br />

Hunter and<br />

Warren form Tan<br />

Corporation.<br />

Hunter transfers<br />

equipment (basis<br />

of $210,000 and<br />

fair market value<br />

of $180,000),<br />

and Warren<br />

transfers land<br />

(basis of $15,000<br />

and fair market<br />

value of<br />

$150,000) and<br />

$30,000 cash.<br />

Each receives<br />

50% of Tan’s<br />

stock. Which<br />

happens as a<br />

result of these<br />

transfers? (Points<br />

: 5)<br />

Hunter has a<br />

recognized loss<br />

of $30,000;<br />

Warren has a<br />

recognized gain<br />

of $135,000.<br />

Neither Hunter<br />

nor Warren has<br />

any recognized<br />

gain or loss.<br />

Hunter has no

ecognized loss;<br />

Warren has a<br />

recognized gain<br />

of $30,000.<br />

Tan Corporation<br />

has a basis in the<br />

land of $45,000.<br />

None of the<br />

above<br />

2. (TCO 1)<br />

Samantha<br />

transferred land<br />

worth $200,000<br />

(basis of<br />

$40,000) to<br />

Lava<br />

Corporation, an<br />

existing entity,<br />

for 300 shares<br />

of its stock.<br />

Lava<br />

Corporation has<br />

two other<br />

shareholders,<br />

Timothy and<br />

Brett, each of<br />

whom holds 50<br />

shares. Which<br />

happens with<br />

respect to the<br />

transfer? (Points<br />

: 5)<br />

Samantha<br />

has no<br />

recognized gain.<br />

Lava<br />

Corporation has

a basis of<br />

$200,000 in the<br />

land.<br />

Samantha has a<br />

basis of<br />

$200,000 in her<br />

300 shares in<br />

Lava<br />

Corporation.<br />

Both B and C<br />

None of the<br />

above<br />

3. (TCO 2)<br />

Pelican Inc., a<br />

closely held<br />

corporation (not<br />

a PSC), has a<br />

$350,000 loss<br />

from a passive<br />

activity,<br />

$135,000 of<br />

active income,<br />

and $160,000 of<br />

portfolio<br />

income. How<br />

much is<br />

Pelican’s<br />

taxable<br />

income? (Points<br />

: 5)<br />

$0<br />

($55,000)<br />

$135,000<br />

$295,000<br />

$160,000

4. (TCO 2)<br />

Silver<br />

Corporation<br />

has average<br />

gross receipts<br />

of $5.7<br />

million, $4.6<br />

million, and<br />

$4.8 million<br />

for the last<br />

three years,<br />

respectively.<br />

Silver is<br />

_____. (Points<br />

: 5)<br />

not subject<br />

to the<br />

corporate<br />

income tax<br />

a small<br />

corporation<br />

with respect to<br />

the AMT<br />

not subject to<br />

the AMT<br />

not a small<br />

corporation<br />

with respect to<br />

the AMT<br />

None of the<br />

above<br />

5. (TCO 3) As of<br />

January 1,<br />

Everest<br />

Corporation has<br />

a deficit in

accumulated E &<br />

P of $75,000. For<br />

tax year, current<br />

E & P (all of<br />

which accrued<br />

ratably) is<br />

$40,000 (prior to<br />

any distribution).<br />

On July 1,<br />

Everest<br />

Corporation<br />

distributes<br />

$60,000 to its<br />

sole,<br />

noncorporate<br />

shareholder.<br />

Which is the<br />

amount of the<br />

distribution that<br />

is a<br />

dividend? (Points<br />

: 5)<br />

$0<br />

$40,000<br />

$60,000<br />

$75,000<br />

None of the<br />

above<br />

6. (TCO 3)<br />

Parrot<br />

Corporation<br />

has<br />

accumulated<br />

E & P of<br />

$40,000 on<br />

January 1,<br />

20×1. In<br />

20×1, Parrot

has current E<br />

& P of<br />

$45,000<br />

(before any<br />

distribution).<br />

On December<br />

31, 20×1, the<br />

corporation<br />

distributes<br />

$120,000 to<br />

its sole<br />

shareholder,<br />

Michael (an<br />

individual).<br />

Which is<br />

Parrot<br />

Corporation’s<br />

E & P as of<br />

January 1,<br />

20×2? (Points<br />

: 5)<br />

$0<br />

($35,000)<br />

$40,000<br />

$85,000<br />

None of the<br />

above<br />

