Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

6 TMWS 16 th - 30 th April 2018<br />

Nautical News<br />

www.tmwsmagazine.com<br />

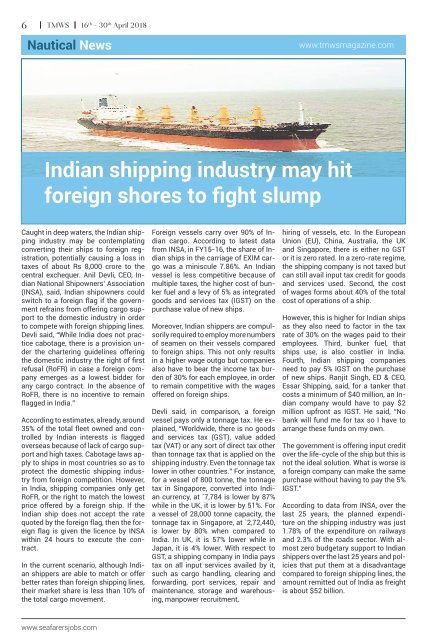

Indian shipping industry may hit<br />

foreign shores to fight slump<br />

Caught in deep waters, the Indian shipping<br />

industry may be contemplating<br />

converting their ships to foreign registration,<br />

potentially causing a loss in<br />

taxes of about Rs 8,000 crore to the<br />

central exchequer. Anil Devli, CEO, Indian<br />

National Shipowners’ Association<br />

(INSA), said, Indian shipowners could<br />

switch to a foreign flag if the government<br />

refrains from offering cargo support<br />

to the domestic industry in order<br />

to compete with foreign shipping lines.<br />

Devli said, “While India does not practice<br />

cabotage, there is a provision under<br />

the chartering guidelines offering<br />

the domestic industry the right of first<br />

refusal (RoFR) in case a foreign company<br />

emerges as a lowest bidder for<br />

any cargo contract. In the absence of<br />

RoFR, there is no incentive to remain<br />

flagged in India.”<br />

According to estimates, already, around<br />

35% of the total fleet owned and controlled<br />

by Indian interests is flagged<br />

overseas because of lack of cargo support<br />

and high taxes. Cabotage laws apply<br />

to ships in most countries so as to<br />

protect the domestic shipping industry<br />

from foreign competition. However,<br />

in India, shipping companies only get<br />

RoFR, or the right to match the lowest<br />

price offered by a foreign ship. If the<br />

Indian ship does not accept the rate<br />

quoted by the foreign flag, then the foreign<br />

flag is given the licence by INSA<br />

within 24 hours to execute the contract.<br />

In the current scenario, although Indian<br />

shippers are able to match or offer<br />

better rates than foreign shipping lines,<br />

their market share is less than 10% of<br />

the total cargo movement.<br />

Foreign vessels carry over 90% of Indian<br />

cargo. According to latest data<br />

from INSA, in FY15-16, the share of Indian<br />

ships in the carriage of EXIM cargo<br />

was a miniscule 7.86%. An Indian<br />

vessel is less competitive because of<br />

multiple taxes, the higher cost of bunker<br />

fuel and a levy of 5% as integrated<br />

goods and services tax (IGST) on the<br />

purchase value of new ships.<br />

Moreover, Indian shippers are compulsorily<br />

required to employ more numbers<br />

of seamen on their vessels compared<br />

to foreign ships. This not only results<br />

in a higher wage outgo but companies<br />

also have to bear the income tax burden<br />

of 30% for each employee, in order<br />

to remain competitive with the wages<br />

offered on foreign ships.<br />

Devli said, in comparison, a foreign<br />

vessel pays only a tonnage tax. He explained,<br />

“Worldwide, there is no goods<br />

and services tax (GST), value added<br />

tax (VAT) or any sort of direct tax other<br />

than tonnage tax that is applied on the<br />

shipping industry. Even the tonnage tax<br />

lower in other countries.” For instance,<br />

for a vessel of 800 tonne, the tonnage<br />

tax in Singapore, converted into Indian<br />

currency, at `7,784 is lower by 87%<br />

while in the UK, it is lower by 51%. For<br />

a vessel of 28,000 tonne capacity, the<br />

tonnage tax in Singapore, at `2,72,440,<br />

is lower by 80% when compared to<br />

India. In UK, it is 57% lower while in<br />

Japan, it is 4% lower. With respect to<br />

GST, a shipping company in India pays<br />

tax on all input services availed by it,<br />

such as cargo handling, clearing and<br />

forwarding, port services, repair and<br />

maintenance, storage and warehousing,<br />

manpower recruitment,<br />

hiring of vessels, etc. In the European<br />

Union (EU), China, Australia, the UK<br />

and Singapore, there is either no GST<br />

or it is zero rated. In a zero-rate regime,<br />

the shipping company is not taxed but<br />

can still avail input tax credit for goods<br />

and services used. Second, the cost<br />

of wages forms about 40% of the total<br />

cost of operations of a ship.<br />

However, this is higher for Indian ships<br />

as they also need to factor in the tax<br />

rate of 30% on the wages paid to their<br />

employees. Third, bunker fuel, that<br />

ships use, is also costlier in India.<br />

Fourth, Indian shipping companies<br />

need to pay 5% IGST on the purchase<br />

of new ships. Ranjit Singh, ED & CEO,<br />

Essar Shipping, said, for a tanker that<br />

costs a minimum of $40 million, an Indian<br />

company would have to pay $2<br />

million upfront as IGST. He said, “No<br />

bank will fund me for tax so I have to<br />

arrange these funds on my own.<br />

The government is offering input credit<br />

over the life-cycle of the ship but this is<br />

not the ideal solution. What is worse is<br />

a foreign company can make the same<br />

purchase without having to pay the 5%<br />

IGST.”<br />

According to data from INSA, over the<br />

last 25 years, the planned expenditure<br />

on the shipping industry was just<br />

1.78% of the expenditure on railways<br />

and 2.3% of the roads sector. With almost<br />

zero budgetary support to Indian<br />

shippers over the last 25 years and policies<br />

that put them at a disadvantage<br />

compared to foreign shipping lines, the<br />

amount remitted out of India as freight<br />

is about $52 billion.<br />

www.seafarersjobs.com