Wacker 2018 Benefits Guide_Non-Union_FINAL

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Spousal Surcharge Program<br />

If your spouse works for a company other than <strong>Wacker</strong> Neuson Corporation, including self-employment, and has medical<br />

coverage available through his/her employer, your spouse must enroll in his/her employer’s medical plan.<br />

You may cover your spouse through the <strong>Wacker</strong> Neuson plan with secondary coverage. However, you will be subject to paying<br />

an additional $125/month payroll deduction.<br />

For information on spouse eligibility, refer to page 3 of the <strong>2018</strong> <strong>Benefits</strong> <strong>Guide</strong>.<br />

Spousal Surcharge FAQs<br />

Can I apply for a Waiver?<br />

Yes, if you qualify. First, fill out the Spousal Surcharge questionnaire when applying for medical coverage online. Next, download<br />

and complete the Waiver form from the enrollment system’s Forms Library. Waivers need to be completed annually.<br />

When does the additional cost (i.e. surcharge) apply to my<br />

payroll deductions?<br />

The additional cost applies when your spouse is enrolled in his/<br />

her company’s medical plan for less than 50% of the cost of single<br />

coverage. If you cover your spouse under the medical plan and<br />

you do not provide an approved <strong>2018</strong> Spousal Surcharge Waiver<br />

form, you will automatically be charged the spousal surcharge.<br />

Does the surcharge apply to the dental plan?<br />

No. The surcharge only applies to <strong>Wacker</strong> Neuson’s Medical plan<br />

as a means to level the playing field in which each employer pays<br />

its fair share for health benefits.<br />

What happens if my spouse loses his/her job, decides to not<br />

work or moves to part-time employment and is no longer<br />

eligible for coverage with his/her employer?<br />

A change in your spouse’s employment status (termination,<br />

change in hours or beginning new employment) qualifies as a<br />

change in life status. This allows you to change your benefit<br />

elections during the plan year to avoid a gap in coverage.<br />

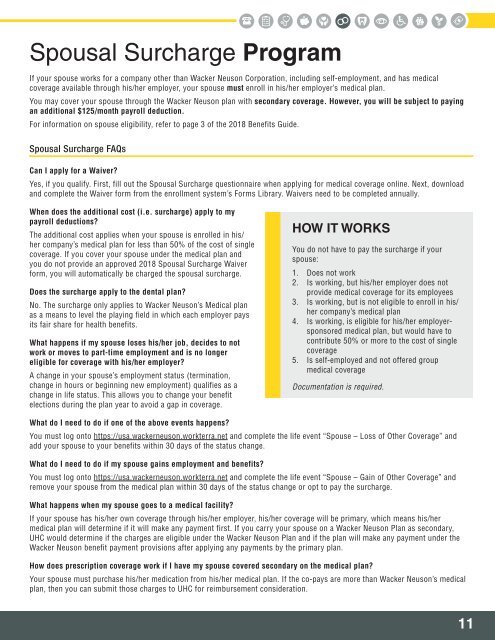

HOW IT WORKS<br />

You do not have to pay the surcharge if your<br />

spouse:<br />

1. Does not work<br />

2. Is working, but his/her employer does not<br />

provide medical coverage for its employees<br />

3. Is working, but is not eligible to enroll in his/<br />

her company’s medical plan<br />

4. Is working, is eligible for his/her employersponsored<br />

medical plan, but would have to<br />

contribute 50% or more to the cost of single<br />

coverage<br />

5. Is self-employed and not offered group<br />

medical coverage<br />

Documentation is required.<br />

What do I need to do if one of the above events happens?<br />

You must log onto https://usa.wackerneuson.workterra.net and complete the life event “Spouse – Loss of Other Coverage” and<br />

add your spouse to your benefits within 30 days of the status change.<br />

What do I need to do if my spouse gains employment and benefits?<br />

You must log onto https://usa.wackerneuson.workterra.net and complete the life event “Spouse – Gain of Other Coverage” and<br />

remove your spouse from the medical plan within 30 days of the status change or opt to pay the surcharge.<br />

What happens when my spouse goes to a medical facility?<br />

If your spouse has his/her own coverage through his/her employer, his/her coverage will be primary, which means his/her<br />

medical plan will determine if it will make any payment first. If you carry your spouse on a <strong>Wacker</strong> Neuson Plan as secondary,<br />

UHC would determine if the charges are eligible under the <strong>Wacker</strong> Neuson Plan and if the plan will make any payment under the<br />

<strong>Wacker</strong> Neuson benefit payment provisions after applying any payments by the primary plan.<br />

How does prescription coverage work if I have my spouse covered secondary on the medical plan?<br />

Your spouse must purchase his/her medication from his/her medical plan. If the co-pays are more than <strong>Wacker</strong> Neuson’s medical<br />

plan, then you can submit those charges to UHC for reimbursement consideration.<br />

11