RCA Benefit Guide

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

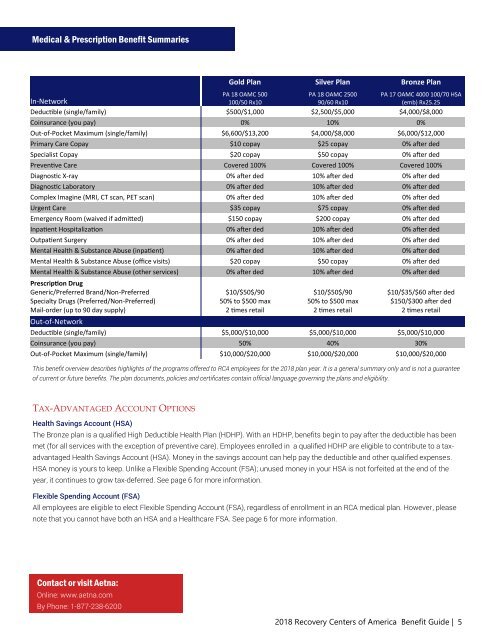

Medical & Prescription <strong>Benefit</strong> Summaries<br />

Gold Plan Silver Plan Bronze Plan<br />

PA 18 OAMC 500<br />

PA 18 OAMC 2500 PA 17 OAMC 4000 100/70 HSA<br />

In-Network<br />

100/50 Rx10<br />

90/60 Rx10<br />

(emb) Rx25.25<br />

Deductible (single/family) $500/$1,000 $2,500/$5,000 $4,000/$8,000<br />

Coinsurance (you pay) 0% 10% 0%<br />

Out-of-Pocket Maximum (single/family) $6,600/$13,200 $4,000/$8,000 $6,000/$12,000<br />

Primary Care Copay $10 copay $25 copay 0% after ded<br />

Specialist Copay $20 copay $50 copay 0% after ded<br />

Preventive Care Covered 100% Covered 100% Covered 100%<br />

Diagnostic X-ray 0% after ded 10% after ded 0% after ded<br />

Diagnostic Laboratory 0% after ded 10% after ded 0% after ded<br />

Complex Imagine (MRI, CT scan, PET scan) 0% after ded 10% after ded 0% after ded<br />

Urgent Care $35 copay $75 copay 0% after ded<br />

Emergency Room (waived if admitted) $150 copay $200 copay 0% after ded<br />

Inpatient Hospitalization 0% after ded 10% after ded 0% after ded<br />

Outpatient Surgery 0% after ded 10% after ded 0% after ded<br />

Mental Health & Substance Abuse (inpatient) 0% after ded 10% after ded 0% after ded<br />

Mental Health & Substance Abuse (office visits) $20 copay $50 copay 0% after ded<br />

Mental Health & Substance Abuse (other services) 0% after ded 10% after ded 0% after ded<br />

Prescription Drug<br />

Generic/Preferred Brand/Non-Preferred<br />

Specialty Drugs (Preferred/Non-Preferred)<br />

Mail-order (up to 90 day supply)<br />

$10/$50$/90<br />

50% to $500 max<br />

2 times retail<br />

$10/$50$/90<br />

50% to $500 max<br />

2 times retail<br />

This benefit overview describes highlights of the programs offered to <strong>RCA</strong> employees for the 2018 plan year. It is a general summary only and is not a guarantee<br />

of current or future benefits. The plan documents, policies and certificates contain official language governing the plans and eligibility.<br />

$10/$35/$60 after ded<br />

$150/$300 after ded<br />

2 times retail<br />

Out-of-Network<br />

Deductible (single/family) $5,000/$10,000 $5,000/$10,000 $5,000/$10,000<br />

Coinsurance (you pay) 50% 40% 30%<br />

Out-of-Pocket Maximum (single/family) $10,000/$20,000 $10,000/$20,000 $10,000/$20,000<br />

TAX-ADVANTAGED ACCOUNT OPTIONS<br />

Health Savings Account (HSA)<br />

The Bronze plan is a qualified High Deductible Health Plan (HDHP). With an HDHP, benefits begin to pay after the deductible has been<br />

met (for all services with the exception of preventive care). Employees enrolled in a qualified HDHP are eligible to contribute to a taxadvantaged<br />

Health Savings Account (HSA). Money in the savings account can help pay the deductible and other qualified expenses.<br />

HSA money is yours to keep. Unlike a Flexible Spending Account (FSA); unused money in your HSA is not forfeited at the end of the<br />

year, it continues to grow tax-deferred. See page 6 for more information.<br />

Flexible Spending Account (FSA)<br />

All employees are eligible to elect Flexible Spending Account (FSA), regardless of enrollment in an <strong>RCA</strong> medical plan. However, please<br />

note that you cannot have both an HSA and a Healthcare FSA. See page 6 for more information.<br />

Contact or visit Aetna:<br />

Online: www.aetna.com<br />

By Phone: 1-877-238-6200<br />

2018 Recovery Centers of America <strong>Benefit</strong> <strong>Guide</strong> | 5