Jeweller - April Issue 2018

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

VOICE OF THE AUSTRALIAN JEWELLERY INDUSTRY<br />

APRIL <strong>2018</strong><br />

It’s time<br />

THE LATEST FASHION WATCH<br />

TRENDS ARE TAKING CENTRE STAGE<br />

Colour me<br />

+ +<br />

COLOURED DIAMONDS<br />

ARE A RETAILER’S DREAM<br />

Charmed life<br />

WHY CHARMS ARE MORE<br />

THAN JUST A PASSING FAD

Seeing is<br />

believing<br />

Personally select<br />

from thousands of<br />

stunning pieces,<br />

just right for your<br />

business.<br />

Meet skilled<br />

craftspeople and<br />

be inspired by their<br />

commitment to<br />

quality and design.<br />

See the latest<br />

fashions and dazzle<br />

your competitors as<br />

you stay ahead<br />

of trends.<br />

pms 2935 C<br />

pms 2935 C<br />

Organised by<br />

August 25 > 27, <strong>2018</strong><br />

ICC Sydney<br />

Exhibition Centre<br />

Darling Harbour

WORLD SHINER PTY LTD<br />

Inspired Performance. Year After Year...<br />

WORLD SHINER<br />

World Shiner proudly introduces Argyle Pink Diamonds<br />

NEW SOUTH WALES Suite 301, Level 3, 70 Castlereagh Street, Sydney 2000, P: 02 9232 3557, E: sydney@worldshiner.com<br />

VICTORIA Suite 502, Wales Corner, 227 Collins Street, Melbourne 3000, P: 03 9654 6369, E: melbourne@worldshiner.com<br />

QUEENSLAND Unit 17, Level 11, 138 Albert Street, Brisbane 4000, P: 07 3210 1237 E: brisbane@worldshiner.com<br />

NEW ZEALAND Suite 4K, 47 High Street, Auckland P: 09 358 3443 E: nz@worldshiner.com<br />

WWW.WORLDSHINER.COM<br />

• AUSTRALIA • BELGIUM • CANADA • GERMANY • INDIA • JAPAN • SPAIN • TAIWAN • UNITED KINGDOM • USA • NEW ZEALAND

One of<br />

ASIA’S<br />

TOP THREE<br />

Fine <strong>Jeweller</strong>y Events<br />

JUNE<br />

Hong Kong <strong>Jeweller</strong>y & Gem Fair<br />

21 – 24 June <strong>2018</strong><br />

Hong Kong Convention & Exhibition Centre<br />

UBM Asia Ltd<br />

Tel : (852) 2585 6127<br />

Fax : (852) 3749 7344<br />

Email : visitjgf-hk@ubm.com<br />

www.<strong>Jeweller</strong>yNet.com

THE LATEST FASHION WATCH<br />

TRENDS ARE TAKING CENTRE STAGE<br />

VOICE OF THE AUSTRALIAN JEWELLERY INDUSTRY<br />

COLOURED DIAMONDS<br />

ARE A RETAILER’S DREAM<br />

APRIL <strong>2018</strong><br />

WHY CHARMS ARE MORE<br />

THAN JUST A PASSING FAD<br />

CONTENTS<br />

APRIL <strong>2018</strong><br />

15/<br />

21/<br />

26/<br />

FEATURES REGULARS BUSINESS<br />

15/ WATCH OUT<br />

<strong>Jeweller</strong>’s latest insight into the<br />

enduring fashion watch category.<br />

21/ COLOURED AFFAIR<br />

It’s time to take advantage of<br />

coloured diamond sales.<br />

24/ WATCH FAIR<br />

Watch connoisseur Martin Foster<br />

explains why luxury watch fairs are<br />

reassuring the industry.<br />

26/ A REAL CHARMER<br />

Why charms present untapped<br />

opportunities for retailers.<br />

7/ Editorial<br />

8/ Upfront<br />

9/ News<br />

29/ Gems<br />

Colour investigation: ruby<br />

37/ My Store<br />

Be inspired by the most unique<br />

store layouts around.<br />

38/ 10 Years Ago<br />

39/ Calendar<br />

40/ My Bench<br />

42/ Soapbox<br />

Coloured gemstones are seriously<br />

underrated, Charles Lawson declares.<br />

31/ Business feature<br />

Francesca Nicasio discusses how<br />

to boost customers through instore<br />

experiences.<br />

33/ Selling<br />

Sales can be greatly improved<br />

with technology, Gretchen<br />

Gordon notes.<br />

34/ Management<br />

Bryan Pearson lays out how<br />

to use data to boost sales.<br />

35/ Marketing<br />

Use in-store data to spot the next<br />

big trends, David Brown states.<br />

36/ Logged On<br />

Melissa Megginson describes<br />

how to use Instagram to reach<br />

more customers.<br />

It’s time<br />

Colour me<br />

+ +<br />

Charmed life<br />

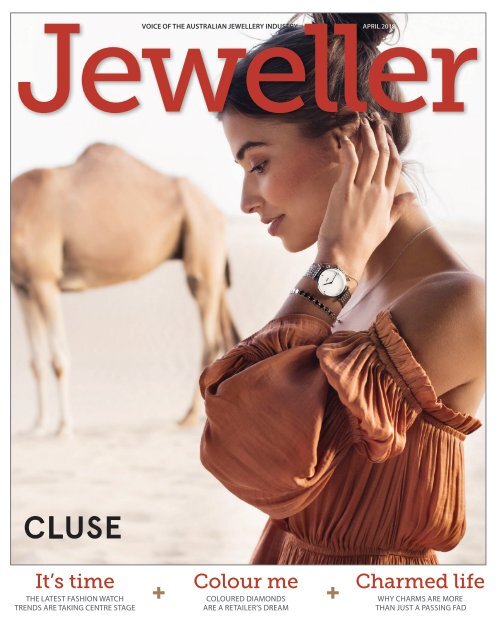

Front cover description:<br />

Cluse watches are distributed<br />

by Heart & Grace.<br />

<strong>April</strong> <strong>2018</strong> <strong>Jeweller</strong> 5

The Original customisable jewellery with interchangeable colours<br />

Mother’s Day<br />

Collection<br />

lesgeorgettes.com - Trademark, registered designs and patents pending - Copyright © <strong>2018</strong> Altesse<br />

