BusinessDay 26 Feb 2018

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

usinessday market monitor<br />

Commodities<br />

Brent Oil<br />

US $66.56<br />

Cocoa<br />

US $2,188.00<br />

NSE<br />

Biggest Gainer Biggest Loser<br />

NB<br />

CCNN<br />

N130 5.78pc N16.85 -4.80pc<br />

42,570.89 0.74<br />

Bitcoin<br />

N3,634,133.67<br />

Powered by<br />

-2.14pc<br />

Everdon Bureau De Change<br />

$-N<br />

£-N<br />

€-N<br />

BUY SELL<br />

360.00 363.00<br />

495.00 505.00<br />

435.00 444.00<br />

FOREIGN EXCHANGE<br />

TREASURY BILLS<br />

Market Spot $/N 3M 6M<br />

I&E FX Window 360.70 -0.01 -0.01<br />

CBN Official Rate 305.95 14.71 15.58<br />

FMDQ Close<br />

5 Years<br />

-0.03%<br />

13.52%<br />

FGN BONDS<br />

10 Years<br />

-0.11%<br />

13.69%<br />

20 Years<br />

-0.06%<br />

13.42%<br />

Diamond Bank reduces losses as oil rally aids bad loan recoveries ...Page 4<br />

NEWS YOU CAN TRUST I **MONDAY <strong>26</strong> FEBRUARY <strong>2018</strong> I VOL. 14, NO 553 I N300 @ g<br />

NASD moves<br />

to connect PE<br />

investors with<br />

growth enterprises<br />

IHEANYI NWACHUKWU<br />

NASD Over-The-<br />

Counter (OTC) Securities<br />

Exchange is<br />

making a bold move<br />

to connect Private Equity (PE)<br />

investors to growth-oriented<br />

enterprises in Nigeria.<br />

NASD Plc, which is the promoter<br />

of a Trading Network<br />

that eases secondary market<br />

trading of all securities of unquoted<br />

public companies, has<br />

just developed an Enterprise<br />

Continues on page 46<br />

2019: NASS raises<br />

Presidential campaign<br />

expenses by 400% to N5bn<br />

....Lawmakers insist amendment in<br />

tune with modern realities<br />

OWEDE AGBAJILEKE, Abuja<br />

In the new Electoral Act<br />

(Amendment) Bill recently<br />

passed by both the Senate<br />

and House of Representatives,<br />

the National Assembly jerked up<br />

the maximum election expenses<br />

to be incurred by a presidential<br />

candidate to N5 billion from<br />

N1 billion, indicating some 400<br />

percent increase.<br />

Lawmakers also increased<br />

Continues on page 46<br />

Finally, FG confirms<br />

110 Dapchi schoolgirls<br />

missing<br />

P. A6<br />

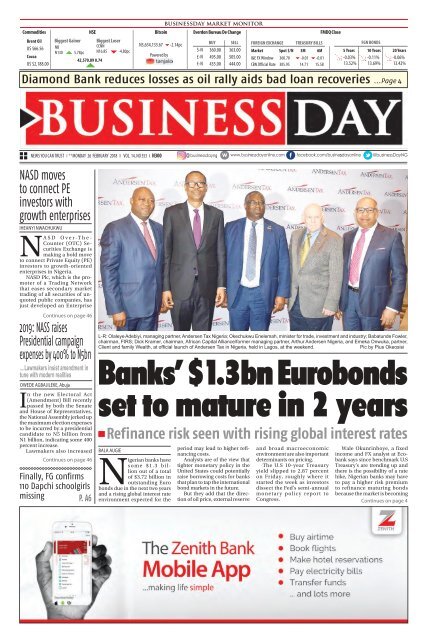

L-R: Olaleye Adebiyi, managing partner, Andersen Tax Nigeria; Okechukwu Enelemah, minister for trade, investment and industry; Babatunde Fowler,<br />

chairman, FIRS; Dick Kramer, chairman, African Capital Alliance/former managing partner, Arthur Andersen Nigeria, and Emeka Onwuka, partner,<br />

Client and family Wealth, at official launch of Andersen Tax in Nigeria, held in Lagos, at the weekend.<br />

Pic by Pius Okeosisi<br />

Banks’ $1.3bn Eurobonds<br />

set to mature in 2 years<br />

Refinance risk seen with rising global interest rates<br />

BALA AUGIE<br />

Nigerian banks have<br />

some $1.3 billion<br />

out of a total<br />

of $3.72 billion in<br />

outstanding Euro<br />

bonds due in the next two years<br />

and a rising global interest rate<br />

environment expected for the<br />

period may lead to higher refinancing<br />

costs.<br />

Analysts are of the view that<br />

tighter monetary policy in the<br />

United States could potentially<br />

raise borrowing costs for banks<br />

that plan to tap the international<br />

bond markets in the future.<br />

But they add that the direction<br />

of oil price, external reserve<br />

and broad macroeconomic<br />

environment are also important<br />

determinants on pricing.<br />

The U.S 10-year Treasury<br />

yield slipped to 2.87 percent<br />

on Friday, roughly where it<br />

started the week as investors<br />

dissect the Fed’s semi-annual<br />

monetary policy report to<br />

Congress.<br />

Wale Okunrinboye, a fixed<br />

income and FX analyst at Ecobank<br />

says since benchmark U.S<br />

Treasury’s are trending up and<br />

there is the possibility of a rate<br />

hike, Nigerian banks may have<br />

to pay a higher risk premium<br />

to refinance maturing bonds<br />

because the market is becoming<br />

Continues on page 4

2 BUSINESS DAY<br />

C002D5556<br />

Monday <strong>26</strong> <strong>Feb</strong>ruary <strong>2018</strong>

Monday <strong>26</strong> <strong>Feb</strong>ruary <strong>2018</strong> C002D5556 BUSINESS DAY 3

4 BUSINESS DAY<br />

C002D5556<br />

Monday <strong>26</strong> <strong>Feb</strong>ruary <strong>2018</strong><br />

NEWS<br />

Netherlands pledges support for<br />

Nigeria’s agricultural growth<br />

... Quality of Nigerian food produce falls short of international standards – Dutch experts<br />

