15262 ADvTECH All About Booklet_Version 1

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

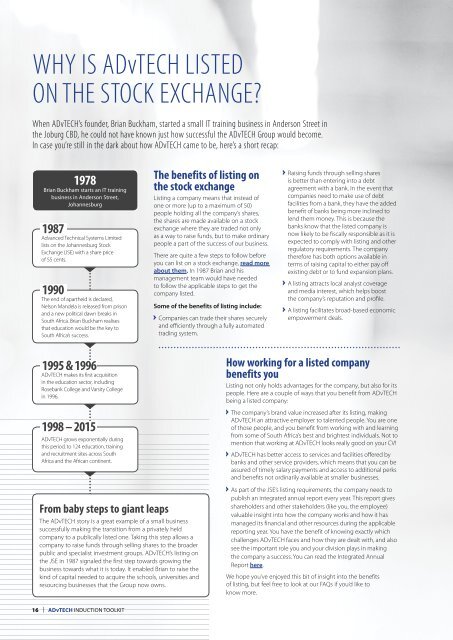

WHY IS <strong>ADvTECH</strong> LISTED<br />

ON THE STOCK EXCHANGE?<br />

When <strong>ADvTECH</strong>’s founder, Brian Buckham, started a small IT training business in Anderson Street in<br />

the Joburg CBD, he could not have known just how successful the <strong>ADvTECH</strong> Group would become.<br />

In case you’re still in the dark about how <strong>ADvTECH</strong> came to be, here’s a short recap:<br />

1978<br />

Brian Buckham starts an IT training<br />

business in Anderson Street,<br />

Johannesburg<br />

1987<br />

Advanced Technical Systems Limited<br />

lists on the Johannesburg Stock<br />

Exchange (JSE) with a share price<br />

of 55 cents.<br />

1990<br />

The end of apartheid is declared,<br />

Nelson Mandela is released from prison<br />

and a new political dawn breaks in<br />

South Africa. Brian Buckham realises<br />

that education would be the key to<br />

South Africa’s success.<br />

1995 & 1996<br />

<strong>ADvTECH</strong> makes its first acquisition<br />

in the education sector, including<br />

Rosebank College and Varsity College<br />

in 1996.<br />

1998 – 2015<br />

<strong>ADvTECH</strong> grows exponentially during<br />

this period, to 124 education, training<br />

and recruitment sites across South<br />

Africa and the African continent.<br />

From baby steps to giant leaps<br />

The <strong>ADvTECH</strong> story is a great example of a small business<br />

successfully making the transition from a privately held<br />

company to a publically listed one. Taking this step allows a<br />

company to raise funds through selling shares to the broader<br />

public and specialist investment groups. <strong>ADvTECH</strong>’s listing on<br />

the JSE in 1987 signaled the first step towards growing the<br />

business towards what it is today. It enabled Brian to raise the<br />

kind of capital needed to acquire the schools, universities and<br />

resourcing businesses that the Group now owns.<br />

The benefits of listing on<br />

the stock exchange<br />

Listing a company means that instead of<br />

one or more (up to a maximum of 50)<br />

people holding all the company’s shares,<br />

the shares are made available on a stock<br />

exchange where they are traded not only<br />

as a way to raise funds, but to make ordinary<br />

people a part of the success of our business.<br />

There are quite a few steps to follow before<br />

you can list on a stock exchange, read more<br />

about them. In 1987 Brian and his<br />

management team would have needed<br />

to follow the applicable steps to get the<br />

company listed.<br />

Some of the benefits of listing include:<br />

Companies can trade their shares securely<br />

and efficiently through a fully automated<br />

trading system.<br />

Raising funds through selling shares<br />

is better than entering into a debt<br />

agreement with a bank. In the event that<br />

companies need to make use of debt<br />

facilities from a bank, they have the added<br />

benefit of banks being more inclined to<br />

lend them money. This is because the<br />

banks know that the listed company is<br />

now likely to be fiscally responsible as it is<br />

expected to comply with listing and other<br />

regulatory requirements. The company<br />

therefore has both options available in<br />

terms of raising capital to either pay off<br />

existing debt or to fund expansion plans.<br />

A listing attracts local analyst coverage<br />

and media interest, which helps boost<br />

the company’s reputation and profile.<br />

A listing facilitates broad-based economic<br />

empowerment deals.<br />

How working for a listed company<br />

benefits you<br />

Listing not only holds advantages for the company, but also for its<br />

people. Here are a couple of ways that you benefit from <strong>ADvTECH</strong><br />

being a listed company:<br />

The company’s brand value increased after its listing, making<br />

<strong>ADvTECH</strong> an attractive employer to talented people. You are one<br />

of those people, and you benefit from working with and learning<br />

from some of South Africa’s best and brightest individuals. Not to<br />

mention that working at <strong>ADvTECH</strong> looks really good on your CV!<br />