An original creation by Altesse Paris<br />

Made in France<br />

contactaus@lesgeorgettes.com - #lesgeorgettes_byaltesse - +61 (0)2 8998 1900

EDITORIAL<br />

PAGE #1 OF GOOGLE; HOT DIGGITY DOG!<br />

You have probably received the emails<br />

yourself – you know the ones; they tell you<br />

that your business is not on the first page of<br />

a Google search or that your website “doesn’t<br />

have major keywords in your niche, which<br />

affects visibility”.<br />

If you believe these promotional emails from<br />

search-engine optimisation (SEO) businesses,<br />

you’ll soon think you have far greater<br />

problems, such as low ‘Domain Authority’ and<br />

‘Page Authority’ or, even worse, “Your website<br />

seems to be attracting traffic but this traffic is<br />

almost stagnant and limited.”<br />

Nothing worse than stagnant traffic, right!<br />

Well, actually there is because your<br />

website has now “been diagnosed with<br />

coding issues”.<br />

Of course, these SEO emails always tug at<br />

your heartstrings; they promise to put you on<br />

the first page of Google and, ideally, within<br />

the first 10 listings!<br />

“As a business owner, you might be<br />

interested to attract more visitors. So despite<br />

having a proficient website, you might be<br />

wondering why you are not able to overturn<br />

your competitors from the top search results.”<br />

the sales pitch goes.<br />

There’s no doubt that all retail businesses<br />

would love to sit at the top spot on the first<br />

page of Google but it’s not as simple as a<br />

pay-to-play solution. These spammers will<br />

claim that they will propel you to the top –<br />

for a handsome fee, of course – but can it be<br />

guaranteed and would it generate any real<br />

value to your business anyway?<br />

For example, and to stretch logic to expose<br />

silly and false claims, is there any sense or<br />

benefit in appearing on the first page of a<br />

Google search for ‘hot dog shops’ if you own<br />

a jewellery store? Of course not but let’s deal<br />

with some other issues.<br />

A recent email told me, “While doing a<br />

search, we found that Gunnamatta Media is<br />

not on the first page of Google.”<br />

Knowing that to be bullshit, I checked<br />

anyway as one should always be sceptical<br />

and check the facts. Of course what I found<br />

was the opposite of what I was told by<br />

Daniel, my international “digital marketing<br />

expert” who, by the way, operates from a<br />

personal Gmail account.<br />

Well, not only was Gunnamatta Media on<br />

the first page but it also occupied the first 30<br />

listings related to the company. So much for<br />

not being “on the first page of a Google”!<br />

I am sure that if you search your own store<br />

name it would, or at least should, appear<br />

on the first page, depending on how many<br />

jewellery stores have similar names. If it<br />

doesn’t, then adding your suburb to the<br />

search should fix the problem.<br />

You see, being on the first page is<br />

determined by keywords and how specific<br />

those terms are, such as whether they<br />

include your store name and suburb.<br />

WHAT’S THE<br />

USE OF BEING<br />

ON PAGE ONE<br />

FOR SEARCH<br />

TERMS THAT NO<br />

ONE IS USING?<br />

YOU MAY AS<br />

WELL BE ON<br />

PAGE ONE<br />

FOR ‘HOTDOG<br />

SHOPS’.<br />

Obviously, if you search ‘jewellery stores<br />

NSW’, it’s unlikely a small store would be on<br />

page one, which is dominated by the major<br />

jewellery chains. That’s because this is a broad<br />

search term and it is unlikely that any SEO<br />

service could guarantee you the first search<br />

page on such a broad criteria. Again, even if it<br />

were possible, what benefit would it be?<br />

On the other hand, if the keyword search is<br />

more specific, such as ‘diamond jewellery<br />

Melbourne’, then there’s way more value for<br />

stores to appear on page one, which is where<br />

the competition for position heats up, as<br />

does the work, effort and cost!<br />

So how do these SEO businesses claim to get<br />

you a page-one ranking? Well one way is that<br />

they rank your website for keywords that no<br />

one is searching. That’s one trick but what’s<br />

the use of being on page one for search<br />

terms that no one is using? You may as well<br />

be on page one for ‘hotdog shops’.<br />

Google searches and ranking are not only<br />

dynamic but are also unstable. You will get<br />

different results in different geographic<br />

locations because local results skew Google<br />

rankings, as do reviews.<br />

Retailers should be very cautious about<br />

SEO ‘consultants’ who make claims about<br />

getting your business onto the first page of<br />

Google searches and, even if true, is there<br />

truly any value?<br />

Coleby Nicholson<br />

Managing Editor<br />

<strong>April</strong> <strong>2018</strong> <strong>Jeweller</strong> 7

UPFRONT<br />

“I miss a lot of<br />

independent<br />

retailers in<br />

regional towns<br />

who closed. Many<br />

became not just<br />

customers, but<br />

friends.”<br />

What do you miss about the industry 10 years ago?<br />

RITA WILLIAMS,<br />

SUNSTATE JEWELLERS<br />

BULLETIN BOARD<br />

n YES, YES YES!<br />

Suppliers must be inventive to keep up<br />

with consumer’s evolving demands.<br />

Case in point: one company created<br />

a smartphone case to conceal an<br />

engagement ring and record the user’s<br />

proposal. With the trend for couples to<br />

share their proposals on social media<br />

becoming more popular, retailers would<br />

do well to think how they too can meet<br />

such demands.<br />

n PINNING IT DOWN<br />

Pinterest has revealed its top three most<br />

pinned engagement ring styles for the<br />

year so far. According to the company,<br />

moissanite gem styles are up 294 per<br />

cent, marquise diamond art deco styles<br />

have increased 173 per cent and oval<br />

engagement stones are up 125 per cent.<br />

n HEALTHY PROFITS<br />

According to a JewelerProfit.com article,<br />

keeping inventory over a year old,<br />

wrong price points, under-charging for<br />

repairs, low web traffic and poor sales<br />

staff are key reasons why retailers find<br />

themselves in financial distress. Solution:<br />

jewellers should focus on “excellent<br />

sales, good salaries and excellent cash<br />

flow,” the article states.<br />

“I miss how<br />

personal it used<br />

to be, spending<br />

time getting to<br />

know customers.<br />

Everything is so<br />

fast paced now,<br />

people don’t build<br />

a connection<br />

anymore.”<br />

JESS RICHARDS,<br />

SECRETS SHHH –<br />

CHADSTONE<br />

DIGITAL<br />

BRAINWAVE<br />

“Ten years ago, we<br />

had a very robust<br />

business. Our retail<br />

was booming and<br />

everybody was<br />

happy. When we<br />

had the election,<br />

everything<br />

changed and it<br />

became tough.”<br />

TIM HAAB, HAAB<br />

DESIGNER JEWELLERS<br />

HIT PLAY<br />

Thinking about getting into video marketing? An<br />

article by business2community offers some hefty<br />

best practice tips for retailers wanting to incorporate<br />

videos into their marketing efforts. First, it<br />

recommends to plan what is going to be said before<br />

pressing record – that means no ‘winging it’ and rambling. Instead, it advises to practice<br />

but don’t read from a script – the more conversational the tone, the better. Other top<br />

tips include creating videos that double as teaching moments, calling on consumers to<br />

take action, and ensuring all keywords – including the video title, description and tags –<br />