CALEB OJEWALE<br />

The Dutch government is<br />

committing to providing<br />

support for Nigeria’s<br />

agricultural development,<br />

aiming to facilitate<br />

the creation of new jobs to<br />

support the economy, and stimulate<br />

economic growth. The Dutch<br />

mission in Nigeria which says it<br />

wants to deepen bilateral relations<br />

with the country has identified agriculture<br />

as the best way to provide<br />

support, owing to the Dutch track<br />

record in high productivity, and<br />

being the world’s second largest<br />

exporter of food despite being one<br />

of the smallest countries by size at<br />

41,543 Km2.<br />

This commitment to find ways<br />

of helping Nigeria develop its<br />

agricultural potentials was demonstrated<br />

earlier this month when<br />

a Dutch delegation led by Robert<br />

Petri, Netherlands ambassador<br />

to Nigeria, in company of Michel<br />

Deleen, head of Netherlands<br />

Representation in Lagos, and<br />

Ilona Domanska, policy officer,<br />

West Africa Division, Netherlands<br />

Ministry of Foreign Affairs, visited<br />

the Wageningen University and<br />

Research (WUR) for series of strategic<br />

meetings on ways Nigeria’s<br />

agricultural development can be<br />

supported.<br />

<strong>BusinessDay</strong> correspondent<br />

was in attendance at some of these<br />

meetings, where the Dutch delegation<br />

met with several experts<br />

who have had experience with<br />

agriculture in Nigeria, some for<br />

the past two decades, researching<br />

on different areas of the sector<br />

and developing programmes to<br />

support local growth.<br />

In an exclusive interview with<br />

Petri after the meetings in Wageningen,<br />

the Dutch Ambassador<br />

told <strong>BusinessDay</strong> his country<br />

“would like to intensify collaboration<br />

with Nigeria, particularly in<br />

the field of agriculture, and this<br />

is because agriculture (appears<br />

to be) a priority for the Nigerian<br />

government.”<br />

According to Petri, with high<br />

population growth, Nigeria will<br />

keep importing more food so<br />

local production has to go up,<br />

and “I think as a country, the<br />

Netherlands has something to<br />

offer Nigeria. We are capable of<br />

producing high yields in a small<br />

piece of land and we have a lot of<br />

expertise in practising agriculture<br />

in a sustainable way. We are also<br />

the second largest exporter of food<br />

in the world.<br />

“We are a small country (in<br />

landmass) but in the area of agriculture,<br />

we certainly have something<br />

to offer Nigeria,” said Petri<br />

The Dutch Ambassador also<br />

noted that “Nigeria is a very big<br />

Banks’ $1.3bn Eurobonds set to mature in...<br />

Continued from page 1<br />

more risk conscious.<br />

“GTBank has offered to redeem<br />

its loans while Fidelity<br />

Bank has already rolled over<br />

theirs last year. Diamond Bank<br />

may look to refinance theirs,”<br />

Okunrinboye said.<br />

“For Tier one lenders that are<br />

going to refinance, they will have<br />

to pay close to 9 percent while<br />

Tier 2 lenders will have to pay<br />

close to 10 percent given the rate<br />

at which they issued few years<br />

ago,” said Okunrubonye.<br />

Fidelity Bank a tier – two bank<br />

rated B- by S&P Global Ratings<br />

and Fitch Ratings, or six steps<br />

into junk territory, issued $400<br />

million of five-year securities<br />

with a 10.75 percent yield in<br />

October 2017.<br />

Proceeds from the new Eurobond<br />

were partly used to<br />

repurchase $256 million of the<br />

bank’s $300mn Eurobond due<br />

in May <strong>2018</strong> (coupon 6.875%),<br />

implying new cash of $144mn<br />

and outstanding value of $44.50<br />

million.<br />

“Fidelity was a beneficiary of<br />

the high interest rate environment<br />

that prevailed in FY17;<br />

however, we believe its Net Interest<br />

Income in 4Q17 will be pulled<br />

lower by the interest expense<br />

on its recently issued $400mn<br />

Eurobond (maturing in October<br />

2022, coupon 10.5%). The new<br />

cash introduced from the bond<br />

raise will be used to drive trade<br />

financing activities, according<br />

to management,” Renaissance<br />

Capital analysts led by Olamipo<br />

Ogunsanya said in a <strong>Feb</strong> 5 report<br />

on the sector.<br />

Guaranty Trust Bank (GT-<br />

Bank), the largest lender by market<br />

value, has $276.93 million in<br />

outstanding Eurobonds due November<br />

8 <strong>2018</strong> and Zenith Bank<br />

has $500 million in Eurobonds<br />

due April 22 2019.<br />

Diamond Bank has $200 million<br />

in 5 year unsubordinated<br />

unsecured Eurobonds maturing<br />

on May 21 2019 and First Bank of<br />

Nigeria Plc has $300 million in<br />

Eurobonds, maturing on August<br />

7 2020.<br />

“I think the need for dollar<br />

liquidity has reduced considerably<br />

compared to the last 2 years,<br />

due to improved FX availability<br />

in the domestic market. So banks<br />

are not necessarily under pressure<br />

to re-issue these bonds as<br />

they mature,” said Kayode Tinuoye<br />

Portfolio Manager/Head<br />

of Research at United Capital<br />

Limited.<br />

“The outlook appears positive<br />

at the moment, and should<br />

ease any pressure on pricing,<br />

especially as most of the banks<br />

have decent credit risk ratings,”<br />

summed Tinuoye.<br />

The Nigerian economy is<br />

recovering slowly from its worst<br />

slump in around 30 years, triggered<br />

by the 2014 collapse in<br />

crude prices.<br />

Ratings agencies also downgraded<br />

the Nigerian sovereign at<br />

the height of the oil shocks.<br />

However, a rebound in oil<br />

production on the back of relative<br />

peace in the Niger Delta<br />

region and the adoption of a<br />

flexible exchange rate policy<br />

that eased dollar shortages<br />

were responsible for the country<br />

existing a recession as GDP<br />

expanded by 0.55 percent and<br />

1.42 percent in the second and<br />

third quarter of 2017, accord-<br />

country and very important for<br />

not only West Africa but is an economic<br />

engine for the rest of Africa.<br />

If it goes well in Nigeria, it will go<br />

well in the rest of Africa and this<br />

will be to the benefit of Europe.<br />

“Employment will be my primary<br />

focus and that of the Netherlands,<br />

because we know that there<br />

are many job seekers that come to<br />

the market every year in search of<br />

employment, and now the oil sector<br />

and the oil age is slowly coming<br />

to an end.<br />

“As long as job seekers remain<br />

unable to secure employment,<br />

this will invariably lead to unrests<br />

and chaos which we do not want,”<br />

Petri said.<br />

The prospects of attracting<br />

more investors to Nigeria, is according<br />

to Petri, somewhat limited<br />

owing to the country’s less known<br />

potentials.<br />

“We have to explain very well,<br />

how beautiful your country is,<br />

what the potential of the country<br />

is, because there isn’t very much<br />

that is known, frankly speaking,”<br />

noted Petri, adding that “but you<br />

can start with big awareness campaigns,<br />

and it sometimes works<br />

better to focus on one sector; in<br />

this case agriculture, so people<br />

can see that it can work, and that<br />

will help companies in other sectors<br />

to also come in and make<br />

their decisions (whether or not to<br />

Diamond Bank<br />

reduces losses as<br />

oil rally aids bad<br />

loan recoveries<br />

LOLADE AKINMURELE & MICHEAL ANI<br />

The rebound in global oil<br />

prices and local production<br />

is helping Diamond<br />

bank, Nigeria’s sixth largest<br />

commercial bank; recover nonperforming<br />

loans (NPLs) that<br />

swelled in the thick of low oil<br />

prices in 2016 and militant attacks<br />

that cut oil production by<br />

a third.<br />

“In the past few months, we<br />

have had cash flows from at<br />

least three clients that had been<br />

docile since 2016 when the<br />

slump in oil prices and damages<br />

inflicted on the Forcados terminal<br />

constrained chances of loan<br />

servicing,” Caroline Anyanwu,<br />

the bank’s deputy managing<br />

director and chief risk officer<br />

told <strong>BusinessDay</strong> during an interview<br />

at its Lagos headquarters<br />

on Friday.<br />

She declined to name the oil<br />

companies in question.<br />

Thanks to the upswing in<br />

global prices and local production<br />

in Nigeria, oil exploration<br />

companies have now gone back<br />

to work and owners of rigs and<br />

vessels are getting new jobs, according<br />

to Anyanwu.<br />

That has breathed life into<br />

the bank’s NPLs which had a 36<br />

Continues on page 46<br />

L-R: Oluwatoyin Ashiru, director, First City Monument Bank (FCMB) Group plc; Ibikunle Amosun, governor,<br />

Ogun State, and Adam Nuru, managing director, FCMB, during a courtesy visit by the management of the<br />

bank to the governor in his office at Abeokuta, Ogun State.<br />

stay in Nigeria).”<br />

“The country is known but not<br />

the investments opportunities,”<br />

said Petri, “I think it has to be explained<br />

better, and that will help in<br />

showing good examples. It is also<br />

important for companies coming<br />

into Nigeria to prepare to be in it<br />

for the long haul.”<br />

Other experts who attended<br />

the sessions with the Dutch delegation,<br />

mentioned several areas<br />

Nigeria needs to improve so as to<br />

record increased productivity, and<br />

also on quality of food, not only<br />

in targeting exports but to ensure<br />

Nigerians are not being ‘slowly<br />

poisoned’.<br />

Louise Fresco, president, Executive<br />

Board of Wageningen<br />

University & Research, noted<br />

that if Nigeria hopes to one day<br />

become an agricultural exporting<br />

country, there has to be a monitoring<br />

system in place.<br />

“Nigeria like other African<br />

countries needs to build up the<br />

expertise to effectively monitor<br />

quality and standards in food<br />

production,” said Fresco, also<br />

explaining that if this is not part of<br />

a national strategy, risk becomes<br />

imminent with changes in people<br />

or institutions, and building that<br />

national capacity is very essential.<br />

•Continues online at www.businessdayonline.com<br />

ing to the National Bureau of<br />

Statistics (NBS).<br />

Nigeria’s external reserves have<br />

hit a 4 year high of $42.50 billion,<br />

according to recent data from the<br />

Central Bank of Nigeria (CBN).<br />

Benchmark sovereign bond<br />

yields have fallen to 13.10 percent<br />

as at <strong>Feb</strong>ruary <strong>2018</strong> from<br />

17.10 percent high of 2015 as the<br />

economy continues to improve.<br />

Ayodeji Ebo, managing director<br />

and CEO of Afrinvest Securities<br />

Limited says based on the<br />

expected rate hike by the U.S<br />

Federal Reserve, they expect that<br />

any re-issuance by banks will be<br />

more expensive.<br />

“So banks will now have to<br />

decide whether to pay off the<br />

loans as at maturity or if they<br />

have the dollar lending opportunity,<br />

they may decide to reissue<br />

new ones at the prevailing<br />

rates,” said Ebo.<br />

Since the dollar is a global<br />

reserve currency, changes in<br />

its valuation can have a tremendous<br />

impact on everything<br />

from foreign reserves at global<br />

central banks to corporate balance<br />

sheets containing dollardenominated<br />

debt.<br />

“GTBank says it will only<br />

redeem and they may not issue<br />

new ones. But Diamond Bank is<br />

bit of a worry. Recently, they issued<br />

a $200 million Eurobond,”<br />

said Okunrubonye.