7. (TCO 4)<br />

Cardinal<br />

Corporation<br />

has 1,000<br />

shares of<br />

common<br />

stock<br />

outstanding.<br />

John owns<br />

300 of the<br />

shares,

John’s<br />

grandfather<br />

owns 200<br />

shares,<br />

John’s<br />

daughter<br />

owns 300<br />

shares, and<br />

Redbird<br />

Corporation<br />

owns 200<br />

shares. John<br />

owns 60% of<br />

the stock in<br />

Redbird<br />

Corporation.<br />

How many<br />

shares is John<br />

deemed to<br />

own in<br />

Cardinal<br />

Corporation<br />

under the<br />

attribution<br />

rules of<br />

§318? (Points<br />

: 5)<br />

600<br />

720<br />

800<br />

300<br />

None of the<br />

above<br />

8. (TCO 5)<br />

Francis<br />

exchanges her<br />

20% interest in<br />

Beryl

Corporation for<br />

10,000 shares of<br />

Pyrite<br />

Corporation<br />

(value $200,000)<br />

and $40,000<br />

cash. Francis’s<br />

basis in her Beryl<br />

stock is $95,000.<br />

The accumulated<br />

earnings of Beryl<br />

are $325,000,<br />

and the<br />

accumulated<br />

earnings of Pyrite<br />

are $225,000 at<br />

the time of the<br />

reorganization.<br />

How does<br />

Francis treat this<br />

transaction for<br />

tax<br />

purposes? (Points<br />

: 5)<br />

No gain is<br />

recognized by<br />

Francis in this<br />

reorganization.<br />

Francis reports a<br />

$40,000<br />

recognized<br />

dividend<br />

Francis reports a<br />

$40,000<br />

recognized<br />

capital gain.<br />

Francis reports a<br />

$35,000<br />

recognized<br />

dividend and a<br />

$5,000 capital

gain.<br />

None of the<br />

above<br />

9. (TCO 6)<br />

How are the<br />

members of<br />

a<br />

consolidated<br />

group<br />

affected by<br />

computations<br />

related to E<br />

& P? (Points<br />

: 5)<br />

E & P is<br />

computed<br />

solely on a<br />

consolidated<br />

basis.<br />

Consolidated<br />

E & P is<br />

computed as<br />

the sum of<br />

the E & P<br />

balances of<br />

each of the<br />

group<br />

members.<br />

Members E<br />

& P balances<br />

are frozen as<br />

long as the<br />

consolidation<br />

election is in<br />

place.<br />

Each member<br />

keeps its own<br />

E & P

account.<br />

None of the<br />

above<br />

10. (TCO 11)<br />

Which<br />

statement, if<br />

any, does not<br />

reflect the rules<br />

governing the<br />

negligence<br />

accuracyrelated<br />

penalty?(Points<br />

: 5)<br />

The<br />

penalty rate is<br />

20%.<br />

The penalty is<br />

imposed only<br />

on the part of<br />

the deficiency<br />

attributable to<br />

negligence.<br />

The penalty<br />

applies to all<br />

federal taxes,<br />

except when<br />

fraud is<br />

involved.<br />

The penalty is<br />

waived if the<br />

taxpayer uses<br />

Form 8275 to<br />

disclose a<br />

return position<br />

that is<br />

reasonable,<br />

though

contrary, to the<br />

IRS position.<br />

None of the<br />

above<br />

1. (TCO 7) On<br />

January 1 of the<br />

current year,<br />

Rachel and Julio<br />

form an equal<br />

partnership.<br />

Rachel makes a<br />

cash contribution<br />

of $80,000 and a<br />

property<br />

contribution<br />

(adjusted basis of<br />

$110,000, fair<br />

market value of<br />

$80,000) in<br />

exchange for her<br />

interest in the<br />

partnership. Julio<br />

contributes<br />

property (adjusted<br />

basis of $120,000,<br />

fair market value<br />

of $160,000) in<br />

exchange for his<br />

partnership<br />

interest. Which<br />

statement is true<br />

concerning the<br />

income tax results<br />

of this partnership<br />

formation? (Points<br />

: 5)<br />

Rachel has a<br />

$160,000 tax basis<br />

for her partnership<br />

interest.