are catchy and natural. Time to get recording!<br />

TOP PRODUCT<br />

Dansk Smykkekunst’s ‘Tamara<br />

Orbit’ earrings feature a silverplated<br />

ball on 7cm rose goldplated<br />

copper. They are also<br />

available in haematite with a gold<br />

coloured ball, rhodium with a rose<br />

gold coloured ball, and silver with a<br />

haematite ball. They were the most<br />

popular product last month ranked<br />

by views at jewellermagazine.com.<br />

VOICE OF THE AUSTRALIAN<br />

JEWELLERY INDUSTRY<br />

jewellermagazine.com<br />

Managing Editor<br />

Coleby Nicholson<br />

Assistant Editor<br />

Alex Eugene<br />

alex.eugene@jewellermagazine.com<br />

Journalist<br />

Talia Paz<br />

talia.paz@gunnamattamedia.com<br />

Advertising Manager<br />

Gary Collins<br />

gary.collins@jewellermagazine.com<br />

Digital Manager<br />

Angela Han<br />

angela.han@gunnamattamedia.com<br />

Production Manager<br />

& Graphic Design<br />

Jo De Bono<br />

art@gunnamattamedia.com<br />

Accounts<br />

Paul Blewitt<br />

accounts@gunnamattamedia.com<br />

Subscriptions<br />

info@jewellermagazine.com<br />

<strong>Jeweller</strong> is published by:<br />

Gunnamatta Media Pty Ltd<br />

Locked Bag 26, South Melbourne,<br />

VIC 3205 AUSTRALIA<br />

ABN 64 930 790 434<br />

Phone: +61 3 9696 7200<br />

Fax: +61 3 9696 8313<br />

info@gunnamattamedia.com<br />

Copyright: All material appearing<br />

in <strong>Jeweller</strong> is subject to copyright.<br />

Reproduction in whole or in part is<br />

strictly forbidden without prior written<br />

consent of the publisher.<br />

Gunnamatta Media Pty Ltd strives to<br />

report accurately and fairly and it is<br />

our policy to correct significant errors<br />

of fact and misleading statements in<br />

the next available issue. All statements<br />

made, although based on information<br />

believed to be reliable and accurate at<br />

the time, cannot be guaranteed and<br />

no fault or liability can be accepted<br />

for error or omission. Any comment<br />

relating to subjective opinions should<br />

be addressed to the editor.<br />

Advertising: The publisher reserves<br />

the right to omit or alter any<br />

advertisement to comply with<br />

Australian law and the advertiser<br />

agrees to indemnify the publisher for<br />

all damages or liabilities arising from<br />

the published material.<br />

8 <strong>Jeweller</strong> <strong>April</strong> <strong>2018</strong>

NEWS<br />

NEWS<br />

Michael Hill closes Emma & Roe stores<br />

Michael Hill International (MHI) has<br />

announced it will close 24 of its 30 Emma &<br />

Roe stores in order to refocus the “direction”<br />

of the brand.<br />

According to the company, the 24<br />

Australian and New Zealand stores would<br />

be closed by 30 June <strong>2018</strong>. The remaining<br />

six will be repositioned to take on the<br />

demi-fine jewellery market in smaller,<br />

concentrated stores.<br />

“In January, MHI announced it had<br />

undertaken a comprehensive review of<br />

Emma & Roe to help shape the future<br />

strategic direction of the brand,” a company<br />

statement said. “The findings of this review<br />

identified a major opportunity in the demifine<br />

jewellery segment [up-market fashion<br />

jewellery] and an emergence in customer<br />

preferences towards fine fashion.<br />

“These remaining stores will be focused in a<br />

single market area, [as MHI] considers the six<br />

store footprint will provide the opportunity<br />

to iterate the new model at speed.”<br />

The statement added MHI estimated it<br />

would cost between $5.8 and $7.9 million to<br />

exit the stores.<br />

As previously reported by <strong>Jeweller</strong>, MHI will<br />

also close all of its “loss-making” stores in<br />

the US. MHI CEO Phil Taylor noted the nine<br />

US stores had “struggled” with a reported<br />

$12 million loss over the last 12 months.<br />

He said a highly competitive market,<br />

costly advertising and “significant” industry<br />

pressure aided the decision.<br />

The recent company statement added<br />

negotiations for exiting the US stores were<br />

“ongoing” and it would provide further<br />

information at a later date.<br />

MHI’s Emma & Roe range was launched<br />

in <strong>April</strong> 2014. It specialises in a range of<br />

charms, bracelets, necklaces, earrings and<br />

stackable rings. Named after Michael Hill’s<br />

daughter Emma and his wife’s maiden<br />

name Roe, the range was launched to<br />

complement MHI’s offering.<br />

‘Unicorn’ watch up for auction<br />

One of the rarest watches ever made is<br />

estimated to sell for more than CHF$3<br />

million (AU$4 m) at an upcoming<br />

international auction. According to auction<br />

house Phillips, the Rolex Cosmogaph<br />

Daytona 6265 is the only known white gold<br />

manual-winding Daytona ever produced.<br />

EMMA & ROE JEWELLERY STORES SET TO CLOSE<br />

Butterfly Silver in<br />

administration<br />

Well-known fashion jewellery chain<br />

Butterfly Silver has been placed into<br />

administration. Headquartered in<br />

Brisbane, the retail business specialises<br />

in sterling silver rings, earrings,<br />

necklaces, bangles and charms. It<br />

is understood that in mid-March<br />

it appointed P.A Lucas & Co as its<br />

administrator. Auctioneer house<br />

Hymans is handling the expressions of<br />

interest from potential buyers.<br />

Advertisements offering the business<br />

for sale have appeared in national<br />

newspapers.<br />

“This prominent and popular jewellery<br />

retailer runs from 19 outlets across the<br />

east coast of Australia, operating out of<br />

a head office and distribution centre in<br />

Brisbane,” a Hymans statement noted. “It<br />

had an annual turnover of approximately<br />

$6.5 million, with approximately<br />

$800,000 stock on hand at cost price.”<br />

It added that offers for all or individual<br />

stores would be considered, with retail<br />

outlets located throughout Queensland,<br />

New South Wales and Victoria.<br />

<strong>Jeweller</strong> contacted P.A Lucas & Co<br />

and Hymans asking why the business<br />

had been placed into administration<br />

and how many expressions of interest<br />

had been submitted. However, a<br />

response had not been received at<br />

the time of publication.<br />

Butterfly Silver managing director<br />

Michael Granshaw was also contacted<br />

for comment.<br />

Butterfly Silver was established in 2002.<br />

At the time of publication the company’s<br />

website had made no mention of being<br />

“under administration”.<br />

“Nicknamed ‘The Unicorn’ because of its<br />

elusive nature, Rolex made this extravagant<br />

Daytona in 1970 and delivered it to a<br />

German retailer,” a Phillips statement read.<br />

“Before the discovery of this piece, we<br />

believed that only stainless steel and yellow<br />

gold versions of the 6265 existed.”<br />

More than 30 of the “most sought-after”<br />

Daytonas will be on offer at Phillips’ Daytona<br />

Ultimatum auction in Geneva, Switzerland<br />

on 12 May. The headlining 6265 watch is<br />

RAREST ROLEX WATCH EVER MADE WILL AUCTION<br />

fitted with a sigma dial and white gold<br />

hour indicator, and has a crown made from<br />

stainless steel. It also features a white gold<br />

bracelet with bark finish, which was added<br />

by its current owner, Italian watch collector<br />

John Goldberger. Proceeds from the sale will<br />

go to charity Children Action.<br />

+ MORE BREAKING NEWS<br />

JEWELLERMAGAZINE.COM<br />

A BUTTERFLY SILVER PROMOTIONAL SHOT<br />

<strong>April</strong> <strong>2018</strong> <strong>Jeweller</strong> 9

NEWS<br />

IN BRIEF<br />

*<br />

GENIUS RATING<br />

A new industry report has revealed<br />

the digital strategies of high-profile<br />

jewellery and watch brands. The Digital<br />

IQ Index: Watches & <strong>Jeweller</strong>y <strong>2018</strong> report<br />