Monday <strong>26</strong> <strong>Feb</strong>ruary <strong>2018</strong> C002D5556 BUSINESS DAY 5

6 BUSINESS DAY C002D5556<br />

NEWS<br />

Need for maritime bank re-echoes<br />

at NIMASA, stakeholders confab<br />

… stakeholders worry if insurers can guarantee change from FoB to CIF<br />

IGNATIUS CHUKWU<br />

The need to set up<br />

a bank dedicated<br />

to the maritime<br />

economy where<br />

ship owners and<br />

other investors can borrow<br />

at cheap rates re-echoed in<br />

Warri, Delta State, when the<br />

Nigerian Maritime Administration<br />

and Safety Agency<br />

(NIMASA) hosted a day<br />

stakeholders’ conference to<br />

gather ideas to move the industry<br />

forward.<br />

This is as the ability of the<br />

insurance industry in Nigeria<br />

to cope with the mooted<br />

idea of transferring the sale<br />

of crude oil in Nigeria from<br />

Free on Board (FoB) basis to<br />

Cost Insurance and Freight<br />

(CIF) basis.<br />

The urgent need for a<br />

maritime bank has also<br />

found its way into the communiqué<br />

at the end of the<br />

conference. The conference<br />

at the instance of NIMASA<br />

with the Federal Ministry<br />

of Transportation focused<br />

on the executive order one<br />

signed by President Muhammadu<br />

Buhari on ‘Ease<br />

of Doing Business’ and local<br />

content push.<br />

The fresh call for a marine<br />

bank was led by the<br />

chairman, Ship Owners<br />

Forum, Margaret Onyema<br />

– Orakwusi, who spoke on:<br />

“Ease of doing business in a<br />

secured maritime environment”.<br />

Recommending such a<br />

bank to boost funding and<br />

help Nigerians compete in<br />

the maritime sector, she<br />

suggested a rate not more<br />

than three per cent, saying<br />

the commercial rates prevailing<br />

in the country would<br />

never allow huge capital<br />

input into the sector. She<br />

said this would continue to<br />

put the maritime economy<br />

in the hands of foreigners.<br />

The chairman further urged<br />

the Federal Government to<br />

improve security in the nation’s<br />

territorial water to restore<br />

investors’ confidence<br />

in the sector.<br />

She however wondered<br />

if the insurance sub-sector<br />

was ready for the push to<br />

move from FoB to CIF would<br />

be a success. Maritime experts<br />

began the fresh push<br />

to sell CIF in 2017 led by<br />

Chinedu Jideofo-Ogbuagu,<br />

one-time consultant to the<br />

United Nations Committee<br />

on Trade (UNCTAD, now<br />

the president of the Marine<br />

Club of Nigeria. Ogbuagu<br />

had argued thus; “The cargo,<br />

meaning the crude oil<br />

and the refined product,<br />

which are carried in vessels,<br />

must be sold CIF (Cost<br />

Insurance and Freight). By<br />

this, the person selling will<br />

now be able to nominate<br />

which vessel will carry either<br />

the crude or the refined<br />

product. As long as they are<br />

patriotic, why would they<br />

not nominate Nigerian vessels?<br />

But when you sell FoB<br />

(Free on Board), you lose 60<br />

per cent of the extra profit<br />

in the shipping or insurance<br />

that is involved.”<br />

The resolutions at the<br />

end of the conference at<br />

the KFT Centre in Warri<br />

also called on the Ministry<br />

and its Agencies to promote<br />

the automation of all shipping<br />

related administrative<br />

processes to reduce human<br />

subjectivity and corruption;<br />

to consider reviving NIMA-<br />

REX as a platform for bridging<br />

the gap between the<br />

Nigerian shipping industry<br />

and prospective international<br />

investors so as to<br />

provide impetus for growth<br />

and investment; and to also<br />

liaise with relevant Ministries<br />

and Agencies in Trade<br />

and investment sector with<br />

a view to reducing the tax<br />

burden and other ancillary<br />

costs borne by the indigenous<br />

shipping investor”.<br />

The report urged NI-<br />

MASA to take careful stock<br />

of available indigenous<br />

tonnage and their current<br />

state of health so as to be<br />

empirically guided in the<br />

determination of the lingering<br />

Cabotage waiver issues;<br />

and urged the Ministry to<br />

consider inviting the Finance<br />

and Trade Ministries<br />

alongside the Customs Service<br />

to subsequent Stakeholders<br />

Forum with a view<br />

to benefiting from their input<br />

on key issues”.<br />

Bayelsa gears up for <strong>2018</strong><br />

Africa SMEs Roundtable<br />

SAMUEL ESE, Yenagoa<br />

Bayelsa State government<br />

has concluded<br />

arrangements to<br />

host the <strong>2018</strong> Africa<br />

SMEs Roundtable with the<br />

theme: The Position of Africa<br />

SMEs Within the Global<br />

Economy: Unlocking Market<br />

Opportunities.<br />

<strong>BusinessDay</strong> gathers that<br />

already 15 African countries<br />

have registered for the March<br />

1 to 3 event, while 20 African<br />

development institutions, 10<br />

global SME funding support<br />

institutions and many others<br />

have also indicated readiness<br />

to attend.<br />

The event is expected to<br />

provide a platform for business-to-business<br />

and government-to-business<br />

opportunities,<br />

promote bilateral<br />

trade and boost inter African<br />

trade as part of an African<br />

sister cities business fair/exposition.<br />

Director-general of<br />

Bayelsa Microfinance<br />

and Enterprise Development<br />

Agency (BYMEDA),<br />

Ebiekure Eradiri, described<br />

the roundtable as “apt in<br />

view of the global economic<br />

realities of recession and<br />

crude oil negative downward<br />

slide.”<br />

Eradiri called on African<br />

trade and finance ministers,<br />

government agencies, entrepreneurs,<br />

banks and the<br />

African Union among others<br />

to participate, as the roundtable<br />

will afford opportunities<br />

to examine “policies,<br />

strategies, best practices,<br />

solutions and programmes<br />

to upgrade African SMEs<br />

and launch them into new<br />

growth trajectories.”<br />

He said the programme<br />

would spotlight evolution<br />

of Africa SMEs marketplace,<br />

increase foreign direct investment<br />

and promote accelerated<br />

development of<br />

SMEs in the continent.<br />

According to Eradiri, the<br />

roundtable would also take<br />

stock of the implementation<br />

of the Consolidated Plan of<br />

Action, which would take<br />

into account emerging areas<br />

and contributions of Africa<br />

to the attainment of the<br />

Millennium Development<br />

Goals (MDGs).<br />

On the expected impact<br />

of the programme, Eradiri<br />

explained that the recommendations<br />

are expected<br />

to fit into the implementation<br />

plan path for the new<br />

umbrella group for SMEs<br />

advocacy, All Africa Association<br />

of Small and Medium<br />

Enterprises. The three-day<br />

programme would feature<br />

exhibitions in two major sectors<br />

and encourage exchange<br />

of business information,<br />

brands promotion and build<br />

prospect data and generate<br />

sales leads among others.<br />

Eradiri said expected<br />

results include synthesis of<br />

best practices, benchmarking<br />

tool for entrepreneurs,<br />

guidelines for mainstreaming<br />

SMEs into national development,<br />

incubation of<br />

newly identified entrepreneurs<br />

and procurement of<br />

loans and monitoring.<br />

Monday <strong>26</strong> <strong>Feb</strong>ruary <strong>2018</strong><br />

25,000 to benefit from<br />

<strong>2018</strong> Lagos ready-setwork<br />

training pack<br />

JOSHUA BASSEY<br />

Lagos State government<br />

has launched<br />

the third edition<br />

of its Ready-Set-<br />

Work (RSW) training programme<br />

targeting to train<br />

over 25,000 students of<br />

various tertiary institutions<br />

in the state.<br />

The RSW is an initiative<br />

of the state government<br />

that brings students<br />

of tertiary institutions in<br />

Lagos, especially those in<br />

the final year, together for<br />

a training programme that<br />

builds their confidence<br />