The partnership<br />

has an $80,000<br />

adjusted basis in<br />

the property<br />

contributed by<br />

Rachel.<br />

Rachel recognizes<br />

a $30,000 loss on<br />

her property<br />

transfer.<br />

Julio has a<br />

$120,000 tax basis<br />

for his partnership<br />

interest.<br />

None of the above<br />

2. (TCO 7)<br />

Samantha<br />

and Rebecca<br />

are equal<br />

partners in<br />

the S&R<br />

Partnership.<br />

On January<br />

1 of the<br />

current year,<br />

each<br />

partner’s<br />

adjusted<br />

basis in S&R<br />

was<br />

$240,000.<br />

During the<br />

current year,<br />

S&R<br />

borrowed<br />

$180,000 for<br />

which<br />

Samantha<br />

and Rebecca<br />

are

personally<br />

liable. S&R<br />

sustained a<br />

net operating<br />

loss of<br />

$30,000 in<br />

the current<br />

year ended<br />

December<br />

31. If<br />

liabilities are<br />

shared<br />

equally by<br />

the partners,<br />

which is<br />

each<br />

partner’s<br />

basis in her<br />

interest in<br />

S&R on<br />

January 1 of<br />

the next<br />

year? (Points<br />

: 5)<br />

$135,000<br />

$225,000<br />

$240,000<br />

$315,000<br />

None of the<br />

above<br />

3. (TCO 7)<br />

Naomi<br />

contributed<br />

property<br />

($80,000<br />

basis and<br />

fair market<br />

value of

$120,000)<br />

to the ABC<br />

Partnership<br />

in exchange<br />

for a 50%<br />

interest in<br />

partnership<br />

capital and<br />

profits.<br />

During the<br />

first year of<br />

partnership<br />

operations,<br />

ABC had<br />

net taxable<br />

income of<br />

$60,000 and<br />

tax-exempt<br />

income of<br />

$56,000.<br />

The<br />

partnership<br />

distributed<br />

$24,000<br />

cash to<br />

Naomi. Her<br />

share of<br />

partnership<br />

recourse<br />

liabilities on<br />

the last day<br />

of the<br />

partnership<br />

year was<br />

$32,000.<br />

Which is<br />

Naomi’s<br />

adjusted<br />

basis<br />

(outside<br />

basis) for<br />

her<br />

partnership<br />

interest at<br />

yearend?<br />

(Points

: 5)<br />

$110,000<br />

$146,000<br />

$144,000<br />

$196,000<br />

None of the<br />

above<br />

4. (TCO 8)<br />

During 20×2,<br />

Houston Nutt,<br />

the sole<br />

shareholder of<br />

a calendar-year<br />

S corporation,<br />

received a<br />

distribution of<br />

$16,000. On<br />

December 31,<br />

20×1, his stock<br />

basis was<br />

$4,000. The<br />

corporation<br />

earned $11,000<br />

ordinary<br />

income during<br />

the year. It has<br />

no accumulated<br />

E & P. Which<br />

statement is<br />

correct? (Points<br />

: 5)<br />

Nutt<br />

recognizes a<br />

$1,000 LTCG.<br />

Nutt’s stock<br />

basis will be

$2,000.<br />

Nutt’s ordinary<br />

income is<br />

$15,000.<br />

Nutt’s return of<br />

capital is<br />

$11,000.<br />

None of the<br />

above<br />

5. (TCO 8) Which<br />

statement is correct<br />

with respect to an S<br />

corporation? (Points<br />

: 5)<br />

There is no<br />

advantage also to<br />

elect § 1244 stock.<br />

An S corporation<br />

can own 85% of an<br />

insurance company.<br />

An estate may be a<br />

shareholder.<br />

A voting trust<br />

arrangement is not<br />

available.<br />

None of the above<br />

6. (TCO 9)<br />

Which<br />

reduces a<br />

shareholder’s<br />

S corporation<br />

stock

asis? (Points<br />

: 5)<br />

Depletion<br />

in excess of<br />

basis of<br />

property<br />

Illegal<br />

kickbacks<br />

Nontaxable<br />

income<br />

Sales<br />

None of the<br />

above<br />

7. (TCO 9) Matt<br />

and Hillary are<br />

husband and<br />

wife, and live in<br />

Pennsylvania.<br />

Using joint<br />

funds, in 1990<br />

they purchase an<br />

insurance policy<br />

on Matt’s life<br />

and designate<br />

their daughter,<br />

Sandra, as the<br />

beneficiary. The<br />

policy has a<br />

maturity value of<br />

$2,000,000. Matt<br />

dies first and the<br />

insurance<br />

proceeds are<br />

paid to Sandra.<br />

As to the<br />

proceeds, (Points<br />

: 5)

8. (TCO 10) The<br />

trustee of the<br />

Washington Trust<br />

is not required to<br />

distribute all of the<br />

current-year annual<br />

accounting income<br />

of the trust to its<br />

sole beneficiary,<br />

Betty. Which is the<br />

trust’s personal<br />

exemption? (Points<br />

: 5<br />

9. (TCO 10) The<br />

Jain Trust is<br />

required to pay its<br />

entire annual<br />

accounting income<br />

to the Daytona<br />

Museum, a<br />

qualifying charity.<br />

Which is the trust’s<br />

personal<br />

exemption? (Points<br />

: 5)<br />

10. (TCO 10)<br />

Pam makes a<br />

gift of land<br />

(basis of<br />

$313,000; fair<br />

market value<br />

of $913,000)

to her<br />

granddaughter,<br />

Tracy. As a<br />

result of the<br />

transfer, Pam<br />

paid a gift tax<br />

of $45,000.<br />

Which is<br />

Tracy’s<br />

income tax<br />

basis in the<br />

land? (Points :<br />

5)