eca_review_2018_02_15

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

E C A r e v i e w H A N N A / C o r o N A t i o n / S t e t t l e r , A b F e b r u a r y 1 5 ' 1 8 9<br />

Clearview Trustees outline challenges to MLA<br />

Linda Stillinger<br />

Review Reporter<br />

Drumheller-Stettler MLA Rick<br />

Strankman met with Clearview<br />

Trustees during the Feb. 8 regular<br />

board meeting.<br />

Discussing how the United<br />

Conservative Party can best support<br />

education in Alberta, the board advocated<br />

stable, sustainable funding,<br />

focussing on the importance of protecting<br />

rural education funding to<br />

ensure equity of opportunity for all students<br />

in our communities.<br />

Vital funding includes “Small School<br />

by Necessity” for both education and<br />

maintenance, transportation, and<br />

“Equity of Opportunity” funding.<br />

According to the board report, the<br />

basic per student grant, which provides<br />

about half of the division’s funding, has<br />

had only one increase in the last five<br />

years, while the Small School by<br />

Necessity grant has had one increase in<br />

the last eight years.<br />

Likewise, transportation and maintenance<br />

funding have seen only one<br />

increase in the past eight years.<br />

In fact, changes to the funding<br />

framework have resulted in a decline<br />

in both transportation and maintenance<br />

funding.<br />

In transportation, removal of the fuel<br />

price contingency grants reduced<br />

funding by $300,000 or approximately<br />

10 per cent of transportation grants.<br />

In maintenance, removal of the special<br />

education factor resulted in a<br />

funding reduction of $250,000 or<br />

approximately 10 per cent of maintenance<br />

grants.<br />

The board went on to point out how<br />

funding cutbacks can lead to service<br />

level reductions, increased fees to<br />

parents, and decreased employment in<br />

rural communities.<br />

According to Board Chair Ken<br />

Checkel, up till now, Clearview has<br />

been very successful rolling with the<br />

punches.<br />

By drawing down on reserves in a<br />

planned manner the division has been<br />

able to meet operational needs, but with<br />

total operating reserves projected to<br />

decrease by 62 per cent from $4,928,941<br />

at August 2010 to $1,864,191 at August<br />

<strong>2018</strong>, the ability to continue operations<br />

under the current model may be<br />

strained due to lack of resources.<br />

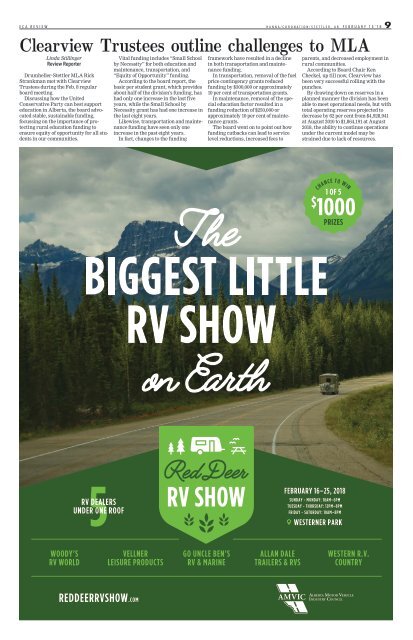

CHANCE TO WIN<br />

1 OF 5<br />

$<br />

1000<br />

PRIZES<br />

RV DEALERS<br />

UNDER ONE ROOF<br />

FEBRUARY 16–25, <strong>2018</strong><br />

SUNDAY - MONDAY: 10AM–6PM<br />

TUESDAY - THURSDAY: 12PM–8PM<br />

FRIDAY - SATURDAY: 10AM–8PM<br />

WESTERNER PARK<br />

WOODY’S<br />

RV WORLD<br />

VELLNER<br />

LEISURE PRODUCTS<br />

GO UNCLE BEN’S<br />

RV & MARINE<br />

ALLAN DALE<br />

TRAILERS & RVS<br />

WESTERN R.V.<br />

COUNTRY<br />

REDDEERRVSHOW.COM