Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

No matter the type of merchant – online or offline,<br />

B2B or B2C, every business is working on controlling<br />

and reducing churn to ensure a stable customer base<br />

and predictable cash inflow. This task can become a<br />

challenge of massive proportions if the business model<br />

of this merchant is based on recurring payments. And<br />

why is that?<br />

Recurring payments are a win-win for both sides as<br />

they allow consumers to easily and effortlessly plan<br />

their expenses, and in return help merchants smooth<br />

out their revenue stream and ensure long life-cycles.<br />

Moreover, as reported by The Economist Intelligence<br />

Unit, consumer demand for new consumption models<br />

– subscriptions, sharing or leasing - is hitting the roof<br />

at over 85%. In a world where online purchases for<br />

goods and services are dominating, businesses have<br />

to find ways to ensure seamless online purchasing<br />

experiences. With that in mind, offering recurring<br />

payments and subscription options can help lead the<br />

way to a necessary change.<br />

Moreover, the advent and uptake of eCommerce also<br />

means cross-border sales now represents one of the<br />

biggest opportunities available to merchants around<br />

the globe. With the accelerating shift to subscription/<br />

new consumption models, companies who want to<br />

grow their business or remain leaders in their industries<br />

will increasingly explore cross-border opportunities,<br />

especially in high-growth markets such as LATAM and<br />

India.<br />

A pressing issue to take into consideration is involuntary<br />

churn: a worry for any subscription-based business.<br />

What is specific for high growth markets is that when<br />

we look into a terminated subscription because of a<br />

payment issue in those markets, the problem does not<br />

only come in the form of fraud, expired or lost cards.<br />

In some cases, subscriptions could be cancelled and<br />

payments could not be going through if the preferred<br />

method of payment of customers is not supported by the<br />

merchant, resulting in unnecessary cancellation, even<br />

if the consumer might still want the product or service.<br />

Merchants should ensure their payment processor can<br />

offer a strong solution for subscription business models.<br />

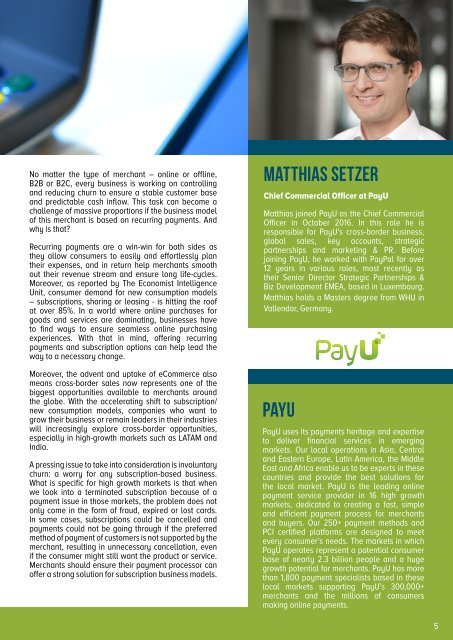

MATTHIAS SETZER<br />

Chief Commercial Officer at PayU<br />

Matthias joined PayU as the Chief Commercial<br />

Officer in October 2016. In this role he is<br />

responsible for PayU’s cross-border business,<br />

global sales, key accounts, strategic<br />

partnerships and marketing & PR. Before<br />

joining PayU, he worked with PayPal for over<br />

12 years in various roles, most recently as<br />

their Senior Director Strategic Partnerships &<br />

Biz Development EMEA, based in Luxembourg.<br />

Matthias holds a Masters degree from WHU in<br />

Vallendar, Germany.<br />

PAYU<br />

PayU uses its payments heritage and expertise<br />

to deliver financial services in emerging<br />

markets. Our local operations in Asia, Central<br />

and Eastern Europe, Latin America, the Middle<br />

East and Africa enable us to be experts in these<br />

countries and provide the best solutions for<br />

the local market. PayU is the leading online<br />

payment service provider in 16 high growth<br />

markets, dedicated to creating a fast, simple<br />

and efficient payment process for merchants<br />

and buyers. Our 250+ payment methods and<br />

PCI certified platforms are designed to meet<br />

every consumer’s needs. The markets in which<br />

PayU operates represent a potential consumer<br />

base of nearly 2.3 billion people and a huge<br />

growth potential for merchants. PayU has more<br />

than 1,800 payment specialists based in these<br />

local markets supporting PayU’s 300,000+<br />

merchants and the millions of consumers<br />

making online payments.<br />

5