released by L2 Research, analysed the<br />

digital performance of several prominent<br />

companies including Swarovski, Pandora,<br />

Tiffany & Co and Alex and Ani. All were<br />

ranked by five digital e-commerce<br />

categories, from ‘genius’ through to<br />

‘feeble’. Tiffany & Co and Cartier were the<br />

only brands given ‘genius’ status.<br />

*<br />

INDIA EXPORTS STRONG<br />

Indian polished diamond exports went<br />

up in February, according to a Gem &<br />

<strong>Jeweller</strong>y Export Promotion Council India<br />

(GJEPC) report. The 0.5 per cent increase<br />

represented US$2.5 billion (AU$3.2 b)<br />

annually, but a 6 per cent drop in volume<br />

to 3.1 million carats. The average price<br />

of polished diamonds rose 6 per cent to<br />

US$791 (AU$1,028) per carat.<br />

*<br />

FITBIT GETS IN SHAPE<br />

A significantly cheaper Fitbit smartwatch<br />

model that “looks more like an Apple<br />

watch” has been released, a recent article<br />

by Fortune.com revealed. According<br />

to the report, the company’s first<br />

smartwatch was released in 2017, but<br />

was met with “tepid” sales figures. The<br />

revamped Fitbit design reportedly aims to<br />

appeal to more women.<br />

Alexandre Sidrov<br />

Master diamond workshop announced<br />

Sydney-based <strong>Jeweller</strong>y Institute of Australia<br />

(JIA) will host a workshop with Dutch<br />

“master setter” Alexandre Sidrov this month.<br />

Sidrov will deliver a class in micro-pave<br />

setting, and highlight methods used by<br />

the Alexandre School for Optical Diamond<br />

Setting, Belgium.<br />

“Sidrov is the pioneer in optical diamond<br />

setting. He created setting techniques that<br />

are faster, safer and more appealing, with the<br />

ability to make your own custom tools for<br />

each job,” Gabriel Owen, the founder of JIA<br />

told <strong>Jeweller</strong>.<br />

Synthetic prices on a downer<br />

According to a recent report by the Mining<br />

Journal, synthetic diamonds have decreased<br />

in price.<br />

Independent New York diamond analyst<br />

Paul Zimnisky noted that the decreasing<br />

cost of technology had contributed to<br />

the fall. “The price pressure is directly a<br />

result of supply growth leading to more<br />

price competition, especially as generic<br />

production coming out of Asia increases,”<br />

Zimnisky told <strong>Jeweller</strong>.<br />

However, this would help boost diamond<br />

quality, he said. “The result of more<br />

production facilities, and increased<br />

Million dollar fail<br />

“We are lucky here in Australia to have such<br />

a master come and visit. Usually people have<br />

to wait six months to a year for a seat at his<br />

school in Belgium,” Owen added.<br />

As previously reported by <strong>Jeweller</strong>, Owen, a<br />

jeweller and graduate of the Gemological<br />

Institute of America (GIA), founded the JIA in<br />

2017. He started the school because there<br />

were “no advanced classes for micro-pave<br />

setting and hand engraving.”<br />

Students are invited to attend either one<br />

or two week courses, beginning Monday<br />

16 <strong>April</strong>.<br />

production capacity of existing facilities, will<br />

impact both supply output and quality of<br />

output going forward, with both metrics<br />

inevitably improving.”<br />

Zimnisky added he believed “consumer<br />

sentiment towards laboratory-created<br />

diamonds is improving, as awareness and<br />

education about the product increases”.<br />

According to the report, true gem-quality,<br />

synthetic diamonds suitable for jewellery<br />

represent less than 10 per cent of global<br />

output. However, laboratories supply around<br />

99 per cent of industrial-grade diamonds for<br />

other applications.<br />

*<br />

SYNTHETIC RUBY LAYER<br />

The Gemological Institute of America<br />

(GIA) has identified two red stones as<br />

colourless natural sapphires with a<br />

synthetic ruby ‘overgrowth’. According to<br />

the GIA, the outer layers were “a cover of<br />

lab-grown stone that tinted the entire<br />

gems red.” To “the naked eye”, they had the<br />

appearance of chemically treated natural<br />

rubies, it noted. “This is not the first report<br />

of synthetic ruby overgrowth, but it marks<br />

the first time the laboratories have had<br />

them submitted for identification. The<br />

resurfacing of these vintage overgrowth<br />

synthetics shows that once a material is in<br />

the trade, it is here to stay,” the GIA added.<br />

+ MORE BREAKING NEWS<br />

JEWELLERMAGAZINE.COM<br />

The National Museum of Prague has<br />

discovered that some of its diamonds,<br />

sapphires and rubies are “fakes”. According<br />

to reports, a routine audit exposed the<br />

stones. One diamond was reportedly plain<br />

glass with a diamond cut, while others were<br />

synthetic instead of natural.<br />

Ivo Macek, head of the museum’s precious<br />

stones department said, “What we have is<br />

still a sapphire, but it is not a natural stone as<br />

was documented when the museum gained<br />

it in the 1970s. It was artificially created so it<br />

does not have the value we thought it did. It<br />

was acquired for CZK$200,000 (AU$12,354)<br />

and today it would have been worth tens<br />

of millions.”<br />

The museum’s deputy director Michal Stehlík<br />

said the museum was now investigating<br />

how the fakes came to be part of its<br />

collection, adding that the museum would<br />

“thoroughly” audit all its artefacts over the<br />

next three years.<br />

10 <strong>Jeweller</strong> <strong>April</strong> <strong>2018</strong>

Pink Diamonds from Argyle<br />

Suite 1108, 227 Collins Street, Melbourne, 3000<br />

Tel: 61 3 9650 3066 Mobile: 61 (0) 411 331 777<br />

pinkdiamondsfromargyle@gmail.com

NEW PRODUCTS<br />

HERE, JEWELLER HAS COMPILED A SNAPSHOT OF THE LATEST PRODUCTS TO HIT THE MARKET.<br />

SEIKO<br />

The Seiko Astron GPS Solar<br />

Dual-Time watch is powered by<br />

light, connects to a GPS network<br />

and automatically adjusts at<br />

the touch of a button. It also<br />

features a 12-hour sub-dial with<br />

a separate AM/PM indicator<br />

to keep track of a different<br />

timezone. Visit: seiko.com.au<br />

NAJO<br />

The ‘Amarres Wide Bangle’ is 64 mm and features four<br />

rows of vine-like coils wrapped around a beaten sterling<br />

silver bangle, which can also be stacked. Visit: najo.com.au<br />

OSJAG<br />

These earrings are part of the<br />

new <strong>2018</strong> Gold Collection. They<br />

come with black diamonds,<br />

and are crafted in 14¬-carat or<br />

18-carat gold. Visit: osjag.com<br />

STONES<br />

& SILVER<br />

These pieces are some of the latest<br />

available from Australian designers<br />

Stones & Silver. All products are<br />

set in .925 sterling silver.<br />

Visit: stonesandsilver.com.au<br />

DYRBERG/<br />

KERN<br />

These ‘Shiny Gold Arc’ earrings<br />

from Dyrberg/Kern are available<br />

in a range of different finishes.<br />

Supplied by JLM International.<br />

Visit: dyrbergkern.com<br />

PASTICHE<br />

The new Rising Sun collection from<br />

Pastiche is “inspired by light and shade,<br />

and the beauty of the moments in<br />

between”. These earrings and necklace<br />

are crafted from rose gold-plated,<br />

stainless steel. Visit: pastiche.com.au<br />

WORTH &<br />

DOUGLAS<br />

New designs have been added to<br />

the Ziro range of rings, which include<br />

roman numerals and skulls engraved<br />

in black zirconium, which has a<br />

ceramic-like texture.<br />

Visit: wdrings.com<br />

12 <strong>Jeweller</strong> <strong>April</strong> <strong>2018</strong>

NEW PRODUCTS<br />

COUTURE KINGDOM<br />

Mickey Mouse is nine decades old this year!<br />

Celebrate with the 90th birthday Mickey Mouse<br />

Limited Edition Collectable pieces from Couture<br />

Kingdom, to be released in October <strong>2018</strong>.<br />

Visit: couturekingdom.com<br />

NIKKI LISSONI<br />

The secret behind Nikki Lissoni’s designs<br />

is said to be that “each piece of precision<br />

cast and hand-finished jewellery<br />

provides the opportunity for women<br />

to create their own signature style.” The<br />

new range is available from Duraflex.<br />

Visit: nikkilissoni.com.au<br />

+ MORE NEW PRODUCTS<br />

JEWELLERMAGAZINE.COM<br />

SAMS GROUP<br />

This Blush Arabella Pendant and<br />

earring set features a floral<br />

design of natural Australian<br />

Argyle pink diamonds, with<br />

fine white diamonds.<br />

Crafted in 18-carat rose<br />

and white gold.<br />

Visit: samsgroup.com.au<br />

FABULEUX<br />

VOUS<br />

The latest addition to the Heart Series is the<br />

‘Captured’ design. Made in sterling silver, these<br />

delicate earrings are “inspired by love and the many<br />

shapes and forms it comes in”. They are available as<br />

drop earrings or studs. Visit: fabuleuxvous.com<br />

THOMAS<br />

SABO<br />

Available from Duraflex, the<br />

Generation Charm Club has<br />

been completely reinvented<br />

this year. Over 250 new<br />

pieces will be available.<br />

Visit: thomassabo.com<br />

CLUSE<br />

This slim rose gold-plated necklace chain,<br />

with an elegant, simple marbled hexagon<br />

pendant is from the new Cluse collection.<br />

Available through Heart & Grace. Visit: cluse.com<br />

BAUSELE<br />

Available from Bolt International,<br />

the new Noosa After Dark watch is<br />

said to “capture the breathtaking<br />

beauty of two of<br />

Australia’s most celebrated<br />

beaches with sophistication<br />

and style”. Pure white grains<br />

of sand from Whitehaven<br />

beach are nestled in the<br />

crown. Visit: bausele.com<br />

<strong>April</strong> <strong>2018</strong> <strong>Jeweller</strong> 13

Instyle Watches PTY LTD<br />

02 8399 7300<br />

adminw@instylewatches.com.au<br />

www.pierrecardinwatches.com.au

FASHION WATCHES<br />

About time: <strong>2018</strong>’s<br />

FASHION<br />

watch styles<br />

WHILE JEWELLERY TRENDS<br />

COME AND GO, FASHION WATCHES<br />

REMAIN STYLISH NO MATTER THE<br />

SEASON. TALIA PAZ PROVIDES<br />

THE LATEST INSIGHT INTO THIS<br />

ENDURING CATEGORY.<br />

very year, suppliers and retailers are introduced to luxury<br />

watch manufacturers’ latest offerings, including their<br />

updated versions, special editions, and a bevy of new,<br />

unique styles.<br />

After key releases are unveiled at the important watch fairs<br />

– think Switzerland’s enigmatic Baselworld – the fashion watch trends<br />

inevitably trickle down the supply chain, making their way to the local<br />

market. Here is where the cascade of vibrant colours, striking bands,<br />

simplistic details and ornate embellishments come into play, with<br />

consumer demand for this category showing no signs of abating.<br />

With that in mind, here’s a taste of the latest trends shaping the<br />

ultimate statement accessory category.<br />

PEAK DEMAND<br />

Minimalist yet versatile styles continue to saturate the watch market,<br />

Simon Garber, director of Cluse distributor Heart & Grace attests.<br />

PIERRE CARDIN<br />

<strong>April</strong> <strong>2018</strong> <strong>Jeweller</strong> 15

FASHION WATCHES<br />

Sceats agrees with these sentiments, adding that it’s up to retailers to make sure<br />

their stock is fresh and consistently in tune with consumer demand.<br />

“The market is tiring of so many watches with leather straps or mesh bands and<br />

consumers are looking for watches with linked, integrated metal bands,” Sceats<br />

says. “As well as wholesalers, we are watch designers and we need to work hard to<br />

find and design styles that the consumer is looking to purchase.”<br />

HEART & GRACE<br />

INSTYLE WATCHES<br />

“Classic styles continue to stay on trend and always will,” Garber says. “They can be<br />

adapted with new fashionable colours and fabrications each season to match any<br />

wardrobe. Classic watches really can be dressed up or down to suit any look.”<br />

Cluse expanded into jewellery mid-2017 when the brand debuted three bracelet<br />

ranges. Capitalising on the trend of pairing watches with bracelets has paid off – it’s<br />

one of the key trends making the rounds locally and internationally. Are there other<br />

trends that retailers should consider this year?<br />

“Square watch faces, rose gold, interchangeable watch straps and new bi-colour<br />

mesh straps,” Garber declares.<br />

Jeanette Sceats, managing director of Pierre Cardin supplier Instyle Watches, has a<br />

few other ideas. She says simple, understated styles remain strong and what was<br />

fashionable a few years ago also seems to be coming back for round two – albeit in<br />

a slightly revamped way.<br />

“Medium-size women’s watches are coming back but not as large as they have<br />

been in previous years,” Sceats notes. “We have also been asked to release more<br />

women’s watches with crystals so it looks like ‘bling’ may be coming back too.”<br />

