ACCT 344 Cost Accounting Final Exam Answers

ACCT 344 Cost Accounting Final Exam Answers

ACCT 344 Cost Accounting Final Exam Answers

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

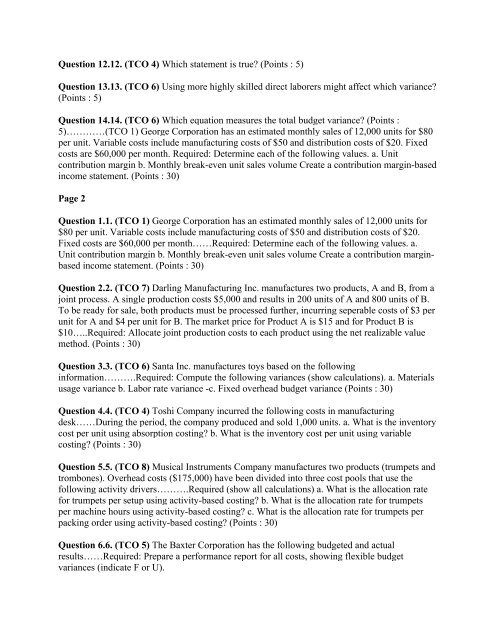

Question 12.12. (TCO 4) Which statement is true? (Points : 5)<br />

Question 13.13. (TCO 6) Using more highly skilled direct laborers might affect which variance?<br />

(Points : 5)<br />

Question 14.14. (TCO 6) Which equation measures the total budget variance? (Points :<br />

5)…………(TCO 1) George Corporation has an estimated monthly sales of 12,000 units for $80<br />

per unit. Variable costs include manufacturing costs of $50 and distribution costs of $20. Fixed<br />

costs are $60,000 per month. Required: Determine each of the following values. a. Unit<br />

contribution margin b. Monthly break-even unit sales volume Create a contribution margin-based<br />

income statement. (Points : 30)<br />

Page 2<br />

Question 1.1. (TCO 1) George Corporation has an estimated monthly sales of 12,000 units for<br />

$80 per unit. Variable costs include manufacturing costs of $50 and distribution costs of $20.<br />

Fixed costs are $60,000 per month……Required: Determine each of the following values. a.<br />

Unit contribution margin b. Monthly break-even unit sales volume Create a contribution marginbased<br />

income statement. (Points : 30)<br />

Question 2.2. (TCO 7) Darling Manufacturing Inc. manufactures two products, A and B, from a<br />

joint process. A single production costs $5,000 and results in 200 units of A and 800 units of B.<br />

To be ready for sale, both products must be processed further, incurring seperable costs of $3 per<br />

unit for A and $4 per unit for B. The market price for Product A is $15 and for Product B is<br />

$10…..Required: Allocate joint production costs to each product using the net realizable value<br />

method. (Points : 30)<br />

Question 3.3. (TCO 6) Santa Inc. manufactures toys based on the following<br />

information……….Required: Compute the following variances (show calculations). a. Materials<br />

usage variance b. Labor rate variance -c. Fixed overhead budget variance (Points : 30)<br />

Question 4.4. (TCO 4) Toshi Company incurred the following costs in manufacturing<br />

desk……During the period, the company produced and sold 1,000 units. a. What is the inventory<br />

cost per unit using absorption costing? b. What is the inventory cost per unit using variable<br />

costing? (Points : 30)<br />

Question 5.5. (TCO 8) Musical Instruments Company manufactures two products (trumpets and<br />

trombones). Overhead costs ($175,000) have been divided into three cost pools that use the<br />

following activity drivers……….Required (show all calculations) a. What is the allocation rate<br />

for trumpets per setup using activity-based costing? b. What is the allocation rate for trumpets<br />

per machine hours using activity-based costing? c. What is the allocation rate for trumpets per<br />

packing order using activity-based costing? (Points : 30)<br />

Question 6.6. (TCO 5) The Baxter Corporation has the following budgeted and actual<br />

results……Required: Prepare a performance report for all costs, showing flexible budget<br />

variances (indicate F or U).