and prepares their minds<br />

towards the world of work<br />

and self-reliance upon<br />

graduation from school.<br />

The special adviser to<br />

Governor Akinwunmi Ambode<br />

on education, Obafela<br />

Bank-Olemoh, who spoke<br />

at the launch of the <strong>2018</strong><br />

edition of the programme,<br />

on Thursday, said the training<br />

would last for 13 weeks,<br />

adding that since the takeoff<br />

in 2016, thousands had<br />

benefitted from it.<br />

“What we are doing<br />

here is the official launch<br />

of The Ready-Set-Work<br />

faculty. We are building<br />

the largest volunteer faculty<br />

in Nigeria. Since the inception<br />

of the programme,<br />

we have engaged volunteers,<br />

who are professionals<br />

from various sectors of<br />

the economy to train and<br />

mentor the students in<br />

the 13-week training programme.

Monday <strong>26</strong> <strong>Feb</strong>ruary <strong>2018</strong> C002D5556 BUSINESS DAY 7

8 BUSINESS DAY<br />

C002D5556<br />

Monday <strong>26</strong> <strong>Feb</strong>ruary <strong>2018</strong>

Monday <strong>26</strong> <strong>Feb</strong>ruary <strong>2018</strong><br />

C002D5556<br />

BUSINESS DAY<br />

9<br />

NEWS<br />

Niger Delta to blame for death of eastern ports<br />

IGNATIUS CHUKWU<br />

Minister of<br />

T r a n s -<br />

portation,<br />

Chibuike<br />

R o t i m i<br />

Amaechi, former of Rivers<br />

State, has asked the Niger<br />

Delta people to blame themselves,<br />

not anybody from<br />

Lagos or westerners, for the<br />

steady decline of ports in the<br />

east. He spoke in tense voice,<br />

saying the truth must be told.<br />

Amaechi spoke while in<br />

Warri, Delta State, at a day<br />

stakeholders’ conference organised<br />

by Nigerian Maritime<br />

Administration and Safety<br />

Agency (NIMASA) in conjunction<br />

with his ministry to<br />

harvest ideas and issues in the<br />

maritime economy.<br />

The minister said the accusation<br />

had been that west-<br />

TUC wants state<br />

of emergency<br />

in power sector<br />

JOSHUA BASSEY<br />

Saddened by the deteriorating<br />

power supply<br />

in Nigeria and<br />

resultant economic<br />

losses, the Trade Union<br />

Congress of Nigeria (TUC)<br />

has asked the Federal Government<br />

to declare a state<br />

of emergency in the power<br />

sector.<br />

The union, which rose<br />

from its National Executive<br />

Council (NEC) meeting in<br />

Lagos, wekend, said this had<br />

become absolutely necessary,<br />

“as no nation can develop<br />

without power.”<br />

The TUC also urged the<br />

Federal Government to be<br />

decisive in its bid to rebuild<br />

the confidence of the citizenry<br />

in the system, by arresting<br />

and prosecuting killers<br />

of innocent Nigerians,<br />

masquerading as herdsmen<br />

and militia in different parts<br />

of the country. The union in<br />

a communiqué issued after<br />

the meeting, expressed<br />

concern about the ceaseless<br />

killing by the Boko Haram<br />

sect, noting that it was time<br />

the insurgents were made to<br />

face the law.<br />

On the volatility of the<br />

political system, ahead of<br />

the 2019 general elections,<br />

the TUC in the communiqué<br />

signed by Bobboi Kaigama,<br />

president and Musa Lawal,<br />

secretary general, called<br />

on politicians and their followers<br />

to act in a manner<br />

that would guarantee peace<br />

within the polity.<br />

“Politicians should avoid<br />

hate speeches so that both<br />

the common man and workers<br />

can attain fulfilment.<br />

The NEC also called on governors<br />

owing workers to pay<br />

such monies and warned<br />

converting public funds and<br />

workers’ salaries for election<br />

purposes.<br />

The union also blamed<br />

the recurring fuel crisis on<br />

the Nigerian National Petroleum<br />

Corporation (NNPC)<br />

as the sole provider of fuel<br />

for the country and called on<br />

the government to, however,<br />

reimburse the corporation<br />

and marketers of money<br />

spent on subsidy.<br />

… ‘blame yourself, not Lagos’<br />

ern Nigeria did not want eastern<br />

ports to survive and thus<br />

waxed all manner of policies<br />

to achieve the plot, saying he<br />

too believed it. How however<br />

said the moment he took over<br />

as minister, he went into the<br />

issue and found that the issue<br />

was not true at all.<br />

Returning the blame to<br />

his people, Amaechi said the<br />

youths had taken to piracy<br />

and theft, turning the waters<br />

to the region unsafe. He said it<br />

was wrong for someone in the<br />

conference to call for military<br />

escort for ships sailing to the<br />

South South.<br />

Amaechi referred the<br />

stakeholders to the war insurance<br />

system, which made<br />

cost of taking goods to the<br />

Niger Delta water double the<br />

cost of Lagos. “I once called<br />

Peter Obi, former governor of<br />

Anambra State, to educate me<br />

on why importers in Onitsha<br />

and Aba shun Port Harcourt<br />

ports. He said they preferred<br />

paying to transport containers<br />

for eight hours from Lagos<br />

and pay bribe on the way to<br />

Onitsha and Aba than import<br />

through Port Harcourt that is<br />

mere 30 minutes drive.<br />

“He said it was still far<br />

cheaper to import from Lagos<br />

because of insecurity and<br />

the war insurance charged<br />

by international shippers to<br />

venture into risky waters,” the<br />

minister said.<br />

The minister urged the<br />

Niger Delta people to look<br />

at issues objectively instead<br />

of looking for who to blame<br />

always. “They say I am not a<br />

good politician. I could come<br />

here and speak good English<br />

and promise how we are going<br />

to make eastern ports to<br />

overtake Lagos, and you will<br />

clap, but it will be untrue. Instead,<br />

we must stop looking<br />

at outsiders, call ourselves<br />

in hall and tell ourselves the<br />

truth. That is where to start,”<br />

he said.<br />

He went on: “We are not<br />

the hungriest people in Nigeria.<br />

We are not poorer than<br />

those in Lagos or north. We<br />

must admit that violence<br />

and piracy do not help any<br />

economy.” He told the ship<br />

owners to consider protests<br />

and petition to the President<br />

because, as he put it, some<br />

saboteurs were frustrating<br />

moves by the Federal Government<br />

to protect Nigerian<br />

waters through the $195 million<br />

(about N70.2bn) contract<br />

signed a year ago. The fund is<br />

meant to acquire three helicopters,<br />

three aircrafts, three<br />

big battle-ready ships, 12 vessels<br />

and 20 amphibious cars<br />

to combat the menace of piracy<br />

in the Gulf of Guinea. The<br />

contract had been approved<br />

to an Israeli security firm, but<br />

it has rather become a mirage.<br />

Amaechi alleged that<br />

some government officials,<br />

and “People making money<br />

from water” were sabotaging<br />

government’s effort in restoring<br />

peace on the nation’s<br />

troubled waters.<br />

He said: “For ship owners,<br />

you need to do a petition<br />

to the President, you need to<br />

behave like an activist. The<br />

President approved a contract<br />

of $195 million and there are<br />

people in the system sabotaging<br />

that contract. The contract<br />

is to restore security in the nation’s<br />

waters.”<br />

He threatened to disclose<br />

the names of those behind<br />

the sabotage if pushed to the<br />

wall. “I won’t say who they<br />

are until it gets out of control.<br />

We are still battling for the<br />

contract to take place, but if it<br />

gets out of hand, we will name<br />

them, including the security<br />

people.<br />

“These are people who<br />

make billions of dollars from<br />

the waters so they don’t want<br />

security on the waters, because<br />

if we secure the waters,<br />

all this rubbish will go. We<br />

need to ask ourselves what<br />

happened to an approval that<br />

was given about two years ago<br />

by the President,” he said.