This appears to be the case for the men as well. “After the last few years of the<br />

very simple and minimal style men’s watches, we have been asked for more<br />

large, multi-function and chronograph men’s watches,” she continues. “There is<br />

still a part of the market that wants understated, simple styles, but this look is<br />

diminishing in popularity.”<br />

David Faraday, managing director of Oozoo Timepieces and Dukudu distributer<br />

Hipp, offers his own take on what consumers will want this year.<br />

“While the 40 mm, oversized watches continue to be the most popular, retailers<br />

need to be aware of the resurgence of desire for smaller-case watches – think<br />

32 or 36 mm,” Faraday says. “Also, mesh straps are definitely in greater demand.<br />

Understated, simple styles are classic, and classic will always be popular.”<br />

Part of the game plan is to take more chances with stock, Garber adds: “Take a risk<br />

with new styles and colours to see if they resonate with your customer. Fashion<br />

trends now move at a fast pace, so it’s important to stay one step ahead and<br />

educate customers on the latest offering.”<br />

YOUNG AT HEART<br />

A 2017 report by UK research firm Deloitte offered interesting insight into how<br />

retailers can sell watches to younger generations. One of its main conclusions?<br />

Gen Y and Gen Z shoppers care more about the style of a watch than any<br />

of its functions.<br />

“For all practical purposes we can assume that every Millennial consumer already<br />

owns a functioning and highly-accurate timepiece in the form of a smartphone<br />

or tablet,” the report begins. “Mobile devices can offer all of the functionality of an<br />

analogue watch and more. They can also duplicate most, if not all, of the functions<br />

of a smartwatch. Yet Millennials continue to buy analogue watches for reasons of<br />

fashion and prestige.”<br />

An article by US business publication Fast Company also provides insight into the<br />

younger generation’s penchant for fashion watches.<br />

“Many of us [Millennials] are feeling that we’re not consuming technology anymore;<br />

technology is consuming us,” it begins. “Millennials have distinct memories of<br />

wearing watches while they were growing up… [therefore] Millennials have a<br />

nostalgic association with analogue watches. They’re looking for timepieces that<br />

look more sophisticated than the plastic Swatch or Casio Baby G watches they<br />

wore when they were children, but don’t want to shell out thousands for a highend<br />

luxury watch.”<br />

As Steven Kaiser, president of watch and jewellery consultant company Kaiser Time<br />

also explained in an article with US publication National Jeweler, a watch should<br />

always be treated as the emotional purchase it is. As such, this means some specific<br />

selling strategies need to come into play for younger generations.<br />

“Aside from being technically educated on the intricacies of quartz and mechanical<br />

watches, sales staff need to romance the purchase by sharing the history of<br />

the brand and by telling personal stories that resonate with potential buyers,”<br />

STAYING AHEAD OF THE GAME<br />

Fashion watches continue to experience healthy consumer interest; however,<br />

suppliers and retailers agree that maintaining a share of the market is one of the<br />

biggest issues they face. Those challenged with the task of maintaining robust sales<br />

believe a well-considered strategy is integral to success.<br />

“We all know many brands have entered the fashion watch market because of the<br />

high consumer demand,” Faraday says. “Retailers should always consider the quality<br />

of the watches and a supplier’s commitment to fast warranty servicing and aftersales<br />

service when choosing which brands to stock.”<br />

HIPP<br />

16 <strong>Jeweller</strong> <strong>April</strong> <strong>2018</strong>

INSTYLE WATCHES<br />

Kaiser said back in 2016. “The ability of the<br />

salesperson to key in on the emotional part<br />

of the purchase is in many cases just as<br />

important as the technical aspects of the<br />

timepiece itself.”<br />

Staff must also be equipped to counter<br />

an all-too-common sales rejection: that<br />

consumers don’t require watches when they<br />

have mobile phones. The best way to do<br />

this is to entice shoppers to physically try on<br />

watches of interest.<br />

“Phones do tell the time but nothing<br />

will ever replace the feeling of having a<br />

beautiful timepiece on your wrist,” Gretchen<br />

Mathews, senior vice president of human<br />

resources at watch retailer Tourneau, said in<br />

the same article.<br />

Faraday also offers some advice for<br />

capitalising on the desires of younger<br />

generations. “Choose models that are in line<br />

with the current fashion trends,” he says. “Keep<br />

your range looking fresh and always have<br />

something new and exciting to catch your<br />

customers’ eyes.”<br />

FOR THE ‘GRAM<br />

Employing some simple social-media<br />

techniques can do wonders for watch<br />

sales, and a good place to start is by<br />

taking inspiration from some of the big<br />

watch names.<br />

Last year, Omega marketed its latest watch on<br />

Instagram and then created its own hashtag<br />

– #SpeedyTuesday – so that consumers could<br />

upload images of their purchases or search<br />

directly for the watch. The simple strategy<br />

paid off as the watch reportedly sold out<br />

within four hours!<br />

Local retailers could use similar marketing<br />

ideas to improve the visibility of their latest<br />

HIPP<br />

offerings. After all, as Faraday explains, social<br />

media continues to be “very influential” for<br />

shoppers.<br />

“Consumers are more aware of the concept<br />

of a fashion watch and are matching their<br />

watches to their outfits and changing them in<br />

line with the season,” he says.<br />

Garber agrees with these sentiments.<br />

“Social and digital media has had a huge<br />

influence on consumers buying fashion<br />

watches,” she adds. “Influencers, celebrities<br />

and consumers love to share their watches<br />

on social media; consumers follow these<br />

fashion influencers to stay up to date with<br />

the colours and styles trending globally and<br />

buy into these new styles.”<br />

Keeping track of what consumers are<br />

following on social media isn’t the only<br />

strategy retailers should be employing to<br />

boost watch sales. Instead, Sceats advises<br />

those seeking additional inspiration to take<br />

notice of what’s on the fashion runways.<br />

“Look to the more fashion-forward parts of<br />

the market to determine what styles are the<br />

focus of international icons. These styles will<br />

usually trickle down the market but leave<br />

their influence in many ways, such as sizes,<br />

colours, simplicity or bling,” Sceats explains.<br />

“Look for new styles that are wearable but<br />

have features that will attract the eye of<br />

passing consumers. By adding some colour<br />

and imagery to the store windows, you will<br />

attract customers more than by just showing<br />

the same conservative styles you have been<br />

selling for several years,” she adds.<br />

Trends may come and go but consumers<br />

continue to maintain a healthy appetite for<br />

fashion watches. With a few savvy techniques,<br />

retailers can ultimately gain the upper hand in<br />

this robust sector. i<br />

Exclusive Distribution by hiPP.com.au<br />

in AU & NZ<br />

info@hiPP.com.au | 1300 132 522<br />

(NZ 0800 65 4477)

COLOURED DIAMOND REPORT<br />

BOLTON GEMS WORLD SHINER ELLENDALE DIAMONDS<br />

True<br />

COLOURS<br />

WITH CONSUMERS INCREASINGLY SAVVY ABOUT<br />

WHITE DIAMONDS, COLOURED DIAMONDS<br />

CONTINUE TO OFFER RETAILERS A BETTER MARGIN.<br />

ALEX EUGENE REPORTS ON THE BEST WAY TO TAKE<br />

ADVANTAGE OF THESE HIGHLY-PRIZED STONES.<br />

here’s a scene in the film Titanic where Kate Winslet’s character<br />

Rose sits for a seductive nude portrait, wearing a 56-carat blue<br />

diamond, strung upon a chain of white diamonds.<br />

The fictional gemstone, known as ‘the heart of the ocean’, is a replica of<br />

the famous Hope Diamond, a 45.52-carat stone reportedly stolen from<br />

an ancient statue in India, and subsequently blamed for the misfortune that<br />

afflicted its various owners. According to myth, the Hope Diamond is cursed,<br />

but this hasn’t stopped it from enchanting the collective consciousness of<br />

gemstone lovers since the 17th century.<br />

History is abundant with intriguing tales of coloured diamonds, which have<br />

only become more popular over time.<br />

A HISTORY OF LOVE<br />

Whether invention or fact, many of the greatest love stories have involved<br />

coloured diamonds.<br />

“There has traditionally been a romance associated with coloured diamonds<br />

and this has always attracted a premium in their pricing,” says Gersande Price,<br />

sales manager at Ellendale Diamonds. “There is no fixed price for exceptionally<br />

fine coloured diamonds.”<br />

Brett Bolton, Director of Bolton Gems confirms this is the case: “Consumers<br />

believe price is secondary to finding the right stone for them. Colour is more<br />

of an incentive.”<br />

Add to that the dwindling supply of some colours, notably Australian pink, and<br />

say hello to one of the most lucrative products available to jewellers.<br />

“Despite producing 95 per cent of the world’s pink diamonds, the Argyle<br />

mine’s total pinks production is under 1 per cent, and with the upcoming<br />

closure in two to three years’ time, Argyle pink diamonds are a unique West<br />

Australian sensation around the world,” says Price.<br />

Miri Chen, CEO of the Fancy Color Research Foundation (FCRF) says that<br />

fancy-colour diamonds are so rare and beautiful they have become a serious<br />

investment opportunity.<br />

“Out of all diamonds in the world, only a fraction of a percent actually<br />

show special colours and are entitled to being called fancy-colour diamonds,”<br />

she says.<br />

Maulin Shah, director of World Shiner says, “Demand is increasing for the pink<br />

diamonds; they are very unique. People are buying Argyle diamonds<br />

for investment.”

