SACOME Annual Report 2012-13

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

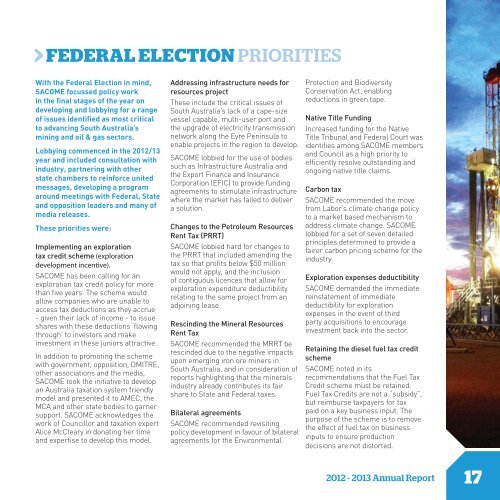

FEDERAL ELECTION PRIORITIES<br />

With the Federal Election in mind,<br />

<strong>SACOME</strong> focussed policy work<br />

in the final stages of the year on<br />

developing and lobbying for a range<br />

of issues identified as most critical<br />

to advancing South Australia’s<br />

mining and oil & gas sectors.<br />

Lobbying commenced in the <strong>2012</strong>/<strong>13</strong><br />

year and included consultation with<br />

industry, partnering with other<br />

state chambers to reinforce united<br />

messages, developing a program<br />

around meetings with Federal, State<br />

and opposition leaders and many of<br />

media releases.<br />

These priorities were:<br />

Implementing an exploration<br />

tax credit scheme (exploration<br />

development incentive).<br />

<strong>SACOME</strong> has been calling for an<br />

exploration tax credit policy for more<br />

than five years. The scheme would<br />

allow companies who are unable to<br />

access tax deductions as they accrue<br />

- given their lack of income - to issue<br />

shares with these deductions ‘flowing<br />

through’ to investors and make<br />

investment in these juniors attractive.<br />

In addition to promoting the scheme<br />

with government, opposition, DMITRE,<br />

other associations and the media,<br />

<strong>SACOME</strong> took the initiative to develop<br />

an Australia taxation system friendly<br />

model and presented it to AMEC, the<br />

MCA and other state bodies to garner<br />

support. <strong>SACOME</strong> acknowledges the<br />

work of Councillor and taxation expert<br />

Alice McCleary in donating her time<br />

and expertise to develop this model.<br />

Addressing infrastructure needs for<br />

resources project<br />

These include the critical issues of<br />

South Australia’s lack of a cape-size<br />

vessel capable, multi-user port and<br />

the upgrade of electricity transmission<br />

network along the Eyre Peninsula to<br />

enable projects in the region to develop.<br />

<strong>SACOME</strong> lobbied for the use of bodies<br />

such as Infrastructure Australia and<br />

the Export Finance and Insurance<br />

Corporation (EFIC) to provide funding<br />

agreements to stimulate infrastructure<br />

where the market has failed to deliver<br />

a solution.<br />

Changes to the Petroleum Resources<br />

Rent Tax (PRRT)<br />

<strong>SACOME</strong> lobbied hard for changes to<br />

the PRRT that included amending the<br />

tax so that profits below $50 million<br />

would not apply, and the inclusion<br />

of contiguous licences that allow for<br />

exploration expenditure deductibility<br />

relating to the same project from an<br />

adjoining lease.<br />

Rescinding the Mineral Resources<br />

Rent Tax<br />

<strong>SACOME</strong> recommended the MRRT be<br />

rescinded due to the negative impacts<br />

upon emerging iron ore miners in<br />

South Australia, and in consideration of<br />

reports highlighting that the minerals<br />

industry already contributes its fair<br />

share to State and Federal taxes.<br />

Bilateral agreements<br />

<strong>SACOME</strong> recommended revisiting<br />

policy development in favour of bilateral<br />

agreements for the Environmental<br />

Protection and Biodiversity<br />

Conservation Act, enabling<br />

reductions in green tape.<br />

Native Title Funding<br />

Increased funding for the Native<br />

Title Tribunal and Federal Court was<br />

identifies among <strong>SACOME</strong> members<br />

and Council as a high priority to<br />

efficiently resolve outstanding and<br />

ongoing native title claims.<br />

Carbon tax<br />

<strong>SACOME</strong> recommended the move<br />

from Labor’s climate change policy<br />

to a market based mechanism to<br />

address climate change. <strong>SACOME</strong><br />

lobbied for a set of seven detailed<br />

principles determined to provide a<br />

fairer carbon pricing scheme for the<br />

industry.<br />

Exploration expenses deductibility<br />

<strong>SACOME</strong> demanded the immediate<br />

reinstatement of immediate<br />

deductibility for exploration<br />

expenses in the event of third<br />

party acquisitions to encourage<br />

investment back into the sector.<br />

Retaining the diesel fuel tax credit<br />

scheme<br />

<strong>SACOME</strong> noted in its<br />

recommendations that the Fuel Tax<br />

Credit scheme must be retained.<br />

Fuel Tax Credits are not a “subsidy”,<br />

but reimburse taxpayers for tax<br />

paid on a key business input. The<br />

purpose of the scheme is to remove<br />

the effect of fuel tax on business<br />

inputs to ensure production<br />

decisions are not distorted.<br />

<strong>2012</strong> - 20<strong>13</strong> <strong>Annual</strong> <strong>Report</strong><br />

17