Monday <strong>26</strong> <strong>Feb</strong>ruary <strong>2018</strong><br />

10 BUSINESS DAY<br />

C002D5556<br />

COMMENT<br />

BASHORUN J.K RANDLE<br />

Randle is Chairman/Chief<br />

ExecutiveJK Randle Professional<br />

Services Chartered Accountants<br />

As Ambassador (Dr.) Olatokunbo<br />

Awolowo-Dosunmu<br />

gracefully glides into the<br />

platinum age of 70 years, it<br />

is tempting to overlook the<br />

fact that she is a doughty survivor and<br />

formidable combatant. Even if the scars<br />

are not visible, she has survived the<br />

loss of two brothers Barrister Olusegun<br />

Awolowo (who graduated from University<br />

of Cambridge) in 1963 and Chief<br />

Oluwole Awolowo as well as a sister, Mrs.<br />

Ayodele Soyode (mother of Mrs. Dolapo<br />

Osinbajo - the wife of the Vice-President<br />

of Nigeria, Professor Yemi Osinbajo<br />

SAN). All these in addition to the demise<br />

of both parents – the sage Chief Obafemi<br />

Awolowo in 1987 and his jewel Chief<br />

(Mrs.) H.I.D. Awolowo in 2015.<br />

Rather than indulge in suffocating<br />

self-pity, Olatokunbo has opted to be a<br />

nimble combatant in the battle to rescue<br />

others by caring for the underprivileged;<br />

the aged; the homeless and most especially<br />

those who would otherwise<br />

be denied access to medical facilities<br />

(through the aegis of Obafemi Awolowo<br />

Foundation/Dideolu Hospital). It is selfevident<br />

that it is her caring disposition<br />

that influenced her choice of a career in<br />

medicine which was interrupted by her<br />

sojourn into diplomacy as our beloved<br />

nation’s Ambassador at The Hague, in<br />

The Netherlands, from 2000 to 2003.<br />

I commend her warmly for her<br />

granite steadfastness and exceptional<br />

faithfulness which she has consistently<br />

demonstrated in sustaining the inimitable<br />

legacy of selfless public service<br />

and indomitable spirit of her illustrious<br />

parents. Having regard to her tenacity of<br />

purpose, fierce determination and steely<br />

persistence, she is surely already on the<br />

comment is free<br />

Send 800word comments to comment@businessdayonline.com<br />

Tribute to a survivor and combatant<br />

Indeed, she has restrained herself through reticence<br />

and circumspection from venturing into the vortex of<br />

controversy in the affairs of our nation. Not for her the<br />

temptation to throw her hat into the ring as a potential<br />

first female President or Vice-President of Nigeria<br />

gedness and force of personality.<br />

Meetings at Dr. Akerele’s residence<br />

would sometimes drag on till late at night.<br />

However, first thing the following morning,<br />

Awolowo would have distributed<br />

flawless minutes of the proceedings of the<br />

previous evening to the astonishment of<br />

other members.<br />

That in itself is a story for another day.<br />

It is sufficient to record that our celebrant’s<br />

father displayed uncommon leadership as<br />

well as sagacity combined with vision and<br />

discipline. The followership adored him. A<br />

special chapter would have to be devoted<br />

to how “Awo” charmed the post Victorianage<br />

elite of Lagos into rewarding him with<br />

unprecedented respect and deference.<br />

They adored “Awo” their former protégé<br />

who was now their charismatic leader with<br />

his signature fez “Awo” cap and round rim<br />

pebble glasses.<br />

In physical stature, both Dr. Nnamdi<br />

Azikiwe (Premier of the Eastern Region)<br />

and Sir Ahmadu Bello, (The Sardauna<br />

of Sokoto and Premier of the Northern<br />

Region) towered above Chief Obafemi<br />

Awolowo. However, in the political arena<br />

and strategic thinking he was more than<br />

their equal match.<br />

My late father Chief J.K. Randle was<br />

a friend of Chief Obafemi Awolowo, as<br />

well as his rivals – Dr. Nnamdi Azikiwe<br />

and Alhaji Ahmadu Bello. I am obliged<br />

to reveal the other side of “Awo” which is<br />

rarely ever mentioned – he had a terrific<br />

sense of humour, gaiety and great sense of<br />

fun which were only on display when he<br />

was amongst a very close circle of friends.<br />

It was there for all to see on the few occasions<br />

when he visited the Lagos Island<br />

Club or Lagos Race Club where my father<br />

was the Chairman of both premier clubs.<br />

Somewhere in the archives of the clubs<br />

are iconic photographs of Chief Obafemi<br />

Awolowo looking very relaxed, jovial<br />

and savouring the company of friends<br />

and foes alike.<br />

Regardless, the dominant trait and<br />

enduring legacy were his stern mien,<br />

seriousness of purpose and dedication<br />

to the pursuit of excellence as well as<br />

the upliftment of Nigeria. He made no<br />

excuses for being a thoroughbred Yoruba<br />

first and foremost but it did not preclude<br />

him from his duty to Nigeria and Africa.<br />

He was ever ready to work from the crack<br />

of dawn till late into the night. The free<br />

education policy which was launched<br />

in Western Nigeria in 1955 remains<br />

his most enduring legacy. Knowledge<br />

became the key to freedom and liberty<br />

for the many rather than the few – in the<br />

pursuit of his catchy slogan: “Life More<br />

Abundant.”<br />

He was never awed by intellectuals<br />

and scholars. On the contrary, he cultivated<br />

them. According to the World Bank<br />

report of 1963, under the leadership of<br />

Chief Obafemi Awolowo, the Western<br />

Region of Nigeria was destined to surpass<br />

Singapore; South Korea; Indonesia and<br />

Hong Kong in economic and human<br />

capital development. The prediction is<br />

yet to manifest into reality.<br />

Time and space will not permit us<br />

to dwell on the irony of history when<br />

the feud between Chief Awolowo and<br />

his deputy Chief S. L. Akintola erupted<br />

at Mapo Hall in Ibadan in 1962 and<br />

changed the course of history as well as<br />

the destiny of Nigeria.<br />

Thankfully, the children of Chief<br />

S. O. Adebo (Head of Service, Western<br />

Region) are here to confirm that Chief<br />

Awolowo was fortunate to enjoy the support<br />

and loyalty of dedicated and incorruptible<br />

civil servants. Elder Statesman<br />

Chief Folarin Coker, former civil servant<br />

in the Western Region and Lagos State,<br />

is still with us at the age of 95 years. He is<br />

ever ready to remind us that there was a<br />

moral dimension to Chief Awolowo’s<br />

superlative performance. Mrs. Apinke<br />

Coker was Awo’s personal secretary but<br />

when she accompanied him on his trip<br />

to London to negotiate Nigeria’s Independence,<br />

Chief Awolowo as Premier<br />

of the Western Region personally paid<br />

the fare of Chief Coker so that he could<br />

accompany his wife.<br />

The celebrant was a teenager then.<br />

Here she is, fifty-five years later – still<br />

charming, vibrant, radiant and determined<br />

to keep the flag flying at full mast.<br />

She was previously the Co-Chairman<br />

of African Newspapers of Nigeria Plc,<br />

publishers of “The Tribune” group of<br />

newspapers. The mantle of leadership<br />

as the sole Chairman has fallen on her<br />

shoulders. At the time when the fortunes<br />

of the newspapers were dwindling it was<br />

the then Chairman, Chief (Mrs.) H.I.D<br />

Awolowo, the matriarch of the Awolowo<br />

dynasty who engaged the services of my<br />

firm, J.K. Randle Professional Services to<br />

provide consultancy services which we<br />

successfully executed. The company is<br />

evidently thriving and has been restored<br />

to the front rank of our nation’s media.<br />

At a time when the J.K. Randle family is<br />

under threat, assault, invasion and siege<br />

by the government (and its demolition<br />

squad which is on a rampage) we may<br />

have ignored the incisive observation of<br />

Chief (Mrs.) Awolowo which she shared<br />

with me – no matter the complexion<br />

of the government, you must replenish<br />

your wealth, your power and your<br />

prestige, otherwise you would be in<br />

peril. I remain eternally grateful to her<br />

well-grounded wisdom and profound<br />

knowledge. At close to 100 years old, she<br />

was still mentally alert and genuinely<br />

concerned about the future of Nigeria.<br />

As Olatokunbo steps into those<br />

mega-sized shoes of her parents, we have<br />

every reason to believe that she would<br />

rise up to the challenge. Happy birthday.<br />

Send reactions to:<br />

comment@businessdayonline.com<br />

EMMANUEL UNAEGBU<br />

Unaegbu, an Environmental Protection<br />