COLOURED DIAMOND REPORT<br />

Price agrees with that sentiment. “Everyone<br />

in the market is after an Argyle diamond,<br />

for love of their land, the beautiful arrays of<br />

colours or for pure investment purpose.”<br />

Steve Der Bedrossian, CEO of Sams Group,<br />

is matter of fact about his pink diamond<br />

stock. “A low end pink melee in a light<br />

pink colour is still going to cost around<br />

AU$1,900 a carat. But for white diamonds,<br />

the best, cleanest, small melee white<br />

diamond is never going to pass AU$750 a<br />

carat,” he explains.<br />

THE NEW PRESTIGE, A SEA OF WHITE<br />

Once considered exclusive and for the<br />

elite, white diamonds have become more<br />

accessible to lower ends of the market,<br />

which has made them more popular.<br />

A wealth of online information has<br />

demystified diamonds further.<br />

More information means customers are<br />

more knowledgeable, and generally know<br />

what they want – although the quality<br />

of that knowledge may be lacking. Gary<br />

Holloway, one of the world’s leading<br />

diamond experts and owner of Holloway<br />

Diamonds says that more accurately,<br />

“consumer confidence” is high. Customers<br />

“come in confident of what they want,” he<br />

explains with a smile.<br />

On top of that, “the white diamond market<br />

is saturated,” says Der Bedrossian. “Retailers<br />

can only bill them at 5 to 10 per cent<br />

markup. They make the money on the<br />

ring mount, not the diamond. It’s really<br />

cut throat.” Conversely, he says that pink<br />

diamonds “are more unique and every<br />

stone is individual. There’s less competition<br />

and overall I think the retailers can make<br />

more margin.”<br />

He adds that because of the flooded<br />

white market, retailers can still make more<br />

margins on the sale of brown and black<br />

diamonds, despite the fact that they are<br />

cheaper to buy than white diamonds.<br />

Brown and black diamonds from Australia<br />

also have the upper hand due to their<br />

local origin, he says. “If it’s a diamond from<br />

Argyle, that’s what sells.”<br />

According to Chen, there are many<br />

misconceptions that harm the industry.<br />

“Most people wrongly believe that<br />

diamonds will come out of the ground<br />

ELLENDALE DIAMONDS<br />

forever. This is far from the reality,” she<br />

explains.<br />

THE PRICE ADVANTAGE<br />

Consumers are a long way from knowing<br />

everything about coloured diamonds.<br />

Holloway points out that there’s far more<br />

variation in the way coloured diamonds are<br />

viewed for quality.<br />

Bolton agrees: “Customers are trying to use<br />

what they know about white diamonds<br />

and apply it to colour. There is no finite<br />

grading structure for coloured diamonds.<br />

Consumers need to know that clarity<br />

and symmetry is less important, and that<br />

perfection in colour matching may not be<br />

possible. Coloured diamonds are cut for<br />

colour return.”<br />

Holloway states bluntly: “The grading<br />

system for coloured diamonds is not very<br />

good. It’s quite common to have two<br />

identical diamonds, but of a different grade.<br />

So I might buy a brown diamond that looks<br />

exactly the same as another diamond that<br />

has a higher grade, but really, you can’t tell<br />

them apart.”<br />

Nonetheless, Der Bedrossian says<br />

customers who come asking for coloured<br />

diamonds will be well aware they have to<br />

pay more for them. “When they’ve come for<br />

a 1-carat pink diamond, it could be up to<br />

AU$1million per stone…believe me they’re<br />

going to do their homework,” he says. And<br />

with the Argyle mine estimated to close as<br />

soon as 2020, he says those prices are on<br />

the increase.<br />

Shah agrees that there is a huge difference<br />

in the price when comparing white<br />

and natural pink diamonds, so it’s not<br />

Timeless outside.<br />

Revolutionary inside.<br />

• Timeless design<br />

• Fitness tracking<br />

• Water resistant*<br />

* Certified IP68 water-resistant up<br />

to 1.5 meters for up to 30 minutes.<br />

E sales@samsgroup.com.au<br />

W samsgroup.com.au<br />

P 02 9290 2199

COLOURED DIAMOND REPORT<br />

over-priced. Such a story reinforces the<br />

importance for jewellers to educate their<br />

customers.<br />

A COLOURED POINT OF DIFFERENCE<br />

Retailers who choose to stock coloured<br />

diamonds are already ahead of the game<br />

because they will attract customers looking<br />

to fulfil a special request.<br />

www.ClassiqueWatches.com<br />

E pink@samsgroup.com.au<br />

W samsgroup.com.au<br />

P 02 9290 2199<br />

BOLTON GEMS<br />

comparable at all. “It depends on the<br />

colour, it depends on the shade and there<br />

is a different price structure,” he explains.<br />

Chen confirms it is much harder for the<br />

average consumer to understand what<br />

makes them valuable. “The value of a<br />

fancy-coloured diamond is impacted by<br />

many parameters that are very different<br />

from those used to estimate the value of a<br />

colourless diamond,” she says.<br />

These complexities have helped coloured<br />

diamonds to retain their mystique, for<br />

the most part shielding them from ‘price<br />

hagglers’.<br />

So not only are coloured diamonds rarer,<br />

more unique and more likely to be graded<br />

as high quality, but consumers also know<br />

less about them. This makes them one of<br />

the better products for increasing retail<br />

gross margin.<br />

Another benefit for bricks-and-mortar<br />

retailers is that coloured diamonds are<br />

much harder to properly assess on a<br />

computer screen.<br />

“Coloured diamonds are something that<br />

customers really have to see to appreciate,”<br />

Chen says. “How accurate is a website<br />

description? Has the colour in the photo<br />

been re-touched or colour enhanced? With<br />

coloured diamonds, clients have to come<br />

into the store to see for themselves exactly<br />

what is on offer.”<br />

Holloway stresses the importance of<br />

the jeweller’s knowledge with a striking<br />

anecdote. At a trade fair last year, he viewed<br />

two yellow diamonds that were thousands<br />

of dollars apart in price, but the lighting<br />

had effectively reversed their appearance,<br />

making each look excessively under or<br />

Chen says “offering fancy-colour diamonds<br />

helps retailers position themselves at a<br />

whole different level. Because of their<br />

rarity and the fact that each fancy-colour<br />

diamond is different, they allow a much<br />

more interesting dialogue with the client<br />

who will want to understand what he or<br />

she is buying.”<br />

Shah agrees: “In white diamonds there is<br />

a lot of competition and similar stones<br />

available, but every coloured stone is<br />

different and unique so it will be easier<br />

for retailers to make a sale and a mark-up.<br />

It’s not easy to find something exactly the<br />

same at another jeweller.”<br />

Price says low supply will always fuel<br />

demand. “There is a marked increase in<br />

the desirability of coloured diamonds<br />

with a very restricted supply so prices<br />

can be much higher for these diamonds,”<br />

she explains. “Argyle pink diamonds are a<br />

particular example; as the mine is closing<br />

very soon and is the world’s major source,<br />

supplier prices are revised regularly.”<br />

The attractiveness of Australian pink<br />

diamonds isn’t just about rarity. Der<br />

Bedrossian says demand for ethically<br />

sourced stones is increasing.<br />

“It’s what people want in Australia. It’s<br />

called a chain of custody…from ‘the<br />

ground to the finger’ they say. Argyle<br />

diamonds are always worth more. You can<br />

find the same stone on the market with a<br />

GIA certificate – it will be argyle material,<br />

you can tell – but if it doesn’t have the<br />

inscription or any paperwork saying it came<br />

from Argyle, it will be at least 25 per cent<br />

cheaper than exactly the same stone with<br />

Argyle paperwork,” he explains.<br />

Bolton Gems are delivering on that demand<br />

from consumers: “If a retailer is an exclusive<br />

stockist of Australian Chocolate Diamonds,<br />

they get a stone with a story that starts<br />

from the day the diamond is mined. They

also get diamonds at a price that allows flexibility in creativity to<br />

make a statement piece with larger diamonds.”<br />

It’s also good news for customers of Ellendale. “We supply coloured<br />

diamonds with origin, namely from the Argyle and Ellendale Mine<br />

– Argyle pinks, yellows, champagne, cognacs, Ellendale yellow<br />

and whites. Our diamond inventory covers melee size, matching<br />

