BBInsurance-2017-Annual-Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Management’s Discussion and Analysis<br />

of Financial Condition and Results of Operations<br />

Our cash and cash equivalents of $515.6 million at December 31, 2016 reflected an increase of $72.2 million from the<br />

$443.4 million balance at December 31, 2015. During 2016, $411.0 million of cash was generated from operating activities.<br />

During this period, $122.6 million of cash was used for acquisitions, $28.2 million was used for acquisition earn-out payments,<br />

$17.8 million was used for additions to fixed assets, $70.3 million was used for payment of dividends, $7.7 million was used<br />

for share repurchases, and $73.1 million was used to pay outstanding principal balances owed on long-term debt.<br />

Our cash and cash equivalents of $443.4 million at December 31, 2015 reflected a decrease of $26.6 million from the<br />

$470.0 million balance at December 31, 2014. During 2015, $381.8 million of cash was generated from operating activities.<br />

During this period, $136.0 million of cash was used for acquisitions, $36.8 million was used for acquisition earn-out payments,<br />

$18.4 million was used for additions to fixed assets, $64.1 million was used for payment of dividends, $175.0 million was used<br />

as part of accelerated share repurchase programs, and $45.6 million was used to pay outstanding principal balances owed on<br />

long-term debt.<br />

Our ratio of current assets to current liabilities (the “current ratio”) was 1.13 and 1.20 at December 31, <strong>2017</strong> and 2016,<br />

respectively.<br />

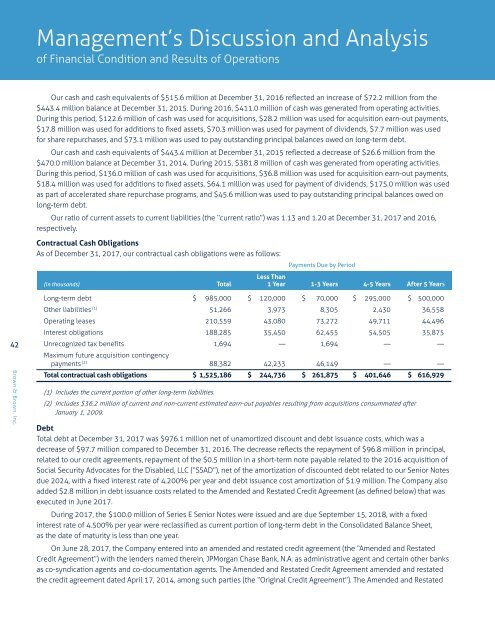

Contractual Cash Obligations<br />

As of December 31, <strong>2017</strong>, our contractual cash obligations were as follows:<br />

Payments Due by Period<br />

Less Than<br />

(in thousands) Total 1 Year 1-3 Years 4-5 Years After 5 Years<br />

42<br />

Brown & Brown, Inc.<br />

Long-term debt $ 985,000 $ 120,000 $ 70,000 $ 295,000 $ 500,000<br />

Other liabilities (1) 51,266 3,973 8,305 2,430 36,558<br />

Operating leases 210,559 43,080 73,272 49,711 44,496<br />

Interest obligations 188,285 35,450 62,455 54,505 35,875<br />

Unrecognized tax benefits 1,694 — 1,694 — —<br />

Maximum future acquisition contingency<br />

payments (2) 88,382 42,233 46,149 — —<br />

Total contractual cash obligations $ 1,525,186 $ 244,736 $ 261,875 $ 401,646 $ 616,929<br />

(1) Includes the current portion of other long-term liabilities.<br />

(2) Includes $36.2 million of current and non-current estimated earn-out payables resulting from acquisitions consummated after<br />

January 1, 2009.<br />

Debt<br />

Total debt at December 31, <strong>2017</strong> was $976.1 million net of unamortized discount and debt issuance costs, which was a<br />

decrease of $97.7 million compared to December 31, 2016. The decrease reflects the repayment of $96.8 million in principal,<br />

related to our credit agreements, repayment of the $0.5 million in a short-term note payable related to the 2016 acquisition of<br />

Social Security Advocates for the Disabled, LLC (“SSAD”), net of the amortization of discounted debt related to our Senior Notes<br />

due 2024, with a fixed interest rate of 4.200% per year and debt issuance cost amortization of $1.9 million. The Company also<br />

added $2.8 million in debt issuance costs related to the Amended and Restated Credit Agreement (as defined below) that was<br />

executed in June <strong>2017</strong>.<br />

During <strong>2017</strong>, the $100.0 million of Series E Senior Notes were issued and are due September 15, 2018, with a fixed<br />

interest rate of 4.500% per year were reclassified as current portion of long-term debt in the Consolidated Balance Sheet,<br />

as the date of maturity is less than one year.<br />

On June 28, <strong>2017</strong>, the Company entered into an amended and restated credit agreement (the “Amended and Restated<br />

Credit Agreement”) with the lenders named therein, JPMorgan Chase Bank, N.A. as administrative agent and certain other banks<br />

as co-syndication agents and co-documentation agents. The Amended and Restated Credit Agreement amended and restated<br />

the credit agreement dated April 17, 2014, among such parties (the “Original Credit Agreement”). The Amended and Restated