and Sustainable Energy Expert, works<br />

with CLIMATTERS and writes from Abuja.<br />

He Tweets @emmalysis<br />

Coal as a natural resource<br />

may havebeen the pillar<br />

upon which many countries<br />

generated wealthbut<br />

that was fifty years and not without<br />

consequences.Importantly, the use of<br />

coal for power was based on the level<br />

of knowledge at the time. As has been<br />

established beyond doubt, coal is the<br />

dirtiest of the fossil fuels. And it is not<br />

cheap as is usually described. The<br />

aftermath costs are often irreparable.<br />

The entire process from mining<br />

to coal cleaning, transportation to<br />

electricity generation and waste disposal,<br />

coal releases numerous toxic<br />

pollutants into the air, water and land.<br />

In a 2001 publication titled “cradle to<br />

the grave: the environmental impacts<br />

from coal” the author posited that coal<br />

causes cancer, damages the nervous<br />

and immune systems, and impedes<br />

reproduction and development. The<br />

Coal mines and a distorted future for host communities<br />

publication was based on evidence<br />

from coal mining sites and coal power<br />

plants in the United States. In essence,<br />

even with all the technical knowhow<br />

and efficient medical facilities coal<br />

processing portends ahealth threat.<br />

In fact, new conventional coal plants<br />

are described as “imprudent financial<br />

investments.”<br />

Few years after Nigeria’s renewed<br />

push for coal power development(a<br />

decision that takes Nigeria back to<br />

1906 when coal was first discovered<br />

in the country), it seems we are already<br />

witnessing the destructive and<br />

life threating impacts of coal mining<br />

inOkobo, Kogi state and Maiganga,<br />

Gombe state.<br />

According to Global Rights (a<br />

Nigerian NGO that advocates for<br />

sustainable justice), coal mining in<br />

these locations is by surface mining<br />

otherwise called opencast mining.<br />

This method of mining requires large<br />

expanse on land with the overlaying<br />

soil covering removed using explosives<br />

and heavy duty machinery.<br />

These sites form craters that scar the<br />

landscape irreparably, destroying entire<br />

ecosystem of plants and animals.<br />

Weathering and leaching of the host<br />

rock result in heavy metals dissolving<br />

into nearby water bodies making<br />

them highly toxic and acidic.<br />

It is more worrying considering<br />

that these mines are only a few years<br />

old. For example, the Okobo site is 6<br />

years old while in Maiganga, mining<br />

activities started in 2007.If current<br />

poor mining practices continue, these<br />

areas will be ruined beyond any use.<br />

Global Rights in the report titled<br />

“power at all cost: the opportunity cost”<br />

which was unveiled to the public on<br />

January 11, <strong>2018</strong> stated that in Maiganga,<br />

dust, smoke and fire are a normal. The<br />

inhalation of the hazardous coal dust<br />

and smoke from spontaneous combustion<br />

of coal in the mining site disrupts<br />

ambient air quality, causing respiratory<br />

diseases. This is exacerbated by the proximity<br />

of the community to the mine site.<br />

The community people say they<br />

have witnessed increased number of<br />

miscarriages in both humans and domestic<br />

animals since mining operations<br />

began. Thus to avoid being victims,<br />

pregnant women leave the community<br />

for some distant community until they<br />

put to bed. Child development defects<br />

have also be recorded. In particular is a<br />

4 years old girl, Bibi Saidu who suffers<br />

partial paralysis. The doctors diagnosed<br />

that her health condition is as a direct<br />

effect of consuming nitrate polluted<br />

water which comes from the on-going<br />

mining activities in Maiganga. Now, she<br />

can only move and play with one side<br />

of her body.<br />

Other predominant health complaints<br />

are gastrointestinal disease<br />

like unexplainable stomach ache,<br />

typhoid and appendicitis; ocular irritation<br />

and; blood urine especially<br />

during dry season.<br />

Beyond the health challenges, the<br />

community has also had to endure violent<br />

suppression. In March 2014, follow-<br />

march to greatness in her own right in<br />

addition to her devotion to the sustenance<br />

and reinforcement of the legend<br />

and legacy of her father and mother.<br />

In this endeavour, she has the benefit<br />

of the support of her only surviving<br />

sibling – Rev. (Mrs.) Tola Oyediran.<br />

Tokunbo deserves kudos for the resilience<br />

she has demonstrated in coping<br />

with the travails of the Awolowo family<br />

together with the triumphs. She is<br />

manifestly endowed with robust shock<br />

absorbers. At a very tender age, she<br />

went through the trauma of witnessing<br />

her beloved father in the dock for<br />

“treasonable felony”. The tragedy was<br />

further compounded by the betrayal<br />

and treachery of former allies particularly<br />

the son of a long standing family<br />

friend (Dr. Ladipo Maja) who turned<br />

out to be the “prosecution witness”.<br />

In politics, she has played her cards<br />

close to her chest, ever ready to welcome<br />

whoever wants to pay homage to<br />

the late sage and supplicate the blessings<br />

of the Awolowo family. Indeed, she<br />

has restrained herself through reticence<br />

and circumspection from venturing<br />

into the vortex of controversy in the<br />

affairs of our nation. Not for her the<br />

temptation to throw her hat into the ring<br />

as a potential first female President or<br />

Vice-President of Nigeria.<br />

She is of course entitled to conclude<br />

that the family has already over-sacrificed<br />

and overinvested in the pursuit<br />

of a vision which has been thoroughly<br />

savaged, bastardised, frustrated and<br />

compromised.<br />

At the age of 70, she is welcome to<br />

reflect on how her father gravitated<br />

from being the humble, assiduous and<br />

committed secretary of “Egbe Omo<br />

Oduduwa” (a Yoruba Cultural Organisation)<br />

with its secretariat at 51, Messina<br />

Avenue, West Hampstead, London (the<br />

home of Dr. Oni Akerele who was the<br />

President) to becoming the leader of<br />

the same group which had transformed<br />

from being a cultural organisation into<br />

the Action Group, as a fully-fledged<br />

political party in Nigeria. He did it by a<br />

combination of zeal, dedication, doging<br />

their frustration, the community<br />

staged a peaceful protest to the company.<br />

In response, the company used<br />

mobile police men to disperse the<br />

people with teargas. Several members<br />

of the community were later arrested,<br />

detained for a whole week without<br />

charges and were released with strict<br />

warning never to repeat same.<br />

Unfortunately, the people of<br />

Maiganga consented to the establishment<br />

of the mine but did so from<br />

an uninformed position. While the<br />

ECOWAS mining directive to which<br />

Nigeria is a signatory clearly proscribes<br />

‘Free, Prior and Informed<br />

Consent’, it was not the case for the<br />

people of Maiganga. In fact, they were<br />

not involved in the environmental impact<br />

assessment process. Till this day,<br />

a community development agreement<br />

which is a requisite has not been<br />

signed. Instead they were verbally<br />

promised schools, water boreholes,<br />

hospitals and jobs. So, they danced<br />

at the opportunity. But 10 years on, it<br />

is pain, tears and sorrow.<br />

These many troubles for the community<br />

has led to mistrust of the<br />

mining company and a feeling of<br />

abandonment by the government at<br />

both the state and federal levels.<br />

It leaves the querying mind with<br />

questions. Why will the company<br />

(with international repute) act with<br />

such irresponsibility? But even if the<br />

company has decided to be irresponsible,<br />

don’t our officials have a duty?<br />

Is it that there are no standards? It<br />

is that they don’t understand their<br />

mandated function of ensuring that<br />

mining operations are conducted in<br />

a manner that protects the environment<br />

and host communities?<br />

One thing is clear though, the<br />

Federal Ministry of Mines and Steel<br />

Development saddled with this responsibility<br />

have to wake up. Enough of<br />

the slumber; lifestyle, livelihoods and<br />

living conditions are being disrupted<br />

on a daily basis from coal mining.<br />

It is recommended that:<br />