sets, single stones to investment stones and are all supplied with<br />

certificate of origin in addition to a lab certificate where available,”<br />

Price says.<br />

This demand also means customers who can’t afford a large stone<br />

would still rather walk away with a small one than nothing at all.<br />

Therefore, even smaller stones are fetching higher prices over time.<br />

“Fancy-colour demand and supply go in opposite directions,” Chen<br />

says. “Supply is dwindling and demand is rising sharply. As such,<br />

we see that in the last three years, clients who look for rare colours<br />

and cannot afford them anymore are willing to settle for very low<br />

clarities or very small sizes.”<br />

THE FUTURE IS BRIGHT<br />

There’s no denying that coloured diamonds are in a class of their<br />

own, and more unique than white diamonds in many ways.<br />

Holloway also points to a lucky break the industry may gain thanks<br />

to technology: “A lot of yellow diamonds that used to be on the<br />

market were in the ‘D to Z’ scale… but those diamonds, by virtue of<br />

the cutting technology, could be turned into fancy and fancy light.”<br />

For now though, most of the focus remains on the shrinking yield<br />

of Australian coloured diamonds, particularly pinks.<br />

“In the past year, World Shiner has increased its inventory of Argyle<br />

pink diamonds, because demand will definitely increase. People<br />

are buying lots of coloured diamonds for reasons of culture and<br />

fashion,” Shah says.<br />

Der Bedrossian couldn’t agree more, saying that prices have<br />

climbed so much in recent years that he wonders just how high<br />

they can go. “Every year these diamonds are getting rarer. I don’t<br />

know what’s going to happen to prices once it closes because it’s<br />

already going up all the time.”<br />

Price sums it up elegantly: “The famous ‘diamonds are a girl’s<br />

best friend’ slogan is still very accurate; the demand for coloured<br />

diamonds is forever increasing. In recent years, the fancy-coloured<br />

diamond market has been reaching record sales.”<br />

Chen, however, turns to numbers to make her point: “The price of<br />

smaller fancy-colour diamonds between 1.5 and 9 carats rose over<br />

400 per cent in the past five years, and it looks like this upward<br />

trend will continue. Also, rare colours in low clarity – SI2 and<br />

lower – used to be hard sellers, but in the last three years, they<br />

have been in high demand as they are more affordable. These two<br />

phenomena will keep gaining momentum for years to come.”<br />

In a challenging retail climate, coloured diamonds offer retailers an<br />

exceptional opportunity to make healthy sales. Salespeople who<br />

are armed with expert information will be able to woo customers<br />

with these unique beauties. i

WATCH FAIR REVIEW<br />

GENEVA WATCH FAIR<br />

reassures the industry<br />

IN A WORLD WHERE THE SWISS WATCH AND CLOCK INDUSTRY IS SUFFERING<br />

UNPREDICTABLE BUYING PATTERNS, THE GENEVA SALON PROVIDED LUXURY WATCH<br />

BRANDS WITH MUCH-NEEDED INTERNATIONAL ATTENTION. MARTIN FOSTER REPORTS.<br />

Each year when the Salon International de la Haute Horlogerie Genève (SIHH)<br />

opens for its annual trade fair, it marks the first showing of the newest high-end<br />

luxury watches.<br />

It’s a fabulous showcase with no equivalent anywhere in the world. The Geneva<br />

Salon, as it is known, is as famous for its prestigious exhibitors as it is for the quality<br />

of its infrastructure. SIHH represents the finest examples on offer from the major<br />

luxury brands of the Swiss watchmaking industry.<br />

This year’s event (15–19 January) expanded the successful presentation elements<br />

of last year, again increasing the number of exhibitors despite an extremely tough<br />

commercial environment.<br />

With BaselWorld enduring a major restructure, Geneva Salon is currently the only<br />

expanding European trade show. More than 20,000 visitors attended this year – a<br />

record number – along with 1,500 media personnel – an increase over last year of<br />

20 per cent and 12 per cent, respectively.<br />

The exhibition area had to be expanded to 55,000 square metres to<br />

accommodate this, a 20 per cent increase in floor space. This year also saw the<br />

largest number of watch houses yet; there were 35 exhibitors, compared with 30<br />

in 2017 and just 16 in 2014.<br />

WHAT IS THE SIHH?<br />

SIHH launched in 1991 as a private exhibition of the luxury house brands of the<br />

Richemont Group. In 2005, the Richemont Group, Audemars Piguet and Girard-<br />

Perregaux formed the Fondation de la Haute Horlogerie (FHH) which is now the<br />

body that oversees the event. Subsequently, the scope of the Geneva Salon has<br />

been expanded to include closely associated watch brands.<br />

In 2016, SIHH added a new category titled Carré des Horlogers (the Watchmaker’s<br />

Square), which consisted of a group of highly skilled artisan-creators representing<br />

avant-guard watchmakers and independent workshops.<br />

Carré des Horlogers brands of note included Christophe Claret, Chronométrie<br />

Ferdinand Berthoud, DeWitt, and Grönefeld among others. Exhibitors in the main<br />

hall included a grand offering of brands, including A.Lange & Söhne, Baume &<br />

Mercier, Cartier, Hermès, IWC and Montblanc to name just a few.<br />

Last year, for the first time the Geneva Salon was opened to the public on the<br />

final day. Fabienne Lupo, President and Managing Director of SIHH said, “The<br />

new approach has proven its worth. The Salon has successfully undertaken<br />

a significant transformation process that implies evolving in order to offer<br />

exhibiting maisons [houses] not only the best platform conducive to doing good<br />

business, but also the finest showcase in terms of communication and visibility –<br />

all firmly plugged into today’s world.”<br />

WHAT IS PALEXPO?<br />

Geneva Salon is held in the PALEXPO, a large exhibition centre located adjacent to<br />

the Geneva airport.<br />

The event organiser gains access to PALEXPO a month before its opening date to<br />

construct an imaginative and attractive fantasy world. Absolutely no expense is<br />

spared: the bare concrete walls are converted into an expansive luxury complex<br />

of about 30 brand suites and showrooms with fine, lofty architectural style, soft<br />

carpets, diffused lighting, and hushed, luxury ambience in keeping with its high<br />

horology exhibitors.<br />

This luxurious set must withstand the footfall of 20,000 visitors in the week of the<br />

trade show, only to be torn down a week later and consigned to the horological<br />

history books. PALEXPO then returns to its regular exhibiting role for the<br />

International Motor Show and Arts Geneva.<br />

The past 12 months was a reassuring year for the luxury watch market, improving<br />

somewhat on the sliding trends of recent years. Reportedly, Richemont’s buyback<br />

implementations were successful and delivered some good year-end results<br />

for the company.<br />

According to Richemont’s November interim report, sales increased by 10 per<br />

cent for the previous six months, and operating profits for the period were up 80<br />

per cent representing final figures of more than €974 million (AU$1.5 b).<br />

Swiss Federal Customs Administration (FCA) confirmed this trend, reporting that<br />

Swiss watch exports for November 2016 stood at just under CHF$2 b (AU$2.7 b),<br />

equivalent to 6.3 per cent growth.<br />

These are very comforting numbers for industry stakeholders, and the group’s<br />

performance was reflected in the optimism around the brands at the fair. Fine and<br />

inventive watchmakers find new ways of combining old ideas in beautiful ways,<br />

and this is philosophically reflected across the exhibiting brands. The 2019 Geneva<br />

Salon will take place from 14–19 January. i<br />

24 <strong>Jeweller</strong> <strong>April</strong> <strong>2018</strong>

CHARM BRACELETS<br />

GET<br />

Lucky<br />

with charms this season<br />

DURAFLEX NIKKI LISSONI<br />

THEY MAY BE SMALL BUT THEY’RE NOT TO BE<br />

IGNORED. ALEX EUGENE DISCOVERS WHY CHARMS<br />

ARE SO MUCH MORE THAN A PASSING FAD.<br />

K Rowling, the author of the Harry Potter children’s book series,<br />

first received a charm bracelet when she was just five years old.<br />

Remembering the event in 2013 for Harper’s Bazaar, she wrote, “I had<br />

never been given anything more beautiful.”<br />

Later in life, when the seventh Harry Potter book was released, Rowling’s editor<br />

gave her what would become “my most treasured piece of jewellery: a bracelet<br />

covered in gold and silver charms from the books. There was a tiny Golden<br />

Snitch, a silver Ford Anglia, a Pensieve and a stag Patronus. There was even a<br />

