Retail Chronicles 12th

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

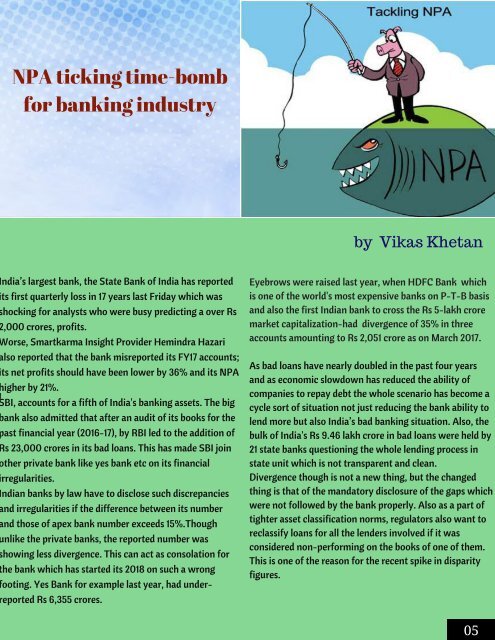

NPA ticking time-bomb<br />

for banking industry<br />

By Vikas Khetan<br />

by Vikas Khetan<br />

ndia’s largest bank, the State Bank of India has reported<br />

ts first quarterly loss in 17 years last Friday which was<br />

hocking for analysts who were busy predicting a over Rs<br />

,000 crores, profits.<br />

orse, Smartkarma Insight Provider Hemindra Hazari<br />

lso reported that the bank misreported its FY17 accounts;<br />

ts net profits should have been lower by 36% and its NPA<br />

igher by 21%.<br />

BI, accounts for a fifth of India's banking assets. The big<br />

ank also admitted that after an audit of its books for the<br />

ast financial year (2016-17), by RBI led to the addition of<br />

s 23,000 crores in its bad loans. This has made SBI join<br />

ther private bank like yes bank etc on its financial<br />

rregularities.<br />

ndian banks by law have to disclose such discrepancies<br />

nd irregularities if the difference between its number<br />

nd those of apex bank number exceeds 15%.Though<br />

nlike the private banks, the reported number was<br />

howing less divergence. This can act as consolation for<br />

he bank which has started its 2018 on such a wrong<br />

ooting. Yes Bank for example last year, had undereported<br />

Rs 6,355 crores.<br />

Eyebrows were raised last year, when HDFC Bank which<br />

is one of the world's most expensive banks on P-T-B basis<br />

and also the first Indian bank to cross the Rs 5-lakh crore<br />

market capitalization-had divergence of 35% in three<br />

accounts amounting to Rs 2,051 crore as on March 2017.<br />

As bad loans have nearly doubled in the past four years<br />

and as economic slowdown has reduced the ability of<br />

companies to repay debt the whole scenario has become a<br />

cycle sort of situation not just reducing the bank ability to<br />

lend more but also India’s bad banking situation. Also, the<br />

bulk of India's Rs 9.46 lakh crore in bad loans were held by<br />

21 state banks questioning the whole lending process in<br />

state unit which is not transparent and clean.<br />

Divergence though is not a new thing, but the changed<br />

thing is that of the mandatory disclosure of the gaps which<br />

were not followed by the bank properly. Also as a part of<br />

tighter asset classification norms, regulators also want to<br />

reclassify loans for all the lenders involved if it was<br />

considered non-performing on the books of one of them.<br />

This is one of the reason for the recent spike in disparity<br />

figures.<br />

05