• Government should as a matter of<br />

priority reevaluate its position on coal<br />

power generation. Beyond sending<br />

us hundred years behind, there are<br />

existential threats to human health as<br />

well as environmental cost.<br />

• Government should urgently<br />

investigate the human rights violation<br />

in coal mining communities and sanction<br />

offenders to forestall reoccurrence.<br />

• Operational mining companies<br />

should be made to deposit a determined<br />

clean-up amount which will<br />

be used to remediate the mining site<br />

as nature will have it.<br />

Finally, we have to ask the hard<br />

question. Do we really need coal power<br />

to develop? If there is any iota of doubt,<br />

then it is important we leave coal in<br />

the ground.<br />

Our future is at stake. We have the<br />

sun, water and natural gas. We cannot<br />

gamble with coal.<br />

Send reactions to:<br />

comment@businessdayonline.com

Monday <strong>26</strong> <strong>Feb</strong>ruary <strong>2018</strong><br />

COMMENT<br />

DAN STEINBOCK<br />

Dr Dan Steinbock is the founder of<br />

Difference Group and has served as<br />

research director at the India, China<br />

and America Institute (USA) and visiting<br />

fellow at the Shanghai Institutes for<br />

International Studies (China) and the<br />

EU Center (Singapore). For more, see<br />

https://www.differencegroup.net/<br />

To avoid cost overruns,<br />

South Korea’s<br />

<strong>2018</strong> Winter Games<br />

was located in Pyeongchang,<br />

the smallest<br />

city to host the Olympics<br />

since Lillehammer 1994 in<br />

Norway. Nevertheless, South<br />

Korea is expected to spend $13<br />

billion on the games; nearly<br />

double the $7 billion originally<br />

projected, which has again<br />

ignited public debate about<br />

Olympic cost overruns.<br />

In 2022, Beijing will become<br />

the first city to host<br />

both Winter and Summer<br />

Olympics. Can the costs be<br />

contained?<br />

C002D5556<br />

In the Cost-Control Scenario, a track-record<br />

of successful planning, rigorous cost-control<br />

and ability to repurpose the Olympic facilities<br />

will play the key role<br />

BUSINESS DAY<br />

11<br />

comment is free<br />

Send 800word comments to comment@businessdayonline.com<br />

Ensuring Olympic success – after the games<br />

Rising economic costs<br />

Hefty price tags and cost overruns<br />

have become all too common<br />

in Olympic Games. The<br />

$15 billion costs of London<br />

2012 Summer Olympics (76%<br />

cost overruns) and the $22<br />

billion Sochi Winter Olympics<br />

(289% cost overrun) contributed<br />

to heavy indebtedness<br />

in the pre-Brexit UK and economic<br />

erosion in Russia.<br />

In Brazil 2016, costs were<br />

projected to be less than $5<br />

billion, yet reportedly more<br />

than doubled amid economic,<br />

political and security challenges.<br />

Moreover, the Olympic<br />

building frenzy has left too<br />

many cities with decaying<br />

stadiums and empty transit<br />

systems, as evidenced by<br />

Athens’s dilapidated venues<br />

and $11 billion in debt that<br />

contributed to the Greek<br />

debt crisis; and the recession<br />

that swept Nagano, Japan,<br />

after the 1998 Winter<br />

Olympics.<br />

Nevertheless, there are<br />

positive examples as well. In<br />

the Los Angeles 1984 Summer<br />

Olympics, budget awareness<br />

showed that the games can<br />

generate actual profit. Moreover,<br />

in summer games, only<br />

few hosts - including Beijing<br />

in 2008 – have managed to<br />

keep cost overruns reasonable.<br />

In the 2022 Winter Olympics,<br />

the estimated budget<br />

in Beijing will be $3.9 billion,<br />

less than one-tenth of<br />

the 2008 Summer Olympics<br />

financing. That illustrates the<br />

new objectives.<br />

Preconditions for success<br />

Cost control is the first economic<br />

precondition for Olympic<br />

success. In 1984, the L.A.<br />

Summer Olympics committee<br />

rejected the idea of new sporting<br />

structures and focused<br />

on modified and upgraded<br />

existing venues. Other success<br />

stories involve new structures<br />

that have been repurposed after<br />

the Olympics.<br />

The second precondition<br />

is environmental sustainability.<br />

In 2014, the International<br />

Olympic Committee (IOC) introduced<br />

the Olympic Agenda<br />

2020, which promotes sustainability<br />

and cost control to<br />

control economic and environmental<br />

damage. The quest<br />

for sustainability requires new<br />

competition venues to be built<br />

with renewable technologies,<br />

as well as energy saving and<br />

environmentally-friendly materials.<br />

The third precondition rests<br />

on successful media deals to<br />

finance the games. In 1984, the<br />

L.A. Olympics sought to make<br />

the games a global TV event;<br />

an objective that was supported<br />

not just by Hollywood<br />

and the industry mecca, but<br />

efforts to sprinkle more than<br />

40 venues throughout almost<br />

500 square kilometres. It was<br />

Olympic branding that fostered<br />

continuity across very different<br />

locations.<br />

Fourth, to promote sports<br />

economy, China is rolling out a<br />

national campaign to encourage<br />

300 million people to participate<br />

in winter sports by 2022. The ven-<br />

ues will be distributed in three<br />

zones which will foster winter<br />

sports in and around Beijing<br />

after the Olympics. If successful,<br />

this would be an important<br />

investment in long-term human<br />

capital: “Healthy mind in<br />

a healthy body,” as educators<br />

put it.<br />

Fifth, Olympics can provide<br />

critical “seed funding”<br />

to local tourism in need for<br />

sustained investment. Even<br />

though Brazil’s Olympics suffered<br />

from cost overruns, it<br />

did attract a record 6.6 million<br />

international tourists. To<br />

avoid waste of resources, local<br />

governments and property<br />

developers should consider<br />

a sustained focus on local<br />

tourism and infrastructure,<br />

accommodations and environmental<br />

protection.<br />

The final precondition involves<br />

a lasting legacy. Under<br />

a 1979 agreement, 40 percent<br />

of the surplus created in the<br />

1984 L.A. Olympics would stay<br />

in Southern California. As the<br />

surplus amounted to $233 million,<br />

the local share was $93<br />

million. Thanks to the great<br />

seed fund for the future, the<br />

LA84 Foundation has awarded<br />

more than $230 million in<br />

grants to youth organizations<br />

ever since 1984.<br />

Olympic scenarios for the<br />

future<br />

In the future, the probable<br />

scenarios for Olympic Games<br />

include three basic trajectories.<br />

In the Dead-End Scenario,<br />

the Olympics will continue as<br />

before in which case the historical<br />

pattern of soaring costs<br />

and cost overruns are likely to<br />

contribute to major economic<br />

losses, social divides and environmental<br />

damage.<br />

In the Cost-Control Scenario,<br />

a track-record of successful<br />

planning, rigorous cost-control<br />

and ability to repurpose the<br />

Olympic facilities will play the<br />

key role. Despite noble goals,<br />

Pyeongchang <strong>2018</strong> failed to<br />

achieve such cost-consciousness.<br />

Beijing 2022 seeks success<br />

in such efforts.<br />

The Regional Scenario<br />

could be an option for smaller<br />

emerging economies. Today,<br />

Olympics take place in several<br />

cities but one country. Why<br />

not organize the games in<br />

multiple cities across borders?<br />

If countries seek scale economies<br />

through regional trade<br />

agreements, why couldn’t they<br />

celebrate sports regionally as<br />

well?<br />

It is not the size of the stadium<br />

that matters but the<br />

audacity of our dreams in our<br />

quest for excellence.<br />

* The original, slightly shorter<br />

commentary was published by<br />

China Daily on <strong>Feb</strong>ruary 22,<br />

<strong>2018</strong><br />

Send reactions to:<br />

comment@businessdayonline.com<br />

BISI ADEYEMI<br />

Adeyemi is managing director, DCSL<br />

Corporate Services Limited<br />

badeyemi@dcsl.com.ng<br />

The effective director: Personal attributes<br />

It is acknowledged that the<br />

office of a Director is a “high<br />

calling”. It is oftentimes challenging<br />

and requires of the<br />

individual certain attributes to<br />

achieve effectiveness. Whilst each<br />

Board has its own peculiarities,<br />