<strong>ADvTECH</strong> has better access to services and facilities offered by<br />

banks and other service providers, which means that you can be<br />

assured of timely salary payments and access to additional perks<br />

and benefits not ordinarily available at smaller businesses.<br />

As part of the JSE’s listing requirements, the company needs to<br />

publish an integrated annual report every year. This report gives<br />

shareholders and other stakeholders (like you, the employee)<br />

valuable insight into how the company works and how it has<br />

managed its financial and other resources during the applicable<br />

reporting year. You have the benefit of knowing exactly which<br />

challenges <strong>ADvTECH</strong> faces and how they are dealt with, and also<br />

see the important role you and your division plays in making<br />

the company a success. You can read the Integrated Annual<br />

Report here.<br />

We hope you’ve enjoyed this bit of insight into the benefits<br />

of listing, but feel free to look at our FAQs if you’d like to<br />

know more.<br />

CORPORATE GOVERNANCE<br />

What does it mean and<br />

why does it matter?<br />

Corporate governance is a term describing the system used to direct and control a<br />

company. At <strong>ADvTECH</strong> our Board of directors oversees the management and control<br />

structure that controls the Group’s overall direction.<br />

The King Code of Corporate Governance<br />

Corporate governance is a dynamic field, with constantly evolving requirements based on the<br />

best practice principles controlling the sector the company operates in. Former High Court<br />

judge Mervyn King S.C. is widely regarded as an expert in the field of corporate governance.<br />

King published a report called the King Code of Corporate Governance in 2017, called King IV.<br />

The report contains 75 reporting principles that guide organisations toward responsible,<br />

transparent reporting that aligns with local and international standards. We have always<br />

supported the values contained in the King Report and we constantly aim for greater<br />

compliance to the Code of Corporate Practices section of the report.<br />

REMUNERATION COMMITTEE<br />

This Committee determines and<br />

approves how much employees are<br />

paid. The Group CEO and Group HR<br />

executive attend these meetings by<br />

invitation, but don’t have any say<br />

regarding decisions about their own<br />

remuneration.<br />

AUDIT COMMITTEE<br />

The Committee is responsible for<br />

appointing the Group’s auditors,<br />

agreeing the fees that must be paid<br />

to them and settling on the terms of<br />

their engagement. They also provide<br />

recommendations to the Board about<br />

a number of operational issues. A full<br />

list of these is available.<br />

RISK COMMITTEE<br />

Every business faces several actual<br />

and potential risks in the day-to-day<br />

execution of their tasks. While the Risk<br />

Committee has assumed responsibility<br />

for monitoring and overseeing the<br />

management of risk within the Group,<br />

the Board, Exco and the internal audit<br />

department continue to review and<br />

assess the integrity and the quality of<br />

our risk control systems and ensure that<br />

risk policies and strategies are effectively<br />

managed.<br />

MORE ABOUT<br />

THE BOARD<br />

The <strong>ADvTECH</strong> Board consists of two<br />

Executive and eight Non-Executive<br />

Directors. The Board encourages greater<br />

integration of corporate governance<br />

principles across all areas of operation<br />

to help the Group to run its business in<br />

an efficient, ethical and sustainable way.<br />

This in turn creates value and sustainable<br />

returns, which means that more<br />

investments will be made into the<br />

private education sector.<br />

The directors have a wide range of<br />

experience in strategic, financial, legal,<br />

Information Technology and educational<br />

activities. This means that there is enough<br />

intellectual capital to guide the business<br />

towards long-term success. You can<br />

find the directors’ details and a short<br />

description of their CVs on the <strong>ADvTECH</strong><br />

website at www.advtech.co.za<br />

The Board has six committees,<br />

established as part of regulatory and<br />

business requirements. Members of the<br />

Board are appointed to Committees<br />

based on their areas of expertise and<br />

experience.<br />

Why corporate<br />

governance matters<br />

While the Board and Group<br />

Management team are ultimately<br />

held accountable for the Group’s<br />

ethical corporate governance, every<br />

one of us plays an important role<br />

in making our business one that is<br />

operated with integrity. When we are<br />

ill-informed about regulatory issues<br />

that could negatively affect our<br />

particular business unit, it places the<br />

entire Group at risk for reputational<br />

or even financial damage. It’s worth<br />

understanding which laws and<br />

regulations govern your particular<br />

area of work and understanding<br />

exactly what you can do to ensure<br />

that we act with complete integrity<br />

and transparency in everything<br />

we do.<br />

INVESTMENT COMMITTEE<br />

The Investment committee reviews<br />

and manages the funding and other<br />

financial aspects that constitute part<br />

of the investment strategy, such<br />

as acquisitions. They provide<br />

recommendations on where and<br />

what to spend money on, in essence,<br />

what would be worthwhile long-term<br />

for the groups sustainability and growth.<br />

TRANSFORMATION, SOCIAL AND<br />

ETHICS COMMITTEE (TSEC)<br />

TSEC monitors and oversees the<br />

Group’s progress on aspects relating<br />

to transformation at every level.<br />

It considers social and ethical<br />

aspects, and, where appropriate,<br />

provides management with guidance<br />

in this regard.<br />

The divisional CEOs must attend the<br />

majority of TSEC meetings held during<br />

the year. This ensures that social and<br />

ethical matters, as well as matters<br />

pertaining to transformation remain<br />

high on management’s agenda.<br />

NOMINATIONS COMMITTEE<br />

The Committee meets when necessary,<br />

to nominate, evaluate and recommend<br />

possible new appointments to the<br />

Board.<br />

16 | <strong>ADvTECH</strong> INDUCTION TOOLKIT<br />

<strong>ADvTECH</strong> INDUCTION TOOLKIT |<br />

17