Philosopher’s Stone in the form of an uncut garnet.”<br />

Like her books, Rowling’s personal story will hit a note for millions of people<br />

everywhere: charms have been made and worn for deeply personal reasons<br />

since the earliest times. And for retailers today, there’s no better item that taps<br />

into the highly emotional market of jewellery, but also presents an opportunity<br />

for repeat business on a regular basis.<br />

IN THE HISTORY BOOKS<br />

“The charm concept has been part of human history going back to prehistoric<br />

times,” Isaac <strong>Jeweller</strong>y director Annet Atakliyan explains. “The need to keep things<br />

close to the body – individual treasure, things of beauty, cherished memories and<br />

marking prominent moments in life – was always met through charm jewellery.”<br />

Indeed, ancient charms have been discovered that were made from shells, wood<br />

and bone long before fine jewellery existed. Christians used tiny fish charms<br />

hidden inside their cloaks to identify themselves to each other during the Roman<br />

Empire’s reign, between 64 AD and 313 AD.<br />

Today it remains popular to wear charms as a symbol of personal meaning. Small<br />

and delicate, they have a unique ability to capture significant moments in life.<br />

This, combined with the sheer diversity of designs on the market, makes charms<br />

a highly “collectable concept” that perfectly suits the personalised jewellery<br />

consumer, says Phil Edwards, managing director of Duraflex.<br />

“For consumers, the appeal of this category is the unique product concepts,<br />

which allow wearers to celebrate their own personality and diversity – there are<br />

innumerable jewellery combinations possible,” he explains.<br />

Ken Abbott, managing director of Timesupply, echoes the sentiment with regard<br />

to the Nomination bracelets, which feature unique interchangeable links. “Being<br />

able to create stories link by link with endless combinations for women, men, girls<br />

and boys allows the wearer to express their personality using an icon<br />

based language.”<br />

Edwards adds there is further appeal for retailers: “Charm bracelets and bangles<br />

make the perfect gift, which can then be added to with additional charms to<br />

celebrate birthdays, Valentine’s Day, Mother’s Day, Christmas and more. This<br />

generates customer loyalty and ignites consumers passion for a brand.”<br />

THE QUIET ACHIEVER<br />

In a price line-up, charms might seem negligible alongside engagement rings<br />

and other big sellers; however, it’s this very affordability that means customers are<br />

more likely to buy more than one and come back frequently.<br />

Pandora has built an empire on these tiny heroes. The company’s managing<br />

director, Mikael Kruse Jensen, admits that Pandora harnessed “a magic formula in<br />

increasing customer basket size and engaging in a long-term relationship with<br />

the customer”.<br />

“Charms as a concept is built on gifting and repeat purchases. With Pandora,<br />

consumers want to fill their bracelets and create different looks according to their<br />

26 <strong>Jeweller</strong> <strong>April</strong> <strong>2018</strong>

CONTACT: (02) 9417 0177

DURAFLEX - THOMAS SABO ISAAC JEWELLERY STONES & SILVER<br />

PANDORA<br />

style and sensibility, as well as mark the moments and milestones in their lives.<br />

The broad spread of pricing also appeals to many consumers, therefore price is<br />

not a barrier,” he explains.<br />

For the quiet achiever to become that winning formula, visibility is crucial,<br />

Edwards explains.<br />

“The concept of collectability is key, and effectively marketing this is critical,” he<br />

says. “This is why with Thomas Sabo, the launch of Generation Charm Club is<br />

accompanied by a comprehensive marketing concept to support local retailpartner<br />

marketing strategies. This includes a new generation Charm Club logo,<br />

unique POS presentation, advertising campaign, value-adding promotions, staff<br />

training portal, social media support and more.”<br />

Atakliyan says charms lend themselves perfectly to today’s online sales climate.<br />

“Charms are playful and full of meaning, and as marketing ingredients, they are<br />

easily conveyed in today’s world of social media,” she says. “Charm material can<br />

be presented with any occasion, memory or message you wish to pass on to<br />

your clientele.”<br />

For Abbott, personally helping the customer make the first step is key. “Be<br />

interested in you customer, listen and ask questions, to be able to help them build<br />

a story in iconic links that resonates emotionally,” he suggests.<br />

GETTING BANG FOR BUCK<br />

Charms don’t have to be limited to the bracelet domain either, Edwards says. In<br />

addition to the Thomas Sabo Generation Charm Club, Duraflex also carries the<br />

popular Nikki Lissoni range, which includes collectible charm bangles.<br />

“They are essentially similar, but also provide options for interchanging,<br />

personalisation and wearing more charms, further driving the passion for<br />

collecting and sales,” Edwards says.<br />

Even better, Atakliyan says retailers can benefit without blowing out the budget.<br />

“Small collections of charms will benefit stores as customers will be attracted to<br />

them. Once the offer is there as a choice, retailers can order on an as-needed basis<br />

without committing a huge part of their yearly budget. They will stay relevant<br />

with the current market demand, instead of missing out,” she explains.<br />

“We have found the Australian consumer loves Australian quality products. The<br />

messages ‘We are Australian’ and ‘Hand-made in Australia’ helps with successful<br />

sales,” she adds.<br />

A CHARMING FUTURE<br />

The popularity of charms has exploded worldwide and the local market is<br />

no different.<br />

“Sell-through from existing Composable stockists has been strong, with<br />

consistent reorders,” says Abbott. “And since the new distribution arrangement<br />

that started in January, with a refocus on Composable Links, we have 25 new<br />

retail partners.”<br />

Edwards says: “Both Thomas Sabo and Nikki Lissoni continue to be strong<br />

jewellery brands in both the Australian and New Zealand markets. The Thomas<br />

Sabo Charm Club is the strongest-selling range in Australia, closely followed by<br />

the sterling silver jewellery range.<br />

“For Nikki Lissoni, the charm products are an excellent addition to the core<br />

concept of interchangeable coins, which are the best sellers here locally.”<br />

Atakliyan also says the Isaac charm collections “have performed very well since<br />

our initial launch of the Surreal brand in 2008.” She puts it down to being an<br />

Australian product, with a quality that inspires consumers to choose Isaac over<br />

other brands.<br />

With the trend still going strong, suppliers are hard at work keeping it new<br />

and fresh.<br />

“We are launching ‘Illuminate’, our new range of charms and jewellery with<br />

luminous gems and diamonds, which are collectable items,” Atakliyan adds. “The<br />

sky is the limit for mixing jewellery with charms; there is always room for<br />

marvellous creations.”<br />

Thomas Sabo also has an extensive new range of offerings. “With around 260<br />

restyled, high-quality charm designs, including extra-large charms, single<br />

earrings and a wealth of different carriers such as necklaces, bracelets and hinged<br />

hoops, the new collection is a completely new and modern offering,” Edwards<br />

says. “Generation Charm Club now addresses all Thomas Sabo target groups,<br />

above and beyond the loyal fans of the collection. This is by means of the new<br />

alignment of the collection, new pricing and combination options, and the<br />

addition of the unisex ‘Vintage Rebel’ designs.”<br />

As Atakliyan puts it, “Charm jewellery has been<br />

in our lives and will be part of it for many<br />

centuries to come.”<br />

If history is anything to<br />

go by, she may be right,<br />

and retailers can be<br />

the ones to help<br />

turn it into<br />

a reality. i<br />

28 <strong>Jeweller</strong> <strong>April</strong> <strong>2018</strong><br />

NOMINATION

GEMS<br />

COLOUR INVESTIGATION: RUBY<br />

African supplies have traditionally produced<br />

darker stones, however the new mines<br />

produce colours that bridge the gap between<br />

those from the classic sources of Myanmar<br />

(low iron, strong fluorescence) and Thailand/<br />

Cambodia (high iron, low fluorescence)<br />

suiting a range of different markets.<br />

A ruby’s value is determined not only by<br />

colour, but its clarity, cut and carat size.<br />

Consumers must be aware of the multitude<br />

of treatments and synthetics.<br />

Heat treatment is common practice as it<br />

parallels what can happen in nature. The<br />

heating process removes silk inclusions,<br />

enhancing clarity and richness of colour.<br />

Although it does affect the price, if heat<br />

treatment does not add anything artificial<br />

to the stone, it is an accepted treatment<br />

amongst gemmologists.<br />

INTERPRETATION OF COLOUR IS SUBJECTIVE<br />

Desire for ruby today is great as ever. With<br />