being possessed of certain attributes<br />

will contribute to the<br />

effectiveness of a Director and<br />

by extension the effectiveness<br />

of the Board. These include the<br />

following:<br />

Strong Interpersonal and Communications<br />

Skills: This key attribute<br />

is relevant in and out of the<br />

Boardroom. An effective Director<br />

should be able to relate well with<br />

his/her peers, be approachable<br />

and communicate clearly. Striking<br />

an appropriate balance between<br />

talking too much and too little at<br />

Board meetings is also critical to<br />

achieving effectiveness. An effective<br />

Director will be able to clearly<br />

articulate the key issues and provide<br />

critical insight. He will speak<br />

to the issues before the Board<br />

rather than attack the persons<br />

involved. Furthermore, whilst Executive<br />

Directors are required to<br />

engage with third parties as part<br />

of their day job, Non-Executive<br />

Directors will occasionally have<br />

to represent the company at meetings<br />

and in discussions with third<br />

parties including the media. Thus<br />

the ability to clearly articulate the<br />

Company’s position even at short<br />

notice is desirable.<br />

Independent Judgement:<br />

Managers are expected to be<br />

“team-players” and sometimes<br />

get knocked when they criticize<br />

a decision made by their peers or<br />

superiors. However, the Director’s<br />

role (whether as an Executive or<br />

Non-Executive) is to take a step<br />

back and critically assess the<br />

motivation and consequences of<br />

a decision, and where necessary,<br />

put forward a reasoned view –<br />

even if it is unpopular. A Director<br />

is expected to apply independent<br />

judgement to all issues before the<br />

Board. This requires the Director<br />

putting the overall interest of the<br />

Company at the forefront. Directors<br />

for the most part, find themselves<br />

being swayed by narrow or<br />

short-term considerations when<br />

faced with certain decisions. An<br />

independent mindset will enable<br />

the Director take a stand when<br />

he/she is of the view that the<br />

company’s long term future is not<br />

being prioritized, no matter the<br />

consequences.<br />

Analytical: Directors are often<br />

presented with problems that<br />

have a number of potential solu-<br />

tions, and the ability to analyze, sift<br />

through data and make sense of it to<br />

find the appropriate solution is an<br />

invaluable personality trait.<br />

Not Sweating the Small Things:<br />

Strategic thinking is a key attribute<br />

of an effective Director as Directors<br />

are not expected to waste time and<br />

effort on the small stuff. Sometimes<br />

in a bid to demonstrate their<br />

competence and area of expertise<br />

(show off) they tend to distract<br />

the Board’s attention and dwell<br />

on less critical issues. The ability<br />

to stay focused on those matters<br />

strictly within the Board’s purview<br />

is a desirable attribute. For<br />

Non-Executive Directors, this also<br />

means respecting the professional<br />

and technical competencies of the<br />

Executive Directors and not seeking<br />

to micro-manage.<br />

Staying Power: Companies are<br />

bound to face pressure from regulators,<br />

short-term focused shareholders,<br />

the media and competition,<br />

particularly during periods of<br />

perceived poor performance, or<br />

significant structural changes. An<br />

effective Director should have the<br />

strength of character to stay calm in<br />

the face of pressure to provide the<br />

much needed stability to the Board<br />

and the Company.<br />

Respect for Alternative Viewpoints:<br />

There are “many ways<br />

to skin a cat” or execute a given<br />

strategy. At the height of Board effectiveness<br />

is diversity of skill set,<br />

experience and perspectives. A<br />

Director should recognize that the<br />

overall interest of the organization<br />

will be better served if multiple<br />

perspectives are considered before<br />

arriving at a decision on any<br />

issue before the Board. The Director<br />

should not attempt to force<br />

his/her viewpoint on the Board on<br />

the oft wrong assumption that it is<br />

the way to go. This also requires<br />

appropriate listening skills – a<br />

sincere attempt to actually “hear”<br />

what another Director has to say<br />

as opposed to waiting to counter<br />

that position.<br />

Integrity: A significant attribute<br />

of an effective Director is integrity.<br />

Integrity connotes sound ethical<br />

values, transparency, accountability,<br />

consistency, commitment<br />

and courage to set an appropriate<br />

“tone at the top”. Transparency<br />

and accountability that ensure<br />

all actions pass the test of public<br />

scrutiny. Enough time and attention<br />

committed to making a good<br />

job of it and courage to ask the<br />

right questions – or to walk away<br />

if that becomes necessary.<br />

In addition to personal attributes,<br />

certain experiential factors<br />

also contribute to the effectiveness<br />

of a Director. These include:<br />

International Exposure: Companies<br />

have embraced regional<br />

and global expansion which come<br />

with unique challenges. A Director<br />

that brings to the Board an<br />

international perspective and<br />

exposure to global benchmarks is<br />

an asset to the Board. An effective<br />

Director is one who keeps abreast<br />

of global issues that would have<br />

direct or remote implications for<br />

the business.<br />

Industry Expertise: The Board<br />

is enriched by a Director that<br />

can contribute knowledge of the<br />

particular industry when evaluating<br />

issues and decisions before<br />

the Board. This need not be the<br />

industry in which the Company is<br />

operating as expertise in a sector<br />

in which the Company necessarily<br />

interfaces with is always desirable.<br />

Financial Knowledge: Whilst<br />

not required to be a financial expert<br />

or an Accountant, the ability<br />

to interpret financial reports and<br />

evaluate the financial implications<br />

of an action or decision is definitely<br />

an advantage. Directors should<br />

not shy away from seeking help in<br />

this regard.<br />

Bringing it all together, it is<br />

important for Directors to always<br />

be reminded that the leadership<br />

and direction they provide to the<br />

enterprise is invaluable and it behooves<br />

upon them to continuously<br />

self-develop to ensure impactful<br />

stewardship.<br />

Bisi Adeyemi is the Managing<br />

Director of DCSL Corporate<br />

Services Limited. Kindly send reactions<br />

and comments to badeyemi@dcsl.com.ng<br />

Send reactions to:<br />

comment@businessdayonline.com

12 BUSINESS DAY C002D5556 Monday <strong>26</strong> <strong>Feb</strong>ruary <strong>2018</strong><br />

EDITORIAL<br />

PUBLISHER/CEO<br />

Frank Aigbogun<br />

EDITOR-IN-CHIEF<br />

Prof. Onwuchekwa Jemie<br />

EDITOR<br />

Anthony Osae-Brown<br />

DEPUTY EDITORS<br />

John Osadolor, Abuja<br />

Bill Okonedo<br />

NEWS EDITOR<br />

Patrick Atuanya<br />

EXECUTIVE DIRECTOR,<br />

SALES AND MARKETING<br />

Kola Garuba<br />

EXECUTIVE DIRECTOR, OPERATIONS<br />

Fabian Akagha<br />

EXECUTIVE DIRECTOR, DIGITAL SERVICES<br />

Oghenevwoke Ighure<br />

ADVERT MANAGER<br />

Adeola Ajewole<br />

MANAGER, SYSTEMS & CONTROL<br />

Emeka Ifeanyi<br />

HEAD OF SALES, CONFERENCES<br />

Rerhe Idonije<br />

SUBSCRIPTIONS MANAGER<br />

Patrick Ijegbai<br />

CIRCULATION MANAGER<br />

John Okpaire<br />

GM, BUSINESS DEVELOPMENT (North)<br />

Bashir Ibrahim Hassan<br />

GM, BUSINESS DEVELOPMENT (South)<br />

Ignatius Chukwu<br />

HEAD, HUMAN RESOURCES<br />

Adeola Obisesan<br />

EDITORIAL ADVISORY BOARD<br />

Dick Kramer - Chairman<br />

Imo Itsueli<br />

Mohammed Hayatudeen<br />

Albert Alos<br />

Funke Osibodu<br />

Afolabi Oladele<br />

Dayo Lawuyi<br />

Vincent Maduka<br />

Wole Obayomi<br />

Maneesh Garg<br />

Keith Richards<br />

Opeyemi Agbaje<br />

Amina Oyagbola<br />

Bolanle Onagoruwa<br />

Fola Laoye<br />

Chuka Mordi<br />

Sim Shagaya<br />

Mezuo Nwuneli<br />

Emeka Emuwa<br />

Charles Anudu<br />

Tunji Adegbesan<br />

Eyo Ekpo<br />

ENQUIRIES<br />

NEWS ROOM<br />

08022238495<br />

08034009034}Lagos<br />

08033160837 Abuja<br />

ADVERTISING<br />

01-2799110<br />

08116759801<br />

08082496194<br />

Sabotaging the war against corruption<br />

The recall of the<br />

Executive Secretary<br />

of the National<br />

Health Insurance<br />

Scheme,<br />